- Home

- »

- Consumer F&B

- »

-

Pasta And Noodles Market Size And Share Report, 2030GVR Report cover

![Pasta And Noodles Market Size, Share & Trend Report]()

Pasta And Noodles Market Size, Share & Trend Analysis Report By Product (Dried, Instant, Frozen & Canned), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-073-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global pasta and noodles market size was valued at USD 83.49 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. In recent years, the demand for international cuisines have increased tremendously, thereby leading to increased consumption of pasts and noodles across the globe. There has been growing consumption of Italian pasta in the U.S. and Asian countries, which bodes well for the market growth.

Even amid the COVID-19 pandemic and the global economic crisis that ensued, pasta and noodles industry sales exceeded USD 78.70 billion in 2020. This growth can largely be attributed to an increase in the purchasing of packaged and shelf stables products. Further, in the pasta category, the product’s extended shelf life has made it a popular choice for consumers looking to stockpile and consumed for longer period of time. The demand for dried pasta in the grocery stores were overwhelming during the pandemic. As per The National Pasta Association, to keep the product supplied on grocery store shelves, National Pasta Association (NPA) members worked tirelessly to increase production and deliver products quickly and efficiently to consumers. The sales through foodservice outlets were affected but the retail sales spurred.

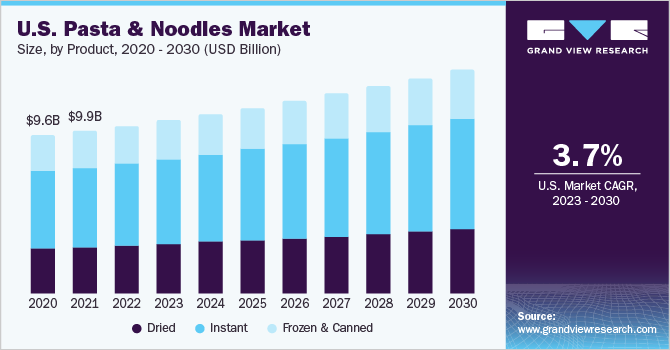

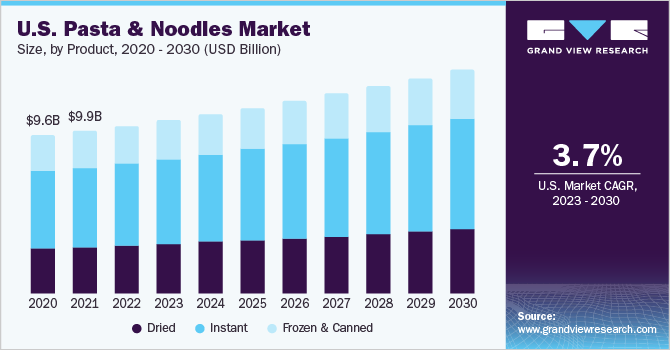

The U.S. is among the prominent consumers of pasta and noodles owing to its RTD format, flavor, and versatility. As per the National Pasta Association, these products are a staple food in U.S. households and one of America’s favorite foods. Further, in an NPA consumer survey conducted in 2021, nearly 86% of participants said they ate pasta at least once a week and that collectively, the U.S. consumes 5.95 billion pounds of pasta per year.

Moreover, the average American consumes approximately 20 lbs. of pasta annually which makes it the 6th highest food per capita in the country. U.S. consumers typically consume more pastas and noodles at dinner compared to lunch. Further, owing to the growing concerns regarding gluten sensitivity, the demand for gluten-free convenient and RTD products spurred before the pandemic. However, after the COVID-19 pandemic, the demand for the product bounced back with unprecedented growth as consumers looked for convenient, comforting and versatile dishes to cook at home.

An increasing number of market players are capitalizing on the product growth through innovation, premiumization, and quality improvements, while avoiding the concerns about product’s healthfulness and leveraging on consumer’s ongoing interest for restaurant quality meals at home. The initial interest in consumption spiked after the pandemic for consumers seeking for comfort and convenience. Due to the improvement of packages, the demand for instant noodles witnessed major growth than traditional noodles as it can be stored for longer duration and are easy to cook, which increased its consumption during the pandemic.

New product launches are a key trend in market. For instance, in July 2022, Nissin Foods, the creator of instant ramen, announced the launch of Cup Noodles Stir Fry in the instant noodles category. Growing demand for Asian-inspired recipes with convenience and taste is boding well for the market growth. Most importantly, instant noodles are produced in large factories equipped with advanced machines at large scale, while the conventional ramen noodles are supposed to enjoy in restaurants, owing to which the instant noodles are experiencing strong demand.

