- Home

- »

- Healthcare IT

- »

-

Healthcare API Market Size, Share & Growth Report, 2027GVR Report cover

![Healthcare API Market Size, Share & Trends Report]()

Healthcare API Market Size, Share & Trends Analysis Report By Services (EHR Access, Appointments, Remote Patient Monitoring), By Deployment Model (Cloud Based, On Premise), By End Use, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-928-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

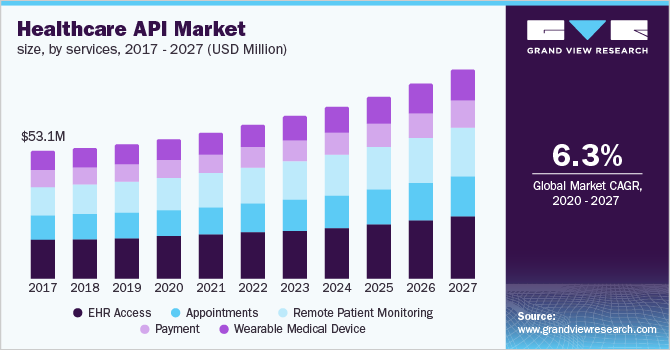

The global healthcare API market size to be valued at USD 336.02 million by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% during the forecast period. Increasing adoption of Application Programming Interfaces (API) integrated Electronic Health Records (EHRs) that provide simplicity and ease of healthcare data accessibility is driving the market growth. Moreover, improved patient outcomes increased patient satisfaction, and development in the care quality are propelling the market expansion. Furthermore, increasing the need for healthcare integration is driving demand.

Integration of new workflows between the providers and the payers, the apps which can access data from EHRs, wearables, and their services, seamless transition of care are some of the major factors increasing the adoption of healthcare API. Internal standardization for various products or workflows will help to easily access the patient’s data. For instance, in June 2018 Apple health launched healthcare API from where developers can access EHR data of patients from more than 500 hospitals in the U.S.

The COVID-19 pandemic has resulted in social distancing and lockdowns. This has led to a shortage of manpower as a consequence of imposed shutdowns. This has necessitated the implementation of a healthcare application programming interface to ease the healthcare operations in the hospitals and other organizations. For instance, in April 2020, Google launched cloud healthcare API v1 in order to protect patient privacy and also to make it interoperable for COVID-19 research purposes.

An increase in funding and growing initiatives from the industry players to develop a completely standardized API is propelling growth. For instance, in April 2019, Redox raised around USD 33 million in funding to develop a cloud-based API. Increasing demand for telemedicine and digital health solutions post COVID-19 is further increasing the need for integrated healthcare API which is expected to boost the market in the forthcoming years.

Healthcare API Market Trends

The market is expected to be driven by technological advancements with frequent updates, a rising need for healthcare integration, increasing activities by electronic health-record suppliers (EHR), and healthcare IT start-ups. Furthermore, the market growth is being fueled by the increasing adoption of application programming interfaces (APIs) coupled with electronic health records, which has made access to simplified health data easier.

The API marketplace in the healthcare industry helps in reducing the cost. Additionally, it eliminates management errors in the supply chain of medicines and provides a common access to medical test results. The healthcare business accumulates large quantity of data for individual health, and the API aids in appropriate management of this data. As a result, the efficiency of healthcare sector is improved to a great extent which is anticipated to contribute to the growth of the market in the forecast period. However, the concerns for data security concerns pertaining to the valuable data of the patient's health along with the lack of skilled professionals are expected to restrict the market growth. Additionally, the factors such as inadequate IT infrastructure, lack of access to effective API tools and poor network connectivity are expected to hinder the market growth.

A growing number of market players are trying to expand their reach across various markets. Due to the limited development of public IT infrastructure in emerging economies, large-scale adoption of healthcare IT solutions is witnessed as a long-term opportunity for developing countries.

Services Insights

On the basis of services, the healthcare API market is segmented into EHR access, appointments, remote patient monitoring, payment, and wearable medical devices. EHR access dominated the market with a revenue share of over 30.00% in 2019. API can easily integrate the EHR with other platforms which will help seamless data integration with the third parties. Moreover, the EHR vendors are actively building APIs in their platform to provide value-based patient care which is further increasing the adoption. For instance, in February 2019 Microsoft Azure launched cloud-based API for FHIR standard for better interoperability and data sharing.

