- Home

- »

- Smart Textiles

- »

-

Personal Protective Gloves Market Size, Global Industry Report, 2024GVR Report cover

![Personal Protective Gloves Market Size, Share & Trends Report]()

Personal Protective Gloves Market Size, Share & Trends Analysis Report By Product (Disposable, Durable), By Raw Material, By End Use (Manufacturing, Oil & Gas, Chemical), By Region, And Segment Forecasts, 2017 - 2024

- Report ID: GVR-1-68038-026-2

- Number of Pages: 91

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry: Advanced Materials

Industry Insights

The global personal protective gloves market size was estimated at USD 9.52 billion in 2016 and is anticipated to expand at a CAGR of 6.5% over the forecast period. Increasing awareness regarding employee health and safety, coupled with rising industrial fatalities in emerging economies owing to the lack of personal protective components, is expected to drive the growth.

The global market has witnessed surging demand owing to various seasonal factors such as outbreaks of viral diseases and incidents of emergency response in natural disaster-inflicted regions. In addition, growing concern over the incidence of hand injuries in the manufacturing and construction industries has contributed significantly to market growth.

According to the U.S. Bureau of Labor Statistics, the manufacturing sector comprised 40% of total hand injury cases registered during 2014. Prevalence of hand injuries or illnesses had the highest incidence rate among upper body parts. Growing concern over lost time injury frequency rates and losses associated with it has urged the employers in this sector to implement stringent steps against working personnel not complying with safety regulations.

The market has witnessed a significant rise in demand from the healthcare sector owing to seasonal factors such as the prevalence of viral outbreaks and infectious diseases. Growing awareness regarding health and safety measures associated with patient treatment and emergency response incidents has played a key role in driving the demand for medical personal protective gloves in the healthcare industry.

In addition, risks associated with the on-the-job transmission of germs and bloodborne pathogens are expected to augment the demand for disposable gloves in medical and healthcare facilities. Increasing awareness of disease prevention and consumer well-being in the healthcare sector is expected to drive the market over the forecast period.

The product demand is influenced largely by the weather conditions. Surging demand for protection against low temperature and cut injuries in colder climatic regions is anticipated to fuel the growth of the personal protective gloves market in these regions. Low temperature plays a seasonal factor in tropical regions while it plays an essential role in driving the demand in Polar Regions exposed to winter climate for over four months during a year.

Product Insights

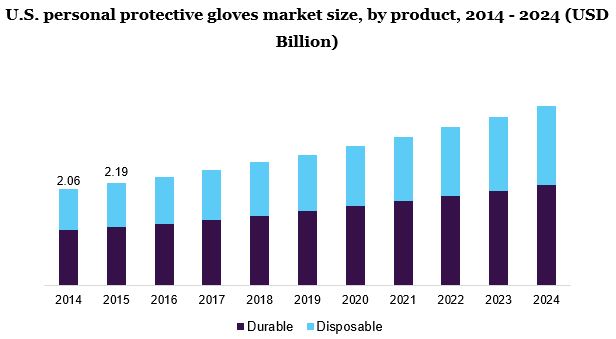

Durable gloves led the product segment in 2016, accounting for over 57% of the total market share in terms of revenue, and are anticipated to witness moderate growth over the forecast period. On the basis of product characteristics and the nature of work involved in end-use application, a wide range of gloves such as cut-resistant, mechanical, multi-task, and oil repellents are available.

Increasing concern over occupational injuries coupled with the surging requirement for durable and chemically resilient personal protective wear during high-risk activities in various industries such as oil and gas, metal forming, construction, and manufacturing, is anticipated to steer the demand for personal protective gloves over the forecast period.

Disposable gloves is expected to emerge as the fastest-growing segment with a revenue share accounting for USD 6.93 billion by 2024. Major materials used in product manufacturing include natural rubber, nitrile, vinyl, neoprene, and polyethylene. Growing concern over product contamination in electronics, medical examination, and food processing industries is expected to drive the growth.

Nitrile gloves are anticipated to exhibit various benefits associated with the product over its counterparts. In addition, they are puncture-resistant, frictionless, and have a longer shelf life than latex gloves. The increasing occurrence of pandemic diseases, such as swine flu (H1N1), coupled with the rising need for infection control is anticipated to drive the market.

Raw Material Insights

Based on raw materials, the market has been segmented into natural rubber or latex, nitrile, neoprene, vinyl, aramid fiber, and leather. Furthermore, the raw materials are transformed into application-specific fibers such as flame retardants, and chemical, and mechanical abrasion-resistant fabrics.

