- Home

- »

- Next Generation Technologies

- »

-

Mobile Payment Market Size & Share Analysis Report, 2030GVR Report cover

![Mobile Payment Market Size, Share & Trends Report]()

Mobile Payment Market Size, Share & Trends Analysis Report By Technology (Near Field Communication, Direct Mobile Billing), By Payment Type (B2B, B2C, B2G), By Location, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-461-1

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

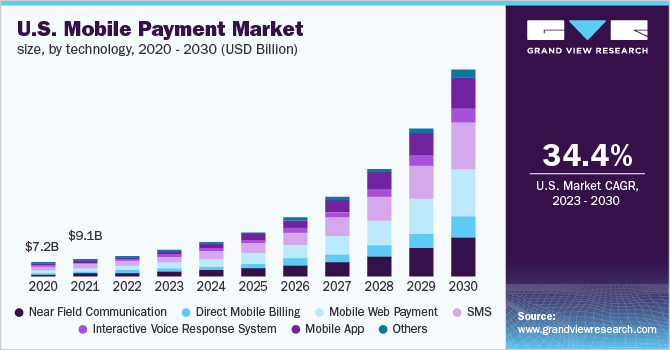

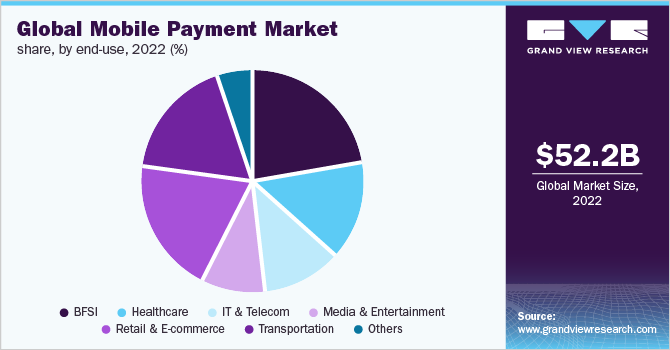

The global mobile payment market size was valued at USD 52.21 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 36.2% from 2023 to 2030. The global mobile payments transactions were valued at over USD 2 Trillion in 2022. The market growth can be attributed to factors such as the rising m-commerce industry and the surge in the penetration of smartphones across the globe. The increasing internet penetration for online shopping is expected to further propel market growth over the forecast period. Businesses across the globe are making their payment modes mobile-compatible, thereby creating growth opportunities for the market.

Mobile payment solutions are fast and convenient. An increasing number of customers across the globe have embraced the concept of using smartphones and tablets to pay for products and services. Moreover, both e-commerce and traditional businesses are focusing on adapting to changing customer behavior, including cashless payment methods through mobile devices, due to the challenges posed by the COVID-19 pandemic. These aforementioned factors are expected to fuel the market growth over the forecast period.

In mobile payment technology, Near-Field Communication (NFC) effectively transmits encrypted data to the Point of Sale (POS) devices directly and instantly. This saves time significantly compared to PIN and chip technology. NFC in mobile devices makes use of close-proximity radio frequency identification to effectively communicate with NFC-enabled card machines. Customers need not come into physical contact with the POS devices to transfer information and only the mobile devices need to be near the terminal.

The increasing adoption of sound wave-based mobile payments is expected to drive market growth. Instead of using existing technologies, such as banking applications or mobile wallets, NFC, or card terminals, sound wave-based payment transactions are processed through unique sound waves containing encrypted information about the payments. The internet is not required for sound wave-based mobile payments. Sound wave-based mobile payment solutions are easy to deploy at a low cost, particularly in regions and countries where residents cannot afford the most advanced smartphones.

However, security concerns related to mobile payment solutions are expected to hinder the growth of the market. The increasing number of high-profile data breaches across the globe is expected to hamper the growth of the mobile payment market over the forecast period. Customers prefer to use debit or credit cards since most customers choose to stay secure from data breaches while making payments. Some customers are still more comfortable using debit or credit cards rather than making a contactless payment.

COVID 19 Impact Analysis

The outbreak of the COVID-19 pandemic positively impacted market growth. An increase in health-related concerns due to COVID-19 is also changing consumers’ shopping patterns. The pandemic has boosted the preference for contactless payments to minimize the number of touchpoints at the point of sales. According to the statistics provided by EastWestBank, in 2020, the usage of contactless payment in the U.S. increased by 150% compared to 2019. Moreover, 87% of consumers preferred shopping in stores by using contactless payment options.

