- Home

- »

- Medical Devices

- »

-

Orthopedic Braces And Supports Market Size Report, 2030GVR Report cover

![Orthopedic Braces And Supports Market Size, Share & Trends Report]()

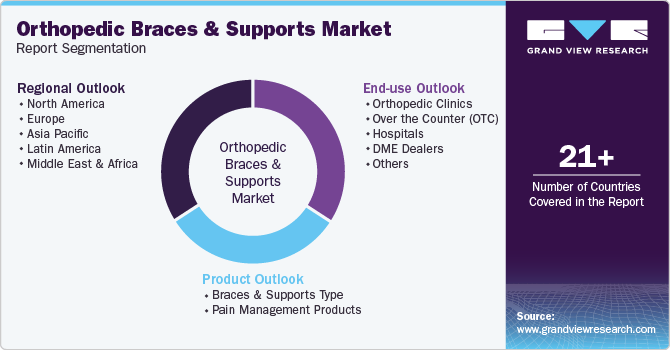

Orthopedic Braces And Supports Market Size, Share & Trends Analysis Report By Product (Braces & Supports Type, Pain Management Products), By End-use (Orthopedic Clinics, OTC), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-429-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Orthopedic Braces & Supports Market Trends

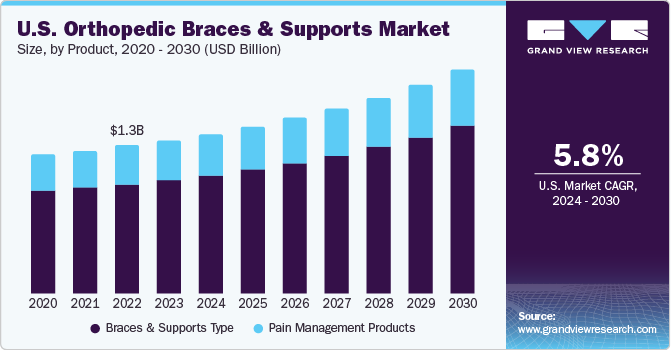

The global orthopedic braces and supports market size was estimated at USD 4.44 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030. Increasing technological advancements, rising number of sports and accident-related injuries, increasing geriatric population and growing public awareness of preventive care are key drivers in the orthopedic braces and support market. These factors contribute to developing innovative products and solutions for better patient outcomes. For instance, according to the Population Reference Bureau, population in the U.S. aged 65 and above is projected to rise from 58 million in 2022 to 82 million by 2050.

Additionally, the rising prevalence of chronic and acute conditions, such as arthritis and sports injuries, further boosts the demand for orthopedic braces and supports. Major companies in the market are actively involved in initiatives to improve product offerings and expand their market presence, which is expected to contribute to the overall market growth. For instance, in February 2021, BREG, Inc, a provider of billing services and orthopedic bracing, introduced two new product lines called Pinnacle and Ascend. These product lines consist of 15 orthopedic braces specifically designed for patients with spinal injuries. The launch of these new product lines signifies the company's expansion of its product portfolio, allowing it to offer a broader range of solutions to meet the needs of patients with spinal injuries.

Injuries associated with sports are rising due to the increasing number of sports activities. Athletes involved in fitness-related pursuits, including cycling, running, and others, are particularly susceptible to physical injuries, including ligament injuries. Indoor athletes, in particular, face a high threat of ankle ligament tears, leading to a significant demand for ankle braces. For instance, according to the National Safety Council, in the U.S., 445,642 and 409,224 exercise and exercise equipment injuries were reported in 2022 and 2021, respectively. Additionally, ankle braces are commonly recommended for recovery from acute ankle sprains. Athletes utilize orthopedic braces to safeguard themselves from injuries during sports activities. These braces aid in restricting unwanted movements during matches, allowing athletes to play with greater ease and convenience.

The demand for market products, including postoperative bracing solutions and unloader OA (Osteoarthritis) bracing products, is expected to be driven by several factors, such as the growing popularity of amateur sports and increased activity levels contributing to the need for orthopedic braces and supports. The aging population in key markets worldwide creates a higher demand for these products as older individuals are more prone to musculoskeletal issues. Moreover, the rising number of orthopedic surgeries further fuels the demand for postoperative bracing solutions.

