- Home

- »

- Petrochemicals

- »

-

Liquid Synthetic Rubber Market Size & Trends Report, 2025GVR Report cover

![Liquid Synthetic Rubber Market Size, Share & Trends Report]()

Liquid Synthetic Rubber Market Size, Share & Trends Analysis Report By Product (Isoprene, Butadiene, Styrene Butadiene), By Application (Tire, Industrial Rubber, Adhesive), And Segment Forecasts, 2020 - 2025

- Report ID: GVR-2-68038-769-8

- Number of Report Pages: 138

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2018

- Forecast Period: 2020 - 2025

- Industry: Bulk Chemicals

Report Overview

The global liquid synthetic rubber market size was estimated at USD 3.87 billion in 2019, projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2020 to 2025. Increasing demand for isoprene, butadiene, and styrene-butadiene across the globe in tire manufacturing, adhesives, sealants and coatings, and industrial rubber products manufacturing is expected to drive growth.

Raw materials used for manufacturing liquid synthetic rubber (LSR) are polymer compounds, such as cis-1,4-polyisoprene, cis-1,4-polybutadiene, and styrene. Major polybutadiene suppliers include petrochemical companies such as Sibur, Sinopec, and ExxonMobil, which are integrated across the value chain; i.e. from petroleum refining to polybutadiene manufacturing.

Raw materials, such as styrene-butadiene, are obtained from petrochemical feedstock and the fluctuations in petrochemical prices have a major impact on the overall cost of LSR. To ensure premium quality and a constant supply of raw materials through efficient distribution channels, manufacturers have long-term tie-ups with the major raw material suppliers.

The LSR manufacturers distribute their products directly to the application industries through internal marketing, sales, and service teams. In addition, there exist distributors, such as Weber & Schaer and Milagro Rubber Co. offering a wide variety of products as well as aiding in geographical and clientele expansion.

LSRs have major applications in adhesives, sealants, and coating industries. Liquid isoprene and butadiene rubber are utilized for a range of applications, such as plasticizing and tackifying of hot-melt adhesives. In addition, it finds application in automotive and electronics adhesives, where isoprene grades functionalized with Maleic Anhydride (MAH) by carboxylation or grafting method are used to improve the adhesion.

Natural rubber has found itself losing market share to synthetic rubber owing to numerous factors, such as high cost and low abrasion resistance, which is projected to have a positive impact on the market growth. Furthermore, the macro factors affecting the natural rubber market, such as limited availability leading to price volatility, are projected to have a positive impact on liquid synthetic rubber market growth.

Liquid Synthetic Rubber Market Trends

Rising global demand for automotive tires for new vehicles as well as for replacement purposes is one of the major factors driving styrene butadiene rubber (SBR) market. Over 70% of the SBR produced globally is used in the manufacturing of tires, which has led to an increase in the demand for synthetic rubbers in automotive industry. As the global demand for OEM tires is witnessing an increase owing to the growth of automotive industry, the demand for liquid synthetic rubbers is projected to rise rapidly. Replacement tires market has witnessed growth due to increased vehicle life and a shift in consumer preference toward high-performance tires.

Major countries including Japan, China, the U.S., and South Korea have implemented tire labeling regulations owing to which tire manufacturers are forced to use synthetic rubbers in order to match the performance levels. Liquid synthetic rubber reduces Mooney viscosity and is majorly used as a raw material in the production of high-performance tires as it reduces migration. Liquid synthetic rubber enhances tire performance significantly by simultaneously controlling the fuel efficiency, balance of grip, and wear resistance.

Natural rubber (NR) is obtained from the latex of Hevea brasiliensis tree and takes seven years from plantation before the rubber can be extracted from the tree. Although natural rubber exhibits certain excellent properties in terms of physical behavior, it is losing market share to synthetic rubber for various reasons such as high cost, low abrasion resistance, not resistant to acid, weather and oil, which, in turn, is projected to have a positive impact on the market growth. The macro factors affecting NR market include limited supply leading to price volatility and uncertainty in terms of the supply of raw materials. Natural rubber plantations have a narrow geographical concentration and hence there is a high dependency on regions like Southeast Asia to meet the demand.

The major factor inhibiting the growth of liquid synthetic rubber market is the volatility in the prices of the raw materials. Styrene and butadiene, major raw materials for liquid SBR and BR respectively, are obtained from petroleum feedstock via different processes and the price of crude oil directly affects their prices. Different catalysts and solvents such as hexane, cyclohexane, benzene or toluene derived from oil & gas sector are also used in the manufacturing of liquid synthetic rubber. Over the last few years, the global chemicals industry has observed a series of large-scale disruptions such as a shift to the faster-growing Asian markets and the development of shale gas in the U.S. and coal in China.

