- Home

- »

- Clothing, Footwear & Accessories

- »

-

Stuffed Animals And Plush Toys Market Size Report, 2030GVR Report cover

![Stuffed Animals And Plush Toys Market Size, Share & Trends Report]()

Stuffed Animals And Plush Toys Market Size, Share & Trends Analysis Report By Product (Stuffed Animals, Cartoon Toys, Action Figures), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-568-7

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The global stuffed animals and plush toys market size was estimated at USD 11.76 billion in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030. Limited edition or specialty stuffed animals, often tied to specific events, holidays, or characters, attract collectors and enthusiasts, contributing to market growth. This broad product appeal across different demographics ensures a diverse consumer base, sustaining demand and fostering a resilient market environment. As the global audience for animated shows and movies continues to grow, the demand for corresponding merchandise, including stuffed animals based on cartoon characters, experiences a parallel increase.

The trend of collectibles within the toy industry influences the cartoon toys segment. Many cartoons feature characters that become iconic and collectible for fans. Toy manufacturers capitalize on this trend by producing limited-edition or collectible cartoon toys. The allure of exclusivity and the desire to build a collection contribute to heightened demand, particularly among avid fans and collectors, thereby driving the segment's growth.

Licensing agreements play a pivotal role in the dynamic landscape of the stuffed animals and plush toys market. Taking license agreements enables companies to elevate their products and offerings by optimizing product range and expanding product segments to meet demand. This strategic approach ensures operational efficiency and facilitates swift, comprehensive, and reliable delivery services, meeting the evolving expectations of the market.

Gifting stuffed animals and toys to children has become a cherished and popular option. Beyond their physical appeal, these items hold significant emotional value, providing children with a sense of companionship. Stuffed animals serve as comfort objects, offering security during times of stress and anxiety. These toys also play a crucial role in nurturing children's imagination and creativity, acting as tools for storytelling and imaginative play. The developmental benefits extend to cognitive, social, and emotional skills, laying the foundation for future learning and growth.

Moreover, innovation in the industry is evident through interactive and smart plush toys that incorporate technology such as sensors, lights, sounds, and connectivity to mobile apps, creating a more immersive play experience. Customization options allow children to personalize their stuffed animals, while limited edition and exclusive releases add an element of excitement and collectability.

Additionally, companies have implemented various business strategies, including mergers and acquisitions, as well as partnerships. These initiatives are expected to contribute positively to the growth of the stuffed and plush toys market in the coming years. For example, Reliance Retail's acquisition of the prominent toy store, Hamleys, aims to broaden its geographic presence and enhance market expansion efforts.

In January 2022, Hasbro extended its contract with Lucasfilm for launching toys of Star Wars characters and signed a new agreement to advance products created on the Indiana Jones movies. Hasbro claimed to continue to produce toys designed to offer to supporters of all ages.

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. The market for stuffed animals and plush toys is fragmented, with the key players focusing on innovation and business expansion.

The degree of innovation in the stuffed animals and plush toys market is significant, with ongoing advancements in design, technology integration, and the introduction of unique features. Companies are continually exploring creative concepts, personalized options, and sustainable materials to meet the evolving preferences of consumers, making innovation a key driver in this industry.

The level of mergers and acquisitions (M&A) activities in the smart toys industry is currently moderate. As the technology matures and market demand grows, companies are increasingly exploring strategic partnerships, acquisitions, and collaborations to enhance their capabilities, expand their product offerings, and gain a competitive edge.

Product Insights

The stuffed animal toys market segment accounted for a revenue share of 40.6% in 2023. Limited edition or specialty stuffed animals, often tied to specific events, holidays, or characters, attract collectors and enthusiasts, contributing to market dynamics. This broad appeal across different demographics ensures a diverse consumer base, sustaining demand and fostering a resilient market environment.

The cartoon toys market segment is expected to grow at a CAGR of 9.8% from 2024 to 2030. The rise of niche and fandom markets is driving the adoption of cartoon toys. As entertainment franchises expand to cater to diverse interests and genres, niche markets emerge within the broader fandom. Cartoon figures catering to specific fandoms, including those related to science fiction, fantasy, and cult classics, witness increased demand. Manufacturers tap into these niche markets by producing specialized action figures, creating a diverse and dynamic market landscape.

