- Home

- »

- Clinical Diagnostics

- »

-

Primary Care PoC Diagnostics Market Size Report, 2030GVR Report cover

![Primary Care PoC Diagnostics Market Size, Share & Trends Report]()

Primary Care PoC Diagnostics Market Size, Share & Trends Analysis Report By Product (Glucose Testing, Hb1Ac Testing), By End-use (Pharmacy & Retail Clinics, Physician Office), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-333-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

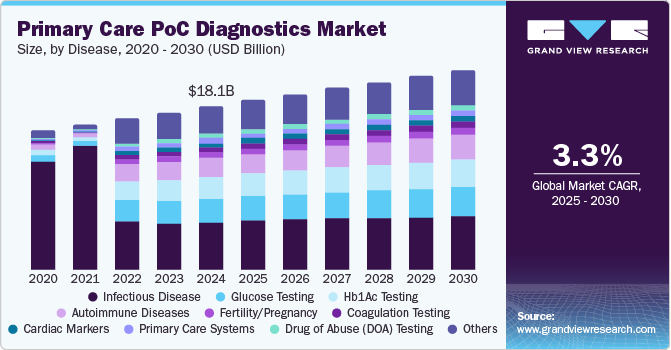

The global primary care PoC diagnostics market size was valued at USD 21.44 billion in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030. The market growth can be attributed to the factors such as rising prevalence of chronic diseases, the rising number of point-of-care diagnostic devices, and a rise in healthcare expenditures within secondary and tertiary care.

The rising prevalence of chronic diseases is driving the market growth of primary care POC devices. According to a World Health Organization (WHO) report published in September 2023, chronic diseases account for 74% of global deaths. These include cardiovascular diseases, cancers, and diabetes. Cardiovascular disease accounts for 17.9 million deaths for non-communicable diseases. Such growing concerns drive the market growth for primary care POC diagnostics.

The outbreak of the COVID-19 pandemic raised the potential for point-of-care devices (POC) to examine and conduct the test rapidly. Various companies are involved in providing the POC diagnostic devices to perform the test for the COVID-19 virus. For instance, F Hoffmann-La Roche Ltd. offers solutions to support COVID-19 testing, such as the SARS-CoV-2 Rapid Antigen Test 2.0. The pandemic outbreak brought a peak in the market for point-of-care diagnostic devices.

The increasing investment by pharmaceutical companies in point-of-care diagnostic devices is expected to drive the market growth. For instance, CrisprBits entered a strategic partnership with Molbio Diagnostics Pvt. Ltd. in August 2023 to bring innovation through CRISPR diagnostics tests in the point-of-care assessments for various diseases.

Product Insights

Glucose testing dominated the market and accounted for a share of 14.7% in 2023. The rising prevalence of diabetes is driving the growth of the segment. According to the World Health Organization (WHO) report published in April 2023, more than 95% of diabetic people have type 2 diabetes. The rising health concerns are driving companies to innovate testing devices that the patient can conduct to examine and record their glucose levels. A wide range of glucometers are available in the market, such as Abbott’s FreeStyle Libre 3, FreeStyle Libre 2 enabled with real-time alarm, Ascensia Diabetes Care Holdings AG’s contour blood glucose monitoring systems, contour plus elite, contour next EZ, and others. In addition, various companies are innovating advanced systems. For instance, Prevounce launched a new cellular-connected glucose testing device dedicated to remote patient monitoring in June 2024.

The cancer markers segment is expected to register the fastest CAGR during the forecast period. The rising cancer incidences, increased demand for screening cancer, and technological advancements are driving the segment’s growth. The World Health Organization (WHO) recorded 20 million cancer cases in 2022 and 9.7 million deaths. Tumor markers are commonly used tests to diagnose cancer. Some tumor markers available to diagnose cancer are alpha-fetoprotein (AFP), beta-2-microglobulin (B2M), BRCA1, CA-125, carcinoembryonic antigen (CEA), estrogen receptor (ER), to detect various cancers. Companies are involved in innovating advanced options. For instance, Boditech Med Inc. launched three new tumor markers in October 2021 to diagnose various kinds of cancers, such as prostate cancer, liver cancer, and colon cancer. Such innovations are expected to drive market growth.

