- Home

- »

- Medical Devices

- »

-

Transplantation Market Size, Share & Growth Report, 2030GVR Report cover

![Transplantation Market Size, Share & Trends Report]()

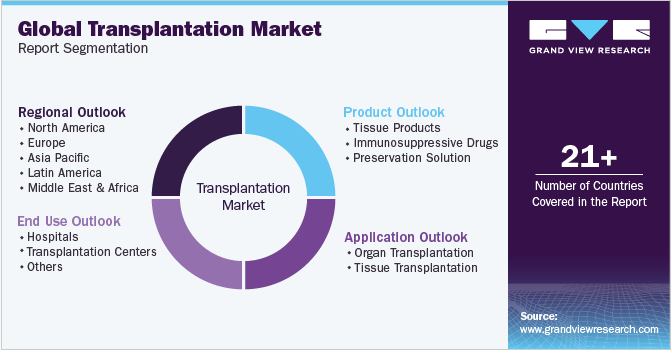

Transplantation Market Size, Share & Trends Analysis Report By Product (Tissue Products, Immunosuppressive Drugs, Preservation Solution), By Application (Organ, Tissue Transplant), By End Use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-864-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Transplantation Market Size & Trends

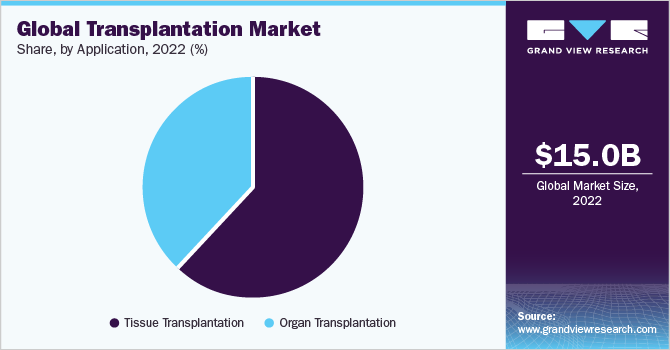

The global transplantation market size was estimated at USD 15.0 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. Growing demand for novel tissue transplantation products and organ transplantation for the treatment of organ failure is a major factor contributing to the market growth. Organ failure usually occurs due to various factors such as serious trauma, loss of blood, poisoning, drug abuse, leukemia, sepsis, and other acute diseases. Demand for tissue and organ transplantation, mainly kidney, heart, liver, and lungs, is very high globally. Unhealthy dietary habits, alcohol consumption, lack of exercise, and drug abuse are some leading causes of organ failure. Thus, demand for transplantation products is expected to rise soon.

After a transplantation surgery, the recipients are prescribed powerful immunosuppressive drugs; thus, increasing their susceptibility to infectious diseases as their immunity is weakened. This can be attributed to the decline in transplantation numbers in many countries amid the COVID-19 situation. Moreover, the shortage of resources such as primary protective equipment, ICU, and blood products during the pandemic has contributed to the sharp fall in the market’s revenue in 2020.

The global increase in the demand for organs for transplant can be attributed to an increase in the incidence of acute diseases, which in turn results in an increase in the number of organ failures. For instance, diabetes and high blood pressure are the most common causes of end-stage renal disease, where kidney transplants or dialysis are the only treatment options to keep a patient alive. According to the U.S. Department of Health & Human Services, there were around 122,913 patients in the U.S. waiting to receive organs for transplant in 2019. Thus, there are high demand for advanced transplantation products for the treatment of organ failure. To manage such issues, in March 2023, U.S. government department of Health Resources and Services Administration (HRSA) took an initiative regarding transplantation network and organ procurement modernization. This idea focuses on the release of new organ donor and transplant data.

Some of the major driving factors impacting the market include the introduction of technologically advanced products and an increasing number of tissue banks. However, some of the factors such as the shortage of organ donors for transplantation procedures are expected to restrain the market growth. There is a huge gap between the demand and supply of organs for organ failure treatment. According to the U.S. Department of Health & Human Services, in 2019, there were around 43,201 patients waiting for kidney transplants in the U.S. However, only 23,401 kidney transplant procedures were performed in 2019. Lack of awareness for organ donation and religious & customary beliefs prevent a large number of people from donating. Thus, the shortage of organs for the treatment of organ failure is expected to adversely affect the market growth.