Furthermore, the increasing incidence of osteoarthritis, the most commonly occurring form of arthritis affecting individuals of all age groups, significantly drives the demand for orthopedic braces and supports. For instance, according to Arthritis & Osteoporosis Tasmania, in Australia, 3.9 million individuals have arthritis, projected to increase to 5.4 million by 2030. This increases the risk of muscle injuries, particularly in the shoulders and knees of older people. Stiffening of the joints is a common issue among older people, emphasizing the need for braces and supports to improve mobility.

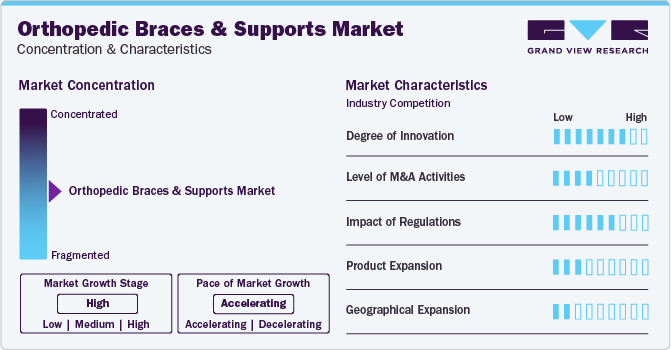

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The orthopedic braces and supports market is characterized by a moderate-to-high degree of growth owing to rising falls, growing awareness regarding the benefits of braces, and the creation of separate divisions for orthopedic braces and supports by market players. For instance, in December 2023, OrthoPediatrics Corp., a Warsaw-based company, introduced the OrthoPediatrics Specialty Bracing division focusing on pediatric braces.

The global orthopedic braces and supports market is characterized by a high degree of innovation with technological advancements and increased funding for product development. For instance, in June 2021, TayCo Brace, a medical device company and manufacturer of ankle braces, raised USD 1.2 million in seed round financing for the development of orthotic devices.

Several market players engage in acquisition strategies to strengthen their market position. This strategy enables companies to expand their product portfolios, increase their capabilities, and improve competency. For instance, in January 2024, OrthoPediatrics Corp. acquired Boston Orthotics & Prosthetics, a pediatric orthotic management company. This acquisition expands our company's launched OrthoPediatrics Specialty Bracing division.

Strict regulatory guidelines issued by different regulatory bodies may hinder market growth. For instance, the European Union Commission has implemented a new regulation for medical devices sold within the European Union. Braces fall under this new medical device regulation. The European market needs to undergo a significant regulatory process to enhance the safety of patients, followed by strict post-market surveillance.

Several orthopedic braces and supports companies are embracing this strategy to stay competitive and ahead in the dynamically evolving market landscape. For instance, in August 2021, Össur, an orthotics and prosthetics (O&P) company, introduced the Rebound ACL Brace to aid patients suffering from anterior cruciate ligament (ACL) injuries.

Market players are adopting diverse strategies, including partnerships, collaborations, mergers, and acquisitions, to expand their footprints in global markets. For instance, in May 2022, Ultra Ankle and Tandem Sport entered into a partnership agreement to accelerate growth for both companies within the rapidly expanding North American volleyball market.

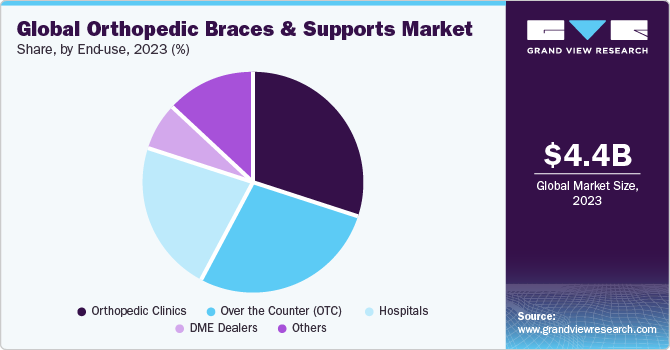

End-use Insights

In 2023, the orthopedic clinics segment dominated the market regarding revenue share. This demand can be attributed to the rise in number of orthopedic surgeons and the fact that orthopedic clinics are primary healthcare providers for patients experiencing musculoskeletal pain. For instance, according to an article published by Definitive Healthcare, LLC. in October 2023, there are more than 27,000 active orthopedic surgeons in the U.S.

