- Home

- »

- Plastics, Polymers & Resins

- »

-

Global Structural Adhesive Market Size & Share Report, 2030GVR Report cover

![Structural Adhesive Market Size, Share & Trends Report]()

Structural Adhesive Market Size, Share & Trends Analysis Report By Product (Urethane, Epoxy, Acrylic), By Technology (Water-based, Solvent-based), By Application (Transportation, Construction), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-467-3

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

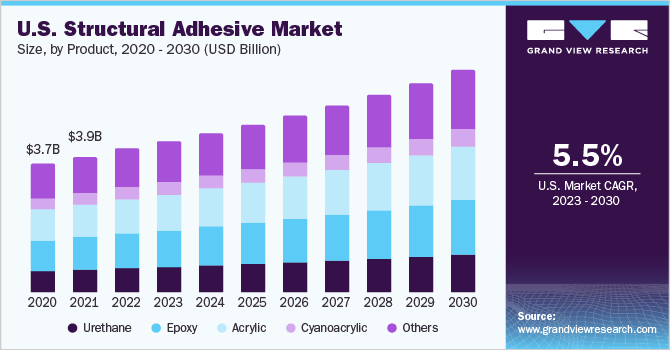

The global structural adhesive market size was valued at USD 20.19 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The growth is attributable to the high demand for structural adhesives from the construction application, owing to the rising construction activities across the globe. Rapid industrialization and growth of construction and automotive industries in emerging economies such as India and China are anticipated to drive the demand for structural adhesives in the coming years. Increasing R&D initiatives and a growing preference for innovative products with high bond strength, lesser curing time, and lower toxic emissions are likely to contribute to the growth of water-based adhesives demand across the globe.

Adhesive manufacturers offer more than 250,000 unique products for diverse applications. Increasing demand for low-carbon emitting and lightweight vehicles across the globe is likely to fuel the demand for adhesives in transportation applications. Additionally, increasing focus on energy efficiency, retention, and sustainable energy generation in building & construction due to the growing demand for eco-friendly materials is expected to fuel product demand in the coming years.

Structural adhesives play an important role in determining the overall vehicular weight in automotive applications, leading to the reduction of carbon emissions by increasing fuel efficiency. Most mechanical fasteners and welds are increasingly being replaced by structural adhesives owing to their durability and ability to bond dissimilar substrates such as metal, wood, and plastics. Such adhesives are widely utilized in the automotive and aerospace industries, where cost and processing time are of crucial importance when selecting raw materials for production. In the automotive industry, most design decisions are driven by the total cost and durability of materials and processing operations. Increasing demand for lightweight composites and automotive components is expected to boost the growth of the market in the coming years.

The development of light commercial vehicles, innovative passenger cars, and new aircraft with high penetration of composite materials is anticipated to drive the structural adhesives industry. Automotive and aerospace are expected to remain the largest application markets for adhesives in composites over the forecast period. Other applications that require lightweight materials with high-performance benefits are also expected to drive the market. The demand for structural adhesives and composites is rising despite high competition from substitute materials, mainly in applications requiring fuel economy, high performance, weight savings, and other benefits.

The global structural adhesives industry was negatively impacted in the short term due to COVID-19, owing to its wide application in the automotive, industrial, and construction sectors. According to the National Centre of Information report published in April 2020, the automotive industry declined by almost 30% in March 2020, as compared to March 2019. The decline was witnessed due to the shutting down of automotive companies and factories.

Product Insights

The epoxy product segment dominated the market with the highest revenue share of 23.7% in 2022. Its high share is driven by the growing use of epoxy in end-use industries as a bonding agent. Epoxy structural adhesive provides strong bonding and is most versatile for many substrates. It ensures high strength toward permanent bonding applications. Epoxy is mostly used for aerospace, automotive, and industrial applications. They are vibration resistance bonds, which makes them the best glue for aluminum when utilized as an automotive structure and panel adhesive.

Urethane adhesives also present a decent growth promise owing to their application in the plastic & rubber industry. Urethanes are of two types, namely one-part and two-part urethane. Two-part urethane structural adhesives react when mixed and do not require moisture to cure. Two-part urethane adhesives offer vibration resistance and excellent impact in bonding when cured, as it is relatively flexible. Urethanes are used to bond wood, concrete, plastic, and rubber.

Cyanoacrylics are one-part products that cure very rapidly by reacting with moisture. This reaction is so quick that it requires very little clamping time. Cyanoacrylics are developed for high-strength requirements such as tight-fitting joints, small bond areas, and rapid curing applications.

Technology Insights

The water-based technology segment dominated the market with the highest revenue share of 46.6% in 2022. Its high share is driven by its growing application in providing high heat resistance. Water-based structural adhesives are in liquid form, but they become solid as the water evaporates. These adhesives are generally developed using a combination of additives, water, and polymers. Water-based adhesives offer high heat resistance. They are known for their compatibility with recyclable substrates. These adhesives have low volatile organic compound (VOC) content and are versatile and easy to clean with no odor. They can be applied on stainless steel rollers or nozzles.

Solvent-based structural adhesives are utilized in taping, medical, and packaging applications. They are the most commonly used adhesives owing to their high resistance to the impacts of the environment and their compatibility to be used with different types of substrates. Solvent-based adhesives are available in liquid form. These adhesives can be applied to both porous and non-porous surfaces, as they provide secure adhesion after the liquid evaporates while the bonding agent remains. As solvent-based adhesives are easier to apply than water-based adhesives, they are utilized in graphics and food packaging applications.