Technology Insights

The mobile web payment segment dominated the market in 2022 with a revenue share of more than 23.0%. The growth of the segment can be attributed to the security and flexibility provided by mobile web payment solutions. The growing popularity of m-commerce also bodes well for the growth of the segment. The mobile web payment platforms have a URL and can be properly bookmarked, making it easier for customers to re-visit or share the website.

The near-field communication segment is expected to expand at the highest CAGR over the forecast period. NFC technology allows merchants to integrate customer loyalty programs into their payment processes and customers to redeem their coupons immediately using mobile phones. The rise in e-commerce platforms and continued implementation of the latest technologies in financial transactions are expected to drive the growth of the segment. Factors such as the increasing adoption of wearable payment devices and the growing mobile commerce trend are expected to drive the adoption of NFC-based payments.

Payment Type Insights

The B2B segment held the leading revenue share of more than 60.0% in 2022. Aggressive investments by private equity and venture capital firms in B2B payments are creating new growth opportunities. For instance, in January 2022, Rupifi, a B2B payment application provider, raised USD 25 million in a series-A round funding, led by Tiger Global Management, LLC and Bessemer Venture Partners. Rupifi plans to use this funding to build complete B2B checkout product and omnichannel mobile-first B2B payments solutions for distributors, merchants, and sellers. Moreover, banks are also increasingly adopting B2B mobile payments to enhance the experience for business customers.

The B2C segment is expected to expand at the highest CAGR over the forecast period. B2C payments are payments made by consumers while buying a product or subscribing to a service for personal use. The increasing share of mobile payments in the e-commerce industry vertical is driving the growth of the segment. According to a study conducted by SalesForce, mobile consumers account for 60% of the world’s total e-commerce traffic. The increasing adoption of digital wallets across the globe is expected to drive the B2C segment growth over the forecast period.

Location Insights

The remote payment segment held the dominant revenue share of more than 59.0% in 2022. The popularity of remote payments is increasing, particularly due to the outbreak of the COVID-19 pandemic, as remote payments do not require any direct interaction while making payments. Several companies are launching remote payment apps to allow customers to make payments remotely. For instance, in March 2020, SumUp announced the launch of mobile payments and invoicing across Europe to help consumers in paying remotely and safely through smartphones. The increasing adoption of a virtual terminal for remote billing is expected to drive segment growth.

The proximity payment segment is expected to expand at the highest CAGR over the forecast period. Proximity payments require the payer and the payee to be in proximity and the transactions take place between the payer’s and the payee’s devices via QR codes, NFC, or Bluetooth connectivity. This payment method allows paying for goods and services by mobile phones and other devices at a physical POS terminal. In the wake of the COVID-19 pandemic, the preference for proximity payments has significantly increased as banks, fintech industries, and merchants are aiming to improve the digital experience for their customers and reduce their operational costs.

End-use Insights

The BFSI segment dominated the market in 2022 with a revenue share of more than 22.0%. Several banks are trying aggressively to introduce mobile payments, thereby contributing to the growth of the segment. Businesses are also focusing on adopting a custom suite of comprehensive payment solutions, which helps resolve unique challenges across wealth management, lending, and insurance sectors. Mobile banking and payments create new opportunities for banks to offer additional convenience to their existing customers and reach a large population of unbanked customers in developing countries.

The retail and e-commerce segment is expected to expand at the highest CAGR over the forecast period. The growing number of smartphone users and the subsequent rise in mobile commerce sales bode well for the growth of the segment. Smartphones applications are emerging as the most preferred way of shopping. According to the statistics provided by J.P. Morgan 2020 E-commerce Payments Trends Report, 54% of mobile commerce payments are done through dedicated shopping applications. Increasing cross-border shopping is also emerging as one of the major factors driving the preference for mobile payments.

