- Home

- »

- Advanced Interior Materials

- »

-

Pneumatic Tire Market Size, Share & Growth Report, 2030GVR Report cover

![Pneumatic Tire Market Size, Share & Trends Report]()

Pneumatic Tire Market Size, Share & Trends Analysis Report By Product (Radial, Cross-ply), By Vehicles (2-Wheelers, 4-Wheelers, Aircrafts), By Sales (OEM, Replacement), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-658-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Pneumatic Tire Market Size & Trends

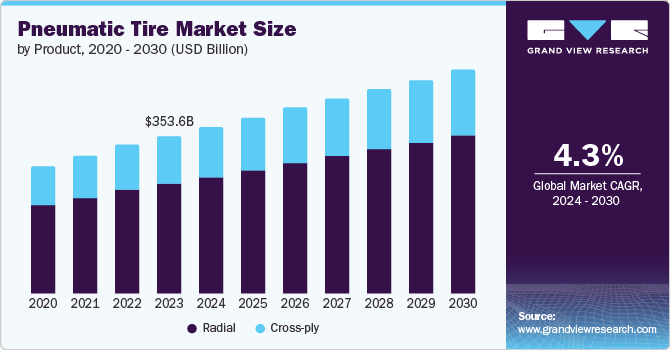

The global pneumatic tire market size was valued at USD 353.6 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. Increasing vehicle production and sales significantly boost demand, especially in emerging economies. Technological advancements in tire manufacturing, such as the development of durable and fuel-efficient tires, also play a crucial role. Furthermore, rising consumer awareness regarding vehicle safety and performance, along with stringent government regulations on vehicular emissions, propel the adoption of high-quality pneumatic tires.

The burgeoning e-commerce sector, leading to a surge in logistics and transportation activities, further amplifies market growth. Additionally, the growing trend towards electric vehicles and advancements in autonomous driving technology presents new opportunities for innovation in the pneumatic tires industry.

Stricter environmental laws, such as the European Union's Regulation (EC) No 661/2009, mandate the use of low-rolling resistance tires to reduce CO2 emissions, pushing manufacturers to develop eco-friendly alternatives. In the United States, the Tire Identification and Recordkeeping Regulation requires manufacturers to adhere to rigorous safety standards, influencing the production of higher-quality tires. Additionally, government initiatives such as the Indian Ministry of Road Transport and Highways' mandate for tire pressure monitoring systems (TPMS) in vehicles aim to enhance road safety, driving the demand for advanced pneumatic tires. Such regulations not only ensure consumer safety and environmental protection but also compel manufacturers to innovate, leading to the development of sustainable and efficient tire technologies that align with global standards.

Product Insights

The radial segment dominated the market and accounted for a share of 70.0% in 2023. The increased flexibility and reduced rolling resistance of radial tires result in improved fuel efficiency, making them a preferred choice for both passenger vehicles and commercial trucks. Additionally, the growing emphasis on vehicle safety and performance has boosted the demand for radial tires, as they offer better heat dissipation, which reduces the risk of blowouts and extends the overall tire lifespan. The robust infrastructure and economic growth in emerging markets, particularly in the Asia-Pacific region, have further propelled the adoption of radial tires, contributing significantly to their dominant revenue share in the global market.

The cross-ply segment is expected to grow at a CAGR of 3.9% from 2024 to 2030. Cross-ply tires, also known as bias-ply tires, offer advantages such as higher load-carrying capacity and better resistance to punctures and cuts, making them suitable for off-road and heavy-duty applications. The expected growth in the cross-ply segment can be linked to the rising demand in agricultural, industrial, and construction sectors where durability and robustness are critical. Furthermore, advancements in cross-ply tire technology, aimed at improving performance and lifespan, are likely to attract a broader customer base. Government initiatives and subsidies for agricultural machinery in developing regions are also expected to drive the demand for cross-ply tires.

Vehicle Insights

The four-wheelers segment captured the largest revenue share of 81.8% in 2023. This substantial market share can be attributed to the high demand for passenger cars, SUVs, and commercial vehicles globally. The rapid urbanization and increasing disposable incomes in emerging economies have significantly boosted automobile sales, thereby driving the demand for pneumatic tires. Moreover, the continuous advancements in tire technology, including the development of run-flat tires and all-season tires, have enhanced the safety, performance, and durability of four-wheeler tires, further propelling their market growth. The growing consumer awareness regarding the importance of tire maintenance and the benefits of high-quality tires also contributes to the segment's dominance. Additionally, the rise of electric and hybrid vehicles, which require specialized tires, presents lucrative opportunities for manufacturers in the four-wheeler segment to innovate and cater to the evolving market needs.

The aircraft segment is expected to grow fastest at a CAGR of 6.5% from 2024 to 2030. This rapid growth is driven by the expansion of the global aviation industry, characterized by increasing passenger traffic and the proliferation of low-cost carriers. The demand for new aircraft to accommodate this growth directly translates to a higher demand for high-performance pneumatic tires capable of withstanding extreme conditions and ensuring safety during takeoff, landing, and taxiing. Innovations in tire materials and designs to enhance durability and reduce maintenance costs are also fueling the segment's growth. Furthermore, the increasing investments in modernizing existing aircraft fleets and the emphasis on fuel efficiency and carbon footprint reduction are encouraging the adoption of advanced tire technologies in the aviation sector. As airlines and aircraft manufacturers prioritize safety and performance, the demand for superior-quality pneumatic tires is expected to soar, making the aircraft segment a critical growth driver in the market.