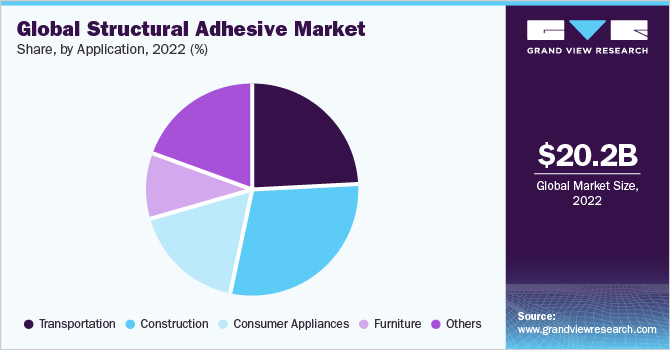

Application Insights

The construction application segment dominated the market with the highest revenue share of 29.3% in 2022. Its high share is driven by the growing construction activities owing to the rapid increase in urbanization and industrial development globally. The construction industry widely utilizes structural adhesives for joining dissimilar materials such as metal, concrete, and timber. These adhesives are also used for bonding concrete to concrete, concrete to ceramic tiles, outside doors, construction panels, metal parts, and structural glass. The commonly used adhesives in the construction industry include acrylic adhesives, resin adhesives, anaerobic adhesives, and hot-melt adhesives.

Apart from construction, structural adhesives are also used in the transportation and vehicle sector as they help in making vehicles light in weight, increase durability, and make the vehicle production process faster. Commonly used adhesives for transportation vehicles include methyl methacrylate (MMA) and modified silane polymer (SMP). Structural adhesives can be utilized to assemble or seal the body of transport vehicles. In addition, they protect vehicles against water infiltration by bonding the roof of the vehicles.

The furniture industry excessively utilizes structural adhesives for creating a bond between foams, plastics, metal, and fabrics. In soft furniture, adhesives keep the foam of the furniture in place. It is vital during application that the furniture glues stay on the surface, permitting strong bindings with other materials without changing the qualities of the substrates, rather than allowing them to permeate the pores of the substrate.

Structural adhesives are widely preferred in furniture applications owing to resistance to dimensional changes in wood, strong bonding capability, and moisture resistance. Widespread availability coupled with the aesthetic appeal of wood is expected to fuel furniture demand globally.

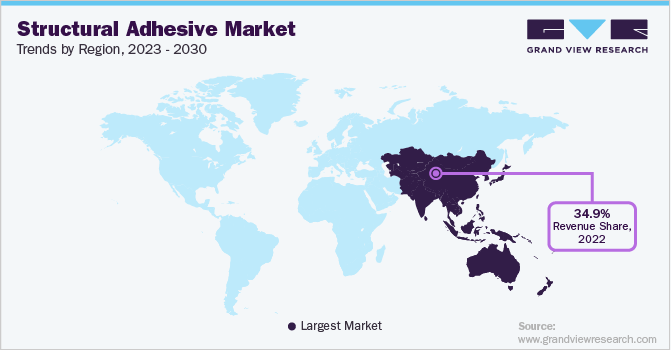

Regional Insights

Asia Pacific dominated the structural adhesives industry with the highest revenue share of 34.9% in 2022. The high demand in the Asia Pacific region is driven by the growing construction industry in countries like China, India, and Japan. According to the International Trade Administration, China has the highest urbanization rate in the world, and as the country develops as a greener economy, there will be increased opportunities for low-carbon construction such as green buildings. This is predicted to boost the growth of the construction sector in the country, thereby leading to the growth of the structural adhesives industry over the predicted years.

Europe is likely to offer lucrative growth opportunities for structural adhesives industry players on the account of escalating construction activities around the region, owing to the rapidly growing industrial sector coupled with a high urbanization rate. In addition, the growing transportation sector is also expected to augment the demand for structural adhesives in Europe. Factors such as congested roads and increasing volume of traffic are likely to boost the growth of the transportation industry in the region, thereby positively impacting the market in the near future.

Key Companies & Market Share Insights

The global structural adhesives industry is highly competitive on the account of the presence of multinationals like Henkel AG & Co. KGaA, 3M, HB Fuller Company, and others. These companies are heavily involved in carrying out rapid research & development activities for new product development. Growing demand for structural adhesives has also inspired new and emerging players to develop in the market. Some prominent players in the global structural adhesive market include:

-

Henkel AG & Co. KGaA

-

Dow

-

3M

-

HB Fuller Company

-

Franklin International, Inc.

-

Avery Dennison Corporation

-

Ashland Global Specialty Chemicals Inc.

-

Lord Corporation

-

Arkema S.A.

-

Scott Bader Co.

Structural Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.28 billion

Revenue forecast in 2030

USD 31.87 billion

Growth Rate

CAGR of 5.9 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Henkel AG & Co. KGaA; Dow; 3M; HB Fuller Company; Franklin International, Inc.; Avery Dennison Corporation; Ashland Global Specialty Chemicals Inc.; Lord Corporation; Arkema S.A.; Scott Bader Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structural Adhesive Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global structural adhesive market report based on product, technology, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Urethane

-

Epoxy

-

Acrylic

-

Cyanoacrylic

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Solvent-based

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Construction

-

Consumer Appliances

-

Furniture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global structural adhesive market size was estimated at USD 20.19 billion in 2022 and is expected to reach USD 21.28 billion in 2023

b. The global structural adhesive market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 31.87 billion by 2030.

b. Water based technology dominated the structural adhesive market with a share of 46.6% in 2022. This is attributable to environment-friendly and economically viable products that have wide bonding application in leather, wood, paper, and textiles.

b. Some key players operating in the structural adhesive market include The Dow Chemical Company, 3M Company, Sika AG, Henkel AG & Co., Lord Corporation, Ashland Inc., Scott Bade Company, and Ried BV.

b. Key factors that are driving the structural adhesive market growth include growing demand from end-use industries including construction, transportation, and furniture, and increasing composites utilization.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."