- Home

- »

- Petrochemicals

- »

-

Global Polyacrylic Acid Market Size & Share Report, 2025GVR Report cover

![Polyacrylic Acid Market Report]()

Polyacrylic Acid Market Analysis By Application (Water & Wastewater Treatment, Detergents & Cleaners, Paints, Coatings, & Inks, Super Absorbent Polymers), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-525-0

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Bulk Chemicals

Industry Insights

The global polyacrylic acid market was valued at USD 2.24 billion in 2016. This product is characterized by high water solubility and absorbability. It is polymerized by using acrylic acid monomers, is commercially available in both liquid & dry formulations, and is widely used as a dispersant, thickener, binder, antiscalant, and as an intermediate in a wide number of industries.

Asia Pacific, North America, and Europe, and Central & South America have been the key consumers of polyacrylic acid in the past few years. Growth of the water & wastewater treatment, detergents, and household, institutional, & industrial (HI&I) cleaners sectors in these regions is likely to drive the global demand during the forecast period.

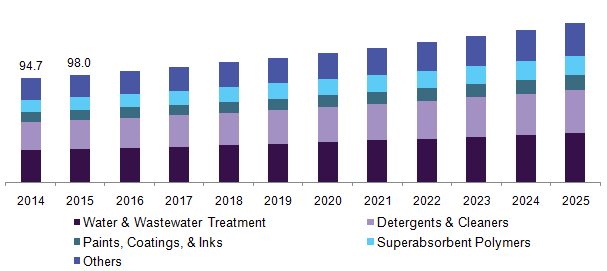

U.S. polyacrylic acid market volume by application, 2014 - 2025 (Kilo Tons)

The U.S. was the largest consumer among the rest of the countries in the North America region, in 2016. Strong utilization of household cleaning products and laundry & dishwashing detergents along with the presence of key end-user industry players in the country such as Unilever, Reckitt Benckiser, and Procter & Gamble Co., are a couple of growth-supporting factors of the industry.

Companies such as Lubrizol Corporation are engaged in providing cross-linked polyacrylic acid products for the home care sector. These polymers are used for the processing of household products such as surface and floor cleaners.

Major developments in the industrial and municipal water treatment in the U.S. are expected to boost the utilization of chemicals such as antiscalants and corrosion inhibitors. Implementation of safe drinking water policies and extensive usage of cooling water recirculation systems in the industrial sector is expected to propel the use of polyacrylic acid as a scale inhibitor in the future.

Kemira Oyj offers KemGuard series an extensive product portfolio comprising partially or fully neutralized derivatives of polyacrylic acid for applications including boiler water treatment, membrane desalination, sludge dispensation, mineral scaling.

Research & development in the area of utilizing biobased raw materials is projected to offer favorable growth opportunities in the industry over the next couple of years. For instance, companies such as Cargill, Inc., and Novozymes have collaborated for developing biobased process technologies to produce acrylic acid. This, in turn, is likely to pave way for industry growth over the years ahead.

Application Insights

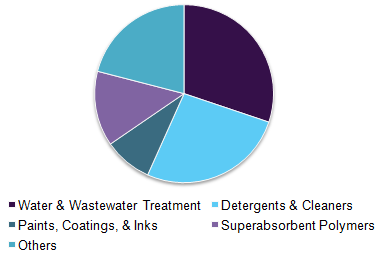

Detergents & cleaners, paints, coatings, & inks, superabsorbent polymers, and water & wastewater treatment are the major application segments of the product. Water & wastewater treatment constituted a significant volume share of the total industry in 2016 and is likely to witness growth at a CAGR of 5.1% during the forecast period.

Polyacrylic acid is used as a key component in manufacturing inorganic and composite membranes that are used in aqua purification. The product prevents and stabilizes the precipitation of calcium carbonate, calcium sulfate, and other mineral scaling in various equipment systems including cooling water circulation, seawater desalination, and boiler units. The product demand in this category is anticipated to increase in the future, as it effectively removes scaling and enables improved heat transfer and equipment durability.

Household detergents and industrial & institutional cleaners serve as the next important application of the industry. The product is characterized by good dispersion and fabric softening properties, owing to which it is utilized as a key ingredient for the manufacturing of detergent builders. Furthermore, this polymer is used in processing of liquid detergents used in laundry and cleaning of household products.

Global polyacrylic acid market volume by application, 2016 (%)

Industrial as well as institutional cleaners are the other key counterparts of the detergent application. BASF SE offers Sokalan PA products for use as dispersing agents for prevention of deposit formation on fabrics and for use in technical cleaners required in various industrial sectors including food and dairy processing.

Water-based inks and coating formulations significantly use binders such as polyacrylic acid and its salts for stabilization of the pigment particles, owing to the high water affinity of these products. The low molecular weight of these polymers helps in keeping the pigment particles uniformly suspended in the coating resin solution and prevents the formation of flocculates.

Research & development regarding the use of PAA for enhancing the mechanical properties of hydrogels used as biological glues in the medical and tissue engineering sector is one of the emerging applications of the industry.

Superabsorbent polymers segment is likely to provide lucrative growth prospects in the global industry. This application segment is estimated to illustrate a fast-paced market growth, owing to the water-holding and absorption capacity of the product. Other applications include food additives, personal care, and pharmaceutical.

Regional Insights

The industry is expected to rise at a strong growth rate by the end of 2025. Asia Pacific is likely to drive the global product demand, while Central & South America and Middle East & Africa are expected to be the emerging regions during the forecast period. North America and Europe are expected to illustrate stabilized industry growth, in the next couple of years.

Asia Pacific accounted for a revenue share of 41.3% of the total market in 2016. Significant industrial developments in the wastewater treatment sector in Asia Pacific are likely to drive the demand for aqua treatment chemicals in the coming years. This trend is likely to reflect in countries including China, India, and Philippines.

LG Electronics has recently announced its plans of investing over USD 400 million for development of innovative membrane filtration systems. The company aims to reach a revenue of USD 7.0 billion by the end of 2020. This development is expected to boost the usage of water-soluble polymers including polyacrylic acid in the Asia Pacific region.

Europe accounted for the second-largest revenue share followed by North America in 2016. Significant product utilization in industrial water treatment and superabsorbent polymers is expected to contribute towards the stable growth in both regions. Key countries such as the U.S., Germany, and France are likely to be the major product consuming countries by 2025.

Competitive Insights

The market is highly concentrated and is dominated by key players that are fully integrated across the value chain. High degree of both backward and forward integration exists as the prominent manufacturers are engaged in the manufacturing of raw materials as well as product derivatives and have also penetrated into the distribution channels and end-user sectors.

Key companies profiled in the research study include Ashland, Inc., Arkema S.A., BASF SE, Kemira Oyj, Lubrizol Corporation, Nippon Shokubai Co., Ltd., The Dow Chemical Company, Henan Qingshuiyuan Technology Co., Ltd., Aurora Chemicals, and Zouping Dongfang Chemical Co., Ltd.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Volume in Kilo Tons, revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, France, China, India, Brazil

Report coverage

Volume and revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts volume and revenue growth at global, regional & country levels and provides an analysis on the industry trends for each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global polyacrylic acid market on the basis of application and region:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Water & Wastewater Treatment

-

Detergents & Cleaners

-

Paints, Coatings, & Inks

-

Superabsorbent Polymers

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."