- Home

- »

- Medical Devices

- »

-

Humanoid Robot Market Size, Share & Trends Report, 2030GVR Report cover

![Humanoid Robot Market Size, Share & Trends Report]()

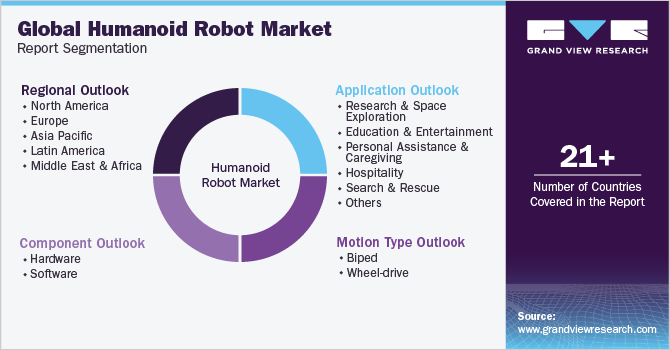

Humanoid Robot Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Motion Type (Biped, Wheel Drive), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-126-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Humanoid Robot Market Size & Trends

The global humanoid robot market size was estimated at USD 1.32 billion in 2023 and is projected to grow at a CAGR of 17.3% from 2024 to 2030. The market growth is propelled by several factors, including the wide utilization of humanoid robots for surveillance and security, such as detecting unauthorized intrusion and terrorist activities. Furthermore, humanoid robots are utilized for research and space exploration, enabling connectivity from remote locations. For instance, in April 2022, Jane Li, an Assistant Professor of Robotics Engineering at Worcester Polytechnic Institute in Massachusetts, along with her research team, initiated the development of advanced remote-controlled humanoid robots designed to assist healthcare professionals in managing patients in quarantine or isolation.

Public and corporate subsidy funds become more demanding for the goals and guiding research in humanoids despite significant advancements in many fundamental and technological areas of humanoid robotics. For instance, in February 2024, Figure AI, a startup developing humanoid robots, received funding of USD 675 million from investors including Nvidia, Jeff Bezos, OpenAI, and Microsoft to accelerate the development of its humanoid robot. Apart from pure robots, humanoid robots can help study participation, cognition, and a broader range of neuroscience and behavioral sciences. They are also represented by working in the media sector as staff members and participating in other social activities, such as assisting older individuals.

The novel product launched by industry players boosts the market. For instance, in January 2023, Aeo, a dual-arm humanoid robot from Aeolus Robotics, was launched for novel uses in a range of service duties, including delivery, security, eldercare, operating kiosks, and ultraviolet germicidal cleaning. Operated by Aeo, the business's hands-on approach to service blends distinctive mobility with cutting-edge functionality to carry out duties like opening doors, picking up goods, and riding elevators.

Even patients with mobility impairments can easily approach the robot due to its height and the container's location. Medical professionals can guarantee that each patient receives proper medication through a video call option included in the robot's features. The field of robotics is undergoing significant transformation and development, evident by the rise in commercial investment, the entry of international players, reduced hardware costs, and the growing popularity of existing robots. Despite notable advancements in humanoid robotics research, funding from both public and private sources has become more demanding, seeking clearer motivations and perspectives behind such research. For instance, in March 2023, OpenAI invested USD 23.5 million in 1X’s Bipedal Humanoid Robot NEO in a Series A2 funding round.

Apart from robotics applications, humanoid robotics holds potential in areas related to embodiment, consciousness, neurosciences, and cognitive sciences. These robots are also envisioned to have roles in the entertainment industry as receptionists and in social interactions, particularly assisting the elderly. Leading companies such as SoftBank Robotics in Japan and PAL Robotics in Spain have invested substantially in humanoid robots and integrated them into their business strategies, particularly targeting the service industry, including healthcare, hospitality, and retail.

Market Concentration & Characteristics

Due to technological advancement, the market has witnessed a high degree of innovation over the years. Furthermore, novel and innovative robots in the healthcare sector help doctors perform procedures without worrying about injuring themselves or their patients during surgical operations. For instance, in March 2024, NVIDIA announced Project GR00T, a versatile foundational model aimed at humanoid robots, to advance its initiatives in enhancing robotics and making significant progress in embodied artificial intelligence (AI).

