- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Printing Inks Market Size, Share & Growth Report, 2021-2028GVR Report cover

![Printing Inks Market Size, Share & Trends Report]()

Printing Inks Market Size, Share & Trends Analysis Report By Product (Gravure, Flexographic, Lithographic & Digital) By Resin Type (Modified rosin, Modified cellulose, Acrylic & Polyurethane), By Application, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-1-68038-606-6

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2025

- Industry: Bulk Chemicals

Industry Insights

The global printing inks market size was valued at USD 19.2 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 2.8% from 2021 to 2028. The market is expected to witness moderate growth over the forecast period. Factors such as the growing end-use industry, including flexible packaging, commercial printing & publishing, packaging labels, have majorly driven this market.

The superior properties of the constituents such as pigments, binders, solubilizers, and additives to produce text, design, or images along with rising demand from the packaging sector, commercial printing, and changing consumer preference, these solutions are expected to have unceasing demand in the future.

The global printing inks market is heading toward major consolidations to increase efficiency, support growth, and achieve more leverage with suppliers and customers. Market consolidation has become a long-term trend, particularly in the western market, with limited organic growth.

However, downward pricing pressure is expected to limit the revenue growth in the printing inks market owing to the slow growth in product pricing caused by high competition within the industry. Moreover, stringent regulatory frameworks such as Federal Food, Drug, and Cosmetic Act and the U.S. Food and Drug Administration are limiting the usage, manufacturing, and distribution of various inorganic solvents and toxic metals. This, in turn, is expected to hamper the market growth over the forecast period.

Apart from crude oil derivative and inorganic pigments, which are major raw materials, the development of economical and non-toxic raw materials such as graphene, carbon, and modified celluloid is the research initiative at the forefront. This market is strongly affected and driven by advancements in technology and processes such as ink-jet products and digital printing.

Printing Inks Market Trends

Initially, printing inks were majorly used in printing publications for newspapers, magazines, and journals. However, due to rapid urbanization and the growing digitalized needs of consumers, the application scope of printing inks has shifted from commercial printing & publication to the packaging industry. In the packaging industry, printing inks are used to print on packaging materials to make the packaging attractive to customers, as it is one of the powerful ways to promote and market products.

Flexible packaging offers better options for customized packaging. The demand for flexible packaging is driven by the food & beverage industry, supported by the strong growth in the snacks & confectionery category. Moreover, the growing demand for food, on account of the increasing global population, is one of the key trends augmenting the growth of the flexible packaging industry. The booming flexible packaging industry is anticipated to offer substantial growth opportunities for the printing inks market.

Furthermore, developments in production technologies, improved packaging practices, and case-ready packaging are anticipated to influence the printing inks market positively. In addition, advancements in processing technologies in the food sector in the U.S. and the European countries are expected to augment the growth of packaged foods industry. This, in turn, is anticipated to fuel the demand for flexible packaging.

The thriving demand for energy-curing inks in printing & packaging applications is another major factor driving the printing inks market growth. The energy-curing inks include UV-cured inks, latex (resin) inks, solvent-UV hybrid inks, and solid inks. These inks are trending globally owing to their superior properties, zero/low volatile organic content (VOC), and growing application scope.

The superior characteristics of energy-curing inks include better bonding qualities and reduced drying time. Furthermore, increased productivity, high performance, environmental benefits, and lower energy costs are the significant factors for the increased usage of ultraviolet and electron beam-curing inks. However, the initial setup costs associated with these inks are higher. Therefore, companies are adopting new technologies to eliminate the high costs. For instance, Flint Group has developed new UV inks such as the Ultraking XCURA label to attain minor levels of energy consumption during the curing process.

UV LED, another type of energy-curing ink, is the latest trend, with many ink manufacturers tackling the challenge of producing technologically advanced inks. UV LED inks require different formulations from those of traditional UV-curing inks. Lower energy costs, heat reduction, environmental friendliness, and versatility are the major factors boosting the demand for UV LED inks in various applications such as membrane switch, graphics, container & ad specialty, textures, and specialty clears.

