- Home

- »

- Catalysts & Enzymes

- »

-

Glass Bonding Adhesives Market Size, Industry Report, 2014-2025GVR Report cover

![Glass Bonding Adhesives Market Report]()

Glass Bonding Adhesives Market Analysis By Product (UV Cured, Polyurethane, Acrylic, Silicone), By Application (Construction, Furniture, Transportation, Electronics), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-637-0

- Number of Report Pages: 98

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Specialty & Chemicals

Industry Insights

The global glass bonding adhesives market size was estimated at USD 2.36 billion in 2016 and is expected to rise at a predicted CAGR of 7.2% over the forecast period. These glues are specifically used for the adhesion of glass to numerous substrates. Automotive & transportation, furniture, and construction are the major end-users of the industry.

Asia Pacific, North America, and Europe are the key consumers of the product since the past few years. Central & South America is likely to witness robust industry growth over the years ahead. The global industry is highly fragmented in nature owing to the presence of numerous manufacturers on a global as well as regional level.

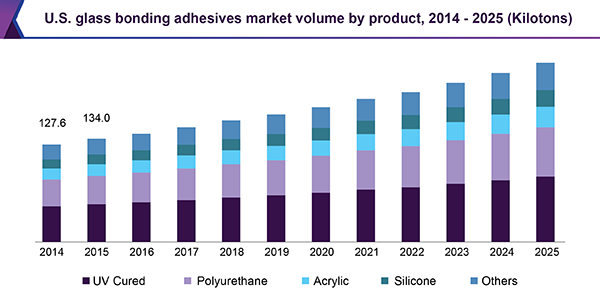

The U.S. accounted for the largest volume share of the total market in the North America region in 2016. The existence of well-established end-use markets including automotive & transportation, electronics, appliances, and furniture have been the key drivers of the product. Moreover, the recovery of the construction sector is estimated to boost the use of glass glues, especially in façade and ceiling constructions over the upcoming years.

Stringent regulations governing the VOC emissions from glues utilized in the industrial assembly of automotive body components, electronic components, and building & construction products are likely to propel the manufacturing and use of radiation cured, solvent free, and isocyanate free bonding agents.

The regulatory scenario in the U.S. is expected to provide favorable scope for the use of solvent free glues in the future. For instance, in 2015, the Massachusetts Department of Environmental Protection (MassDEP) revised the VOC emission limits for adhesives based on the application on various substrates. For fiberglass substrates, the emission limits were set at a value of 200 g/l, while for others the standard was increased to 250 g/l.

Product Insights

UV cured, silicone, acrylic, and polyurethane are the major product segments included in the research study. UV cured adhesives accounted for the largest revenue share of 40.3% in 2016. The product demand is likely to be driven by key application sectors such as furniture, medical devices, electronics, and automotive & transportation.

UV cured glues are favorably used for glass bonding applications owing to their high optical clarity and significant resistance against yellowing, impact load, and thermal shock. Furthermore, the products offer low-stress points as compared to other mechanical and thermal fastening methods and keep the overall aesthetic features of the finished goods intact.

These products are highly utilized in glass to glass as well as glass to metal bonding applications such as automotive latches, potting of industrial product components, stemware, electronics & appliance assemblies, optical assembly, and furniture sectors.

The polyurethane (PU) segment accounted for the second-largest revenue share in 2016 followed by acrylic products. However, strong government regulations over the use of polyurethane and acrylic-based materials in Europe and North America is estimated to adversely impact the industry growth by 2025.

Polyurethane glues exhibit significant mechanical and peel strength and offer higher flexibility. Furthermore, they also add flexibility to the glass joints and exhibit favorable resistance against temperature and chemicals. However, prolonged exposure to elevated temperature surroundings leads to the rapid degradation of polyurethane adhesives.

Poor resistance to UV radiation is another drawback of PU adhesives owing to which their consumption is estimated to decline by the end of the forecast period. Furthermore, these bonding agents comprise of isocyanates that are rendered hazardous to health.

Acrylic adhesives provide performance features similar to that of PU and other bonding agents such as epoxies. These products are also characterized by better gap filling abilities required in the bonding areas of substrates and good thermal barrier properties. They are utilized in structural applications owing to their high tensile and shear strength.

