Offshore Mooring Systems Market Trends

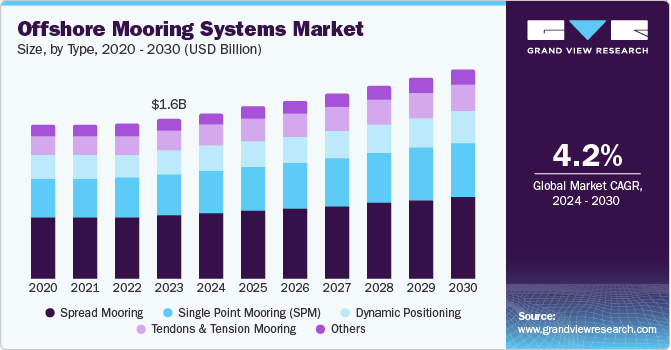

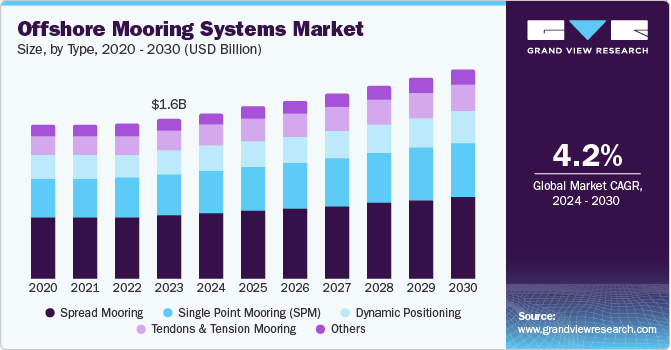

The global offshore mooring systems market size was valued at USD 1.56 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030 Rapid expansion of oil and gas E&P from the offshore fields along with the rising development of high-temperature gas hydrate basins for sustainable future growth is expected to drive the industry over the forecast period. Increasing advancement in high temperature gas hydrate basins to cater the rising energy requirements is anticipated to run the market over the forecast period.

Constantly increasing requirements for subsea explorations, commercialization of wind & hydro-energy farms in the U.S. coastal regions especially in the Gulf of Mexico have led to large deployment of advanced mooring system installations. Growing energy demand across North America coupled with a shift towards clean electricity is expected to steer the market expansion in the region.

The new regulations framed have strict directions for some specific areas, which include mooring system of design, operations, installation assurance & methodology, inspection & maintenance, recovery preparedness & tracking, and development of common met ocean & soil type data sets. Growing population and increase in per capita energy consumption is also expected to propel the market growth.

Type Insights

Spread mooring systems led the market and accounted for the largest revenue share of 39.6% in 2023. These are the most commonly used moors that can be utilized in a wide range of platforms ranging from mobile offshore drilling units (MODU) to the ships with catenary systems being the major product category. Spread mooring systems can be used in applications requiring long service life, in any water depth, and on any size of the vessel. Spread mooring systems are most commonly used in unidirectional environments on floating offshore structures that are insensitive to the direction of environmental loads.

The tendons & tension systems are expected to grow at the fastest CAGR of 4.7% during 2024 to 2030. The tendons & tension systems are used for horizontal movement with wave turbulence and bobbing, owing to this it is used for stability, such as in the hurricane-prone Gulf of Mexico. Dynamic positioning is also estimated to witness above-average growth over the next nine years with significant deployment of the CALM and SALM systems, especially for the ships. The market is driven by the development of vessels, which include floating, production, storage and offloading (FPSO), floating, drilling, production, storage and offloading (FDPSO) and fluidized liquid natural gas (FLNG).

Single point mooring (SPM) systems are expected to grow at a CAGR 4.1% over the forecast period. SPM systems are generally used on ships that allow them to weathervane into environmental conditions. The ship is often free to rotate through 360 degrees. Most of the SPM are turret based which are mostly used in floating, production, storage & offloading (FPSO) platforms, FLNG ships, and service vessels.

