- Home

- »

- Advanced Interior Materials

- »

-

Packaging Machinery Market Size And Share Report, 2030GVR Report cover

![Packaging Machinery Market Size, Share & Trends Report]()

Packaging Machinery Market Size, Share & Trends Analysis Report By Machine Type (Filling, Labelling, Form-Fill-Seal), By Application (Pharmaceuticals, Food, Beverages), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-996-8

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Packaging Machinery Market Size & Trends

The global packaging machinery market size was estimated at USD 59.30 billion in 2024 and is anticipated to grow at a CAGR of 5.5% from 2025 to 2030. The market is experiencing significant growth driven by various factors, including the rising demand for packaged goods, advancements in technology, and increasing consumer preferences for convenience. As e-commerce continues to expand, manufacturers are investing in automated and flexible packaging solutions to enhance production efficiency and reduce labor costs. Additionally, the growing emphasis on sustainability is pushing companies to adopt eco-friendly packaging materials and machinery that minimize waste.

Increasing demand for packaging machinery can be attributed to the need for differentiating products in the retail space. Consumers are demanding greater product diversity and a wider range of products. The pandemic has had a significant impact on people's lifestyles and purchasing habits. Following the lockdown, people panicked buying increased the demand for packaged food products. Customers' preferences for healthy and natural foods prompted packaged food companies to diversify their product lines. As a result, the demand for packaged food products, such as intermediary food items, ready-to eat food, and frozen foods, increased during the lockdown period. During the initial phases of the lockdown, consumers stocked up on ready-to-eat and ready-to-cook products.

Drivers, Opportunities & Restraints

The packaging machinery market is driven by the increasing demand for convenience and ready-to-eat foods, as consumers seek quick and easy meal solutions. The rise of e-commerce further fuels this demand, necessitating efficient and protective packaging to ensure product integrity during transport. Additionally, advancements in automation and smart technologies enhance production efficiency and reduce operational costs, making packaging processes faster and more reliable. The growing emphasis on sustainability also pushes manufacturers to adopt eco-friendly packaging solutions, creating a favorable environment for the development of innovative machinery.

Despite its growth potential, the market faces challenges such as high initial investment costs associated with advanced technologies. Smaller companies may find it difficult to afford these investments, hindering their competitiveness. Additionally, the complexity of integrating new machinery with existing systems can disrupt production, while a shortage of skilled labor to operate and maintain sophisticated equipment further complicates matters. Regulatory compliance concerning food safety and environmental impact also adds to operational costs and may slow the adoption of new technologies.

The market presents significant opportunities, particularly in emerging economies where rising consumer demand for packaged goods is driving growth. Technological innovations, such as smart packaging and automation, allow manufacturers to improve efficiency and product traceability, catering to evolving consumer preferences. Moreover, the trend toward personalized packaging creates opportunities for differentiation, enabling brands to enhance their identity and engage consumers. As companies seek to meet these demands, the market for flexible and adaptable packaging machinery is expected to expand, offering substantial growth prospects.

Machine Type Insights

“The demand for the form fill & seal machine type segment is expected to grow at a significant CAGR of 6.6% in terms of revenue from 2025 to 2030.”

The filling machine type segment led the market and accounted for a revenue share of 19.8% in 2024.Filling machines are classified into semi-automatic and automatic filling machines. While semiautomatic filling machines require minimal human intervention, automatic filling machines cover the processes of filling, packing, and cardboard casing by integrating other packaging machines. Reducing manual labor and saving time on the packaging would result in increased productivity. Furthermore, using a filling machine allows for a predetermined quantity of filling, consistent quality, and efficient operation.

Form-Fill-Seal (FFS) machines are packaging machines that fill and seal a package on the same machine. These are highly sophisticated machines with control networks and computer interfaces. Many businesses prefer to use FFS systems because they provide additional advantages such as versatility and speed.

Application Insights

“The demand for the beverages application segment is expected to grow at a significant CAGR of 5.8% in terms of revenue from 2025 to 2030.”

The food application segment led the market and accounted for a share of 36.1% in 2024. Food end-use industry is the largest consumer group in the packaging machinery market. Increasing demand for ready-to-eat, convenience food items is anticipated to favor the growth of the market. Apart from this, there has been a trend toward the consumption of healthy and organic food products which require a special type of packaging to maintain the authenticity and richness of the food products which is projected to further augmented the demand for packaging machinery. Additionally, consumers also look for easy-to-use and attractive packaging, which has forced food manufacturers to develop artistic packaging to gain a competitive advantage which in turn has driven the demand for packaging machinery.