The market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This strategy enables companies to access complementary technologies, expertise, and distribution networks, which helps them accelerate their product development, enhance operational efficiency, and secure a larger share. For instance, in March 2024, Highest Performances Holdings Inc. (HPH) acquired 77.5% equity with White Group through a supplementary agreement in Singapore White Lingjun Pt. The acquisition aims to enhance the Company's AI Humanoid product offerings for physical disability assistance, medical education, and elderly care.

Industry regulation in the U.S. operates through a distinctive framework where state governments primarily legislate on public health, safety, and welfare matters. In contrast, the federal government oversees interstate and international trade regulations. The Food and Drug Administration (FDA) is focused on establishing regulations and policies for using AI in healthcare settings. The FDA has approved 692 medical devices incorporating AI/machine learning (ML) technologies. Furthermore, the Ministry of Industry and Information Technology in China has released specific guidelines to advance humanoid robotics.

Several market players are adopting this strategy to expand their business by introducing new products and entering new geographical regions to strengthen their market position. For instance, in January 2024, Kody Technolab Limited, an Indian company, introduced Skändä, its first advanced AI-powered humanoid robot, at the Vibrant Gujarat 2024 Summit.

Component Insights

By component, hardware held the largest market share in 2023. This segment consists of bodily parts and electronic, electrical, & mechanical components that cooperate to carry out a given duty, as well as sensors, actuators, generators, control systems, and others. The hardware elements give the humanoid robots a human-like look, significantly increasing their worth. Humanoid robots can perform duties in a variety of industries, including medical care, research, and education, as the hardware components that enable the smooth integration of new technology. For instance, in March 2023, through its collaboration with Canadian Tire Corporation, Sanctuary AI revealed that it accomplished its goal of the very first installation of a special system created to provide the first human-like cognitive ability in broad-application robots at a client commercial site.

Software is anticipated to witness the fastest CAGR of 18.2% over the forecast period. Humanoid robots have a software feature that allows them to carry out difficult jobs and interact with their environment. A software framework for complex human-robot interaction scenarios, the iCub-HRI is used in the case of the iCub Humanoid Robot. In addition, in January 2023, as a part of the Ansys Startup Program, Halodi Robotics revealed that it is employing Ansys simulation software to create humanoid robots that can interact with people in regular settings. These robots could help with the developing shortage of workers by allowing key individuals to focus solely on jobs that call for their advanced abilities. These robots will carry out activities, including nighttime building patrols, grocery store shelf replenishment, and hospital logistics. Ansys helped Halodi Robotics cut the length of the development process by months with the help of Elite Channel Partner EDRMedeso.

Application Insights

By application, personal assistance and caregiving dominated the market with a revenue share of 31.75% in 2023. Humanoid robots are utilized in various instances, including homes, hospitals, and assisted living facilities; these robots are intended to support and help people. By helping with daily chores and offering companionship, the program aims to improve users' quality of life. Humanoids provide daily assistance to patients and the elderly, helping them with tasks like timely medication delivery. The normal chores that caregivers often carry out include monitoring vital signs, giving medications, assisting with meals, and alerting medical personnel in an emergency. These humanoids are likewise designed to carry out these tasks.

However, the education and entertainment segment is expected to grow at the fastest CAGR over the forecast period. Humanoid robots are employed in the educational sector to improve students' learning opportunities. They can serve as interactive tutors, giving pupils individualized training and involving them in enjoyable and creative ways. In addition, the robots can assist in STEM (science, technology, engineering, mathematics) and foreign language classrooms. Humanoid robots are employed in entertainment to amuse audiences at theme parks, exhibits, events, and even as characters in films and television programs. These robots have cutting-edge AI and sensors that allow them to interact with people, dance, sing, and do other entertaining things. For instance, the AI for Good Global Summit organized by the International Telecommunication Union was held in July 2023. Various new technology, including robots that can manage things from medicine to rock music, was displayed at the Summit. 51 novel robots were displayed at the summit, nine of which were humanoid and geared to assist people by performing tasks to the SDGs. According to ITU, Engineered Arts' Ameca is an ideal platform for examining how machines may coexist with people in future sustainable communities, work with them, and enhance human life. According to the UN organization, assistive robots alter human lives in many ways. These robots help with mobility, interaction, wellness, and other crucial everyday tasks using artificial intelligence, restoring people's confidence and autonomy.

Motion Type Insights

By motion type, Wheel-drive held the highest market share in 2023. Wheel-drive technology has substantially contributed to robots by providing effective mobility and adaptable maneuverability. For instance, a humanoid robot with a wheeled base and cutting-edge AI capabilities for human interaction is Pepper by SoftBank Robotics (Japan). The small humanoid robot Alpha Mini by UBTECH (China) has wheels for easy movement and interactive features. Designed for amusement and education, MIP is a little wheel-drive robot by WowWee U.S. These many wheel-drive robots have significantly increased the potential in robotics, allowing applications in customer service, research in education, and entertainment.

