- Home

- »

- Petrochemicals

- »

-

GCC Off-Highway Construction Equipment Lubricants Market Size, 2025GVR Report cover

![GCC Off-Highway Construction Equipment Lubricants Market Size, Share & Trends Report]()

GCC Off-Highway Construction Equipment Lubricants Market Size, Share & Trends Analysis Report By Product (Transmission Fluid, Hydraulic Fluid, Greases, Gear Oil, Heavy-Duty Engine Oil), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-020-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

Report Overview

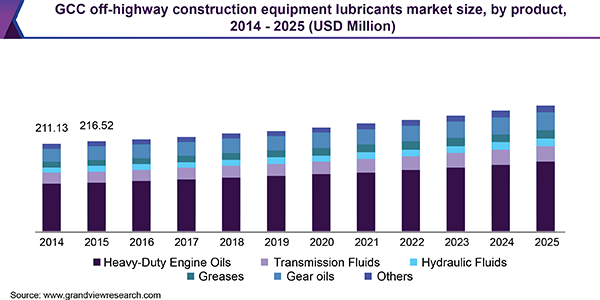

The GCC off-highway construction equipment lubricants market size was valued at USD 745.8 million in 2018 and is projected to register a CAGR of 4.8% from 2019 to 2025. Increasing demand for heavy-duty engine oils, transmission fluids, and gear oils are likely to drive the regional market. Rapid industrialization and urbanization have also led to a significant rise in construction equipment sales. With an estimation of building projects worth USD 128 billion, the GCC region shall reflect rapid and continuous sales of construction equipment lubricants due to substantial expenditure on infrastructure development.

Exports of heavy machinery from the Association of Southeast Asian Nations to the GCC region increased substantially, which is supported by heavy foreign investments in the region for upcoming infrastructural projects. The region is currently the second-largest heavy-duty machinery importers from ASEAN countries. Road-construction projects and agricultural machines are the key consumers of gear and motor and heavy-duty oils. The implementation of various federal programs regarding reconstruction and development of sectors, such as transportation, roadway infrastructure, and residential housing, is projected to augment the market growth. Moreover, agricultural support and increased investment activities in the field are likely to contribute to industry development.

Multiple advanced technologies in the product segment have been introduced, such as lubricating grease containing ash-free additives, incorporation of thickener matrix to improve “spray off” properties of lubricants, and a combination of lithium and calcium soaps to improve water resistance. The need for advancement in technology rose from demand generation across several construction projects in the province. The building equipment lubricant market is driven by stringent policies and environmental regulations imposed by the governments across GCC, such as Royal Decree No. M/38, which requires a license for the transportation of lubricants in Saudi Arabia.

Major producers, such as ExxonMobil, British Petroleum, and Total, have developed application-specific lubricants, which will also boost market expansion. Furthermore, growing popularity and preference for bio-based counterparts would drive the market. Several regional governments and regulatory bodies have taken initiatives to promote bio-based lubricants and to increase awareness about its minimal environmental impact. These regulations are imposed on regional formulators as a step towards a cleaner environment, which is also contributing to the market expansion.

Product Insights

Heavy-duty engine oil reduces friction between engine parts, minimizes wear and tear, reduces the accumulation of dust and seals the gap, and prevents corrosion. Moreover, they are highly resistant to thermal fluctuations and ensure the smooth functioning and efficiency of the engine. High-performance activities used in these oils assist in cleansing the engine over an extended drain period. Additionally, it also prevents the formation of deposits and soot build up the engine.

Transmission fluids are used in manual or automatic transmission components in the heavy construction equipment for valve operation, brake band friction, and gear lubrication. They provide various benefits, such as wear resistance, reduced high operating temperatures, conditioning gaskets, enhanced cooling function, and improved rotational speed and temperature range in vehicles. Hydraulic oils use synthetic or mineral-grade of base stock oils.

They aid in rust and wear and tear prevention and are combined with additives, such as organophosphate ester, mono ethylene glycols, and polyalphaolefin. Improved ability of the hydraulic fluids to perform under extreme temperatures and pressure will also fuel the segment growth. Greases provide exceptional properties, such as facilitating free movement of parts at extreme temperatures and preventing moisture contamination. They also provide high compatibility with elastomer seals ensuring the performance and efficiency of various automobile parts.

The geographical conditions and overall working climate determines the grade of grease to be used, such as NLGI 1 is preferred in cold areas to improve pumpability. Gear oil prevents engine overheating, offers proper clutch friction, and improves transmission efficiency. The region reflected high sales of gear oils to cater to the rising demand from heavy cargo vehicles, such as trucks and construction machinery, which includes excavators, bulldozers, and more. They aid in improved engine performance by smoothly transmitting lubricants in the gear trains.

Regional Insights

The Russian economy has a major influence on the industry and any fluctuations in the housing and construction sector in Russia have a direct impact on the GCC construction market. Moreover, due to the fall in world oil prices and the economic sanctions imposed on Russia coupled with the unstable political and economic situation in the country, the overall demand for lubricants is reduced. Conversely, there was stability in the Russian industrial segment driven by the upsurge in manufacturing activities and shift in trend towards allying with major oil-exporting economies, which led to the rise in industrial output as well.