The remote patient monitoring segment is expected to exhibit the fastest growth over the forecast period. Connected health and remote patient monitoring gain much attention during the COVID-19 pandemic as doctors and caregivers need to treat patients remotely in order to reduce the risk of contamination. The providers are offering various patient engagement platforms with integrated API for better treatment options and guidance based on their past medical records.

Deployment Model Insights

On the basis of mode of deployment, the healthcare application programming interface market can be segmented into cloud-based API and on premise-based API. The cloud-based API held the largest market share of around 80% in 2019. The growth can be attributed to the availability of free storage space to store and organize healthcare data of patients and hospitals that is easily accessible during emergencies by healthcare professionals and caregivers.

The on-premise healthcare application programming interface also held a considerable revenue share in 2019 owing to its associated advantages such as data privacy and security. This restricts data breaching as they have entire control over the healthcare software. Furthermore, the installation of the software is convenient and the stored data can be utilized for future re-processing.

End-use Insights

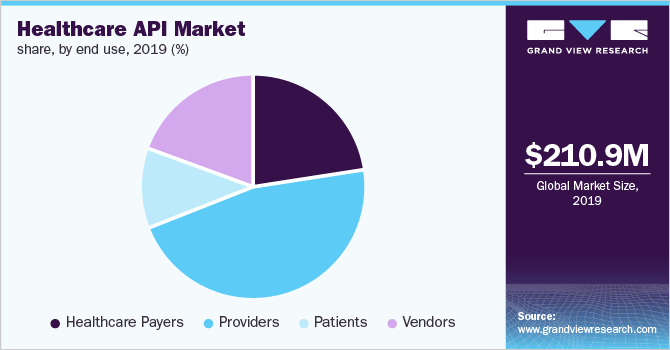

On the basis of end-use, the market can be segmented into healthcare providers, patients, healthcare payers, and vendors. Providers segment held the largest revenue with a revenue share of over 46.0% in 2019. The healthcare providers segment comprises hospitals, clinics, and other organizations. The incorporation of healthcare API in hospitals has propelled the segment growth. API stores medical records, patient information, healthcare data, and patient history which can be easily accessible during an emergency.

The healthcare payers segment is expected to showcase lucrative growth over the forecast period. A customized workflow created by the integrated API ensures easy approval and review of the desired data by healthcare payers and caregivers. API also allows easy patient billing and management of patient appointments. The payers can securely get access to patients’ health records and bills without unwanted phone calls and going through receptionists.

Region Insights

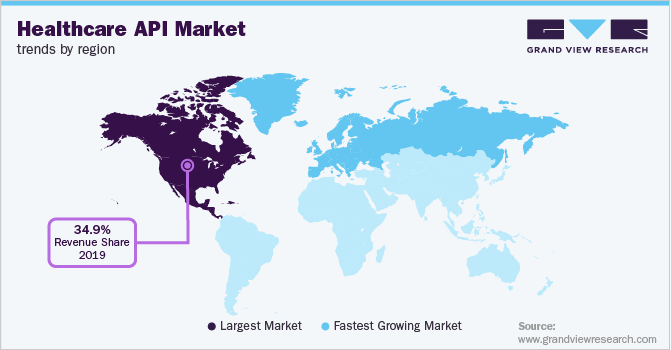

North America dominated the market with a revenue share of around 34.0% in 2019. This growth can be attributed to various factors such as favorable policies for deployment of healthcare application programming interface and high digital literacy rates. Moreover, the presence of established healthcare infrastructure with integrated EHR of patients is another major growth propelling factor for the market. Increase number of adopters such as big HCOs in the U.S. is expected to further drive the regional demand.

Europe is expected to exhibit the fastest CAGR over the forecast period owing to the established healthcare infrastructure in this region and the advent of the Internet of Things (IoT) and related technologies. The General Data Protection Regulation (GDPR) was implemented on May 25th, 2018 in the European Union, which is a law on data privacy and protection. The law is more stringent than that of the U.S., HIPAA, and addresses the personal export of data outside the European countries, which is expected to increase the adoption of healthcare API.

Key Companies & Market Share Insights

The market is competitive in nature. The key players are involved in strategic collaborations, new product launches coupled with mergers and acquisitions to strengthen their market position. For instance, in 2019, Allscripts and Northwell Health partnered to produce artificial intelligence-based, voice-enabled, and cloud-based EHR. This is expected to enhance the company’s penetration. In November 2019, pCare partnered with Redox for better data integration of pCare platform with HCO’s existing HIT systems. In June 2020, MuleSoft launched a new accelerator for healthcare with prebuilt APIs and common EHR systems like Cerner and Epic.