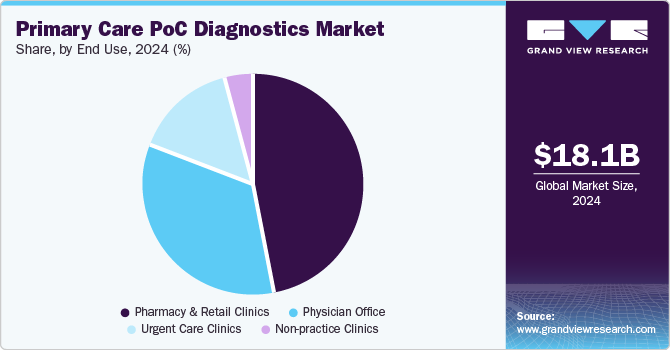

End Use Insights

The pharmacy & retail clinics segment accounted for the largest market revenue share of 47.1% in 2023. Increasing the number of people covered by health plans reduces healthcare costs and improves access to care. This rise has allowed pharmacies and retail clinics to offer POC testing. The number of pharmacists performing tests such as cholesterol and glycated hemoglobin has increased rapidly. The commonly conducted POC tests include blood glucose monitoring, pregnancy tests, hemoglobin, rapid strep tests, urinalysis tests, and COVID-19 tests. The growing incidences of chronic diseases and infectious diseases and the increasing demand for diagnosis are driving the segment’s growth.

Physician office is expected to grow significantly over the forecast period. The growing number of chronic and infectious diseases drive patients to the physician’s office to detect and treat the condition. The physician office segment is growing as healthcare professionals can check and conduct POC tests and determine the course of action to treat the condition. Various companies are offering point-of-care solutions for physicians, such as Siemens Healthcare, which enables the use of various tests for diabetes urinalysis and improves treatment outcomes.

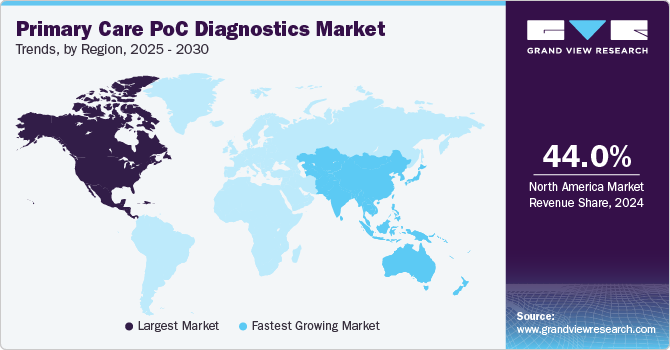

Regional Insights

North America primary care POC diagnostics market dominated in 2023 and accounted for the market share of 44.2%. The growth can be attributed to rising chronic diseases and the involvement of various companies in technological advancements. Chronic diseases are the leading cause of death and disability in Canada, according to the Ontario Agency for Health Protection and Promotion. For instance, the government of Canada estimated lung, breast, colorectal, and prostate cancer as majorly diagnosed types, accounting 46% of diagnoses in 2021. The LHSC (London Health Sciences Center) based in Canada has included a wide range of POC tests for urinalysis, blood glucose, blood gases, and hemoglobin tests. Such instances are expected to drive the region’s market growth.

U.S. Primary Care PoC Diagnostics Market Trends

The U.S. primary care POC diagnostics market accounted for a 39.2% share of the global market in 2023. The American Cancer Society had estimated 1.9 million cancer cases in 2021. Government initiatives to address chronic diseases such as cancer are accelerating the country’s growth. For instance, in February 2022, the U.S. government reignited the Cancer Moonshot initiative to foster collaboration and accelerate scientific discovery in research to reduce the death rate caused by cancer. In addition, various companies are involved in providing POC diagnostic devices, such as Abbott, Thermo Fisher Scientific Inc., and BD, which are expected to drive the market growth.

Europe Primary Care PoC Diagnostics Market Trends

Europe accounted for a significant market share in 2023 in the primary care POC diagnostics market. According to the World Health Organization (WHO), report published in December 2023, half of the countries in the region are prone to respiratory infectious diseases such as respiratory syncytial virus (RSV). The respiratory syncytial virus in children under six months of age accounts for 20% of acute lower respiratory tract infections. Such growing incidences are driving the primary care POC diagnosis in the region. The European Center for Disease Prevention and Control agency is mapping the assessment of point-of-care testing devices for infectious diseases as per a report published in April 2022. Some key players in the region, such as BIOMÉRIEUX, BD, and Abbott, are expected to drive the market growth.

The primary care PoC diagnostics in the UK is driven by the rising chronic and infectious diseases. According to the government of UK, COVID-19 infections increased, with an estimated one in forty people testing positive as per the report published in March 2023. Such incidences demand early detection of the condition for immediate treatment. Companies such as LumiraDx provide point-of-care diagnostic devices to conduct various COVID-19, CRP, D‑Dimer, Flu, HbA1c, and RSV tests. Such instances are expected to drive market growth in the nation.

