- Home

- »

- Agrochemicals & Fertilizers

- »

-

Global Sulfur Bentonite Market Size & Share Report, 2025GVR Report cover

![Sulfur Bentonite Market Size, Share & Trends Report]()

Sulfur Bentonite Market Size, Share & Trends Analysis Report By Application (Oilseeds, Cereals & Crops, Fruits & Vegetables), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-042-2

- Number of Report Pages: 78

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

Report Overview

The global sulfur bentonite market size was valued at USD 89.04 million in 2018 and is projected to expand at an estimated CAGR of 5.6% from 2019 to 2025. Growing production of oilseeds and increasing deficiency of sulfur in soil is expected to drive the demand.

The market is predominantly driven by rising demand for sulfur-rich fertilizers in crop cultivation. The product is a highly concentrated fertilizer and falls under elemental sulfur fertilizers which have 90 or more than 90% of micronutrient content. These fertilizers are used for the cultivation of oilseeds, cereals, fruits, and vegetables and have increased the production yield by almost 20% to 30% for major oilseeds. The oxidative property of sulfur bentonite controls the release of other nutrients, thus reducing nutrient losses from the soil without environmental risks. Other factors such as easy raw material availability, convenient trade opportunities, and product commercialization are further anticipated to positively influence the growth.

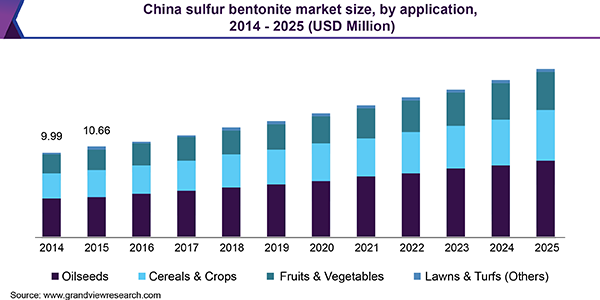

China is one of the prominent importers of sulfur in the world and accounts for one-third of the global trade and about a quarter of the global consumption. Every year, the country imports around 10 million to 12 million tons of the compound, in addition to the domestic production for consumption.

According to the U.S. Geological Survey, the country is also the largest producer of sulfur in the world with total production of 17.4 million tons in 2017. Yet, the country has a deficit of high sulfur based fertilizers, which has resulted in high sulfur deficiency in soil across the country.

Sulfur bentonite is applied to maintain the nutritional balance of soil and improve nutrient availability to the crops. Various parameters have to be taken into consideration for selecting the most efficient fertilizer, such as soil type, crop type, and nutritional requirement for better crop growth.

Reduction in the sulfur content of soil is caused by multiple reasons including bacterial change, soil runoff, poor water drainage, and pollution. In order to balance the soil content and optimize crop yield, the product is widely used for sulfur enrichment than others.

Application Insights

On the basis of application, the sulfur bentonite market is segmented into oilseeds, fruits and vegetables, cereals and crops and lawns and turfs (others). The use of fertilizers is essential for the cultivation of oilseeds as sulfur uptake by the plant is directly related to the oil content in oilseed crops. According to a recent study by research institutes, approximately 12 kg to 18 kg of sulfur is required to produce a ton of oilseeds.

The requirement of compound in cereals is very similar to phosphorus uptake. The protein cells of crops consist of sulfur-containing amino acids such as methionine, cystine, and cysteine. Functionally, the use of the product significantly influences crop yield, improves flavors and odor, and increases resistance to cold climate. Sulfur deficiency is generally observed during the early stages of the growth as it can easily leach from the soil surface. The change in protein composition results in young leaves becoming pale yellow and stems tend to remain shorter in size, ultimately affecting the quality and size of the seed.

The deficiency in fruits and vegetables results in spindly stems, yellowish veins, and poorly nourished flowers and fruits. In late winters, sulfate fertilizers are extremely essential for vegetables such as cabbage, broccoli, turnips and radish as these fertilizers provide weather resistance and are also useful in controlling certain plant diseases. In addition, sulfur plays an important role in lowering the pH of the soil, increasing plant root access to nutrients, and the formation of plant tissues.