In addition, the wheel-drives segment is considered the fastest-growing segment, with a CAGR of 17.6% over the forecast period. Wheel-type robots are predicted to become more prevalent in military and defense applications to their advantage. Wheel-drive humanoid robots are also utilized for entertainment in theme parks, science fairs, and other public venues. It is anticipated that these factors will fuel market growth.

Regional Insights

North American market dominated the market with a revenue share of52.32%. Numerous top robotics businesses and research centers that have been at the forefront of developing humanoid robot technology are located in North America. Humanoid robots have been used in a variety of fields, including research and development, education, entertainment, and healthcare in the United States and Canada. Humanoid robots are being investigated by businesses and organizations in North America to enhance learning environments, assist with medical procedures, and improve customer experiences. The North American market is expected to flourish due to the region's excellent robotics research facilities, encouraging governmental initiatives, and robust academic-industry partnerships.

U.S. Humanoid Robot Market Trends

The humanoid robot market in the U.S. held the largest market share in 2023 owing to substantial investment in research and development, coupled with supportive regulatory environments. Moreover, the country's well-developed healthcare infrastructure, advancements in robotics, and presence of key market players are anticipated to drive the market over the forecast period. For instance, in December 2022, Apptronik, a robotics company in the U.S., collaborated with NASA to develop "Apollo," a general-purpose humanoid robot to aid with tasks in space, the commercial sector, and at home.

Europe Humanoid Robot Market Trends

The humanoid robot market in Europe is anticipated to register a considerable growth rate during the forecast period. Growing demand for humanoid robots from the healthcare sector and the rising development of humanoid robots with technologically advanced features propel market growth during the forecast period. Moreover, the significant rise in the baby boomer population in developed countries offers substantial growth opportunities for the humanoid robot sector.

The UK humanoid robot market is anticipated to register a considerable growth rate during the forecast period. Rising adoption of humanoid robots in the country due to rising awareness regarding the benefits of technological advancements in robotics, the introduction of new robots, and increasing funding for robotic research are among the factors contributing to market growth. For instance, in April 2024, The National Robotarium at Heriot-Watt University partnered with The University of Edinburgh to acquire Ameca from Engineered Arts. This acquisition marks the Robotarium as the first UK facility to host this advanced humanoid robot.

The humanoid robot market in Germany in terms of revenue share in 2023. An increasing number of initiatives undertaken by various public and private organizations and a rise in funding boost market growth. For instance, RobCo, a German robotics startup, received Series A funding from US powerhouse Sequoia Capital in 2022 and a fresh USD 43 million Series B from fellow American VC Lightspeed Venture Partners in 2024.

Asia Pacific Humanoid Robot Market Trends

The humanoid robot market in Asia Pacific held a significant share of the global market in 2023. Some of the leading Asia Pacific marketplaces are Japan, South Korea, and China. The region is a leader in adoption since it has companies producing humanoids. It is also one of the few places in the world where significant firms like Robotis of Korea, Softbank of Japan, Invento Robotics of India, and other businesses have progressed with humanoids. In the aerospace sector, there has been a desire for humanoids in the area. For instance, the Indian Space Research Organization commenced its human launch program in January 2020, which aimed to send its first humans into space starting in 2022. A "half-humanoid" robot astronaut named "Vyommitra" was assigned to the Gaganyaan when it made its initial voyage in December 2020, according to the organization.

Japan humanoid robot market is anticipated to register the fastest growth rate during the forecast period. Advanced healthcare systems, with a strong focus on innovation and technological advancements, are boosting market growth. For instance, Rosemary's Robot Baby CB2 is a humanoid robot developed by the Graduate School of Engineering at Osaka University. This robot, which simulates the movements of a young child and is abbreviated as "Child-Robot with Biometric Body," has captivated global audiences with its unique capability to react to auditory stimuli by moving and altering facial expressions.

The humanoid robot market in China is anticipated to register considerable growth during the forecast period. Key factors contributing to market growth include a structured regulatory framework and the launch of new robots in the Chinese market. For instance, in May 2024, the Beijing Humanoid Robot Innovation Center introduced Tiangong, a humanoid robot running on electric power. Furthermore, Beijing’s Ministry of Industry and Information Technology (MIIT), which regulates the country’s industrial sector, published a guideline in November 2023 to develop humanoid robots.