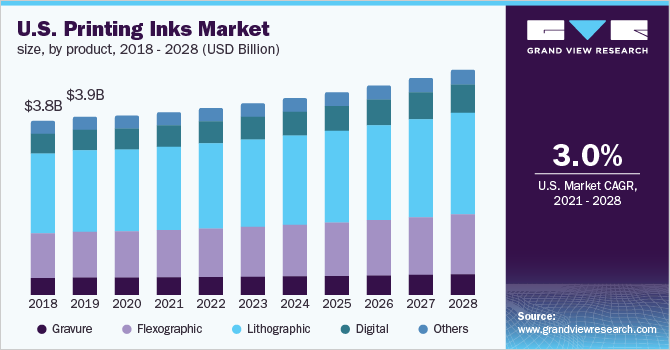

Product Insights

Lithographic segment accounted for a prominent share of the overall market in terms of value in 2020. The segment is expected to witness substantial growth over the forecast period owing to a combination of high-quality prints and efficiency in large-scale projects. This lithographic process is also suitable for flat media such as cloth, foil, paper, plastic, and flat cardboard.

Gravure printing inks are primarily used for printing photographs; they can be utilized on films, thin papers, metal foils, and paper cups. This process utilizes “liquid inks”. The flexibility of this ink technology allows these print processes to cover various applications in food packaging, tobacco products, and cosmetics on a variety of substrates such as cardboards, papers, plastics, foils, and labels.

Flexographic inks can be utilized on various substrates such as paper, laminates, films, foils, and corrugated boards. These inks are expected to witness prominent growth over the forecast period, supported by their eco-friendly nature and low costs. Also, growing demand for flexible packaging and cardboard printing demand in line with the logistics volume assist the need for flexographic ink in U.S. and European Countries.

Resin insights

Polyurethane is the fastest-growing resin segment and is expected to account for over 16% of the resin revenue in 2028. The composition of the resins is a significant factor for the type of ink produced. Hydrocarbons & modified rosins are used for producing lithographic solvents, polyamides & polyurethanes are used for manufacturing gravure and solvent-based-flexographic products. By resin type, acrylic is the predominantly used raw material for manufacturing solutions owing to its faster drying properties, availability, and cost-effective nature.

The other factors contributing to polyurethane’s faster growth for manufacturing printing solvents include its high tensile and tear strength, bonding potential with types of substrates, corrosion resistance, and hardness flexibility. Its increased usage in the flexible packaging segment and energy curing solution is another factor for its faster growth rate.

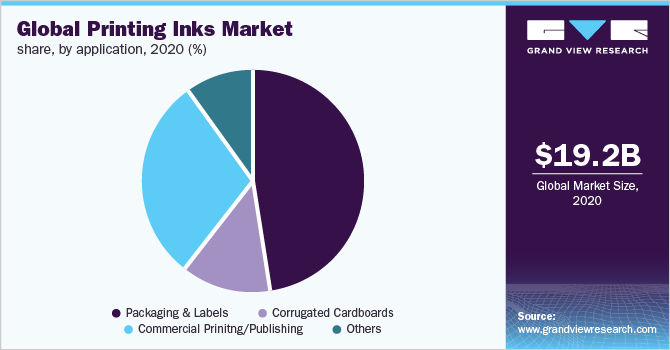

Application Insights

Packaging & labels segment is the largest and fastest ink application segment, which accounts for over 45% of the total segment revenue. The growth of this application has witnessed a flourishing trend in the last five years owing to the growing middle-class population in emerging nations such as India and Thailand, change in consumer preference for the convenience of food packaging & online retailing with extensive internet penetration, and requirement of bio-degradable products.

The other applications of inks include commercial printing & publishing which has witnessed a declining trend in many regions due to growing digitalization and the Internet of Things (IoT). The other significant reason for the decline could be the growth in demand for textile prints, ceramic printing, printed electronics and folding cartons, corrugated cardboard in the packaging segment. The trends for these applications vary with region, for instance, ceramic printing is a growing market in China owing to its increased production of ceramic tiles. Moreover, printed electronics has substantial growth opportunities in Thailand due to its growing electronics industry.

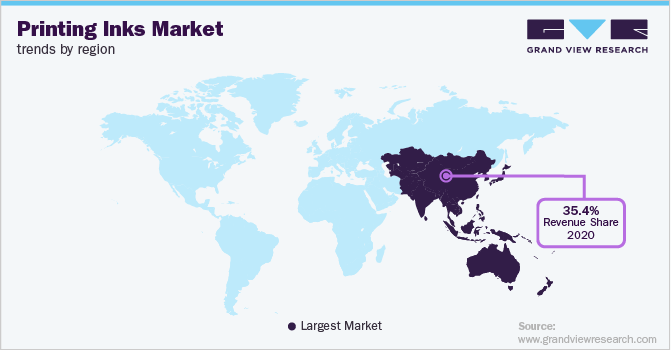

Regional Insights

Asia Pacific dominated the printing inks market and accounted for the highest revenue share of 35.60% in 2021. Asia Pacific dominated the global printing inks market in 2021 and is expected to continue its dominance over the forecast period. Rising consumption of packaged food items, coupled with robust growth in the packaging and labeling industry owing to the emergence of various businesses, including the food & beverage industry, consumer goods, health care sector, and e-commerce, has positively impacted market growth in the region.