The OTC segment is anticipated to exhibit the fastest growth over the forecast period. The segment's growth is attributed to the easy availability of OTC-related orthopedic braces in retail pharmacies. Patients suffering from acute muscle pain often prefer OTC products, which aid in reducing recovery time and providing quick relief to injured joints and muscles. The market growth is anticipated to be propelled by the several initiatives undertaken by key companies operating in the market. For instance, in February 2021, Breg, Inc., a billing services provider and orthopedic bracing company, collaborated with distributor Club Warehouse based in Australia to expand high-value, premium orthopedic products in the Australian market.

Product Insights

The braces & supports type segment dominated the market, capturing a revenue share of 74.9% in 2023, owing to an increase in orthopedic disorders and injuries, such as arthritis. This segment is subdivided into the back, ankle, knee, upper extremity braces and supports, and walking boots. The rising occurrence of ankle, knee, and upper extremity-related injuries and issues among individuals has significantly increased demand for braces and support products. These injuries can stem from various factors, such as sports activities, physical exertion, accidents, or underlying medical conditions. Ankle sprains, knee ligament tears, and upper extremity conditions like wrist fractures or shoulder instability are typical examples of such injuries. For instance, according to Datalys Center and Hospital for Special Surgery (HSS), anterior cruciate ligament (ACL) tears increased by 12% between 2007-08 and 2021-22.

In addition, the braces & supports segment is expected to witness the fastest CAGR growth over the forecast period, owing to the growing number of individuals suffering from knee joint-related disorders. Moreover, with an increasing awareness of the importance of early intervention and proper support in the healing and management of these injuries, individuals seek reliable and effective braces and support. These products provide stability, compression, and targeted support to the affected area, aiding pain relief, reducing inflammation, promoting healing, and preventing further damage.

In 2023, pain management products held a significant market share due to the rising prevalence of pain-related issues and demand for treating chronic joint and back pain. This segment is bifurcated into Deep Vein Thrombosis (DVT) and cold therapy products. For instance, according to data published by the University of Sydney in May 2023, it is estimated that more than 800 individuals globally will suffer from back pain by 2050.

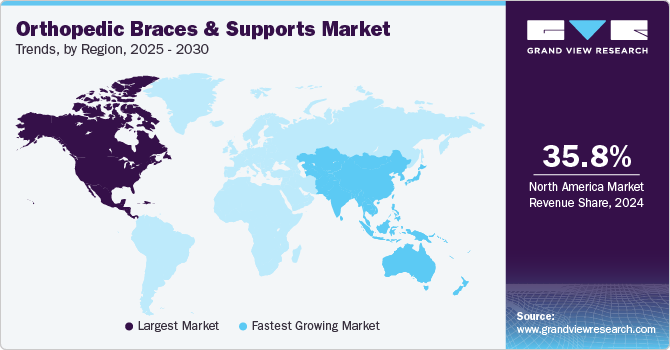

Regional Insights

North America held the largest market revenue share of 33.7% in 2023. The dominance of the North American region is attributed to the presence of technologically equipped hospitals in Canada and the U.S. In addition, the region experiences a growing prevalence of chronic conditions, resulting in an increased number of orthopedic surgeries. The expanding geriatric population further fuels this trend as older individuals are more susceptible to orthopedic issues. For instance, according to America's Health Rankings 2022 data, in the U.S., around 58 million adults ages 65 and older.