Sales Insights

The replacement segment dominated the market in 2023. The growing number of vehicles on the road globally and the increasing awareness among consumers regarding the importance of tire maintenance for safety and performance have significantly contributed to the segment's revenue. Additionally, advancements in tire technology, such as the development of high-performance and all-season tires, have led to a higher replacement frequency, further boosting the market. Moreover, stringent government regulations on tire performance and safety standards compel vehicle owners to replace their tires more frequently, ensuring compliance and enhancing road safety.

The OEM segment is expected to grow at a CAGR of 4.0% from 2024 to 2030. This growth is driven by the steady increase in vehicle production worldwide, especially in emerging economies where automotive manufacturing is rapidly expanding. Collaborations between tire manufacturers and automotive companies for the development of custom tire solutions tailored to specific vehicle models further bolster the segment's growth. Additionally, the increasing emphasis on sustainability and fuel efficiency is leading OEMs to adopt eco-friendly tire technologies, aligning with global environmental regulations and consumer preferences.

Regional Insights

The North American pneumatic tire market witnessed significant growth in 2023. This growth is driven by several factors, including a surge in commercial vehicle production, continuous technological advancements within the industry, and strategic collaborations and partnerships forged by market participants to solidify their competitive edge. These combined elements are significantly propelling the market forward.

U.S. Pneumatic Tire Market Trends

The U.S. dominated the North American pneumatic tire market with a share of 91.8% in 2023. This dominance can be attributed to several factors, including rising automotive production, ongoing infrastructural developments, favorable government policies, and a growing consumer demand for personal mobility. Additionally, the enhanced physical characteristics of pneumatic tires contribute to their market expansion.

Mexico's pneumatic tire market is anticipated to witness the fastest growth in North America, with a CAGR of 8.6% from 2024 to 2030. This growth is attributed to a confluence of factors, including advancements in infrastructure, rising investments, Mexico's strategic geographic location, the proliferation of e-commerce activity and distribution centers, and supportive government initiatives.

Europe Pneumatic Tire Market Trends

Europe's pneumatic tire market was identified as a lucrative region in 2023. This growth is propelled by a significant rise in vehicle demand across various industries, stricter safety regulations mandating high-performance tires, and a flourishing regional automotive industry.

The UK pneumatic tire market is expected to grow rapidly in the coming years, driven by evolving industry trends favoring enhanced tire performance, advancements in technology, and increasingly stringent regulatory requirements.

Asia Pacific Pneumatic Tire Market Trends

The pneumatic tire market in the Asia Pacific region is expected to experience substantial growth, fueled by the rapid expansion of automotive manufacturing, increasing disposable incomes, a growing population, and rising demand for customized vehicles.

China's pneumatic tire market held a substantial market share in 2023 owing to the expansion of the domestic automobile sector, strategic collaborations among manufacturers enhancing production capabilities, and China's position as a leading global exporter of automobile tires.

The pneumatic tire market in Japan held a substantial market share in 2023 owing to robust expansion of the automotive industry, technological advancements, and government regulations aimed at enhancing road safety and environmental sustainability. These factors collectively drive significant growth in the country's tire market.

Middle East & Africa Pneumatic Tire Market Trends

The pneumatic tire market in the Middle East and Africa is expected to experience significant growth, driven by government initiatives aimed at enhancing public infrastructure and vehicle safety standards, which boost demand for high-quality tires. Additionally, the expansion of end-use industries such as mining, construction, and others, coupled with rising disposable incomes and a growing demand for personalized vehicles, is projected to contribute to exceptional market growth in the coming years.

Key Pneumatic Tire Company Insights

Some of the key companies in the pneumatic tire market include THE YOKOHAMA RUBBER CO., LTD, Continental AG, MICHELIN, and many more. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

Key Pneumatic Tire Companies:

The following are the leading companies in the pneumatic tire market. These companies collectively hold the largest market share and dictate industry trends.

- MICHELIN.

- Continental AG

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company;

- Hankook Tire & Technology.

- THE YOKOHAMA RUBBER CO., LTD.

- KUMHO TIRE CO., INC.

Recent Developments

-

In March 2024, Goodyear Tire & Rubber Company introduced the RL-5K, their newest offering in the radial Off-The-Road (OTR) tire category designed specifically for large wheel loaders. These heavy-duty pneumatic tires boast an enhanced load-carrying capacity, making them ideal for applications demanding maximum performance and durability.

-

In August 2023, the Department for Promotion of Industry and Internal Trade temporarily relaxed import restrictions on 'New Pneumatic Tyres,' allowing certain global manufacturers to import tires from their overseas factories into India.

Pneumatic Tire Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 375.0 billion

Revenue forecast in 2030

USD 503.0 billion

Growth Rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle, sales, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Czech Republic; China; Japan; India; South Korea; Thailand; Brazil; Argentina; Morocco; South Africa

Key companies profiled

MICHELIN.; Continental AG; Bridgestone Corporation; The Goodyear Tire & Rubber Company; Hankook Tire & Technology.; THE YOKOHAMA RUBBER CO., LTD.; KUMHO TIRE CO., INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pneumatic Tire Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pneumatic tire market report based on product, vehicle, sales, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Radial

-

Cross-ply

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Two-wheelers

-

Four-wheelers

-

Aircrafts

-

Others

-

-

Sales Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Replacement

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Czech Republic

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Morocco

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."