- Home

- »

- Healthcare IT

- »

-

Healthcare Claims Management Market Size Report, 2030GVR Report cover

![Healthcare Claims Management Market Size, Share & Trends Report]()

Healthcare Claims Management Market Size, Share & Trends Analysis Report By Product (Medical Billing, Claims Processing), By Component, By Solution Type, By Deployment Mode, By End-use, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-958-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global healthcare claims management market size was valued at USD 21.64 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 23.4% from 2022 to 2030. The market is witnessing remarkable expansion globally due to the development of variables such as an increased focus on providing high-quality healthcare services to the target population and the rising rate of adoption of technology-related services. Furthermore, the growing health insurance sector and rising internet usage and digitalization are positively influencing the overall industry growth.

The COVID-19 pandemic has had a positive impact on the market for healthcare claims management since its peak in March 2020, when medical offices were obliged to raise billing and payment due to new pandemic realities. Healthcare IT technologies including medical billing software, practice management software and electronic health records (EHR)/ electronic medical records (EMR) were employed to make the process feasible despite the shortage of people. Customers and competitors paid attention to this, which led to the ongoing existence, focus on improvement, and dependency on such small-scale human interference software over the period.

In addition, the World Health Organization (WHO) reported in its 'Administrative Mistakes: Technical Series on Safer Primary Care 2016' study that administrative errors account for 5-50% of medical errors in primary care, recognizing the need for digital accuracy solutions like medical billing and claims processing management, which includes services and software. Overall, the industry will witness significant growth as a result of this.

Data privacy issues are one of the primary factors that may stymie industry growth in all of the healthcare IT segments that are seeing a revolution through digitization, including the market for healthcare claims management, unless and until set regulations are in place to limit its market impact to some extent.

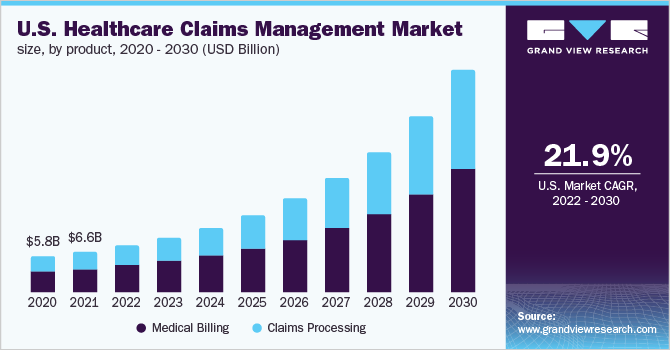

Product Insights

The medical billing segment held the largest revenue share of over 55.0% in 2021. Increasing internet usage, digitization, higher healthcare spending, and demand for risk and compliance management are key factors driving the medical billing segment. Medical billing is further categorized into professional billing and institutional billing. Professional billing is the process of submitting claims for medical services or treatments performed by physicians or healthcare professionals to persons who have insurance. Furthermore, one distinguishing feature of physician billing from professional billing is that it contains medical coding, which may result in pricing variations and be a factor in determining out-of-pocket spending.

Unlike professional billing, where errors can occur for a variety of reasons, including technical errors, institutional billing services are error-free. The majority of hospitals and healthcare providers pick these services since they specialize in medical billing. Institutional billing is larger than the physician billing industry, and this trend is projected to continue as more hospitals and major clinics begin to use institutional billing services, which will ultimately influence the entire medical billing segment to expand throughout the forecast period.

The target population's need for high-quality healthcare services is being prioritized, and technology-related services are being adopted at an increasing pace. As a result, the healthcare claims processing segment is anticipated to grow throughout the forecast period. The claims processing devices are popular among a wide spectrum of customers globally, and demand for them is increasing, which will help the healthcare claims processing segment grow over the forecast period. Furthermore, the expanding health insurance sector is positively influencing the overall industry growth.

