- Home

- »

- Communications Infrastructure

- »

-

Telecom Millimeter Wave Technology Market Size Report, 2030GVR Report cover

![Telecom Millimeter Wave Technology Market Size, Share & Trends Report]()

Telecom Millimeter Wave Technology Market Size, Share & Trends Analysis Report By Frequency Band (V-Band, E-Band, Other Bands), By License, By Application (Military, Civil), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-227-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

The global telecom millimeter wave (mmWave) technology market size was valued at USD 2.28 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 31.2% from 2024 to 2030. The growth of this industry is primarily influenced by factors such as increasing demand for enhanced bandwidth applications, the growing transformation from 4G to 5G networks, which requires mmWave technology, and improvements accomplished through advancements such as better antenna designs and significantly upgraded signal processing capacities.

There is increasing demand for advanced mmWave technology in the military & defense industry for connectivity and radar applications owing to its ability to transmit signals with longer bandwidth, operate in complex surroundings, and transfer data at superior speed while maintaining lesser susceptibility to interceptions, disturbances, and jamming. This market is also influenced by the rising demand for high-speed internet networks for civil infrastructures.

The growing use of innovative technologies that require the availability and uninterrupted accessibility of high-performance telecom networks, such as mobile connectivity & broadband, connected cars, equipment & systems powered by the Internet of Things (IoT), is expected to influence the growth of this market. Devices, systems, and infrastructure that necessitate enhanced connectivity and low latency are increasing demand for mmWave technology. In 2023, the total number of internet users worldwide was 5.40 billion.

The emergence of 5G technology and the growing footprint of the 5G network has added to the growth opportunities. The 5G providers’ networks have expanded across the U.S. and cover as many as 330 million individuals now. As compared to 4G, the rollout of 5G technology and networks was 42% faster. The Digital compass, a policy program adopted by Europe, with a determined target of covering all the populated areas with 5G networks and connectivity by the year 2030, has also influenced the demand for this technology in the region.

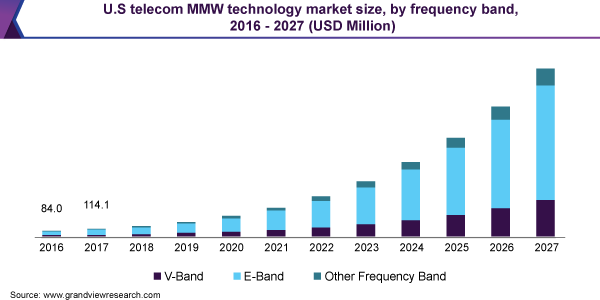

Frequency Band Insights

E-band segment dominated the global industry and accounted for a revenue share of 74.6% in 2023. E-band-based networks can function at 70 GHz to 90 GHz in the electromagnetic spectrum. Allocations comprising 70 GHz, 80 GHz, and 90 GHz, referred to as E-band, account for the largest spectrum for licensed commercial use by the U.S. Federal Communications Commission (FCC). The growing use of devices and systems, the emergence of smart cities, buildings, and automobiles, and increasing dependence on high-performance infrastructure are expected to fuel the growth of the E-band segment.

The v-band segment is anticipated to experience a significant CAGR during the forecast period. This is attributed to the history of extensive use of the V-band before the opening of the E-band for usage. This frequency band's high oxygen absorption capability ensures enhanced spatial re-use and insusceptibility from interferences during transmission. The covert nature of the band has also been useful for defense and security applications. V-band 60 GHz was used for the crosslink communication between military satellites. V-band is also preferred for dense link deployments in crowded cities without spending extra costs and resources on digging lines for fiber optics and cables while avoiding disruptions in infrastructural arrangements.

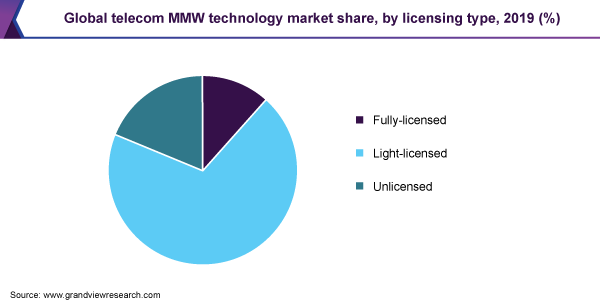

License Insights

The light-licensed segment held the largest revenue share of the global market in 2023. This license type has less restrictive restrictions than fully licensed or unlicensed bands. Light-licensed frequencies are preferred for their suitability for high bandwidth requirements and reduced regulatory stringency. They are highly utilized in mobile backhaul, telecommunications, and other areas.