Furthermore, an article published in March 2022 by Becker's Orthopedic Review highlighted that in 2021 alone, approximately 1 million hip and knee arthroplasties were conducted in the U.S. This statistic underscores the significant volume of orthopedic surgical procedures in the region. Thus, increased number of surgeries fuels the market growth in this region.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to the growing investments and funding by key companies in the market to develop healthcare infrastructure and expand their geographical presence. For instance, in December 2023, Tynor Orthotics, a leading brand in orthotic appliances, invested Rs. 800 crore into an orthopedic manufacturing facility in Punjab. Moreover, the demand for orthopedic braces and support in the APAC region is propelled by the increasing prevalence of obesity, the growing geriatric population, and increasing healthcare expenditure in APAC countries such as India, China, and Japan.

Key Companies & Market Share Insights

Key players operating in the market include BREG, Inc., Össur, DeRoyal Industries, Inc., and DJO, LLC (Enovis). Frank Stubbs Company Inc., Weber Orthopedic LP, and Ottobock are some of the emerging market players in the orthopedic braces and supports market.

-

BREG, Inc. manufactures and markets sports medicine products. The company sells its products through more than 100 distributors in 36 countries. The company offers hip, knee, spine, elbow, ankle, and foot braces. The company utilizes its well-established distribution network to expand its business geographies and cater to emerging economies.

-

Frank Stubbs Company Inc. is an emerging player that designs and manufactures orthopedic supports, binders, and compression garments for the plastic surgery market.

Key Orthopedic Braces And Supports Companies:

- BREG, Inc.

- Frank Stubbs Company Inc.

- DeRoyal Industries, Inc.

- ÖssurFillauer LLC

- Ottobock

- McDavid

- Bauerfeind

- Weber Orthopedic LP

- DJO, LLC (Enovis)

Recent Developments

-

In January 2024, Enovis Corporation acquired LimaCorporate S.p.A., an orthopedic implant solutions company. Lima strengthens Enovis’ position in the global orthopedic reconstruction market by offering various orthopedic medical devices, including braces.

-

In October 2023, OrthoPediatrics Corp. launched DF2 Brace to treat kids suffering from musculoskeletal injuries. It is intended for femur fracture fixation in pediatric patients aged six months to 5 years.

Orthopedic Braces And Supports Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.67 billion

Revenue forecast in 2030

USD 7.01 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Historic Data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BREG, Inc.; Frank Stubbs Company Inc.; DeRoyal Industries, Inc.; Össur; Fillauer LLC; Ottobock; McDavid; Bauerfeind; Weber Orthopedic LP; DJO, LLC (Enovis)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Orthopedic Braces And Supports Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global orthopedic braces and supports market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Braces & Supports Type

-

Knee Braces & Supports

-

Knee Braces for Osteoarthritis & Ligament Injuries

-

Post-operational Knee Braces

-

-

Back Braces & Supports

-

Upper Spine Orthoses

-

TLSOs

-

LSOs

-

Others

-

-

Ankle Braces & Supports

-

Soft Braces

-

Hinged Braces

-

-

Walking Boots

-

Pneumatic

-

Non-pneumatic

-

-

Upper Extremity Braces & Supports

-

Elbow Braces & Supports

-

Wrist Braces & Supports

-

Others

-

-

Hip Braces & Supports

-

Others

-

-

Pain Management Products

-

Cold Therapy Products

-

DVT Products

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Clinics

-

Over the Counter (OTC)

-

Hospitals

-

DME Dealers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic braces and supports market size was estimated at USD 4.44 billion in 2023 and is expected to reach USD 4.67 billion in 2024.

b. The global orthopedic braces and supports market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 7.01 billion by 2030.

b. North America dominated the orthopedic braces and supports market with a share of over 33.7% in 2023. This is attributable to rising awareness regarding bracing devices that aid mobility and prevent further injury.

b. Some key players operating in the orthopedic braces and supports market include Össur, BREG, Inc., DeRoyal Industries, Inc., Bauerfeind, • DJO Global, Inc., Ottobock, Fillauer LLC, Frank Stubbs Company Inc., and McDavid, Hely & Weber.

b. Key factors that are driving the orthopedic braces and supports market growth include rising incidence of osteoarthritis, increasing cases of sports-related injuries, and growing geriatric population bases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."