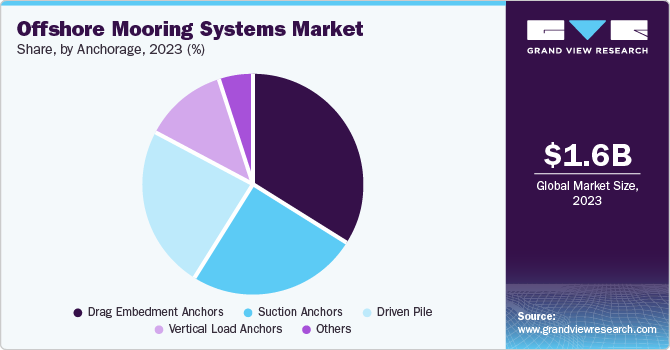

Anchorage Insights

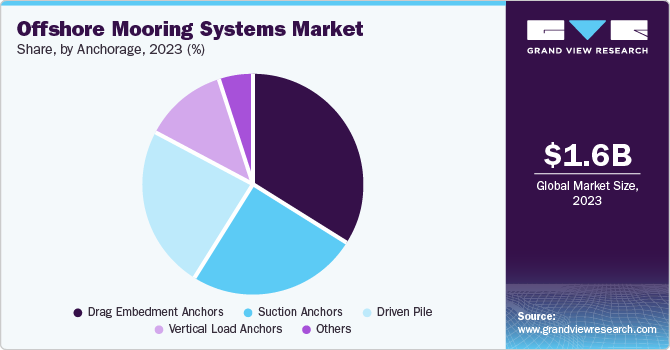

The Drag Embedment Anchors (DEA) captured the largest revenue share of 33.9% in 2023. DEA are used for semi-submersibles, SPM buoys, and floating production systems (FPS) generally used in shallow to deep water while suction anchors are used in ultra-deepwater for systems that requires taut or semi-taut preset mooring systems.

The vertical load anchor is used in taut leg mooring systems, where the mooring line arrives at a certain angle the seabed. It is expected to grow at a highest CAGR of 5.0% during 2024 to 2030. Vertical load anchors are increasingly used owing to their high holding capacity and ease due to low weight and size.

The difference is that when the VLA reaches its design depth, the angle the anchor makes with the mooring line changes, which enables the system to withstand the vertical load. When the anchor must be removed, the mooring line is pulled in the direction the anchor is not facing, after which the anchor can be pulled out relatively easy.

Application Insights

The FPSO segment held a revenue share of 38.8% in 2023. The key driving factors influencing the segment are increasing demand of energy across the globe and rising investments in the deep-water drilling operations.

The SPAR platforms registered the fastest CAGR of 5.5% over the forecast period, 2024 to 2030. These platforms consist of a large cylinder supporting a typical fixed rig platform. These are more economical than other application alternatives such as TLP, particularly for small and medium sized rigs and provide better stability.

Regional Insights

North America was valued at USD 356.4 million in 2023 and is projected to grow at a CAGR of 4.1% over the forecast period. The increased per capita energy consumption in U.S., focus on sea exploration and research to obtain clean energy sources, are the key reasons driving the market.

Asia Pacific Offshore Mooring Systems Market Trends

Asia Pacific offshore mooring systems market dominated the market and accounted for 38.9% of the total revenue in 2023. Increased offshore activities in South China sea (spread across countries including China, Vietnam, Thailand, Philippines, and Myanmar) contributed maximum to the segment growth.

Additionally, countries such as Australia, Vietnam, China, and Indonesia have emerged as the leading FPSO markets globally. The regional market is anticipated to witness overwhelming growth over the next eight years owing to increasing oil and gas E&P to further boost domestic production and reduce the dependence on imports.

Middle East and Africa Offshore Mooring Systems Market Trends

Middle East and Africa region is expected to grow at the fastest CAGR of 4.9% over the forecast period. The high investments by the key players in the market are boosting the offshore drilling industry. Countries such as Qatar and Saudi Arabia are developing their shallow and deep-sea reserves for offshore drilling.