The unlicensed segment is expected to grow at a significant CAGR from 2024 to 2030. The license-exempt frequency bands do not necessitate individual authorization. This absence of expensive licensing processes and scope for innovation has made the unlicensed segment attractive for enterprises and service providers. Cost-effectiveness, high-bandwidth applications, and accessibility are expected to fuel growth in this segment.

Application Insights

The civil application segment dominated the global industry in 2023. The mmWave technology is one of the essential elements for network expansions related to 5G technology, as it supports a massive number of devices and has a capacity for high-speed transmission with low latency or disruptions. The extensive use of mmWave in point-to-point communication links also influences the growth of this segment. Increasing usage in healthcare, industrial applications, and other industries supports the overall increase in demand for the technology.

Based on application, the military segment is expected to experience the fastest CAGR from 2024 to 2030. This is attributed to multiple factor such as growing demand for technology with high bandwidth, enhanced resistance to rain attenuation and reduced susceptibility to interceptions from military and defence industry. The security and communication requirements of military personnel and rising need for advanced equipment supported by network that can offer high-speed transmission and low latency are expected to develop growth for this segment during forecast period.

Regional Insights

North America dominated the global telecom millimeter wave technology market and accounted for a revenue share of 39.6% in 2023. Growth of this market is primarily influenced by the factors such as increasing implementation of 5G networks, increasing market penetration of smartphones and other technology backed devices that require high-speed network connections and low latency, and rising preference by organizations for cost effectiveness.

U.S. Telecom Millimeter Wave Technology Market Trends

The U.S. telecom millimeter wave technology market held the largest revenue share of regional industry in 2023. The U.S. telecom millimeter wave technology market held the largest revenue share of regional industry in 2023. This market is mainly driven by the expansion of 5G networks in the country, a large number of smartphone users in the U.S., high bandwidth requirements, increasing usage in military and defense, and ease of availability and accessibility associated with mmWave technology. In addition, the presence of key service providers such as AT&T, T-Mobile, Verizon, and others adds to the growth of this market.

Europe Telecom Millimeter Wave Technology Market Trends

Europe is identified as one of the lucrative regions for the global telecom millimeter wave technology market in 2023. Growth of this market is driven by the factor such as substantial increase in demand of high bandwidth application, unceasing growth in use of Wi-Fi-enabled devices, wearables and smart technology equipment, and continuous growth in expansion of 5G networks in the region. Collaboration and expanding networks of major market participants such as Ericsson, Telefónica, Qualcomm and others is expected to fuel growth for Europe telecom millimeter wave technology industry.

Germany telecom millimeter wave technology market held significant revenue share of the regional industry in 2030. This is mainly due to the growing availability of 5G technology and the growing industrial application of mmWave services. The high-speed internet requirements of multiple users, including individuals, businesses, and projects by governments, and others, also play a crucial role in the growth of this market. For instance, Germany has established a platform assisting this dialogue in its interest in developing smart cities through dialogue among multiple stakeholders, such as government, politicians, businesses, civil societies, science, and others. The National Smart Cities Dialogue Platform 3.0 involved nearly 70 experts from cities, municipalities, federal states, ministries, scientific organizations, and professional organizations. Such initiatives where technology and advancements in telecom millimeter wave technology play a vital role in the growth of this market.

Asia Pacific Telecom Millimeter Wave Technology Market Trends

Asia Pacific telecom millimeter wave technology market is expected to experience the fastest CAGR from 2024 to 2030. The growth of this regional industry is driven by factors such as the increasing use of smartphone technology and growing demand for high-performance, low-latency networks in countries such as India, unprecedented growth in the use of the internet in the region, and rising reach of 5G network capabilities in the Asia Pacific. For instance, 66.0% of the total population uses smartphones in Asia Pacific.