Latin America Humanoid Robot Market Trends

The humanoid robot market in Latin America is witnessing steady growth in the global market due to growing awareness of their availability and benefits. The healthcare industry in this area has seen a growing need for humanoid robots, as they can support medical staff and improve patient care. Such factors boost the market growth in this region.

The Argentina humanoid robot market is expected to register considerable growth during the forecast period. Argentina has made substantial progress in the use of technology in recent years. Increasing preference and growing availability of humanoid robots in various sectors, such as healthcare, hospitality, and research activities in robotics, boosts the market growth.

Middle East and Africa Humanoid Robot Market Trends

The humanoid robot market in the Middle East and Africa region is experiencing lucrative growth in the global market. The anticipated benefits and current research efforts focused on developing new technologies are expected to enhance the utilization of humanoid robots, leading to their increased implementation in the healthcare industry and further fueling market growth.

The UAE humanoid robot market is expected to register considerable growth during the forecast period. Improving healthcare infrastructure, rapid technological advancements, and growing awareness are among the factors boosting market growth in the country. For instance, in September 2023, RDI Robots, a manufacturer of autonomous service robots, introduced Ardi, a humanoid robot, to arrange a RoboShow.

Key Humanoid Robot Company Insights

Key participants in the humanoid robot market are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Humanoid Robot Companies:

The following are the leading companies in the humanoid robot market. These companies collectively hold the largest market share and dictate industry trends.

- HYULIM Robot Co., Ltd

- HANSON ROBOTICS LTD

- Engineered Arts Limited

- Honda

- KAWADA Robotics Corporation

- SoftBank Robotics

- Sanbot Co

- ROBOTIS

- Willow Garage

- Toshiba Corporation

Recent Developments

-

In April 2024, Boston Dynamics, a U.S.-based engineering and robotics company, introduced its all-new electric Atlas humanoid robot, which succeeds its hydraulic predecessor, to revolutionize the robotics industry.

-

In February 2024, Kepler Exploration Robot Co., Ltd., a manufacturer of humanoid robots, introduced the Kepler Forerunner series of general-purpose humanoid robots (Kepler Humanoid Robot). These robots stand at a height of 178cm (5'10") and weigh 85kg (187 lbs.). They feature highly intelligent hands capable of intricate movements with 12 degrees of freedom.

Humanoid Robot Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.55 billion

Revenue forecast in 2030

USD 4.04 billion

Growth rate

CAGR of 17.3% from 2023 to 2030

Historical data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, motion type

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

HYULIM Robot Co., Ltd; HANSON ROBOTICS LTD; Engineered Arts Limited; Honda; KAWADA Robotics Corporation; SoftBank Robotics; Sanbot Co; ROBOTIS; Willow Garage; Toshiba Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Humanoid Robot Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global humanoid robot market report based on component, application, motion type, and region

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Research and Space Exploration

-

Education and Entertainment

-

Personal Assistance and Caregiving

-

Hospitality

-

Search and Rescue

-

Others

-

-

Motion Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Biped

-

Wheel drive

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global humanoid robot market size was estimated at USD 1.32 billion in 2023 and is expected to reach USD 1.6 billion in 2024.

b. The global humanoid robot market is expected to grow at a compound annual growth rate of 17.3% from 2024 to 2030 to reach USD 4.04 billion by 2030.

b. North America dominated the humanoid robot market with a share of 52.3% in 2023. The market's growth is propelled by several factors, including the expanding utilization of humanoid robots for surveillance and security, such as detecting unauthorized intrusion and terrorist activities. Furthermore, humanoid robots are utilized for research and space exploration, enabling connectivity from remote locations.

b. Some of the key players in the humanoid robot market are HYULIM Robot Co., Ltd, HANSON ROBOTICS LTD, Engineered Arts Limited, Honda, KAWADA Robotics Corporation, SoftBank Robotics, Sanbot Co, ROBOTIS, Willow Garage, and Toshiba Corporation.

b. The global market for humanoid robots is poised for substantial growth due to rapid technological advancements leading to more efficient and affordable robot models. Furthermore, the increasing adoption of humanoid robots in military and defense applications, providing battlefield intelligence and knowledge of enemy movements, is expected to drive market expansion. Additionally, the growing trend of industry automation is anticipated to further fuel the demand for humanoid robots in various sectors in the near future.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."