- Home

- »

- Petrochemicals

- »

-

Offshore Lubricants Market Size, Industry Report, 2022GVR Report cover

![Offshore Lubricants Market Size, Share & Trend Report]()

Offshore Lubricants Market Size, Share & Trend Analysis Report By Application (Engine Oil, Hydraulic Oil, Gear Oil, Grease), By End-Use (Offshore Rigs, FPSOs, OSVs) and Segment Forecasts To 2022

- Report ID: 978-1-68038-535-9

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry: Bulk Chemicals

Industry Insights

Global offshore lubricants market size was 98.81 kilo tons in 2014. Lubricants are used for various offshore applications such as turbines, vessel engines, hydraulic equipment, gearboxes and offshore machinery. They minimize wear & tear of machinery and improve overall operational efficiency.

Growing offshore oil & gas exploration and production activities particularly in the Gulf of Mexico, Caspian, Arabian Sea and the Red Sea is expected to drive the global industry over the forecast period. Regulatory policies play a vital role in shaping the industry development. Regulatory agencies such as the U.S. EPA, REACH, and ECHA constantly evolve, formulate and establish environmental policies associated with their usage.

Other bodies such as BEACH (Beaches Environmental Assessment and Coastal Health) amended acts such as the Clean Water Act to regulate and control petrochemicals pollution in water bodies such as oceans & seas.

Offshore lubricants are widely used in offshore rig units, FPSOs, and OSVs. Heavy duty equipment used in these units consumes considerable amounts of lubricants for machinery maintenance and increased operational efficiency. Growing offshore drilling activities particularly in the Gulf of Mexico, South China Sea, Arabian Sea, and Black Sea are expected to provide impetus for industry growth.

The U.S. EPA has formulated vessel general permit (VGP) guidelines for vessels operating in waters of the U.S. These VGP requirements are a set of guidelines established reduce aquatic environment impact by prescribing a set list of environmentally acceptable lubricants (EAL).

The global market is characterized by volatile raw material prices coupled with stringent environmental regulations for manufacturing conventional lubricants. To overcome these challenges, manufacturers have been collaborating with biotechnology companies to develop bio-based alternatives. This is further supported by governmental favors and tax incentives for employing clean technologies.

Bio-based lubricants have been gaining importance owing to their environmental friendly properties. Growing emphasis on aquatic pollution through the unregulated disposal of conventional lubricants has also been a major factor for the development of bio-based alternatives.

Application insights

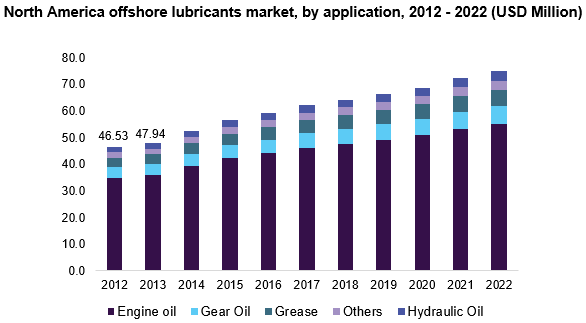

On the basis of application, the global industry has been segmented into engine oil, hydraulic oil, gear oil and grease along with other applications such as cylinder oil, turbine oil, and compressor oil. Engine oil was the leading application segment and accounted for over 74% of the overall market volume in 2014. Growing maritime traffic on account of increasing international trade is expected to be the major driving factor. However, engine oil is expected to lose market share and account for 73.1% of the total market volume by 2022, primarily due to increasing demand for grease and gear oil.

Engine oils are largely used in vessel engines, boat engines, and container engines. Engine oil plays a crucial role in assisting engines to optimum efficiency in their output. These oils are formulated specifically for speed and stroke of engines. They prevent engines from rusting, wear & tear. Growing maritime traffic is expected to drive engine oils demand over the forecast period.

Grease is expected to register the highest volume growth over the forecast period owing to its increasing consumption in offshore machinery, vessels, and other oil & gas equipment. Manufacturers prefer maintaining the efficiency of their equipment in order to reduce their overall downtime and thereby reduce operational costs. This factor is expected to influence high demand over the forecast period.