Leather gloves have a significant presence in the personal protective gloves industry. This can be attributed to the protection it offers in cold environments and preventing splinters. Growing demand for safety gloves for handling the sharp tools and volatile chemicals in construction and woodwork are expected to drive the adoption of the product over the forecast period.

Nitrile gloves are expected to emerge as the fastest-growing product segment owing to increasing adoption in the medical, chemical, painting, laboratory, and oil sectors. The segment is expected to expand at a CAGR of 8% over the forecast period on account of its enhanced resilience to puncture and chemicals as compared to vinyl and latex.

The processed natural latex and nitrile rubbers are made available to product manufacturing companies through a diverse distribution channel. Aramid fiber and leather manufacturers have distributors that market fibers to various personal manufacturers. Some fiber distributors operating in the industry include Transilwrap Co., Inc.; Tekra Corp.; and JG Train and Company (PTY) Ltd.

End-use Insights

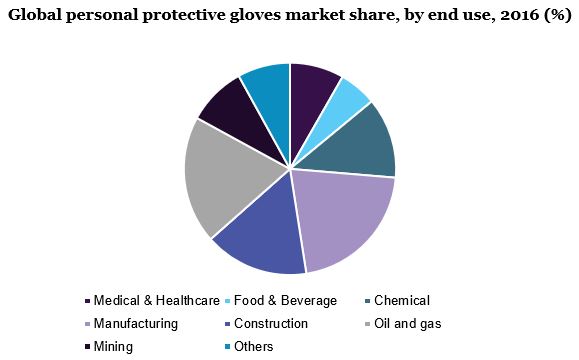

On the basis of end-use, the market has been segmented into medical and healthcare, food and beverage, chemical, manufacturing, construction, oil and gas, and mining. Other end-use industries include general engineering and law enforcement. Safety standards by regulatory agencies, including the Occupational Safety and Health Administration (OSHA), are anticipated to augment the market growth.

Manufacturing was the largest end-use segment for personal protective gloves and is expected to expand at a CAGR of 6.7% over the forecast period. Various primary and ancillary processes involved in the manufacturing industry such as welding, grinding, and torch cutting may cause injuries to employees. Growing concern over employee safety is expected to drive product demand.

Medical and healthcare is projected to witness high growth over the forecast period on account of rising concern regarding disease spread and illnesses in tropical regions of Central and South America, Africa, and Southeast Asia. In addition, growing medical innovation coupled with the recertification process is expected to steer the demand for personal protective gloves over the forecast period.

The rising number of hand cuts, arm injuries, and abrasions at workplaces are expected to fuel the product demand in the forthcoming years. The costs associated with the rising lost time injuries have urged employers of various end-use industries, such as the chemical, manufacturing, and mining industries are anticipated to necessitate the usage of gloves in their operating facilities.

Regional Insights

Europe held the leading market share of over 32% in terms of revenue in 2016. Growing demand for personal protective gloves in industries such as oil and gas, healthcare, food processing, mining, and construction is expected to drive the product demand.

Stringent norms related to workplace health and safety are expected to drive the regional product demand in the forthcoming years. Growing concerns over life-threatening accidents coupled with stringent regulatory norms regarding asbestos and silica content are expected to drive the adoption of personal protective gloves in various industries including construction and mining.

North America is expected to witness a CAGR of 6.4% over the forecast period, attributed to stringent regulatory norms for employees in the mining, construction, and healthcare sectors. In addition, increasing demand for products with multi-task functionality is expected to play a key role in steering the growth.

Asia Pacific is anticipated to witness a CAGR of 7.3% over the forecast period. Increasing construction spending coupled with the rise in transportation and oil and gas industries in the region, particularly in economies such as China, India, Indonesia, and Vietnam, is estimated to drive the regional market.

Personal Protective Gloves Market Share Insights

The market is highly fragmented and is marked by the presence of large integrated companies such as 3M, MSA Safety, Honeywell, Kimberly Clark, and Top Glove. Companies such as Top Glove and Honeywell are the manufacturers as well as suppliers of the product to end-use industries.

The manufacturers have distributors for different locations across the world. Other major companies operating in the market include Kossan Rubber, DuPont, Hartalega, Delta Plus, COFRA, Lindstrom, Mallcom, Radians, Globus, Midas Safety, Towa Corporation, Lakeland, Ansell, and Avon Rubber.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2024

Market representation

Revenue in USD million and CAGR from 2017 to 2024

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East, Africa

Country scope

U.S., Canada, Mexico, Germany, United Kingdom, France, Russia, China, India, Japan, South Korea, Indonesia, Australia, Brazil, Saudi Arabia, United Arab Emirates

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."