- Home

- »

- Homecare & Decor

- »

-

Real Estate Market Size & Trends Report, 2022-2030GVR Report cover

![Real Estate Market Size, Share & Trends Report]()

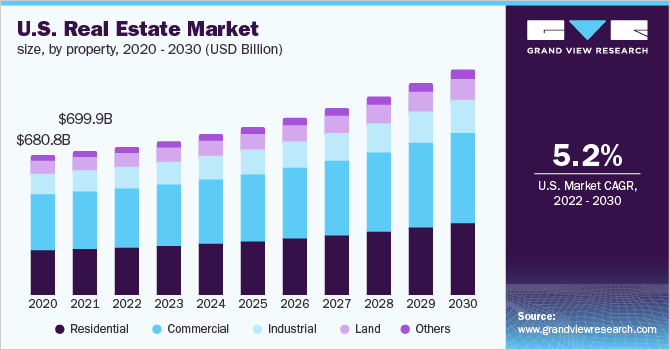

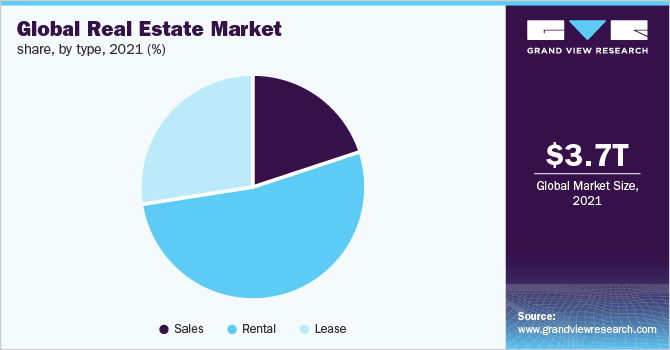

Real Estate Market Size, Share & Trends Analysis Report By Property (Residential, Commercial, Industrial, Land), By Type (Sales, Rental, Lease), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-354-6

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global real estate market size was valued at USD 3.69 trillion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. The market is expected to grow at a healthy pace during the forecast period, owing to the rising population and a desire for personal household space. As of 2021, the commercial real estate space was estimated to be the most important element driving industry expansion.

The COVID-19 pandemic has negatively impacted the growth of the market. The impact of the pandemic was visible in the first few months of the crisis, especially from a retail standpoint, owing to strict lockdown measures and movement restrictions. The lockdowns imposed across various regions resulted in a delay in new construction projects and led to sluggish industry growth.

Despite the pandemic's huge reduction in home sales, real estate activity began to rebound, returning to pre-pandemic levels. Potential buyers began to ramp up their search for and purchase of homes, boosting the growth of the real estate market. According to the National Association of Realtors, pending sales in U.S. metro areas, which were down more than 30% in April 2020, were up almost 30% by August 2020.

Moreover, the influence of the internet has increased awareness among consumers regarding online real estate services. Key players are offering various services such as live-streaming rooms, to gain market share. For instance, according to Alibaba, more than 5,000 real estate agents from almost 100 locations in China have adopted the live-streaming rooms method, allowing homebuyers to explore homes, and make deals all at home.

Furthermore, various initiatives taken by the government of various countries are likely to favor the growth of the market. The Government of India, in collaboration with the governments of several states, has taken several steps to promote development in the sector. Real estate has the opportunity with the Smart City Project, which aims to develop 100 smart cities.

In October 2021, The Reserve Bank of India (RBI) stated that the benchmark interest rate would remain at 4%, providing a substantial boost to the country's real estate sector. Low house loan interest rates are predicted to fuel housing demand and boost sales by 35-40% during the holiday season of 2021. These initiatives will positively impact the growth of the market.

Property Insights

Residential property dominated the market with a revenue share of 35.5% in 2021. The growth is majorly driven by the millennials as they are more inclined toward homeownership in recent years. For instance, according to Apartment List’s Homeownership report, the homeownership rate among millennials has increased to 47.9% in 2021 from 40% in 2020.