End-Use insights

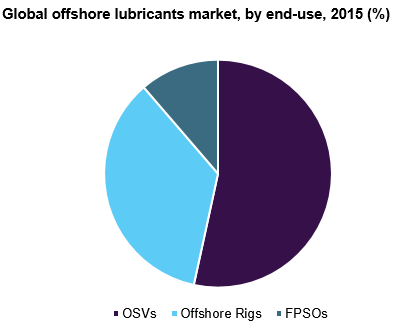

On the basis of end-use, global offshore lubricants industry has been segmented into offshore rigs, FPSOs (floating, production, storage and offloading vessels) and OSVs (offshore support vessels).

OSVs were the leading end-use market and accounted for 57.0% of the global offshore lubricants market volume in 2014. OSVs are largely used as support systems for offshore drilling and production sectors. Major offshore supply vessels include AHTS (Anchor Handling Tug Supply Vessel) and PSV (Platform Supply Vessel). AHTS provides an anchor for semi-submersible rigs and accommodation barges.

AHTS provides anchor for semi-submersible rigs, FPSOs, accommodation barges, etc. Increasing utilization rates of OSVs are directly implied through their rise in maintenance, which in turn is expected to drive the offshore lubricants demand.

Increasing OSVs utilization due to rising deepwater reserves exploration and production will give rise to greater maintenance resulting in higher demand for lubricants such as engine oils, gear oils, compressor oils, hydraulic fluids and transmission fluids.

Regional insights

Regional markets analyzed in the report include North America, Europe, Asia Pacific, and the Middle East. Asia Pacific was the largest consumer and accounted for over 27% of the overall market volume in 2014. Increasing offshore projects in India, Indonesia, Malaysia and China is expected to drive the region’s growth over the forecast period.

On the other hand, economic growth has facilitated for greater maritime trade in the region. Due to this, sea traffic has considerably increased in the recent pasts. This factor is expected to strengthen offshore lubricants demand in Asia Pacific.

Asia Pacific was followed by North America, which accounted for 18.2% of the overall market share in 2014. North America is characterized by stringent regulations by the U.S. EPA regarding utilization of marine lubricants. Increasing offshore activities in the Gulf of Mexico are expected to be a driving factor for this region’s growth. North America is projected to account for 17.2% of the overall market volume by 2022.

Offshore lubricants market share insights

The global offshore lubricants market share was dominated by top four companies, Royal Dutch Shell, Chevron, ExxonMobil, and Castrol, collectively accounting for 46%. The market has the presence of numerous independent producers who command 1/3rd of the overall market share. Other key players with a global presence include Total S.A., British Petroleum, Sinopec, Idemitsu Kosan, JX Nippon Oil & Energy Corp. and Lukoil.

Companies integrated into distribution have a distinct advantage of reaping profit margins which are otherwise attributed to the distributors. This direct level of marketing their products is generally conducted through factory sales centers or outlets. Major companies involved in supply & distribution include Bruke Lubricants, Lynx Marine, Tropic Oil, and Crown Oil.

Technology innovation, product development, and production optimization are crucial for industry participants to maintain a competitive edge. There is also a considerable presence of integrated players who are involved in raw material and base oil manufacturing along with lubricants.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2012 - 2015

Forecast period

2016 - 2022

Market representation

Volume in kilotons, Revenue in USD million and CAGR from 2016 to 2022

Regional scope

North America, Europe, Asia Pacific, Middle East and Rest of the World

Report coverage

Volume forecast, revenue forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue and revenue growth at global & regional analysis and provides an analysis on the industry trends in each of the sub-segments from 2012 to 2022. For this study, Grand View Research has segmented the global offshore lubricants market on the basis of application, end-use, and region.

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2012 - 2022)

-

Engine Oil

-

Hydraulic Oil

-

Gear Oil

-

Grease

-

Others

-

-

End-Use Outlook (Revenue, USD Million; 2014 - 2025)

-

Offshore Rigs

-

FPSOs (Floating, Production, Storage & Offloading Vessels)

-

OSVs (Offshore Support Vessels)

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2012 - 2022)

-

North America

-

Europe

-

Asia Pacific

-

Middle East

-

Rest of the World

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."