Packaging machinery is used in a variety of beverage applications such as beer, bottled water, soda pop, boxes of drink pouches, drink mixes, sparkling fruit coolers, sport drinks wine, and fruit juice. Liquid fillers, capping machines, and labeling machines are some of the packaging machinery used in beverage industry. Tetra Laval, Krones AG, Coesia Group, and others are major manufacturers of packaging machinery.

Regional Insights

“India to witness fastest market growth at 7.4% CAGR from 2025 to 2030”

North America region accounted for 23.8% of the global market share in 2024. Increasing demand for processed food & beverages, growing immigration, and technological advancement in packaging equipment are some of the key factors responsible for driving the market growth. The growth is also driven by factors such as rapid urbanization, rising spending power, high household income, industrialization, and shifting consumer food preferences.

U.S. Packaging Machinery Market Trends

The packaging machinery market in the U.S. is expected to grow at a CAGR of 4.1% from 2025 to 2030. The U.S. market is robust with its growth being propelled by a rising demand for automated solutions in industries such as food and beverage, pharmaceuticals, and cosmetics. Innovation in packaging technologies, including smart machinery and sustainable materials, is helping manufacturers enhance efficiency and meet evolving consumer expectations.

The packaging machinery market in Canada is expected to grow at a CAGR of 4.0% from 2025 to 2030. Canada is experiencing steady growth, fueled by the country's expanding food processing and e-commerce sectors. The focus on sustainable packaging practices is prompting manufacturers to invest in eco-friendly machinery and solutions that comply with stringent environmental regulations.

The Mexico packaging machinery market is expected to grow at a CAGR of 4.6% from 2025 to 2030. Mexico's packaging machinery market is on the rise, supported by a strong manufacturing base and increasing foreign investments in the automotive and food sectors. As demand for flexible and cost-effective packaging solutions grows, local manufacturers are adopting advanced technologies to enhance production capabilities and competitiveness.

Europe Packaging Machinery Trends

The packaging machinery market in Europe held a share of about 26.9% in 2024. The Europe market for packaging machinery is characterized by a strong emphasis on sustainability and regulatory compliance, driving the adoption of eco-friendly packaging solutions. Additionally, advancements in automation and smart technologies are enhancing operational efficiency, catering to the increasing demand for customizable and innovative packaging across various industries.

The Germany packaging machinery market held 23.5% share in the Europemarket in 2024. Germany is home to numerous large manufacturers of packaging machinery. The region is expanding, which can be attributed to the rising demand for German packaging machines from emerging and developing countries. Moreover, the market growth is likely to be driven by global trends such as rising demand for adaptable, highly productive, and efficient packaging equipment to meet changing consumer demands.

The packaging machinery market in the UK held 13.4% share of the Europe market in 2024. The UK market is benefiting from a surge in demand for flexible packaging solutions driven by consumer preferences for convenience and sustainability. Furthermore, the ongoing trend of digitalization in manufacturing is fostering innovation, enabling companies to streamline operations and improve product traceability.

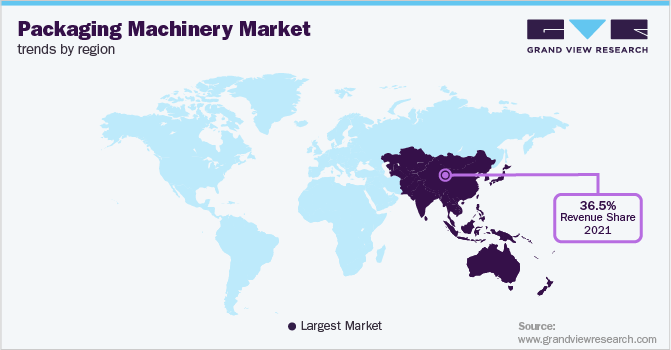

Asia Pacific Packaging Machinery Market Trends

The packaging machinery market in Asia Pacific accounted for a revenue share of 38.3% in 2024. Rapid population growth and rising consumer purchasing power are likely to fuel the demand for packaged goods, which is anticipated to facilitate regional market growth. Launching production facilities by significant regional players is expected to increase the e-commerce industry, which is anticipated to promote the regional market. North America is primarily driven by the highly established food & beverage industry in the U.S. and Canada. The presence of various multinational food processing and manufacturing companies results in an increased demand for packaging machinery. Technological progress in packaging equipment is also one of the leading factors driving the region’s growth.

