- Home

- »

- Medical Imaging

- »

-

Mammography Workstation Market Size Report, 2020-2027GVR Report cover

![Mammography Workstation Market Size, Share & Trends Report]()

Mammography Workstation Market Size, Share & Trends Analysis Report By Modality (Multimodal, Standalone), By Application (Diagnostic Screening, Advance Imaging), By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-059-7

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global mammography workstation market size was valued at USD 116.2 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2020 to 2027. The increasing incidence of breast cancer and technological advancement in the field of mammography are the factors driving the market growth. Breast cancer is the most common form of cancer in women. According to the WHO, there were more than 0.6 million women dying from breast cancer in 2018, accounting for approximately 15% of all cancer deaths. Moreover, increasing awareness about breast cancer and early detection of disease due to the availability of advanced mammography diagnostic devices are also driving the market for mammography workstations. According to Breast Cancer Surveillance Consortium, breast cancer detection due to mammography rose to 34.7 per 100 examinations.

The increasing number of new product launches and speedy FDA approvals is also driving the market for mammography workstations. The U.S. FDA announced new steps to modernize breast cancer screening to empower patients and support decision making. These changes include adding new assessment categories, modernizing quality standards, and advancement in tissue density standards. Rising investment in research activities to develop new technology in early breast cancer detection has increased substantially. Many government-funded projects are focusing on the early stage of medical technology development and to analyze and generate data. In addition, private companies are focusing on the development of next-generation mammography workstations.

Breast cancer is commonly observed in older women. According to the WHO, by 2050, the population aged more than 60 years old is expected to reach 2 billion. However, technological advancement in the field of mammography has translated to a higher rate of detection. Early detection of breast cancer is a key to survival and success as this type of cancer is most likely to develop into a life-threatening illness.

Mammography workstation has an open architecture that provides high-resolution imaging to view, capture, manage, archive, and safeguard digital images and information. These workstations provide support to both diagnostic workflow and screening. These devices are also scalable, from standalone implementation to a system reviewing a large mammography workgroup.

Application Insights

The diagnosis screening segment dominated the market for mammography workstations and accounted for the largest revenue share of around 39.0% in 2019. The high market share of this segment is primarily due to the high usage of mammography workstations in diagnostic screening. Diagnostic screening is performed on asymptomatic women to identify breast cancer at an early curable stage. Furthermore, an increasing number of breast screening programs is boosting the market growth. For instance, BreastScreen Australia is a national breast cancer screening program that invites women aged more than 50 years for a free mammography every two years.

The advance imaging segment is expected to grow at a lucrative growth rate during the forecast period. The high growth rate of the segment is primarily attributed to the high adoption of these devices and innovative product launches. For instance, in November 2019, Candelis, Inc launched an advanced breast imaging workstation. The device provides support for 3D breast ultrasound images and it is acquired by Hitachi, Siemens Acuson ABVS, GE Invenia ABUS, and iVu Sophia with a diagnostic tool for interpretation and reading.

End-use Insights

The hospitals segment dominated the market for mammography workstations and accounted for the largest revenue share of 42.4% in 2019. This is owing to the rising number of breast screenings and technological advancements in the field of mammography workstation. Moreover, increasing healthcare funding and various government reforms are also driving the growth of the segment. Many OECD countries have adopted a breast cancer screening program using tools such as mammography workstation. Thus, the aforementioned factors are contributing to segment growth.

The breast care center segment is anticipated to grow at the fastest pace during the forecast period. The key driver of the segment is the rising awareness about breast care centers and increasing breast centers network. These centers provide complete diagnostic and preventive health services. For instance, the Breast Centers Network is the first international network of clinical centers dedicated to the treatment and diagnosis of breast cancer. This is the project of the European School of Oncology to improve and promote breast cancer care in the world.

