- Home

- »

- Petrochemicals

- »

-

Marine Grease Market Size & Share, Global Industry Report, 2018-2025GVR Report cover

![Marine Grease Market Size, Share & Trends Report]()

Marine Grease Market Size, Share & Trends Analysis Report By Thicker Type (Lithium Complex, Calcium), By End-Use (Bulk Carrier & Cargo Ships, Passenger Ships, Tankers), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-867-1

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Report Overview

The global marine grease market size was valued at USD 238.9 million in 2016. Increasing demand for shipping services globally on account of increasing international trade is a key driver fueling the market growth. Moreover, the development of new waterways and robust growth in the shipbuilding industry are further propelling the market over the forecast period.

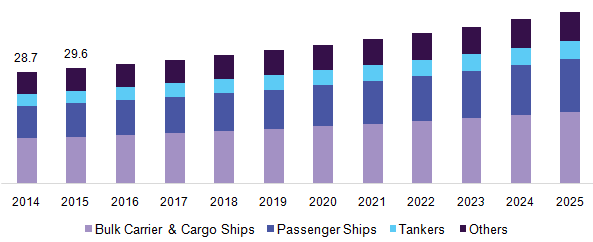

U.S. marine grease market by end-use, 2014 - 2025 (USD Million)

Marine grease is used in the shipping industry owing to its several superior properties. It possesses high-pressure additives, high load carrying capacity, a wider temperature range, mechanical stability, high thermal stability, corrosion protection, longer lubrication intervals, non-melting, and water resistance properties under extreme conditions. It increases the overall efficiency of the ships.

The U.S. market was estimated at USD 30.7 million in 2016 and is anticipated to grow at a CAGR of 4.2% from 2017 to 2025. The presence of water transportation infrastructure coupled with growing international trade is fueling the demand in the country. In addition, robust growth in the end-use segment is further boosting the demand over the forecast period.

Marine grease reduces the friction between rotating machine parts to increase the output efficiency of the engine, machinery, and several components installed in the ship. In addition, it has the capability to gel up with water, which functions efficiently even after water leakage. Among the various thicker types, lithium complex grease is extensively used in the shipping industry.

However, the presence of regulatory standards pertaining to the clean aquatic environment across the globe is expected to restrain the market growth over the forecast period. Different hazardous issues may arise from the spillage of aquatic bodies, owing to which, stringent regulations have been imposed by various regulatory bodies such as REACH, and VGP. The U.S. EPA has issued Vessel General Permit (VGP) regulations for the usage of environment-friendly lubricants in all commercial vessels longer than 79 feet.

Thicker Type Insights

Various thicker types of marine grease are used as a lubricant in the shipping industry including lithium or lithium complex, calcium, polyurea, aluminum, organoclay, barium, and sodium. Lithium complex grease is a unique additive system to serve maximum lubrication under the most critical operating conditions. It is applied in various applications in shipping operations such as outboards, trailer wheel bearing, trailer chassis lubrication, and wheel bearings.

The global calcium thicker type segment was estimated at USD 37.2 million in 2016 and is anticipated to grow at a rate of 3.7% from 2017 to 2025. It is an anhydrous grease that is highly resistant to water and contains additives to protect against oxidation and rust. In addition, it is extensively used in boat trailers, wheel bearings, and other applications.

End-use Insights

Marine grease is extensively used in various end-use segments including the bulk carrier & cargo ships, passenger ships, tankers, and others. It is largely used in the bulk carriers and cargo ships on account of an increasing volume of heavy cargo and the products transported through ships. Increasing transshipment of cargo through ships led to an increasing need for marine grease in order to maintain the efficiency and performance of the ship.

The passenger ship segment was estimated at USD 59.9 million in 2016 and is anticipated to grow at a CAGR of 5.2% between 2017 to 2025. Increasing passenger capacity of new ships along with new local ports and ship diversification is fueling the demand in the passenger ship segment. Other end-use segments include special purpose vessels, service vessels, offshore vessels, and yachts.

Regional Insights

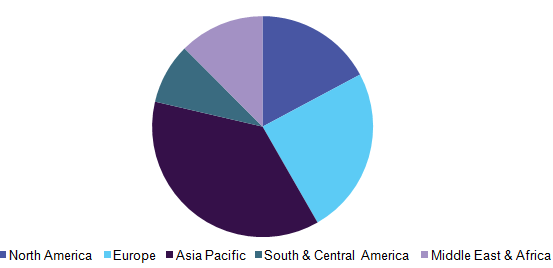

The Asia Pacific dominated the marine grease market in 2016 and is expected to continue over the next eight years. It was valued at USD 88.2 million in 2016 and is projected to grow at a CAGR of 5.3% from 2017 to 2025. Increasing industrialization in the region, coupled with new waterways development, and growing coastal economies is fueling the demand in this region.

Global marine grease market, by region (USD Million), 2016 (%)

The Asia Pacific was followed by Europe in 2016 and is expected to grow at a rate of 4.6% over the forecast period. The flourishing maritime transport sector and the presence of ship transport infrastructure in the region are key factors driving the growth.

Marine Grease Market Share Insights

The major players in the global market include British Petroleum, CHEVRON Lubricants, ExxonMobil Company, Gulf Oil Marine Ltd, Lucas Oil Products Inc, LUK OilMarine, Old World Industries, Penrite Oil Co., Ltd, Royal Dutch Shell Company, Total Lubmarine, and Warren Oil. The companies are focusing on manufacturing non-hazardous and environment-friendly marine grease products.

Marine Grease Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 267.6 million

Revenue forecast in 2025

USD 348.4 million

Growth Rate

CAGR of 4.4% from 2017 to 2025

Base year for estimation

2016

Historical data

2014 - 2015

Forecast period

2017- 2025

Quantitative units

Revenue in USD million and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Thicker type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Netherlands, China, India, Japan, Singapore, Brazil, Saudi Arabia, South Africa

Key companies profiled

British Petroleum, CHEVRON Lubricants, Exxon Mobil Company, Gulf Oil Marine Ltd, Lucas Oil Products Inc, LUK OilMarine, Old World Industries, Penrite Oil Co., Ltd, Royal Dutch Shell Company, Total Lubmarine, and Warren Oil.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the reportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global marine grease market on the basis of thicker type, end-use, and region:

-

Thicker Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Lithium Complex

-

Calcium

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

Bulk Carrier & Cargo Ships

-

Passenger Ships

-

Tankers

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global marine grease market size was estimated at USD 267.6 million in 2019 and is expected to reach USD 278.7 million in 2020.

b. The global marine grease market is expected to grow at a compound annual growth rate of 4.4% from 2017 to 2025 to reach USD 348.4 million by 2025.

b. Asia Pacific dominated the marine grease market with a share of 38.0% in 2019. This is attributable to increasing industrialization in the region, coupled with development of new waterways and growing coastal economies.

b. Some key players operating in the marine grease market include British Petroleum, CHEVRON Lubricants, Exxon Mobil Company, Gulf Oil Marine Ltd, Lucas Oil Products Inc, LUK OilMarine, Old World Industries, Penrite Oil Co., Ltd, Royal Dutch Shell Company, Total Lubmarine, and Warren Oil.

b. Key factors that are driving the market growth include increasing demand for shipping services globally on account of increasing international trade.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."