Distribution Channel Insights

Sales of stuffed animals & plush toys through offline channels accounted for a share of 84.2% of the global revenues in 2023. Social interaction and in-store events contribute significantly to the growth of the offline segment. Offline retail channels, including specialty toy stores, department stores, and other brick-and-mortar outlets, often engage in promotional activities and events. These efforts contribute to creating a vibrant and dynamic shopping environment. In-store promotions, themed displays, and interactive events centered on stuffed animals and plush toys enhance the shopping experience.

In July 2022, Macy's extended its collaboration with WHP Global to introduce Toys 'R' Us store-in-store sections in all U.S. stores during the 2022 holiday season. Each Toys 'R' Us location featured vibrant displays and interactive demonstration tables showcasing a variety of toy collections. Across all Macy's stores, customers enjoyed nine days of in-store events featuring family-friendly activities and daily giveaways from popular brands such as Barbie and LEGO.

Online sales of stuffed animals & plush toys is anticipated to grow at a CAGR of 11.2% from 2024 to 2030. The convenience and accessibility offered by online platforms have revolutionized the way consumers purchase stuffed animals and plush toys. E-commerce channels provide numerous options, enabling shoppers to explore a diverse range of products, compare prices, and read reviews-all from the comfort of their homes. This convenience factor contributes significantly to the surge in online sales within the stuffed animals and plush toys market.

Mobile commerce (M-Commerce) and app-based shopping are driving the growth of the online segment. With the widespread use of smartphones and mobile devices, consumers can easily access online platforms through dedicated apps. M-Commerce offers a user-friendly and streamlined shopping experience, allowing users to browse, purchase, and track orders seamlessly. The convenience of shopping on the go contributes to the increasing dominance of the online segment, particularly among tech-savvy and mobile-oriented consumers.

Regional Insights

The North America stuffed animals and plush toys market accounted for a global revenue share of 38.0% in 2023. Licensing and brand collaborations drive regional market growth. Collaborations with popular entertainment franchises, movies, and characters result in the creation of themed and licensed stuffed animals. The appeal of these products is heightened by consumers' emotional connection with the characters, contributing to increased sales. Strategic partnerships between toy manufacturers and entertainment companies foster a continuous stream of licensed merchandise, attracting consumers of all age groups.

U.S. Stuffed Animals And Plush Toys Market Trends

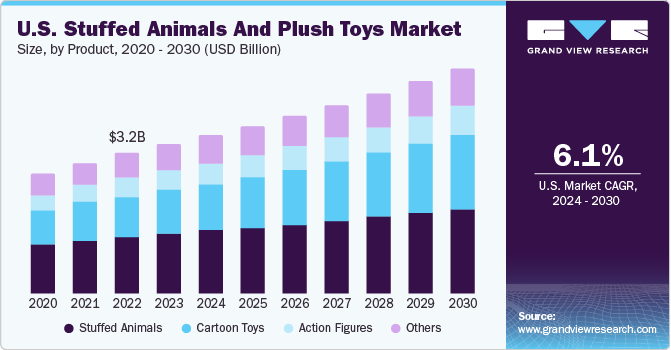

The stuffed animals and plush toys market in the U.S. is expected to grow at a CAGR of 6.1% from 2024 to 2030. The direct-to-consumer (DTC) model and e-commerce boom influence the U.S. plush toy market. The rise of online shopping and the direct-to-consumer model allows manufacturers to reach a broader audience without relying solely on traditional retail channels. This shift in distribution strategies enables brands to connect directly with consumers, offering a seamless shopping experience and contributing to market expansion.

Asia Pacific Stuffed Animals And Plush Toys Market Trends

The stuffed animals and plush toys market in Asia Pacific is expected to grow at a CAGR of 9.6% from 2024 to 2030. The popularity of collectibles and toys featuring beloved characters from animated series, movies, and manga significantly drives demand. Kids in the Asia Pacific region often have a strong connection to characters from regional and international entertainment, and plush toys allow them to bring these characters into their daily lives.

Europe Stuffed Animals And Plush Toys Market Trends

The stuffed animals and plush toys market in Europe is expected to grow at a CAGR of 8.8% from 2024 to 2030.The rising demand in the region is influenced by the convenience they offer parents to monitor and manage their children's playtime. Many stuffed animals & plush toys come with companion apps that allow parents to track their child's progress, set usage limits, and even receive insights into the educational benefits of these toys. The integration of such monitoring features addresses parental concerns about screen time. It ensures a balance between technology-based play and other developmental activities, driving the adoption of stuffed animals & plush toys for modern parents.