Moreover, a rising preference for flexography inks in flexible packaging applications owing to their ability to be printed on non-absorbent material, faster printing process, and enhanced printing options through a range of colors in various substrates is expected to provide huge growth opportunity for the printing inks market over the forecast period.

The Japanese printing ink market is witnessing gradual shrinkage and a waning customer base due to the increasing digitalization of information. The demand for commercial printing and publishing, particularly in the newspapers and magazines segment, is diminishing, which has negatively impacted the demand for printing inks in the country. However, the market for printing inks in food packaging, corrugated cardboards, and printing on containers is growing significantly, which is expected to drive the demand over the forecast period.

China dominated the Asia Pacific printing inks market in 2021 and is expected to continue its dominance over the forecast period. The rising demand from the packaging industry is expected to be the major factor driving the market demand in the country. In recent years, the packaging industry has witnessed significant growth owing to the rapid growth of e-commerce and the growing demand for international shipping of non-consumer goods in the country.

Printing Inks Market Share Insight

The global ink industry is extremely competitive owing to the presence of vertically integrated key players with technologically advanced solutions & equipment and procurement & distribution channels. The industry has witnessed a strong consolidation period in different regions which include, expansions, mergers, and acquisitions, making the industry highly competitive. Some expansion strategies include Epple Druckfarben Italia S.r.I in Milan, Italy, subsidiary of Epple Druckfarben for superior quality German offset printing inks in Italy and Kansas, U.S. plant which was an expansion strategy of Sakata Inx Corporation. Major market players include

-

Flint Group

-

DIC Corporation

-

Siegwerk Druckfarben AG & Co. KGaA

-

Sakata Inx Corporation

-

T&K TOKA Corporation

-

Dainichiseika Color & Chemicals Mfg. Co., Ltd.

-

DEERS I CO., Ltd.

-

Epple Druckfarben AG

-

TOYO INK SC HOLDINGS CO., LTD.

-

Hubergroup

-

TOKYO PRINTING INK MFG CO., LTD.

Printing Inks Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 19.6 billion

Revenue forecast in 2028

USD 23.8 billion

Growth rate

CAGR of 2.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2016-2019

Forecast period

2021-2028

Quantitative units

Revenue in USD thousand, volume in thousand liters, and CAGR from 2020 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resin, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; China; India; Japan; Brazil

Key companies profiled

Flint Group; DIC Corporation; Siegwerk Druckfarben AG & Co. KGaA; Sakata Inx Corporation; T&K TOKA Corporation; Dainichiseika Color & Chemicals Mfg. Co., Ltd.; DEERS I CO., Ltd.; Epple Druckfarben AG; TOYO INK SC HOLDINGS CO., LTD.; Hubergroup; TOKYO PRINTING INK MFG CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printing Inks Market SegmentationThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global printing inks market on the basis of product, resin, application, and region.

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Gravure

-

Flexographic

-

Lithographic

-

Digital

-

Others

-

-

Resin Outlook (Revenue, USD Million, 2016 - 2028)

-

Modified rosin

-

Modified cellulose

-

Acrylic

-

Polyurethane

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Packaging & labels

-

Corrugated cardboards

-

Publication & Commercial Printing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global printing inks market size was estimated at USD 19.2 billion in 2020 and is expected to reach USD 19.6 billion in 2021.

b. The global printing inks market is expected to grow at a compound annual growth rate of 2.8% from 2021 to 2028 to reach USD 23.8 billion by 2028.

b. Asia Pacific dominated the printing inks market with a share of 35.4% in 2020. This is attributable to the growth of end-use applications coupled with technological printing ink advancements and constant research and development initiatives.

b. Some key players operating in the printing inks market include Flint Group, DIC Corporation, Siegwerk Druckfarben AG & Co. KGaA, Sakata Inx Corporation, Wikoff Color Corporation and Sun Chemicals.

b. Key factors that are driving the market growth include printing inks application for food packaging & online retailing, and its application for commercial printing & publishing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."