- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyarylsulfone Market Size & Share Report, 2019-2025GVR Report cover

![Polyarylsulfone Market Size, Share & Report]()

Polyarylsulfone Market Size, Share & Analysis By Product (Polyphenylsulfone (PPSU), Polysulfone (PSU), Polyetherimide (PEI) & Polyethersulfone (PESU)), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: 978-1-68038-464-2

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Bulk Chemicals

Industry Insights

The global polyarylsulfone market size was estimated at 1.61 billion in 2017 and is likely to witness strong growth in demand at a healthy CAGR of 7.7% over the few years. Growing demand for membranes from key end-use industries such as medical, food & beverages, automotive, water treatment, and biotechnology emerged as the biggest demand driver for the PAS market.

Polyarylsulfone (PAS) possesses exceptional chemical and electrical properties which include strong chemical resistance along with high dielectric strength. PAS is also capable of providing excellent resistance to hydrolysis and repeated sterilization which is increasing the product application, primarily in water treatment and the automotive sector.

Chemical & medical filtration process includes reverse osmosis systems, nanofiltration, and ultrafiltration processes. In the beverage industry, PAS is expected to be used to purify juices, corn syrup, wines, dextrose in corn million, and lactose during dairy processing. The construction industry is expected to witness high demand owing to developing use in plumbing fittings and faucet components production.

In 2017, polysulfone (PSU) emerged as the second largest product by volume in the global polyarylsulfone industry with key applications in electrical & electronic, membranes and plumbing fittings. Polyphenyl sulfone (PPSU) is primarily used in specialty applications owing to its high cost.

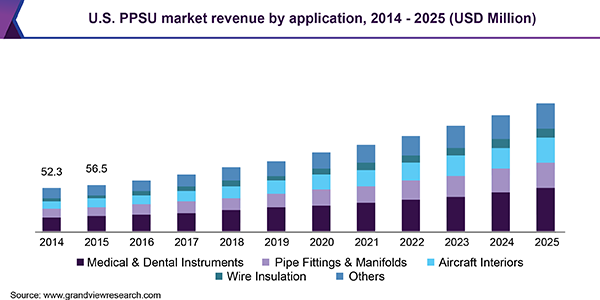

Medical & dental instruments, pipe fittings & manifolds, aircraft interiors, and wire insulation are some of the most prominent application of PPSU. Global polyarylsulfone market value chain consists of raw material, manufacturer, distribution, and end-use industries. PAS supply chain is a pull-based model where supply depends upon customer demand and order.

Stringent regulations are expected to impact the global polyarylsulfone industry negatively. Bisphenol A, the key raw material used in PAS production, is facing issues globally as many countries are considering it as a harmful and noxious element for humans, posing severe threats on human health. In addition, the pricey nature of bisphenol A is further a major restraining factor for the global PAS market over the coming years.

Polyarylsulfone Market Trends

Membranes are considered a key market driver for global polyarylsulfone (PAS) market demand. Different membranes in diversified industries, including medical, food & beverages, automotive, water treatment, and biotechnology. Medical is propelling membrane demand among all end-use industries, anticipated to augment global polyarylsulfone demand over the forecast period. In the medical industry, membranes are useful in blood purification systems.

The food and beverage industry uses membranes for enhanced and quality filtration. Changing consumer preferences for quality and hygienic products is driving the need for sophisticated filtration, which in turn is increasing PSU demand in membrane manufacturing. In the beverages industry, PAS is highly used for juices and wine manufacturing, while in the food industry, it is used for various cereals, including corn and dairy products. Further, stringent emission regulations coupled with continuous environmental problems is increasing the need for wastewater treatment which in turn is augmenting membrane demand in the industry.

Growing mining activities are another key driver for polyacrylamide for augmenting the global polyacrylamide (PAS) market. Polyacrylamide is used as a flocculating agent to treat wastewater generated during mining activities. The expansion in the mining sector is expected to propel the demand for polyacrylamide. Polyacrylamide is widely used in mining processing and treating minerals to separate mineral and mineral ore. It is also used as flocculants in the treatment of wastewater from mineral processing that is formed by the mining channels during the mining process.

Polyarylsulfone, on account of its attributes, is expected to substitute thermosets, metals, and glass. PAS possess enhanced mechanical properties ranging from -50 to +180 degree Celsius (polysulfone) or +220 degree Celsius (polyether sulfone). In addition, PAS has high dimensional stability, good transparency, and exceptional chemical and electrical properties, including higher chemical resistance and dielectric strength. In addition, they are capable of providing enhanced resistance to hydrolysis and repeated sterilization.

Due to exceptional heat distortion temperature and excellent lubricants and fuel resistance, polyarylsulfone finds significant application in the automotive industry for oil pumps, reflectors, connectors, oil control pistons, bezels, and transmissions components, housings, and flapper valves. In addition, high design freedom for smaller vehicle headlights coupled with direct metal plating ability emerge as an advantage over thermosets for the automotive application area.

The increasing lightweight engineering trend over metals is driving PAS demand in the aerospace industry. Excellent flame retardant characteristics attract the aerospace industry to utilize PAS for various components. The aviation industry has started using PAS in trolley manufacturing used in airplanes to serve meals and drinks to passengers in recent years. The purpose of replacing metals with PAS in trolley manufacturing was to reduce its weight by half of the metal versions as huge aircraft use more than 100 such trolleys, which means weight reduction adds significant value. PAS, mainly polyether sulfones are also used as impact modifiers for epoxy systems in the aviation industry.