China packaging machinery market held 42.8% share in the Asia Pacific market in 2024. The China packaging machinery market is experiencing rapid growth, driven by increasing demand in various sectors such as food and beverage, pharmaceuticals, and cosmetics. Technological advancements and the push for automation are enhancing production efficiency and expanding the market's potential, positioning China as a global leader in packaging machinery manufacturing.

The packaging machinery market in India held 19.6% share in the Asia Pacific region in 2024. The India packaging machinery market is expanding significantly due to the booming e-commerce sector and rising demand for packaged consumer goods. With a focus on sustainability and innovation, manufacturers are investing in advanced technologies to meet the diverse needs of industries such as food processing, pharmaceuticals, and personal care products.

Middle East & Africa Packaging Machinery Trends

The packaging machinery market in Middle East & Africa is witnessing steady demand owing to the increased internet penetration, rise of social media influences and demand for organic products, which is expected to drive the cosmetic industry. The growing opportunities in the cosmetics industry both in the Middle East and Africa region are expected to boost the demand for cosmetic packaging such as bottles and vials which, in turn, is expected to boost the regional market growth.

Saudi Arabia packaging machinery market held 36.6% share in the Middle East & Africa region in 2024. The personal care industry's contribution to the country’s economy is growing at an exponential rate. Furthermore, the demand for organic or natural, halal products, as well as innovative and eco-friendly packaging designs, is growing in the country. Moreover, poor water quality, harsh climatic conditions, and a greater emphasis on personal well-being are driving the demand for sophisticated personal care routines and treatments. This, in turn, is expected to increase the demand for packaging machinery.

Latin America Packaging Machinery Trends

The packaging machinery market in Latin America accounted for a market share of 5.8% in 2024. Food & beverage industry in Latin America has experienced tremendous expansion in recent years as a result of industrial sector investments. Rapid urbanization in nations such as Argentina, Brazil, and Chile greatly contributes to the expansion of food & beverage industry. The rising demand for novel flavors and cuisines in food & beverage industry is expected to have a beneficial effect on the market expansion.

Brazil packaging machinery market held 37.4% share in Central & South America in 2024. The Brazil market is expanding due to a resurgence in the food and beverage sector, driven by increasing consumer demand for convenience and ready-to-eat products. Additionally, investments in automation and digital technologies are improving production efficiency and enabling manufacturers to meet the unique packaging needs of a diverse marketplace.

Key Packaging Machinery Company Insights

Some of the key players operating in the packaging machinery market include Tetra Laval International S.A., Krones AG, I.M.A. Industria Macchine Automatiche S.p.A, Sacmi, and GEA Group Aktiengesellschaft.

-

Tetra Laval International S.A. was established in 1993 and is headquartered in Pully, Switzerland. It is a leading multinational company that provides a wide range of systems for the processing, packaging, and distribution of food. The company consists of three industry groups, namely Tetra Pak, Delaval, and Sidel. Tetra Pak manufactures processing, packaging, and distribution machinery for liquid and food products including liquids, ice creams, processed foods, fruits, and vegetables. The company’s production facilities supply packaging material to more than 8,800 packaging machines across the globe. Sidel manufactures plastic packaging and complete packaging lines. Delaval is engaged in the manufacturing of equipment and complete systems for animal husbandry and milk production.

-

Krones AG was established in 1951 and is headquartered in Neutraubling, Germany. The company is engaged in the manufacturing of processing, filling, and packaging lines as well as individual machinery for filling beverages in cans or glass and plastic bottles. It caters to a large set of customers including breweries; juice & soft drink manufacturers; producers of spirits, wine, & sparkling wine; and companies in the liquid food industry. The company also caters to chemical, pharmaceutical, and cosmetic industries. It also offers innovative digitization and intralogistics solutions to its customers. The company’s business segments include digitalization, process technology, bottling & packaging equipment, intralogistics, and lifecycle service. The company’s bottling and packaging equipment segment consists of labeling technology, inspection technology, cleaning technology, plastics technology, packaging filling technology, palletizing technology, and conveyer technology.

Coesia S.p.A., SIG, Bradman Lake, MAILLIS, ROVEMA GmbH, ProMach, and Duravant are some of the emerging players in the packaging machinery market.