Component Insights

The software segment accounted for the largest revenue share of over 65.0% in 2021. The segment is expected to maintain its dominance throughout the forecast period. The healthcare industry has been revolutionized by overall digitization, which has improved patient treatment guidance systems and software technologies that have provided simple access to healthcare data through cost-effective automated billing and claims processing systems. Medical billing and claims processing software have several advantages, including more accurate bills, fewer administrative errors, fewer insurance claim denials, invoice tracking, and speedier payments, which boosts efficiency and accuracy even more.

Medical billing and claims processing services are used to process, fill out, and monitor health insurance claims to save time. Medical offices had to make greater billing and payment tracking modifications in 2020 due to new pandemic realities. As the number of COVID-19 patients grew, practitioners were forced to administer the therapies owing to a lack of resources around the world. This helped the medical billing and claims processing service provider get attention, which, in turn, led to higher revenue growth for the competitors in this industry.

One of the key driving causes for practitioners opting for medical billing and claims processing services is the hassle-free procedure of settling claims with features such as the availability of skilled coders familiar with the newest medical codes and claims processing. The significant risk of data breaches connected with medical billing in the U.S., on the other hand, is likely to stifle market expansion throughout the forecast period. According to Becker's Healthcare reported statistics, nearly 50 million Americans' health records have been compromised in 2021, which is almost three times more than in the previous three years.

Solution Type Insights

The integrated solutions segment dominated the market and accounted for a revenue share of over 70.0% in 2021. It is expected to maintain its dominance throughout the forecast period. Navigating convoluted insurance requirements, recognizing best practices for data gathering, and evaluating data to uncover possibilities for improvement are skills that are unrelated to patient care but equally critical for any healthcare institution that wants to stay in business. For the reasons outlined above, providers are constantly looking for methods to improve claim management and medical billing systems. Thus, implementing an integrated billing and claims processing system, which offers several benefits, is one method to do so.

Standalone solutions are primarily focused on certain features and capabilities. When compared to an integrated solution, this sort of solution can provide more features. Following the development of the criteria, a particular choice of one standalone solution that best meets those needs might be made. Furthermore, even though integrated solutions have a limitation of restricted functionality, the rising acceptance of integrated solutions may hinder the growth of the standalone segment over the forecast period.

End-use Insights

Healthcare providers held the largest revenue share of over 65.0% in 2021. The healthcare providers segment is anticipated to rise moderately over the forecast period, with growth aided by the adoption of rigorous regulatory rules in various countries such as the U.S. Due to IT infrastructure limits in emerging nations, the healthcare providers segment has faced challenges. This is mostly because the price is a key impediment to the adoption of advanced technology such as claims processing software. As advanced deployment modes, such as Cloud-based solutions, gain popularity, implementation of such solutions due to high maintenance costs hinders smaller healthcare provider organizations from adopting such solutions, which might hinder market growth over the forecast period.

Healthcare payers in this market are expected to expand rapidly during the forecast period, supported by the implementation of stringent regulatory requirements, an in-house lack of experienced individuals for claims processing, and growing healthcare costs and related frauds. Payers have also helped healthcare providers by providing a cloud-based and web-based portal that provides accurate and timely information about not just the pandemic but also assists them to handle medical billing and related claims.

Furthermore, increased occurrences of data breaches and loss of confidentiality, and migration from legacy systems are likely to hinder the growth of the healthcare payers in the market.

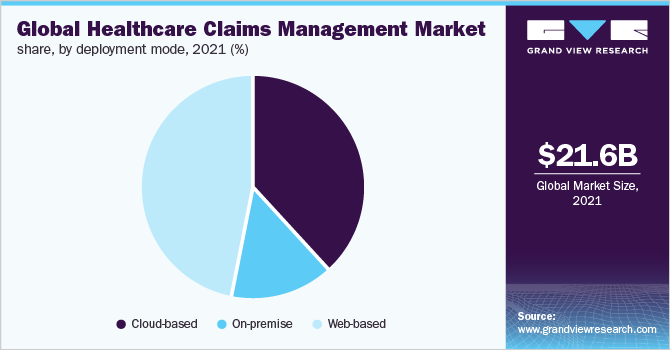

Deployment Mode Insights

The web-based segment held the largest revenue share of over 45.0% in 2021. The web-based and cloud-based segments both have a strong competitive presence in the market. Sales of cloud-based billing and claims processing services and solutions, which can be hosted on public or private clouds, make up the cloud-based billing and claims processing market. Cloud billing is a concept that refers to a hybrid of cloud computing and electronic billing. Furthermore, cloud medical billing is revolutionizing the computer system, offering increased billing flexibility and data accessibility.