Key Stuffed Animals And Plush Toys Company Insights

Bandai Namco Holdings Inc.; LEGO System A/S; Mattel; and Hasbro are some of the dominant players operating in the stuffed animal and plush toys market.

-

Mattel engages consumers through its iconic products and brand range, such as Hot Wheels, Barbie, American Girl, Fisher-Price Thomas & Friends, Monster High, MEGA, Masters of the Universe, and UNO. In addition, Mattel’s offerings incorporate gaming and digital experiences, film and television content, live events, and music.

-

LEGO System A/S, a subsidiary of Kirkbi A/S, designs, manufactures, and promotes an inclusive range of games and toys. Lego’s products focus on the theory of development and learning through play.

Simba Dickie Group; Budsies PR LLC; and Ty Inc. are some of the emerging market players.

-

Simba Dickie Group produces a wide range of toys, including dolls, action figures, playsets, games, and puzzles. The company's brands include Simba, Dickie Toys, Eichhorn, Noris Spiele, and Schuco.

-

Budsies PR LLC is a custom plush toy company that creates custom plush toys from consumers' photos or drawings.

Key Stuffed Animals And Plush Toys Companies:

The following are the leading companies in the stuffed animals and plush toys market. These companies collectively hold the largest market share and dictate industry trends.

- Mattel

- Bandai Namco Holdings Inc.

- LEGO System A/S

- Hasbro

- Simba Dickie Group

- Spin Master

- Budsies PR LLC

- Mary Meyer Corporation

- Ty

- Build-A-Bear Workshop, Inc.

Recent Developments

-

In January 2024, the accumulation of Melissa & Doug's premium, flexible, innovative, and growing toys positions both Melissa & Doug and Spin Master to promote evolution in the toy industry throughout modern and active channels and in markets worldwide.

-

In August 2023, Ty, Inc. launched Aloha, a special edition gold beanie baby teddy bear. The company launched this product to provide relief for people who have suffered in the Maui wildfire incident. All profits from the sales of the Aloha bear will be contributed by Ty Inc. to the American Red Cross, aiming to aid those impacted by the Hawaii wildfires.

-

In January 2023, Mattel, Inc.expanded its plant, focusing on upsurging production capability, advancing manufacturing, and controlling technological competencies while reducing price and optimizing operational efficiencies. The plant expansion is expected to support product growth, with an anticipated rise of over 15% in production volume by 2025.

-

In March 2023, Spin Master Corp. partnered with Lucasfilm to launch Star Wars Galactic Pals, animated shorts & plush toys. The launch aims to deliver the importance of sustaining bedtime habits and deep breathing practices for kids.

Stuffed Animals And Plush Toys Market Report Scope

Report Attribute

Details

Market size in 2024

USD 12.68 billion

Revenue forecast in 2030

USD 20.29 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Mattel; Bandai Namco Holdings Inc.; LEGO System A/S; Hasbro; Simba Dickie Group; Spin Master; Budsies PR LLC; Mary Meyer Corporation; Ty; Build-A-Bear Workshop, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stuffed Animals And Plush Toys Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global stuffed animals and plush toys market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Stuffed Animals

-

Cartoon Toys

-

Action Figures

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stuffed animals and plush toys market size was estimated at USD 11.76 billion in 2023 and is expected to reach USD 12.68 billion in 2024.

b. The global stuffed animals and plush toys market is expected to grow at a compounded growth rate of 8.2% from 2024 to 2030 to reach USD 20.29 billion by 2030.

b. Stuffed animals toys market accounted for a share of 40.6% of the global revenues in 2023. Educational and developmental benefits associated with certain stuffed animals contribute to the segment's adoption. Stuffed animals designed with educational features, such as those incorporating interactive elements or teaching specific skills, appeal to parents who value toys that contribute to their children's learning experiences.

b. Some key players operating in the stuffed animal and plush toys market include Mattel, Inc.; Bandai Namco Group; LEGO A/S; Hasbro, Inc.; Simba Dickie Group; Spin Master Ltd.; Budsies, LLC; Giantmicrobes, Inc.; and Ty, Inc.

b. Key factors that are driving the market growth include the growing demand for limited-edition stuffed animal & plush toys and adoption of recycled fabrics in the production of stuffed animal & plush toys

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."