Product Insights

Instant pasta & noodles segment accounted for a share of 48.5% in the global revenue for 2022. The growth of the segment is characterized by increase in interest towards RTD, flavorful, and convenient foods. Instant noodles are friendly to eaters who need to travel or work in austere environments, as a result the consumption is tremendously increasing. Further, due to innovation in packaging of instant ones, the product can be stored much longer than traditional ones, which drives the demand for instant products. In addition, these products can be produced in large factories equipped with advanced machines at large scale, while the conventional ramen noodles and pastas are supposed to enjoy in restaurants. Therefore, the cost of producing instant product is comparatively low, and their consumption help a person remain on a budget.

Dried product form is anticipated to grow at a CAGR of 3.4% over the forecast period. The growth of the segment is characterized by product’s longer shelf life and this has resulted in a surge in demand in the market. In addition, health and wellness associated with gluten-free, and fat-free pasta has gained popularity in recent years thanks to its high fiber content, and low carbohydrate content, which has driven the demand for dried products. Further, market players are launching new products catering to growing demand. For instance, In 2021, Tsutomu Foods Co.,Ltd. introduced one of its products, ‘SoyNyack Gluten-free Konjac Noodles’ containing soybeans in the U.S.

Distribution Channel Insights

Offline distribution channel accounted for a larger share of 70.9% in 2022. An increasing number of offline retailers such as supermarkets & hypermarkets offer these products in dried, instant, frozen & canned formats, which propels the growth of the segment. Major players chains are offering their own lines of pastas and noodles through supermarket chains owing to the growing interest in convenient dishes. For instance, in August 2022, Upmarket Italian brand Crosta & Mollica launches a range of dried pastas and pasta sauces through Waitrose. The dried pasta range includes spaghetti, rigatoni, fiorelli and tagliatelle.

Online segment is anticipated to grow with a higher CAGR of 5.5% over the forecast period. E-commerce has changed people’s shopping habits substantially, providing various advantages such as doorstep delivery, lucrative discounts, and the availability of various items on one site. The availability of a dynamic range of pastas and noodles and the increasing customer loyalty through ‘Subscribe & Save’ programs are expected to bolster the online channel. For instance, in several online platforms such as Eataly Net USA LLC, Amazon, Alibaba, Ubuy, and Grocerly Go among others are prominent sellers of these products across the globe.

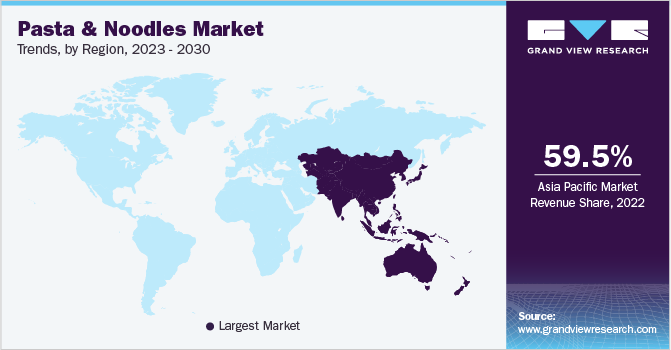

Regional Insights

Asia Pacific made the largest contribution in the market in 2022. The instant pasta and noodles industry experienced rapid development, structural adjustment and industrial upgrading in Asia Pacific in recent years. At present, the annual sales volume of China's instant noodle market has exceeded 40 billion packages, and many interesting industry practices have also been produced. Such factors are bolstering the market growth in the region. Other countries including Vietnam is among the top consumers of such products. Pastas & noodles that can be ready to eat in three minutes have emerged with newfound confidence, having consolidated their popularity among younger people.

Central & South America is the fastest-growing region during the forecast period. The availability of a wide variety of pasta & noodles in authentic flavors and consumers’ willingness to try new flavors in the region will bolster the market growth in the coming years. During and after the COVID-19 pandemic, the interest in instant and frozen & canned pasta & noodles prevailed across the region and economies including Brazil. In October, 2022, Noodles & Company, the national fast-casual chain in Brazil announced the launch of ‘Impossible Chicken’, a plant-based protein option made by ‘Impossible Foods. Noodles' new Impossible Panko Chicken’ in Colorado, Brazil.

