- Home

- »

- Agrochemicals & Fertilizers

- »

-

Slow & Controlled Release Pesticides Market Size Report, 2018-2025GVR Report cover

![Slow And Controlled Release Pesticides Market Size, Share & Trends Report]()

Slow And Controlled Release Pesticides Market Size, Share & Trends Analysis Report By Pesticides-type (Herbicides, Fungicides, Insecticides), By Application (Agriculture), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-532-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Industry Insights

The global slow and controlled release pesticides market size was USD 1.7 billion in 2016 and is anticipated to grow at a CAGR of 7.3% from 2017 to 2025. The limited arable land area and rising demand for food by growing population are expected to drive the segment growth in the forecast period.

The slow and controlled release formulation of pesticides consists of retarding biological agents that release their constituents into the surroundings over a defined period. These agents are bound chemically and physically in a polymer mix by using various techniques. The different systems to incorporate this formulation includes migration control by membranes, migration control without membranes, laminate system, monolithic systems.

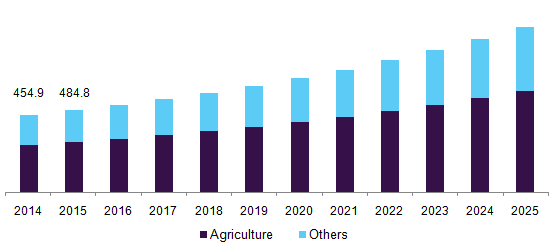

U.S. slow and controlled release pesticides market by application, 2014 - 2025 (USD Million)

The market vendors are working in an integrated manufacturing environment. Most of the manufacturers are also suppliers as these manufacturers require only hydrocarbon-based raw materials such as ethane, propane, and so on. The remaining manufacturing technology used by the vendors is mostly proprietary. Thus, the industry is working in a forward integrated environment.

The change in the dietary habits among the people of the U.S. is driving demand for corn-derived sweeteners which has significantly increased the demand for corn. Thus, to meet the growing demand for corn-based sweeteners the slow and controlled release pesticides industry is expected to rise in the country.

The United States Environmental Protection Agency has established the pesticide tolerance limit for the crops traded in the country. It has set these norms for each crop using deducing risk assessment analysis. The U.S. Food and Drug Administration (FDA) and the Department of Agriculture (USDA) is responsible for enforcing these norms. The USDA is responsible for enforcing tolerance limits for poultry, egg, and meat products whereas FDA enforces the rules for other foods such as vegetables, fruits, and so on.

The market in the U.S. is likely to be driven by the strong growth in the agriculture sector of the country. Increased emphasis on biotech plants or crops is likely to drive the demand for the product in the predicted timeline. Companies manufacturing slow and controlled release formulation are developing technologies to enhance efficiency and reduce the overall pricing of the product. However, recent mergers of the key players in the industry are leading the market towards consolidation. The segment is likely to experience an oligopoly trade policy where the top five companies will control the pricing in the coming years. The key ten vendors almost constitute nearly 90% of the global agrochemical market.

The top five key players are entering a strategic merger which is likely to intensify the competitive scenario of the agrochemical industry. Slow and controlled release pesticides are part of the global agrochemical industry. Any change in the agrochemical industry will affect the market dynamics of the industry.

Pesticides-type Insights

The herbicides segment is likely to be the most dominating pesticides-type from 2016 to 2025. The herbicides are expected to grow from 39.6% in 2016 to 40.2% by 2025. The growth is primarily supported by the demand from the agriculture industry. The herbicides segment is likely to be driven by its increasing usage in the developing nations. The growth in population coupled with rising awareness for a healthy diet is anticipated to be among the major drivers for advancing herbicides segment.

The fungicides are expected to observe strong demand from the European region. France and Italy constitute the major usage of fungicides in the European region due to the limited arable land area and rising migration in the country. However, the government of France has deduced a plan to cut its pesticide consumption by half by 2025. Still, the segment is expected to grow at a CAGR of 6.7% from 2017 to 2025.

The fungicides are projected to observe steady demand from developing economies such as India, South Africa, Brazil, Argentina, and so on. These developing countries have the agricultural sector as one of the major contributors to their GDP. The emphasis on increasing agricultural yield in these countries is likely to act as a catalyst for the growth of the fungicides segment during the forecast period.

The demand for insecticides is expected to accelerate in the projected timeline due to the rising threat of parasites. The change in the global climate has triggered the growth in numbers of pests. The rising global average temperature has caused frost-sensitive insects to outlast winters and breed again in the summers. This has instigated the growth of moths, insects, beetles, aphids, and other types of bugs. Thus, the rising growth of pests and insects is likely to drive the demand for the pesticide sector and it is expected to grow at a CAGR of 7.5% from 2017 to 2025.