Product by Application Insights

Liquid isoprene rubbers are superior in mixing, molding, extrusion, and calendaring processes and are used in a wide range of application industries requiring low water swell, good resilience, and high hot & gum tensile strength, and good tack. It is majorly used for manufacturing adhesive products, such as solvents, hot-melts, cross-linking agents, and light-curing adhesives. Liquid isoprene rubber is used for a wide range of functions in the sealants and coatings industry. This product, when incorporated into sealant formulations for sharp property modifications offers broad cold temperature performance, sound, and dampening performance along with longer product lifetimes driving the market growth.

Liquid isoprene rubber is used in the manufacturing of a wide variety of industrial components including drive belts, hoses, seals, gaskets, bushings, motor mounts, and tank linings. Rising penetration of the product in industrial rubber component manufacturing coupled with increasing manufacturing industries growth across the major economies is anticipated to propel growth.

Liquid butadiene rubber is used in high-performance cross-linked rubber applications owing to its high temperature operating ability ranging from 120 °C to 156 °C, varying with grade. It is incorporated in Ethylene Propylene Diene Monomer (EPDM) rubbers to obtain processability, high-hardness compound, metal adhesion, low VOCs, and excellent curing kinetics. Tire manufacturing is the dominant application segment on account of its properties, such as high resilience with low heat buildup, abrasion, cut growth resistance, and low-temperature flexibility that makes them ideal for use in tires. It is blended with styrene-butadiene or natural rubber and used as a tread rubber, sidewall, and bead filler.

It finds application in sealants and coatings and is used as a structural adhesive for improving adhesion to metal surfaces. Increasing application scope in coatings, binders, adhesives, potting agents, and casting and laminating resins, as well as a vulcanizable plasticizer for rubber, is expected to boost market growth over the forecast period.

Liquid styrene-butadiene rubber is majorly used in the production of tires and tire components, such as tread, apex/rim/flange, and carcass among several others. Increased focus on enhanced durability and superior performance of tires along with the adoption of tire labeling regulations is driving its demand from the tire manufacturing industry.

Styrene-butadiene rubber is used for modification of several polyolefins to introduce new functional groups and other blends, as well as to change the undesired properties including polarity, adhesion to other materials, and resistance to the aging of rubbers, resins, and plastics. It is majorly used as an asphalt modifier and consumed in the preparation of polymer-modified asphalt.

Liquid styrene-butadiene rubber when used as an adhesive for cement bond coats, concrete, and mortars; improves the bond strength and chemical resistance, thereby reducing cracking and increasing durability, tensile strength, and wear resistance. An increasing application of adhesives in the end-use industry is expected to drive market growth over the forecast period.

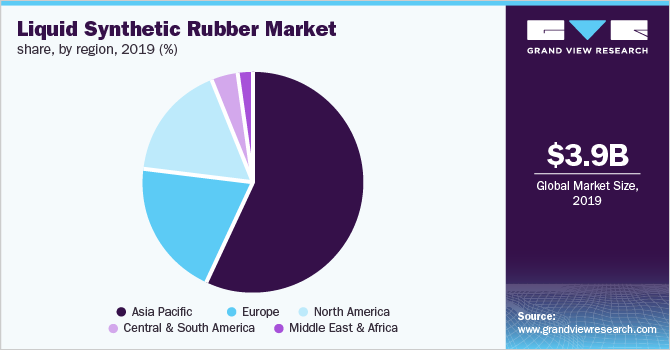

Regional Insights

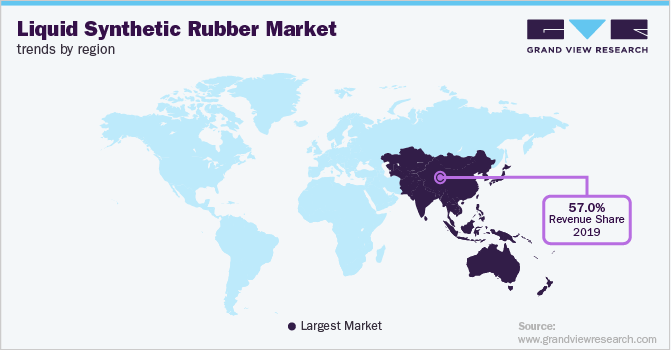

Asia-Pacific dominated the liquid synthetic rubber market and accounted for the largest revenue share of 56.3% in 2017. The presence of major liquid synthetic rubber producers, availability of raw materials, low manufacturing coast and wide scope of application industries have major impact on driving the market growth over the forecast period. India accounted for the fastest growing market followed by China, South Korea and Japan owing to the accelerating growth of end-use industries including automotive, construction, as well as rubber product manufacturing over the forecast period.

The Asia Pacific accounted for the largest market share in terms of volume as well as revenue owing to the presence of major tire manufacturing companies in China and Japan. The presence of numerous manufacturers, availability of raw materials, low manufacturing cost, and a wide scope of application industries are expected to drive the regional market growth over the forecast period.