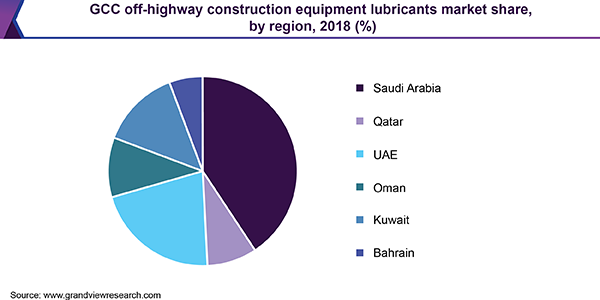

Saudi Arabia was the fastest-growing segment that has transformed the construction business in the GCC region. The country is estimated to reflect the further rise in the consumption of heavy machinery lubricants due to several pipeline projects, such as the KA CARE Renewable Energy Program.

Construction growth in Qatar is driven by Qatar National Vision 2030 and FIFA World Cup 2022. Expenditure for the FIFA World Cup is estimated at USD 30 billion. Continued spending by the government is a driving force behind the country’s economic growth. 25% of the total expenditure planned for the fiscal year 2016 was for infrastructure projects. Government plans to invest USD 200 billion in infrastructure projects between 2016 and 2022.

The country is in the process of implementing new law for enabling PPP models and provide a framework for the efficient delivery of projects. From 2010 to 2016, infrastructure and housing investments were estimated at USD 27 billion. Investments from PPP models are estimated at USD 30 billion for the next ten years. The earthmoving equipment market in Qatar will also expand as the country gears up for the biggest sporting event (FIFA World Cup 2022).

Implementation of infrastructure and building projects, such as Dubai Expo 2020 and Abu Dhabi Vision 2030, will also contribute to the market growth. UAE government plans to build 17 projects with an investment of USD 410 million. The ministry of public works is working actively on 148 housing units and 26 complexes in all emirates. Dubai's municipality’s vision to make the city fully sustainable by 2021 has led to increased investments.

To reduce economic dependence on oil, the government of Oman has planned to diversify economic activities by investing USD 50 billion in infrastructure projects over the next 15 years. Growing travel and tourism will have a positive impact on the hospitality sector, thereby contributing to industry development. Demand for government-funded residential spaces is expected to reach 175,000 units by 2020. Moreover, the Kuwait Development Plan is actively seeking PPP agreements for the structuring of affordable houses, hospitals, educational institutions, airports, and more.

All these factors are likely to contribute to market growth in the years to come. Bahrain has the second-highest ASEAN exports of heavy machinery among the GCC countries. Its construction industry outlook appears to be improving, following the announcement of several major non-residential projects, as the country is already heavily characterized by multiple residential projects. The country shall experience nearly 53,000 social housing project applications, which are currently under approval.

Key Companies & Market Share Insights

The regional market shall witness rapid growth over the forecast period on account of active participation of the government and increasing investments in infrastructure projects, which include commercial spaces, residential complexes, and educational and healthcare facilities. Major companies are focused on expansion and operational strategies to increase their business operations across GCC countries.

Multiple dynamic oil and gas multinationals, such as Total UAE, Shell, Sinopec UAE, ExxonMobil Corporation, and Idemitsu Kosan, have integrated manufacturers of lubricants that ensure a stable and continuous supply of raw materials to the formulators of additives and mineral oil for producing lubricants of construction and off-highway equipment.

GCC Off-Highway Construction Equipment Lubricants Market Report Scope

Report Attribute

Details

The market size value in 2019

USD 779.2 million

The revenue forecast in 2025

USD 1033.4 million

Growth Rate

CAGR of 4.8% from 2019 to 2025

The base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Region

Regional scope

Gulf Cooperation Council (GCC)

Country scope

Saudi Arabia, Qatar, UAE, Oman, Kuwait, Bahrain

Key companies profiled

Total UAE, Shell, Sinopec UAE, ExxonMobil Corporation, and Idemitsu Kosan.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the GCC off-highway construction equipment lubricants market report based on product and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Heavy-Duty Engine Oils

-

Transmission Fluids

-

Hydraulic Fluids

-

Greases

-

Gear oils

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

GCC

-

Saudi Arabia

-

Qatar

-

UAE

-

Oman

-

Kuwait

-

Bahrain

-

-

Frequently Asked Questions About This Report

b. The GCC off-highway construction equipment lubricants market size was estimated at USD 779.2 million in 2019 and is expected to reach USD 814.9 million in 2020.

b. The GCC off-highway construction equipment lubricants market is expected to grow at a compound annual growth rate of 4.8% from 2019 to 2025 to reach USD 1,033.4 million by 2025.

b. Heavy Duty Engine Oils dominated the GCC off-highway construction equipment lubricants market with a share of 53.2% in 2019. This is attributable to their ability to reduce friction between engine parts, minimize wear & tear, reduce the accumulation of dust, and prevent corrosion.

b. Some key players operating in the GCC off-highway construction equipment lubricants market include Total UAE, Shell, Sinopec UAE, ExxonMobil Corporation, and Idemitsu Kosan.

b. Key factors that are driving the market growth include substantial expenditure on infrastructure development.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."