With the rise of the cloud, billing has evolved from a stand-alone back-office solution to a critical component of the whole statement process. Furthermore, regardless of the industry, overall cloud billing services assist organizations in saving money while still offering excellent customer service. According to a Flexera study from 2021, 93% of organizations are using cloud-based technology, with 73% seeking to optimize their present cloud utilization for cost savings. As a result, the cloud-based billing industry's overall growth is being supported by a growing need for cheaper capital and operating costs.

A web browser is required to use web-based medical billing and claims processing systems. Web software is made by combining handwriting (user) with scripting languages like Java and Adobe Flash (server). To allow online web services to work, the web browser relies on the parts of the webserver installed on the device.

The web-based segment would see similar positive acceptance by applicants as a cloud-based system, but market growth would vary over time as cloud-based systems are still preferred since a web-based system requires internet connectivity to access the system. While needing an online internet connection is a limitation compared to a cloud-based system, it does have the advantage of allowing users to access the system from anywhere.

Since the hardware, data, and software platform are within your control and ownership, thus, it is anticipated that throughout the forecast period, on-premise billing and claims processing software and services would contribute to the segment growth. Furthermore, this growth will undoubtedly increase as the system's adoption increases; however, this growth of traditional on-premise medical billing and claims processing systems will be relatively less in comparison to cloud-based and web-based systems, which have gained popularity and acceptance in the aftermath of the pandemic.

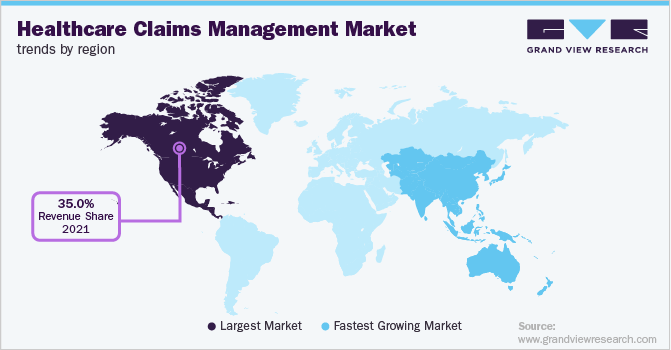

Regional Insights

North America led the overall market with a revenue share of over 35.0% in 2021. This can be attributed to an increase in patient load and healthcare coverage, adoption of EHRs and e-prescribing services, growing government spending, and improving healthcare infrastructure.

With the increased awareness regarding medical claims and rising medical treatment costs, Asia Pacific (APAC) is expected to be the fastest-growing region in the forecast period. Factors such as the quick expansion of the healthcare business in India attempts to improve the quality of healthcare delivery in Japan, and the adoption of healthcare IT systems in countries with well-developed healthcare systems such as China is expected to contribute to Asia's strong growth over the forecast period.

Key Companies & Market Share Insights

The market is highly fragmented with many small and large players. This leads to high competition for the companies to sustain their position. Many software companies have given medical billing and claims processing software to this very profitable area, resulting in increased rivalry. To remain competitive, several companies have begun to provide comprehensive portal solutions via their web interfaces. According to a Kaiser Family Foundation study, insurance companies reject roughly one out of every five claims because of identical claims and a lack of transparency. As a result, companies that can bring more effective technologies to the market will have an edge over the broader market, especially if their software is backed up by solid insurance claims with no or few denials, indicating their superiority over alternatives. This will eventually lead to industry expansion.