Increasing consumption of liquid isoprene rubber in SIS block polymers for use in adhesive accounted for major share in Asia Pacific LIR market. Liquid isoprene rubber is used with natural rubber which works as reactive plasticizer for natural rubber (NR). The material is used with NR to improve adhesion properties to metals such as zinc plated steel cord used in tires. In addition, LIR functions as reactive plasticizer and is vulcanizable with solid rubbers thereby improving processability with the rubber compounds which is expected to drive the market growth over the forecast period.

China is the world’s largest producer of synthetic rubber as well as raw materials, such as butadiene, styrene, solvents, and catalysts. The rapid development of the manufacturing sector in the country; primarily automotive and construction materials, is expected to drive the market over the projected period.

The growing automotive industry in Europe is a lucrative end-user of LSR, aiding the market growth. The presence of major tire manufacturing companies including Bridgestone, Michelin, Goodyear, Pirelli, and Apollo, and innovative manufacturing techniques incorporated by the manufacturers are expected to complement market growth.

In addition, the application of the product as construction sealants coupled with the construction industry undergoing an overhaul in recent with the development of high rise buildings, better residential areas, and new town centers is anticipated to boost the product demand in the region. Europe accounts for a significant share in liquid isoprene rubber consumption on account of low availability of liquid natural rubber. Growing penetration of the product as adhesive sealant in the automotive industry coupled with increase in vehicle production in the region is expected to drive the product demand in the region.

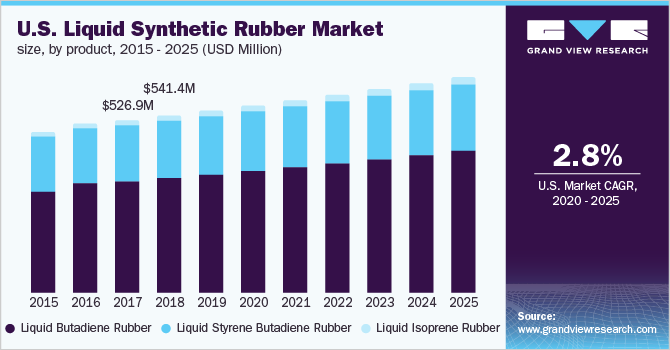

Commencement of infrastructure and commercial projects in North America is projected to drive the demand for adhesives and sealants and coatings. The surplus of opportunities has impelled coating manufacturers to resolve issues with the product, such as chemical resistance, mechanical strength, and weatherability, which is likely to aid market growth.

Key Companies & Market Share Insights

The global market is niche and fragmented with the presence of very few manufacturers. The competitive edge lies with the increased regional presence and growing investment in downstream applications. Manufacturers are expanding in the developing countries to gain an advantage of the low labor costs and on improving products to enhance their product offerings.

Synthomer plc, Royal Adhesives & Sealants, TER HELL & Co. GmbH, and Kuraray Co., Ltd. are the major players. Manufacturers are actively involved in R&D as the low product differentiation has forced the manufacturers to focus on product quality development.

Liquid Synthetic Rubber Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.04 billion

Revenue forecast in 2025

USD 5.0 billion

Growth Rate

CAGR of 4.6% from 2020 to 2025

Base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2020 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; China; India; Japan; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Evonik Industries AG; Synthomer plc; Royal Adhesives & Sealants; Nippon Soda Co., Ltd.; TER HELL & Co. GmbH; Kuraray Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Synthetic Rubber Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global liquid synthetic rubber market report on the basis of the product by application and region:

-

Product by Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Liquid Isoprene

-

Adhesive

-

Sealants & Coatings

-

Industrial Rubber Components

-

Tire Manufacturing

-

Others

-

-

Liquid Butadiene

-

Industrial Rubber Manufacturing

-

Polymer Modification

-

Tire Manufacturing

-

Others

-

-

Liquid Styrene Butadiene

-

Tire Manufacturing

-

Polymer Modification

-

Adhesives

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

U.K.

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global liquid synthetic rubber market size was estimated at USD 3.8 billion in 2019 and is expected to reach USD 4.04 billion in 2020.

b. The global liquid synthetic rubber market is expected to grow at a compound annual growth rate of 4.6% from 2017 to 2025 to reach USD 5.0 billion by 2025.

b. Asia Pacific dominated the liquid synthetic rubber market with a share of 57.29% in 2019. This is attributable to the presence of numerous manufacturers, availability of raw materials, low manufacturing cost, and wide scope of application industries.

b. Some key players operating in the liquid synthetic rubber market include Evonik Industries AG, Synthomer plc, Royal Adhesives & Sealants, Nippon Soda Co., Ltd., TER HELL & Co. GmbH and Kuraray Co., Ltd.

b. Key factors that are driving the market growth include increasing demand for isoprene, butadiene, and styrene butadiene in tire manufacturing, adhesives, sealants and coatings, and industrial rubber products manufacturing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."