Asia Pacific Primary Care PoC Diagnostics Market Trends

Asia Pacific primary care POC diagnostics market is estimated to register the fastest CAGR over the forecast period. The growth is attributed to factors such as increased chronic diseases; for instance, the Australian Institute of Health and Welfare reported approximately 1.3 million Australians were living with diabetes in 2021. According to a study published in November 2023, point-of-care diagnostic devices are very useful in conducting tests in rural and remote Australia as the cases rise and early diagnosis is raising the demand for these devices and driving the market growth.

The rising prevalence of diabetes is the primary factor in India for the region’s market growth. According to the World Health Organization (WHO), approximately 77 million people above the age of 18 are affected with type 2 diabetes, with more than 50% unaware of the condition. This health challenge is pushing the country’s capabilities to discover advanced alternatives. Various companies offer POC devices, such as glucometers, to detect and record blood sugar levels. Some glucometers available in the market are Accu-Chek Active Blood Glucose Monitoring System, Dr. Morepen Gluco One Blood Glucose Monitoring System, and Accu-Chek Instant S Blood Glucose Monitoring System. Various companies that are involved in offering point-of-care diagnostic devices are Molbio Diagnostics Pvt. Ltd, Siemens Healthcare Private Limited, and Morepen Laboratories. Companies are innovating technologically advanced alternatives; for instance, BlueSemi, an Indian startup, launched a non-invasive blood glucose monitoring gadget in March 2023. Such innovations are expected to drive market growth in the nation.

The rising chronic cases and increasing population in China are driving the growth of the market. According to the World Health Organization (WHO) report published in November 2023, a rise in respiratory illness among children was noted in the country. In addition, China’s National Health Commission monitored an increase in respiratory diseases nationwide. These illnesses are majorly rising among children. Such rising prevalences are majorly driving the primary care POC diagnostics market growth.

Key Primary Care PoC Diagnostics Company Insights

Some key companies in the primary care POC diagnostics market include F Hoffmann-La Roche Ltd., Danaher, Siemens Healthineers, and Johnson & Johnson Services, Inc. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Siemens Healthineers is a Germany-based company operating as a medical technology dedicated to providing healthcare services. The company offers medical imaging, laboratory diagnostics, point-of-care devices (POC), and reading solutions for healthcare applications. The company provides point-of-care devices for blood gas products such as RAPIDPoint 500e, epoc Blood Analysis System, and Urinalysis products such as CLINITEK Status+ Analyzer and CLINITEK Advantus Urine Chemistry Analyze.

-

F Hoffmann-La Roche Ltd., is a healthcare-based company offering diagnostics solutions. The company specializes in medicines for oncology, virology, immunology, urinalysis, and blood screening. The company extends a range of POC devices for diagnostics including a multiplate analyzer, SARS-CoV-2 Rapid Antigen Test 2.0, BM-Lactate, Accutrend Cholesterol, cobas Strep A, Urisys 1100 analyzer, and cobas pulse system.

Key Primary Care PoC Diagnostics Companies:

The following are the leading companies in the primary care PoC diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F Hoffmann-La Roche Ltd.

- Danaher

- Abbott

- Siemens Healthineers

- BIOMÉRIEUX

- QIAGEN

- Nova Biomedical

- Johnson & Johnson Services, Inc.

- OraSure Technologies, Inc.

- BD

Recent Developments

-

In June 2024, BIOMÉRIEUX received FDA approval for its BIOFIRE SPOTFIRE Respiratory/Sore Throat, a POC platform.

-

In May 2024, Cipla signed an agreement for an investment in Achira Labs Private Limited, responsible for commercialization of point-of-care test kits in India.

-

In March 2023, bioLytical Laboratories Inc.'s INSTI Multiplex HIV-1/2 Syphilis Antibody Test was approved by Health Canada.

Primary Care PoC Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.09 billion

Revenue forecast in 2030

USD 26.08 billion

Growth rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

F Hoffmann-La Roche Ltd.., Danaher, Abbott, Siemens Healthineers, BIOMÉRIEUX, QIAGEN, Nova Biomedical, Johnson & Johnson Services, Inc., OraSure Technologies, Inc., BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Primary Care PoC Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global primary care POC diagnostics market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Glucose Testing

-

Hb1Ac Testing

-

Coagulation Testing

-

Fertility/Pregnancy

-

Infectious Disease

-

Cardiac Markers

-

Thyroid Stimulating Hormone

-

Hematology

-

Primary Care Systems

-

Decentralized Clinical Chemistry

-

Feces

-

Lipid Testing

-

Cancer Marker

-

Blood Gas/Electrolytes

-

Ambulatory Chemistry

-

Drug of Abuse (DOA) Testing

-

Autoimmune Diseases

-

Urinalysis/Nephrology

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmacy & Retail Clinics

-

Physician Office

-

Urgent Care Clinics

-

Non-practice Clinics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."