Other products utilized as bonding agents include polyisobutylene, modified silane, and moisture curing glues. Moisture curing adhesives are favorably used in the construction and automotive windshield installations. H.B. Fuller Company offers moisture curing glues for glass bonding applications in the building & construction industry.

Application Insights

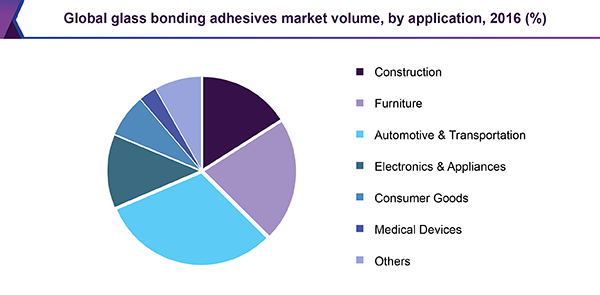

Furniture, construction, automotive & transportation, medical devices, electronics & appliances, and consumer goods are the key application segments of the global market. In terms of revenue, the automotive & transportation sector and constituted 30.4% industry share in 2016.

Glass adhesives are utilized for the bonding of windshields of cars and public transport buses. Automotive & transportation is likely to maintain its position as a top consumer owing to the growth of the automotive aftermarket industry mainly in developing countries.

Inclination toward minimizing the overall weight of the automotive body components is expected to fuel the consumption of glass adhesives over other types of joining or fastening products in the automotive sector.

Epoxy, UV curable, silicone, acrylic, and polyurethane are widely utilized by the automotive & transportation industry. The use of adhesives for assembling, bonding, and laminating automotive body parts is expected to spur the global industry growth over the forecast period.

In terms of revenue, the furniture application held the second-largest share of the total industry in 2016. This application is another significant growth driver of glass bonding adhesives. Doors, mirrors, design panels, partitions, bathroom and display cabinets, decorative products, and shelves utilize glass adhesives for effective bonding.

DELO Industrie Klebstoffe GmbH & Co. KGaA; Dymax Corporation; Permabond LLC; Bohle AG; and Kissel + Wolf GmbH KIWO are the key manufacturers offering product lines mainly for the furniture sector.

Other applications include renewable energy, general product assembly, military & defense, and optical sectors. The product consumption in these sectors is estimated to be supported by the rising requirements of adhesives as fasteners in the bonding of photovoltaics or solar glass panels in the renewables energy sector.

Regional Insights

The Central & South America and Asia Pacific regions are projected to be the fastest-growing consumers over the forecast period. In terms of revenue, Asia Pacific is estimated to witness a CAGR of 7.8% over the forecast period. Rising number of foreign investments in these regions is likely to enhance the growth of the industry over the coming years.

The industry growth in Asia Pacific is mainly driven by strong GDP growth, rapid industrialization, and the presence of a wide production and assembly expanse. China, India, Japan, and Thailand are likely to be the key contributors of industry demand, over the years ahead, due to significant product consumption in OEM and aftermarket operations.

The North America and Europe regions are estimated to demonstrate stabilized industry growth in the upcoming years. Rising utilization of glass glues in the electronics, consumer goods, and medical devices sectors in Germany, the UK, and the U.S. are considered as key growth supporting factors of the market.

Competitive Insights

New and technologically advanced product launches, acquisitions, joint ventures, significant forward integration of business operations across the value chain, and sustainability development are the major strategies implemented by manufacturers to strive for optimum business growth.

H.B. Fuller; Henkel AG & Co. KGaA; The 3M Company; Ashland Inc.; Sika AG; and The Dow Chemical Company are some of the major players operating in the industry. Dymax Corporation; DELO Industrial Adhesives; Permabond LLC; and Master Bond Inc. are few other important industry players.

In May 2017, Henkel AG & Co. KGaA launched HY 4080 GY and HY 4090, a new range of hybrid adhesives under the Loctite brand. The products are capable of bonding various substrate materials required in LED lighting, speakers, and sign bonding applications.

Report Scope

Attributes

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Volume in kilotons, revenue in USD Million, and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, UK, China, India, Brazil

Report coverage

Volume and revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts volume and revenue growth at a global, regional & country level, and provides an analysis on the industry trends for each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global glass bonding adhesives market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

UV Cured

-

Polyurethane

-

Acrylic

-

Silicone

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Construction

-

Furniture

-

Automotive & Transportation

-

Electronics & Appliances

-

Consumer Goods

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."