-

Coesia S.p.A. was established in 1923 and is headquartered in Bologna, Italy. Coesia S.p.A. is a group of companies engaged in the design, manufacturing, and distribution of industrial and packaging solutions. It operates through three business segments, namely, advanced automated machinery & materials, industrial process solutions, and precision gears.The group offers its services to various industries such as aerospace, automotive, beverage, chemicals, dairy, electronics, food, personal care, industrial goods, and tobacco. It designs and manufactures a wide range of machinery and solutions including filling, packing, cutting, wrapping, cartoning, printing & labeling, feeding, assembly & combining, and monitoring & inspection.

-

SIG was established in 1853 and is headquartered in Neuhausen, Switzerland. SIG Combibloc Group AG is a multinational company and operates as a subsidiary of SIG Combibloc Group Holdings S.à r.l. SIG Combibloc Group AG was formerly known as SIG Holding AG. It has filling technology that enables the highest level of speed and flexibility for production. The company’s filling machines are high in speed, efficient, reliable, and aseptic safety. It is a leading manufacturer and supplier of aseptic carton packaging and filling machines, carton packaging sleeves, spouts, and caps as well as aftermarket services for food & beverage producers worldwide.

Key Packaging Machinery Companies:

The following are the leading companies in the packaging machinery market. These companies collectively hold the largest market share and dictate industry trends:

- Langley Holding plc

- Maillis Group

- Rovema GmbH

- Douglas Machine Inc.

- KHS Group

- SIG

- Tetra Laval International S.A.

- Krones AG

- I.M.A. Industria Macchine Automatiche S.p.A.

- Syntegon Technology GmbH

- ProMach

- GEA Group Aktiengesellschaf

- Sacmi

- Coesia S.p.A.

- Duravant

Recent Developments

-

In February 2024, IMA Group, a producer of automatic machines for pharmaceutical, food, and battery processing and packaging, unveiled two artificial intelligence (AI) solutions designed to improve the efficiency and effectiveness of its customer services. The IMA Sandbox solution is a collaborative, cloud-based platform that facilitates co-development and partnership in creating advanced algorithms within a secure and shared environment.

-

In July 2024, Eliter Packaging Machinery launched its newest model of automatic sleeving machine, the Multi-Wrap C-80S, designed for multipacks with a maximum speed of 80 wraps per minute. This machine efficiently groups packaging containers such as cans, bottles, cups, and pots into various configurations, ranging from 1x2x1 to 1x4x1, as well as cluster-pack formats like 2x2x1 and 2x3x1. It features a grouping system that enables quick changeovers to accommodate different packaging arrangements.

-

In July 2024, Cama Group introduced a new top-loading packaging machine, the MTL. This flexible, modular system significantly enhances the efficiency of packaging a variety of boxes.

Packaging Machinery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 62.08 billion

Revenue forecast in 2030

USD 80.96 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; Russia; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Langley Holding plc; Maillis Group; Rovema GmbH; Douglas Machine Inc.; KHS Group; SIG; Tetra Laval International S.A.; Krones AG; I.M.A. Industria Macchine Automatiche S.p.A.; Syntegon Technology GmbH; ProMach; GEA Group Aktiengesellschaf; Sacmi; Coesia S.p.A.; Duravant

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaging Machinery Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the packaging machinery market report based on machine type, application, and region:

-

Machine Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Filling

-

Labelling

-

Form Fill & Seal

-

Cartoning

-

Wrapping

-

Palletizing

-

Bottling Line

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beverages

-

Food

-

Chemicals

-

Personal Care

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global packaging machinery market size was estimated at USD 59.30 billion in 2024 and is expected to reach USD 62.08 billion in 2025.

b. The global packaging machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 80.96 million by 2030.

b. The food application segment led the market and accounted for a share of 36.1% in 2024. The food end-use industry is the largest consumer group in the packaging machinery market. Increasing demand for ready-to-eat, convenience food items is anticipated to favor the growth of the market.

b. Some of the key players operating in the packaging machinery market include Langley Holding plc, Maillis Group, Rovema GmbH, Douglas Machine Inc., KHS Group, SIG, Tetra Laval International S.A., Krones AG, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Technology GmbH, ProMach, GEA Group Aktiengesellschaf, Sacmi, Coesia S.p.A., Duravant, among others.

b. The packaging machinery market is experiencing significant growth driven by various factors, including the rising demand for packaged goods, advancements in technology, and increasing consumer preferences for convenience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."