Key Offshore Mooring Systems Company Insights

The market is characterized by key players such as Balltec Ltd., Balmoral Comtec Ltd, Bluewater Energy Services B.V. (Aurelia Energy N.V.), and others. Companies are aiming to cater specific requirements of the clients such as design, customized mooring technology and aligned services.

- Delmar Systems provides anchoring and mooring solutions mainly to oil and gas industry. It aims to deliver innovative and customer centric solutions with safety and sustainability.

Key Offshore Mooring Systems Companies:

The following are the leading companies in the offshore mooring systems market. These companies collectively hold the largest market share and dictate industry trends.

- Balltec Ltd.

- Balmoral Comtec Ltd

- Bluewater Energy Services B.V. (Aurelia Energy N.V.)

- BW Offshore Limited

- Delmar Systems Inc.

- Lamprell plc

- Mampaey Offshore Industries B.V

- MODEC Inc.

- NOV Inc.

- Offspring International Limited

- SBM Offshore N.V.

Recent Developments

- In April 2024, Bekaert joined TAILWIND Project to develop floating offshore wind mooring solutions. The TAILWIND project was launched in January 2024 to deliver station-keeping technologies and maintain Floating Offshore Wind (FOW) energy farms through innovative anchoring systems and mooring lines.

Global Offshore Mooring Systems Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.6 billion

|

|

Revenue forecast in 2030

|

USD 2.0 billion

|

|

Growth Rate

|

CAGR of 4.2% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2020 - 2023

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in Million, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, anchorage, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia, and UAE

|

|

Key companies profiled

|

Balltec Ltd.; Balmoral Comtec Ltd; Bluewater Energy Services B.V. (Aurelia Energy N.V.); BW Offshore Limited;

Delmar Systems Inc.; Lamprell plc; Mampaey Offshore Industries B.V; MODEC Inc.; NOV Inc.; Offspring International Limited; SBM Offshore N.V.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

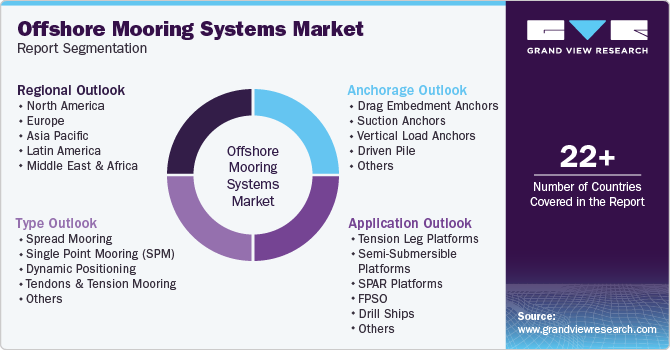

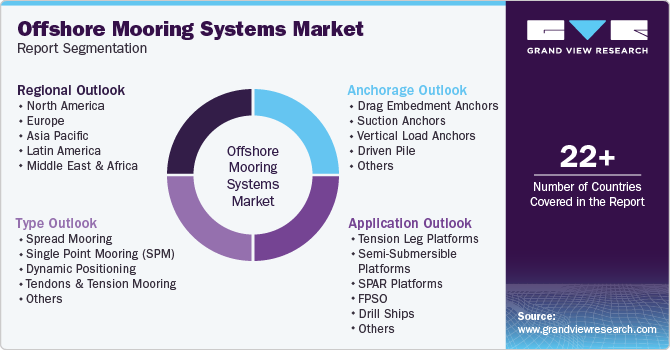

Global Offshore Mooring Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global offshore mooring systems market report based on type, anchorage, application and region.

-

Type Outlook (Revenue, USD Million, 2020 - 2030)

-

Anchorage Outlook (Revenue, USD Million, 2020 - 2030)

-

Drag Embedment Anchors

-

Suction Anchors

-

Vertical Load Anchors

-

Driven pile

-

Others

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)