Some of the prominent players in the healthcare API market include:

-

Practo Technologies Pvt. Ltd.

-

Apple, Inc.

-

General Electric Company

-

Athenahealth

-

Cerner Corporation

-

Microsoft Corporation

-

Epic Systems Corporation

-

eClinical Works LLC

-

Allscripts Healthcare Solutions Inc.

-

Greenway Health, LLC

-

Practice Fusion, Inc.

-

MuleSoft, Inc.

Recent Developments

-

In April 2023, epocrates, an athenahealth company, partnered with Cognito Therapeutics to offer targeted video messaging to healthcare professionals through Message in Motion. This partnership aims to increase awareness and engagement for epocrates' HOPE pivotal trial and educate healthcare professionals about neurodegenerative disease research advancements.

-

In April 2023, Microsoft and Epic announced a strategic collaboration to integrate generative AI into healthcare by combining Azure OpenAI Service with Epic's EHR software. This partnership expands the existing partnership, allowing organizations to run Epic environments on the Microsoft Azure cloud platform.

-

In March 2022, Microsoft announced advancements in healthcare cloud strategy, including Azure Health Data Services and updates to Microsoft Cloud for Healthcare. The company aims to address challenges in the industry, such as reducing clinician burnout, providing personalized experiences, and enabling health data interoperability.

Healthcare API Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 219.39 million

Revenue forecast in 2027

USD 336.02 million

Growth Rate

CAGR of 6.3% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Practo Technologies Pvt. Ltd.; Apple, Inc.; General Electric Company; Athenahealth; Cerner Corporation; Microsoft Corporation; Epic Systems Corporation; eClinical Works LLC; Allscripts Healthcare Solutions Inc.; Greenway Health, LLC; Practice Fusion, Inc.; MuleSoft, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

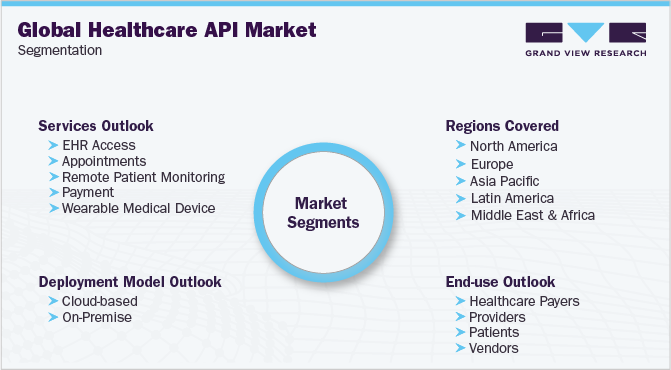

Global Healthcare API Market SegmentationThis report forecasts revenue growth at global, regional, and country-level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global healthcare API market report on the basis of services, deployment model, end-use, and region.

-

Services Outlook (Revenue, USD Million, 2016 - 2027)

-

EHR Access

-

Appointments

-

Remote Patient Monitoring

-

Payment

-

Wearable Medical Device

-

-

Deployment Model Outlook (Revenue, USD Million, 2016 - 2027)

-

Cloud-based

-

On-Premise

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Healthcare Payers

-

Providers

-

Patients

-

Vendors

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global healthcare API market size was estimated at USD 210.95 million in 2019 and is expected to reach USD 219.39 million in 2020.

b. The global healthcare API market is expected to grow at a compound annual growth rate of 6.3% from 2020 to 2027 to reach USD 336.02 million by 2027.

b. North America dominated the healthcare API market with a share of 34.8% in 2019. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance, favorable policies, and high digital literacy rates.

b. Some key players operating in the healthcare API market include Practo Technologies Pvt. Ltd., Apple, Inc, Epic Systems Corporation, General Electric Company, Microsoft Corporation, eClinical Works LLC, Greenway Health, LLC, Allscripts Healthcare Solutions Inc., Practice Fusion, Inc., and MuleSoft, Inc.

b. Key factors driving the healthcare API market growth include increasing healthcare investments & adoption of technologically advanced healthcare solutions, the adoption of API integrated electronic health records (EHRs) that provide simplicity and ease of healthcare data accessibility, improved patient outcomes, increased patient satisfaction & development in care quality.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."