Regional Insights

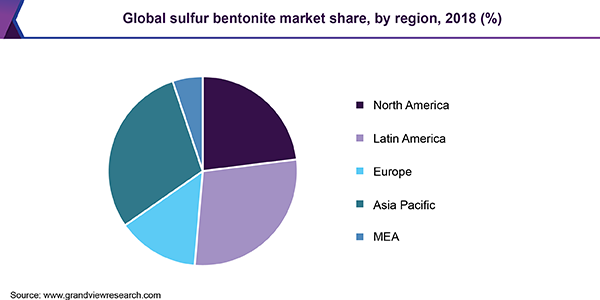

Asia Pacific held the dominant volume share of 31.9% in 2018. The region is expected to dominate the industry over the forecast period due to growing awareness of consumer towards sulfur based fertilizers. China and India dominate the regional consumption. These countries are characterized by the presence of global manufactures such as Coromandel International Limited, Deepak Fertilizers & Petrochemicals Corporation Limited, and National Fertilizers Limited. A significant share of the product is also being imported from North America and Middle East and Africa under brand name Omasulf, Tiger-sul, and Brimstone among others.

Latin America is the second largest market for sulfur bentonite and is majorly driven by the growing demand of various food crops and oil seeds. The region has inadequate cultivable land and rising micronutrients deficiency in soil to satisfy the food requirement and sustain its large population; hence farmers use variety of fertilizers to improve soil fertility. In Latin America, Brazil accounts for the highest sulfur bentonite consumption followed by Mexico, Argentina, and Colombia. Brazil and Argentina also represent noteworthy share in the global oilseeds production, thus representing major demand.

North America accounted for a revenue share of 23.1% in 2018 owing to the presence of large reserves of sulfur in the region. The U.S. produced 9.64 million metric tons of sulfur as well as 3.70 million metric tons of bentonite clay in 2017, accounting second in the list of global producers after China.

Rising oilseeds production such as soybean and rapeseed is expected to propel the consumption of product in the region. Furthermore, Middle East and Africa (MEA) is one of the leading sulfur-producing regions across the world. Increasing production of crops such as dates, watermelons, wheat, potatoes, and tomatoes drives the regional market. MEA also exports the product to the countries from Asia Pacific and Europe.

Key Companies & Market Share Insights

H Sulphur Corp., Tiger Sul, Devco Australia, Coromandel International, Coogee Chemicals, National Fertilizer Limited, and Deepak fertilizers are some of key players of the global market. The global market is significantly competitive with few major companies holding the majority share in the market.

Major players such as Tiger Sul, Devco Australia, and Coromandel International, among others are continuously investing in R&D to improve the product quality. These companies also have a strong foothold, better established and well recognized products and brands that makes it difficult for the new players to compete in the market.

Sulfur Bentonite Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 94.2 million

Revenue forecast in 2025

USD 130.6 million

Growth Rate

CAGR of 5.6% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, U.K., China, India, Japan, Brazil, Argentina

Key companies profiled

H Sulphur Corp., Tiger Sul, Devco Australia, Coromandel International, Coogee Chemicals, National Fertilizer Limited, and Deepak fertilizers.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at a global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global sulfur bentonite market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Oilseeds

-

Cereals and Crops

-

Fruits and Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global sulfur bentonite market size was estimated at USD 94.2 million in 2019 and is expected to reach USD 99.6 million in 2020.

b. The global sulfur bentonite market is expected to grow at a compound annual growth rate of 5.6% from 2019 to 2025 to reach USD 130.6 million by 2025.

b. Asia Pacific dominated the sulfur bentonite market with a share of 29.7% in 2019. This is attributable to growing awareness of consumer towards sulfur based fertilizers and presence of major fertilizer manufacturers including Coromandel International Limited, Deepak Fertilizers & Petrochemicals Corporation Limited, and National Fertilizers Limited.

b. Some key players operating in the sulfur bentonite market include H Sulphur Corp., Tiger Sul, Devco Australia, Coromandel International, Coogee Chemicals, National Fertilizer Limited, and Deepak fertilizers.

b. Key factors that are driving the market growth include growing production of oilseeds and rising awareness regarding definiency of sulfur in the soil.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."