India telecom millimeter wave technology market is anticipated to experience significant growth during forecast period. This market is mainly driven by the country's growing telecom infrastructure, rising expansion of 5G technology networks, heavy investments by companies, and a supportive government approach. Continuous growth in internet usage and the number of smartphone users coupled with rising adoption of multiple consumer electronics devices that require high-speed network connections and low latency is projected to assist this market in growth.

Key Companies & Market Share Insights

Some of the key companies operating in the telecom millimeter wave technology market include AVIAT NETWORKS, Ceragon, QuinStar Technology, Inc., Smiths Group plc and others. The major market participants are adopting strategies such as innovation, extensive expansion of application areas, growing collaborations with other organizations and enhanced research & development effort.

-

AVIAT NETWORKS, one of the prominent companies in wireless transport solutions, offers a range of products, services, and customer support. Some of its products in the millimeter wave technology category include iPasolink EX/A 10 Gbps radio, WTM 4000 All-Outdoor, IP/SDN Radio, and others. Its portfolio entails radios, antennas, routers, hosted software, accessories, license keys, and kits.

-

QuinStar Technology, Inc., a major industry participant, designs and develops millimeter-wave (MMW) products. The company offers multiple products, including amplifiers, millimeter-wave sources, millimeter-wave antennas, and more. QuinStar also provides mass customization and rapid prototyping expertise.

Key Telecom Millimeter Wave Technology Companies:

The following are the leading companies in the telecom millimeter wave technology market. These companies collectively hold the largest market share and dictate industry trends.

- AVIAT NETWORKS

- Bridgewave Communications

- E-Band Communications, LLC

- Farran

- Keysight Technologies

- QuinStar Technology, Inc.

- Eravant

- Ceragon

- Smiths Group plc

- NEC Corporation

Recent Developments

-

In June 2024, NEC Corporation, an organization operating in business segments such as systems integration, maintenance, cloud services, software services, and system equipment, successfully demonstrated a newly developed compact millimeter-wave distributed antenna specially designed for beyond 5G/6G technology implementation. The innovation is expected to resolve issues related to a combination of cost-effective and stable millimeter-wave communication and obstacle-laden environments such as factories, underground malls, railways, indoor settings, high-rise buildings, and others.

-

In June 2024, Deutsche Telekom AG, a key company in the telecommunications industry, announced that it had successfully accomplished trials for 5G frequencies in mmWave for the first time, involving industrial use cases. The company further announced that it is commencing with offering 5G mmWave in Germany for industrial applications.

Telecom Millimeter Wave Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.14 billion

Revenue forecast in 2030

USD 16.02 billion

Growth Rate

CAGR of 31.2 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Frequency band, license, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Acronis International GmbH; Actifio Inc.; Arcserve, LLC; Axcient; Cohesity, Inc.; Commvault; Dell Inc.; Hewlett Packard Enterprise Development LP; IBM; Microsoft; NinjaOne; Rubrik; Unitrends; Veeam Software

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecom Millimeter Wave Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the telecom millimeter wave technology market report based on frequency band, licensing, application and region

-

Frequency Band Outlook (Revenue, USD Billion, 2020 - 2030)

-

V-Band

-

E-Band

-

Other Frequency Bands

-

-

Licensing Outlook (Revenue, USD Billion, 2020 - 2030)

-

Fully licensed

-

Light-licensed

-

Unlicensed

-

-

Application Outlook (Revenue, USD Billion, 2020 - 2030)

-

Military

-

Civil

-

-

Regional Outlook (Revenue, USD Billion, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global telecom millimeter wave technology market size was estimated at USD 573.3 million in 2019 and is expected to reach USD 814.5 million in 2020.

b. The global telecom millimeter wave technology market is expected to grow at a compound annual growth rate of 37.01% from 2020 to 2027 to reach USD 7,383.1 million by 2025.

b. North America dominated the telecom millimeter wave technology market with a share of 39.87% in 2019. This is attributable to the increasing demand for Carrier Ethernet services in the U.S. and Canada.

b. Some key players operating in the telecom millimeter wave technology market include Aviat Networks, Inc., Siklu Communication Ltd., E-band Communications LLC, Keysight Technologies, Sage Millimeter, Inc., and Bridgewave Communications, Inc.

b. Key factors that are driving the market growth include increasing research & development activities pertaining to the MMW technology and constantly growing demand for bandwidth-intensive applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."