The maximum growth for the insecticides segment is anticipated to be from the Asia-Pacific region. The growth is supported by the technological advances implemented by developing countries of the region such as India, China, and so on. These countries practice agrarian culture due to their large population. The booming population coupled with rising urbanization and increasing purchasing power of the middle-class is likely to drive the demand for agricultural commodities. The growth in the demand for agricultural commodities is likely to act as a key driver for the growth of the insecticides segment in the region.

Application Insights

The slow and controlled release pesticides market by application is segmented into agriculture and other sectors. The agriculture sector is anticipated to dominate the industry with the primary share of 61.8% in 2016 and is expected to increase its share to 62.7% by 2025. Furthermore, the growing population coupled with swiftly rising urbanization is likely to strain the food resources. To counter this challenge, crop yield is likely to be increased with the use of biotech crops and growth enabling chemicals.

The global agricultural output is largely dependent on six countries which include China, India, Brazil, Nigeria, the U.S., and Indonesia. Brazil has significantly grown its agricultural output by becoming the leading exporter of corn, sugar, meat, soybeans, and coffee. The country’s government has reformed its agricultural policies and enabled the use of modern technology to increase agricultural output and also by investing in the expansion of the harvested area. Thus, change in government policies supporting agricultural growth is likely to drive the segment growth.

Similarly, the agriculture sector of India is likely to play an important role in the development of the industry. Indian agriculture has added the advantage of diverse topography, a variety of soil types, and climate which provides farmers to engage in agricultural activities throughout the year. The growing agriculture sector in India is likely to offer potential demand for the development of industry during the projected timeline.

The others segment included in the segmentation includes residential, commercial, and household application of slow and controlled release formulation. The segment is expected to decline by 38.2% in 2016 to 37.3% in 2025. Although, it is anticipated to grow at a stable pace, owing to the increasing population of pests in residential, commercial, and household properties. This growth has further accelerated with the change in climatic conditions.

Regional Insights

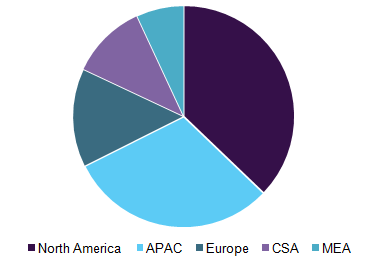

The North America region is likely to dominate the market for slow and controlled released pesticides from 2017 to 2025. High agricultural productivity output is likely to create a constant demand for the slow and controlled release formulation. The North America region is anticipated to be followed by APAC, Europe, CSA, and MEA. However, the strongest growth concerning CAGR is likely to be recorded in the APAC and CSA region respectively.

Global slow and controlled release pesticides market share, by region, 2016(%)

The growth is likely to occur in developing economies such as Mexico, India, South Africa. For instance, Mexico has signed multiple trades and sanitary agreements with the U.S. to provide avocados, berries, tomatoes. Furthermore, Mexico also signed the pact with China to provide tobacco, berries, dairy, and other products. The stable demand is expected to create strain to increase agricultural output. Thus, developing nations are anticipated to play a primary role in the development of this industry.

Slow and Controlled Release Pesticides Market Share Insight

The market is moving towards consolidation. Major players are implementing a growth-through-acquisition strategy to increase their presence. The key players of the industry compete at a global level to increase their industry presence. The merger of top players in the industry is likely to result in an oligopoly trade practice in the coming years.

The sector is observing a rise in strategic mergers among key industry players. For instance, the key mergers of slow and controlled release pesticides industry include the merger of Dow and DuPont, Bayer and Monsanto, and Syngenta and ChemChina.

Key players include ADAMA Agricultural Solutions Ltd., Arysta LifeScience Corporation, BASF SE, Bayer AG, The Dow Chemical Company, DuPont, Monsanto Company, Sumitomo Chemical Co. Ltd., and Syngenta.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historic data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Revenue in USD Million & CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America & Middle East & Africa

Country scope

U.S., Canada, Mexico, Russia, Germany, France, Japan, China, India, Australia, Brazil, Argentina, and South Africa

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2014 to 2025. For the purpose of this report, Grand View Research has segmented the global slow and controlled release pesticides market on the basis pesticides-type, application, and region:

-

Pesticides-type Outlook (Revenue, USD Million, 2014 - 2025)

-

Herbicides

-

Fungicides

-

Insecticides

-

Others

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

France

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

The Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."