Commercial property is projected to register a CAGR of 5.1% from 2022 to 2030. The market is booming at an exceptional pace as a result of the growth of the tourism sector. Moreover, the growing number of hotels and resorts is expected to drive the demand for bathroom furniture. According to TOPHOTELPROJECTS GmbH, in 2020, Citadines Apart’ Hotels was the most active hotel brand in Thailand with five projects consisting of 945 rooms.

Type Insights

In terms of revenue, the rental type dominated the market with a share of 52.1% in 2021. This is attributable to rising home prices in developed countries, owing to which there is a rise in the number of renters, favoring the segment growth. For instance, according to a blog published by Mansion Global, Germany is the country of renters with about 60% of the properties being rented in 2021.

Sales type is estimated to expand at a CAGR of 6.1% over the forecast period. The COVID-19 pandemic has changed consumer perception towards owning a property, as result, there has been a rise in demand for luxury homes, villas, and second homes. For instance, according to a blog published by Construction Week Online, between January and September 2021, around 1,63,000 units of new residential supply were added from the top 7 cities across India.

Regional Insights

Asia Pacific dominated the market with a share of 52.6% in 2021. The growth is majorly attributed to the rising homeownership rates in the region. China is estimated to be the leader in the region accounting for over 64.8% of the share. The rising number of tourists in developing countries such as India, Philippines, Indonesia, Thailand, and Vietnam is further estimated to support the market growth in the region.

Middle East & Africa is expected to witness a CAGR of 6.3% from 2022 to 2030. The growth is majorly attributed to the rising number of residential and commercial projects in the country. For instance, according to the Middle East Construction Pipeline Trend Report in the third quarter of 2021, the hotel projects stand at 545 projects with 168,042 rooms. Moreover, in July 2021, Durrat Marina signed an agreement with Tamcoon for the development of 18 residential villas in Bahrain.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of real estate. Players in the market are diversifying the service offering to maintain their market share.

-

For instance, in December 2021, Coldwell Banker launched the “Franchise and Capitalize” program, which aims to support the development of the real estate sector in Egypt In September 2021, Simon Property Group launched a brand campaign named “more choices” in Simon mall. The campaign showcases the diversity of offerings by the brand, likely favoring the attract consumers

Some prominent players in the global real estate market include:

-

Brookfield Asset Management Inc.

-

ATC IP LLC.

-

Prologis, Inc.

-

SIMON PROPERTY GROUP, L.P.

-

Coldwell Banker

-

RE/MAX, LLC.

-

Keller Williams Realty, Inc.

-

CBRE Group, Inc.

-

Sotheby’s International Realty Affiliates LLC.

-

Colliers

Real Estate Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.81 trillion

Revenue forecast in 2030

USD 5.85 trillion

Growth rate

CAGR of 5.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Property, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India

Key companies profiled

Brookfield Asset Management Inc.; ATC IP LLC; Prologis, Inc.; SIMON PROPERTY GROUP, L.P.; Coldwell Banker; RE/MAX, LLC.; Keller Williams Realty, Inc.; CBRE Group, Inc.; Sotheby’s International Realty Affiliates LLC.; Colliers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global real estate market report based on property, type, and region:

-

Property Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Land

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Sales

-

Rental

-

Lease

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. Asia Pacific region dominated the real estate market with a share of 52.64% in 2021. This is attributable to the presence of a large population in Asian countries, coupled with rapid economic growth.

b. Some key players operating in the real estate market include Brookfield Asset Management Inc., ATC IP LLC, Prologis, Inc., SIMON PROPERTY GROUP, L.P., Coldwell Banker, RE/MAX, LLC., Keller Williams Realty, Inc., CBRE Group, Inc., Sotheby’s International Realty Affiliates LLC., Colliers.

b. Key factors that are driving the real estate market growth include increasing population and demand for personal household space, high potential for investor returns, and high demand for both personal and commercial real estate spaces.

b. The real estate market size was estimated at USD 3.69 trillion in 2021 and is expected to reach USD 3.81 trillion in 2022.

b. The real estate market is expected to grow at a compound annual growth rate of 5.2% from 2022 to 2030 to reach USD 5.85 trillion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."