- Home

- »

- Electronic Devices

- »

-

Household Vacuum Cleaners Market Size, Analysis Report, 2022GVR Report cover

![Household Vacuum Cleaners Market Report]()

Household Vacuum Cleaners Market Analysis By Product (Upright, Canister, Central, Robotic, Drum, Wet/dry), And Segment Forecasts To 2022

- Report ID: 978-1-68038-553-3

- Number of Pages: 70

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry: Semiconductors & Electronics

Report Overview

The global household vacuum cleaners market size was valued at USD 11.2 billion in 2014. Improved living standards and concerns towards hygiene and cleanliness are anticipated to drive demand over the forecast period. Technological developments to minimize operational time and energy are expected to favor industry growth over the next seven years. Government initiatives for hygiene & cleanliness may benefit the household vacuum cleaners market.

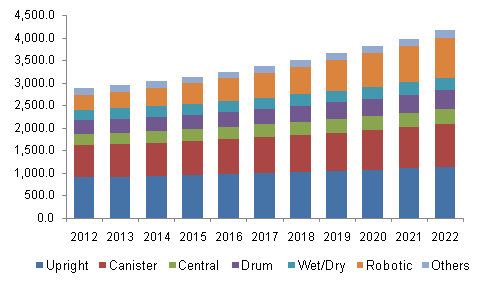

Europe household vacuum cleaners market share by product, 2012 – 2022 (USD Million)

Rising trend for dual income families and limited time for domestic chores is also expected to favor industry demand. Increasing technically sound population, particularly in Asia Pacific, is anticipated to drive demand over the forecast period. The increase in competition owing to the presence of a large number of players with a low degree of product differentiation is expected to result in reducing prices; this has made these products affordable for the lower middle-class population.

Rising energy consumption and price of electricity is expected to hinder household vacuum cleaners industry growth over the forecast period. The inability of these devices to efficiently clean complex structure is also anticipated to restrain growth over the next seven years.

Product Insights

The industry can be segmented based on product into upright, canister, central, robotic, drum, and wet/dry vacuum cleaners. Central products are easier to use and cause low noise. However, they take large storage space and require professional installation. Handheld products are small and used for quick cleaning; they have comparatively less power and capacity than other full-sized models, and can also be operated by a rechargeable battery.

Robotic vacuum cleaners are more expensive than other available products. These are automated and require least manual guidance; they have various innovative features to make cleaning a hassle-free process, including sweeping brushes, acoustic sensors, automated mapping, and self-charging capabilities. Limited time availability for residential cleaning activity is anticipated to drive demand over the forecast period. Robotic cleaners are also equipped with security features to alert people about fire or intrusion. The segment is expected to grow at a CAGR of 11.4% over the forecast period.

Regional Insights

Asia Pacific household vacuum cleaners market is anticipated to witness growth owing to increasing health awareness and rise in disposable income. Rising standard of living, particularly in China, Japan and India is anticipated to impact positively revenue growth. Further, Clean India Initiative of Indian government is also expected to contribute to regional industry demand.

North America vacuum cleaners market is expected to grow at a significant rate owing to the popularity of bag-less and multi-surface products. The region accounted for over 25% of the overall revenue share in 2014 and is expected to grow at a CAGR of 4.5% over the forecast period. Low consumer confidence and the depressed housing industry may pose a challenge to regional growth.

Europe, household vacuum cleaners market, is anticipated to witness growth owing to decreasing lifetime of products and increasing new as well as replacement demand. Energy efficiency may play an important role owing to European Union concerns to curb energy consumption.

Market Share Insights

Key vacuum cleaners manufacturers include Electrolux Group, Stanley Black & Decker, Dyson Ltd., Oreck Corporation, TTI Floor Care, Miele, Eureka Forbes Ltd, and Haier Group. Other prominent vendors include LG Corporation, iRobot Corporation, Panasonic Corporation, Bissell Inc., Royal Philips Electronics, and Samsung.

In August 2014, Electrolux announced the launch of UltraOne Quattro, which is grade AAAA by EU energy labeling and eco-design regulations. In July 2013, TTI acquired Oreck Corporation to enhance its product portfolio. The company offers its products through a number of a brand such as Hoover, Vax, Dirt Devil and Oreck. Eureka Forbes Ltd offers products through two brands Euroclean and Forbes.

In September 2015, iRobot Corporation announced the launch of Roomba 980, which is equipped with features such as iAdapt 2.0 navigation technology, vSLAM technology for the creation of visual landmark in its map, AeroForce cleaning system, self-charging and app-based support.

Household Vacuum Cleaners Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 14.55 billion

Revenue forecast in 2022

USD 16.07 billion

Growth Rate

CAGR of 4.7% from 2016 to 2022

Base year for estimation

2015

Historical data

2013 - 2015

Forecast period

2016 - 2022

Quantitative units

Revenue in USD billion and CAGR from 2016 to 2022

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; India; Japan; China; Brazil; Mexico.

Key companies profiled

Electrolux Group; Stanley Black & Decker; Dyson Ltd.; Oreck Corporation; TTI Floor Care; Miele; Eureka Forbes Ltd; Haier Group.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."