Besides, notable players contribute to the industry growth by entering acquisitions and launching new products. For instance, in October 2021, The SSI Group developed a strategic alliance with RCxRules to provide updated automated billing solutions for healthcare organizations' population health and revenue cycle operations, resulting in revenue growth as the strategic partnership grows. Likewise, in January 2021, Optum acquired Change Healthcare, with the acquisition assisting the company in gaining software, advisory management, technology, and revenue cycle management. Some prominent players in the global healthcare claims management market include:

-

McKesson Corporation

-

The SSI Group, Inc.

-

Quest Diagnostics

-

Kareo

-

Optum, Inc (a subsidiary of UnitedHealth Group)

-

Conifer Health Solutions

-

CareCloud

-

eClinicalWorks

-

IBM

-

Cerner Corporation

Recent Developments

-

In April 2023, Welldoc and Conifer Health Solutions announced a partnership to launch Conifer Connect, a personalized digital health app intended to help members manage their daily health while fostering relationships with their personal health nurse.

-

In October 2022, Optum, completed its merger with Change Healthcare. The united companies share a common objective of creating a simpler, more intelligent, and adaptive health system for patients, payers, and providers.

-

In September 2022, CareCloud, Inc. introduced the Remote Patient Monitoring (RPM) service. RPM is the most recent product to be added to CareCloud Wellness, a broad range of digital health solutions that also includes Chronic Care Management (CCM).

-

In September 2022, McKesson Corporation acquired Rx Savings Solutions (RxSS). RxSS joined the company's Prescription Technology Solutions division.

Healthcare Claims Management Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 25.44 billion

Revenue forecast in 2030

USD 136.67 billion

Growth rate

CAGR of 23.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, solution type, deployment mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Israel

Key companies profiled

McKesson Corporation; The SSI Group, Inc.; Quest Diagnostics; Kareo; Optum, Inc. (a subsidiary of UnitedHealth Group); Conifer Health Solutions; CareCloud; eClinicalWorks; IBM; Cerner Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Claims Management Market Segmentation

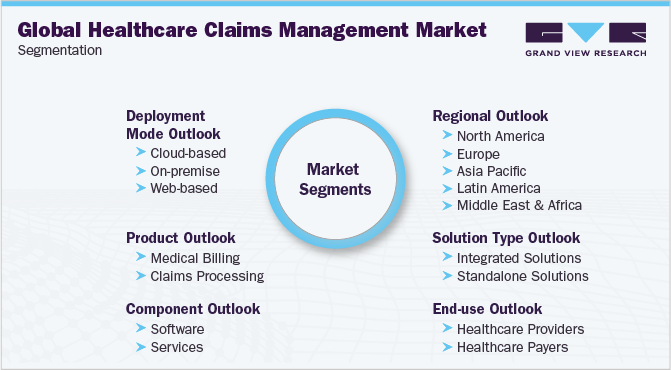

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global healthcare claims management market report based on product, component, solution type, deployment mode, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Medical Billing

-

Professional

-

Institutional

-

-

Claims Processing

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Solution Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Integrated Solutions

-

Standalone Solutions

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud-based

-

On-premise

-

Web-based

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global healthcare claims management market size was estimated at USD 21.64 billion in 2021 and is expected to reach USD 25.44 billion in 2022

b. The global healthcare claims management market is expected to grow at a compound annual growth rate of 23.4% from 2022 to 2030 to reach USD 136.67 billion by 2030

b. North America dominated the healthcare claims management market with a share of 38.0% in 2021. This is attributable to an increase in patient load and healthcare coverage, adoption of EHRs and e-prescribing services, growing government spending, and improving healthcare infrastructure.

b. Some key players operating in the healthcare claims management market include McKesson Corporation; The SSI Group, Inc; Quest Diagnostics; Kareo; Optum, Inc (a subsidiary of UnitedHealth Group); Conifer Health Solutions; CareCloud; eClinicalWorks; IBM; and Cerner Corporation.

b. Key factors that are driving the healthcare claims management market growth include improvements to the overall healthcare organization's process, the growing importance of denials management, and increasing patient volumes and health insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."