Product Insights

On the basis of product, the polyarylsulfone market has been segmented into polyphenyl sulfone (PPSU), polysulfone (PSU), and polyetherimide (PEI) & polyethersulfone (PESU). PEI & PESU with a market share of more than 53% emerged as the most significant product segment in this market. High strength, excellent dimensional stability, rigidity, outstanding electrical properties, and excellent flame retardancy of PEI are the primary driver for its increasing application scope.

PESU is widely utilized in safety face shields, printed circuits, connectors, high-intensity light bases, and machine guards owing to its excellent properties including transparency, low smoke generation, outstanding electrical properties at extreme temperature, and excellent chemical resistance.

PPSU has a property of getting sterilized easily by high temperature steam without any feature loss owing to which the product has significant potential to witness increased demand in medical devices and dental instruments at the fastest growth rate. In the aerospace industry, PPSU is highly used for aircraft interiors.

Growing concerns regarding food quality and safety coupled with stringent regulations by FDA is influencing filter demand which in turn is expected to propel PSU demand for membrane manufacturing applications. PSU is likely to witness higher demand owing to its increasing use for membrane application in oil & gas, medical, biotechnology, wastewater treatment, and sanitary industry.

In the beverages industry, PAS is majorly used in the manufacturing of wines and juices while in the food industry, it is used for various cereals including corn and dairy products. The increasing need for wastewater treatment which is a major application of the product segment is likely to develop the overall market over the coming years.

Regional Insights

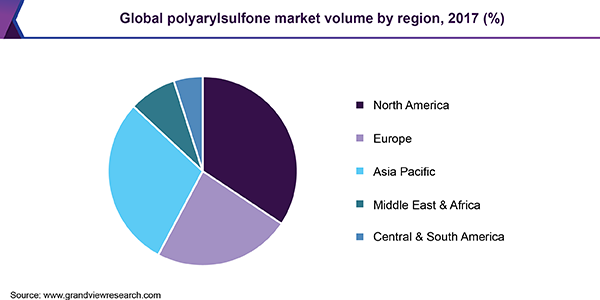

In terms of region, North America emerged as the largest market across the globe in 2017. Presence of well-developed and organized thermoplastic industry coupled with ongoing technical development in key end-use industries such as automotive, aerospace, medical, and electric/electronic across U.S., Canada, and Mexico is positively impacting the market growth across the North America region.

The U.S. dominated the North America polyarylsulfone market in 2017, and the dominance is expected to continue over the forecast period. Original equipment manufacturers in the country are focusing on upgrading traditional powertrain models. In addition, the growing production of automobiles in the country is further creating considerable demand for polyarylsulfone across the automotive industry. In addition, the increasing production of automobiles, the demand for polyarylsulfone in various automotive applications is anticipated to grow during the forecast period.

The Asia Pacific led by China, Japan, India, and South Korea, among others emerged as the second largest polyarylsulfone market and is likely to grow at the fastest growth rate over the forecast period. The demand has been primarily driven by the presence of large-scale automotive industry coupled with developing manufacturing industry primarily in China and India.

The demand for polyarylsulfone in China is driven by the evolving automotive industry. Electric vehicles remain a promising category for polyarylsulfone market in China as the government is providing substantial subsidies to manufacturers and favorable discounts and incentives for customers who are purchasing e-vehicles.

Growth in automotive production, high standard of living, growing population, and the presence of newly developed economies are several important factors which are creating a positive growth potential for PAS in Europe. Rapid urbanization along with the presence of renowned large-scale automakers are contributing towards the development of the automotive market in this region which is developing the product application scope.

Strong demand for consumer electronics in emerging markets including the UAE, Saudi Arabia, and Qatar coupled with the proliferation of wearable devices are anticipated to be some of the key trends driving the PAS demand in the region. The lifting of economic sanctions in Iran and the drive for economic diversification between the oil-exporting countries of the Gulf cooperation council, the MEA region is projected to continue witnessing the growth in the polyarylsulfone market.

Polyarylsulfone Market Share Insights

Key raw material manufacturers include Bayer, Nan Ya Plastics Corp, Mitsui Chemicals Inc., Momentive Specialty Chemicals Inc., Dow Chemical, Acros Organics, Triveni Interchem Pvt. Ltd. SABIC, major PAS manufacturer has integrated its operations and has invested in raw material production plant. The company has backward integrated its functions in order to produce cost-effective PAS and has emerged as a major PAS supplier in the global market.

Many of the market participants are actively involved in mergers and acquisition activities over the past few years. Key companies are looking to enhance their regional presence, particularly in unorganized markets such as India, Brazil, and China which is increasing the importance of the distribution channel in this market.

Major PAS manufacturers include Solvay, BASF SE, Sumitomo Chemical, SABIC, Quadrant AG, Ensinger GmbH, Polymer Industries, Techmer PM, RTP Company, among others. Companies including Emco, Trident Plastics Inc., Meyer Plastics Inc., and Ensinger Inc. are key PAS manufacturers, which have forward integrated operations and are also specialized in providing distribution services.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Volume in Tons, Revenue in USD Million & CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Germany, Italy, UK, China, India, Japan, South Korea, Taiwan

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global polyarylsulfone market report on the basis of product and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

PPSU

-

Medical & Dental Instruments

-

Pipe Fittings & Manifolds

-

Aircraft Interiors

-

Wire Insulation

-

Others

-

-

PSU

-

Electrical & Electronics

-

Membranes

-

Plumbing Fittings

-

Others

-

-

PEI & PESU

-

Medical

-

Automotive

-

Electrical/Electronic

-

Aerospace

-

Others

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."