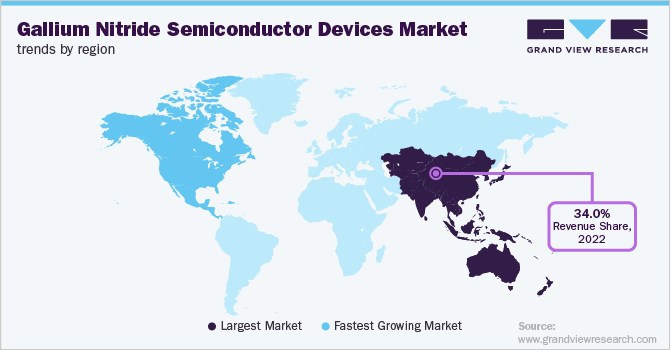

Regional Insights

Asia Pacific dominated the market in 2022 with a revenue share of more than 34.0%. The changing lifestyle, the latest online retailing trends, and increased smartphone penetration are expected to drive regional market growth over the forecast period. The increasing government initiatives across the Asia Pacific countries to go cashless are expected to create growth opportunities for the regional market. The widespread adoption of mobile technology in emerging countries offers fintech players and banks a new way to offer mobile banking solutions to underserved and unbanked customers in remote areas.

North America is anticipated to witness significant growth over the forecast period. It is characterized by the presence of several key market players. The region has also been an early adopter of the latest and advanced technologies. The growing number of unmanned stores in the U.S. is also driving the adoption of mobile payments. The growth in the e-commerce industry is mainly responsible for the extensive adoption of mobile payment solutions in North America.

Key Companies & Market Share Insights

Major players in the market are adopting strategies such as new product launches, strategic agreements, and product upgrades as part of their efforts to cement their market position. They are also focusing on striking strategic partnerships with financial service providers to enhance customer experience. For instance, in April 2021, MoneyGram International announced a partnership with Sigue, a B2B and P2P payment company based in the U.S. The partnership allowed Sigue’s customers to access MoneyGram International’s new MoneyGram as a Service business line and allowed other financial institutions on the Sigue platform to access MoneyGram International’s latest API-driven payment technology.

The key players are also investing aggressively in enhancing their product offerings. For instance, in January 2021, Safaricom announced the launch of the M Pesa bill management service. The service was mainly launched to target schools, utilities, landlords, and other businesses that receive repeated customer payments. This platform is focused on providing details to the customer, such as their pending payments, reminders regarding bill payments, and electronic bills after the payments are done. Some of the prominent players operating in the global mobile payment market are:

-

Google (Alphabet Inc.)

-

Alibaba Group Holdings Limited

-

Amazon.com Inc.

-

Apple Inc.

-

American Express Company

-

M Pesa

-

Money Gram International

-

PayPal Holdings Inc.

-

Samsung Electronics Co. Ltd.

-

Visa Inc.

-

WeChat (Tencent Holdings Limited)

Mobile Payment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 67.51 billion

Revenue forecast in 2030

USD 587.52 billion

Growth rate

CAGR of 36.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Technology, payment type, location, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Google (Alphabet Inc.); Alibaba Group Holdings Limited; Amazon.com Inc.; Apple Inc.; American Express Company; M Pesa; Money Gram International; PayPal Holdings Inc.; Samsung Electronics Co. Ltd.; Visa Inc.; WeChat (Tencent Holdings Limited)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mobile payment market report based on technology, payment type, location, end-use, and region:

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Near Field Communication

-

Direct Mobile Billing

-

Mobile Web Payment

-

SMS

-

Interactive Voice Response System

-

Mobile App

-

Others

-

-

Payment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

B2B

-

B2C

-

B2G

-

Others

-

-

Location Outlook (Revenue, USD Billion, 2017 - 2030)

-

Remote Payment

-

Proximity Payment

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Media & Entertainment

-

Retail & E-commerce

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global mobile payment market size was estimated at USD 52.21 billion in 2022 and is expected to reach USD 67.51 billion in 2023.

b. The global mobile payment market is expected to grow at a compound annual growth rate of 36.2% from 2023 to 2030 to reach USD 587.52 billion by 2030.

b. The mobile web payment segment dominated the mobile payment market in 2022 with a revenue share of more than 23.86%.

b. Some key players operating in the mobile payment market include Google, Apple Inc., Samsung, American Express, Visa, Amazon, PayPal, and others.

b. Key factors that are driving the mobile payment market growth include the growing propensity to use smartphones and increasing penetration of mobility and smartphones, especially in emerging nations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."