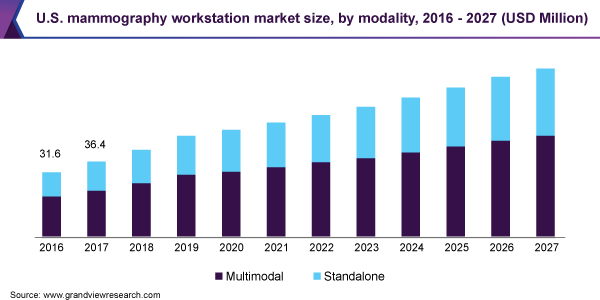

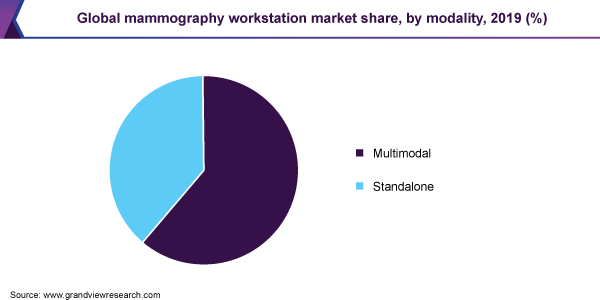

Modality Insights

The multimodal segment dominated the market for mammography workstations and accounted for a revenue share of 61.2% in 2019. The high market share of the segment is primarily due to the high usage of these devices in hospitals and breast care centers. The multimodality workstation provides a high-resolution display and has the ability to compare two-dimensional display and tomosynthesis images. Furthermore, these workstations provide customization for reading personalized configuration and protocols.

The standalone workstation segment is expected to witness a lucrative growth rate during the forecast period. The high growth rate of the segment is primarily due to the high adoption of these devices. The standalone workstation enables multimodality and multivendor images and integration. These standalone workstations simplify clinicians’ efforts by streamlining complex steps. The devices integrate data from multiple modalities in a single location and help in automatically aligning breast tissue images. Furthermore, these devices also provide patient history through a graphical patient history timeline, and also display digital and computed radiography on the screen.

Regional Insights

North America dominated the market for mammography workstations in 2019 and accounted for a revenue share of 48.2% and is expected to maintain its dominance over the forecast period. Regionally, the market for mammography workstations is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. The rising geriatric population and an increasing number of product launches are boosting the mammography workstation market in North America. Continuous technological advancement in the field of mammography and speedy FDA approvals is also contributing to the growth in the region. In addition, the presence of major players in the industry is further augmenting the growth of the market in the region.

In Asia Pacific, the market is anticipated to witness the fastest growth rate during the forecast period. The rising geriatric population and increasing awareness about early detection of breast cancer are the major factors contributing to market growth. Breast cancer in the Asia Pacific region is lower than its western counterpart. However, there has been a substantial rise in the incidence among the Asian population. Approximately, 24.0% of all breast cancer cases occur in the region, with the majority of those occurring in China and Japan. Furthermore, increasing government funding related to mammography and continuous technological development is boosting the market growth.

Key Companies & Market Share Insights

Key players are heavily investing in research and development and are engaged in various technological collaborations. Furthermore, an increasing number of product launches and speedy FDA approval is also boosting the market growth. For instance, in January 2019, Trivitron Healthcare launched new mammography systems at Arab Health Convention. These players in the industry are focusing on the development of next-generation mammography workstations, which focus on a wide area of radiology. Moreover, artificial intelligence and machine learning have undergone a transformation that has improved the quality of diagnosis. This technology helps the radiologist to detect breast cancer at an early stage and also helps in risk prediction in mammography. Some of the prominent players in the mammography workstation market include:

-

Hologic

-

Fujifilm

-

Siemens Healthcare

-

GE Healthcare

-

Philips Healthcare

Mammography Workstation Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 123.6 million

Revenue forecast in 2027

USD 198.5 million

Growth Rate

CAGR of 7.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Hologic; Fujifilm; Siemens Healthcare; GE Healthcare; Philips Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global mammography workstation market report based on modality, application, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2016 - 2027)

-

Multimodal

-

Standalone

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Diagnostic screening

-

Advance imaging

-

Clinical review

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Breast care centers

-

Academia

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mammography workstation market size was estimated at USD 116.2 million in 2019 and is expected to reach USD 123.6 million in 2020.

b. The global mammography workstation market is expected to grow at a compound annual growth rate of 7.0% from 2020 to 2027 to reach USD 198.5 million by 2027.

b. North America dominated the mammography workstation market with a share of 28.9% in 2019. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the mammography workstation market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

b. Key factors that are driving the mammography workstation market growth include increasing medicare reimbursement for telehealth services, reducing emergency room visits and hospitalization rate, and technological innovation in communication technology across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."