Key Companies & Market Share Insights

The market is characterized by the presence of some large multinational companies with strong presence across the globe. Some of the key players in the market are. Nestlé, Barilla, ITC, Kraft Heinz Company, Conad, Conagra Brands, Inc., and Nissin Foods. Companies have been implementing various expansion strategies such as mergers & acquisitions, capacity expansions, strengthening of online presence, and new product launches to gain a competitive advantage.

These manufacturers are adopting various strategies, including new product launches, expansion of product portfolios, and mergers & acquisitions. For instance:

-

In October 2022, Barilla, the world's leading pasta maker, has reimagined pasta with its new supremely delicious Al Bronzo line in the U.S. Available in six beloved pasta cuts: Bucatini, Mezzi Rigatoni, Penne Rigate, Fusilli, Spaghetti, and Linguine, Al Bronzo can be purchased in variety packs on Amazon and is available on additional retail shelves nationwide in the U.S.

-

In December 2021, Agro Tech Foods Ltd., one of the leading FMCG companies in India expanded its ready-to-cook segment under its brand Sundrop. Sundrop introduced its first ‘Mini Meal Kit’ with the launch of ‘Sundrop5 Min Yum Pasta’ with an authentic pasta sauce. This product is yet another endorsement to the brand leading the innovations bandwagon in the Ready-To-Cook (RTD) category.

-

In October 2021, Abokichi Inc. continues to expand its line of healthy, Japanese-inspired artisanal food products with two new offerings for 2021: plant-based Instant Ramen product lines; ABO Ramen which contains dry noodles (launched through a campaign in August 2021) and ABO Ramen - Fresh which has soft, fresh noodles in Toronto, Canada in 2021.

Some of the key players operating in global pasta and noodles market include:

-

Nestlé

-

Barilla Group

-

ITC

-

The Kraft Heinz Company

-

Unilever

-

Toyo Suisan Kaisha, Ltd.

-

Nissin Foods Holdings Co.,Ltd.

-

Campbell Soup Company

-

Conagra Brands, Inc.

-

TreeHouse Foods, Inc.

-

Ebro Foods, S.A.

Pasta and noodles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 86.07 billion

Revenue forecast in 2030

USD 109.52 billion

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy, Spain, China; Japan; India; South Korea, Australia, Brazil; South Africa; Saudi Arabia

Key companies profiled

Nestlé; Barilla Group; ITC; The Kraft Heinz Company; Unilever; Toyo Suisan Kaisha, Ltd.; Nissin Foods Holdings Co., Ltd.; Campbell Soup Company; Conagra Brands, Inc.; TreeHouse Foods, Inc.; Ebro Foods, S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Pasta And Noodles Market Report Segmentation

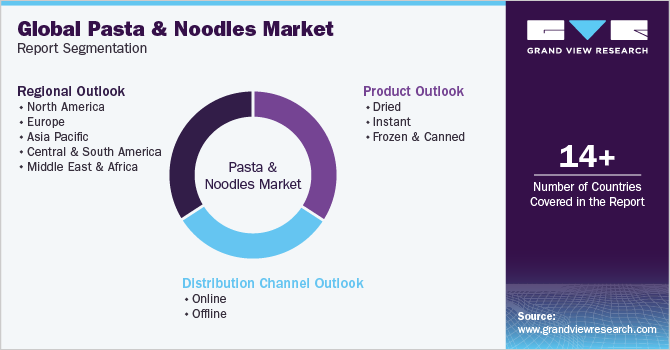

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the pasta and noodles market on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Dried

-

Instant

-

Frozen & Canned

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The instant pasta and noodles segment dominated the global pasta and noodles market with a share of 48.5% in 2022. The growth of the segment is characterized by increase in interest towards RTD, flavorful, and convenient foods. Instant noodles are friendly to eaters who need to travel or work in austere environments, as a result the consumption is tremendously increasing.

b. Some key players operating in the telemedicine market include Nestlé; Barilla Group; ITC; The Kraft Heinz Company; Delverde; Nissin Foods Holdings Co.,Ltd.; Campbell Soup Company; ConAgra Foods, Inc.; TreeHouse Foods, Inc.;Ebro Foods, S.A.

b. The global pasta and noodles market size was estimated at USD 83.49 billion in 2022 and is expected to reach USD 86.07 billion in 2023.

b. The global pasta and noodles market is expected to grow at a compounded growth rate of 3.5% from 2023 to 2030 to reach USD 109.52 billion by 2030.

b. Key factors that are driving the market growth include the increasing demand for international cuisines, growing consumption of Italian pasta in the U.S. and Asian countries, and increase in the purchasing of packaged and shelf stables products

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."