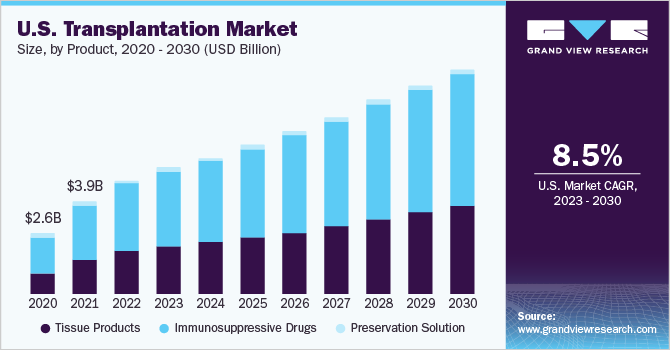

Product Insights

Tissue products were the highest revenue-generating segment in 2022 with a market share of 57.7%. Major products used for tissue or organ transplantation are tissue products, immunosuppressants, and preservation solutions. The increasing number of transplantation procedures such as that of cochlear, heart valves, bone marrow, and orthopedic soft tissues is attributed to the growth of the segment. In addition, new product development is also fueling market growth.

Manufacturers are focusing on new product development, mergers & acquisition, and collaborations to expand their current product portfolio and reinforce their position in the industry. For instance, in September 2016, Stryker Corporation announced the acquisition of Instratek, a leading manufacturer of minimally invasive soft tissue recession instruments for ankle, foot, and upper extremity procedures.

Immunosuppressive drugs segment is projected to showcase lucrative growth during the study period. This can be attributed to the high usage of these drugs to prevent post-transplant tissue or organ rejection. The increasing prevalence of chronic diseases has led to a rise in demand for organ replacement globally. Thus, demand for immunosuppressive drugs is expected to rise at a significant pace during the forecast period.

The preservation solutions segment is expected to exhibit significant growth during the study period due to rising government support for stem cell research and the high application of these products to improve the physiological function of organs. In addition, rising cases of organ failure, increasing organ transplant procedures, and escalating number of organ donations worldwide are expected to drive the segment growth.

Application Insights

Tissue transplantation dominates the market with market size of 79.2 billion in 2022. This is since the replacement of skin, cornea, bones, heart valves, tendons, nerves, and veins are most commonly performed procedure worldwide. The escalating number of burn and accident cases is expected to propel the demand for tissue products. According to the European Road Safety Observatory report, there were 102,362 injury accidents were reported in Spain. Thus, creating the demand for tissue transplantation.

The organ transplantation segment is expected to show a lucrative growth rate during the forecast period. The increasing number of organ transplantations globally as well as the repetitive purchase of immunosuppressants is anticipated to boost the market growth soon. For instance, in 2017, around 90,306 kidney transplant procedures were performed globally.

Advancement in transplantation technology and the launch of new products by manufacturers is expected to propel the number of transplant procedures, including kidney, liver, heart, lungs, and tissues. For instance, in November 2020, Lupin announced the launch of the generic immunosuppressant drug Tacrolimus in the U.S. market indicated for prophylaxis of organ rejection in the allogeneic liver, kidney, and heart transplant.

In 2020, a high number of transplant procedures was documented in the U.S., Germany, U.K., and France, and this number is expected to increase in the near future. Thus, there is high demand for transplantation products in these countries. Well-developed healthcare infrastructure and availability of expert surgeons & advanced products in these countries are some key factors that can be attributed to the growth of the regional market.

End-use Insights

The hospitals segment held the largest market share of 49.5% in the year 2022. Many organ and tissue transplant procedures are conducted at hospitals as they are primary treatment centers. Additionally, the emergence of hospitals with developed infrastructure is further expected to fuel market growth. The majority of these hospitals have access to well-defined databases to check for the availability of organs aiding in rapid medical intervention.

The number of transplant centers is expected to exhibit the highest growth during the forecast period. Escalating transplantation procedures have triggered the need for an increased number of healthcare centers catering to the unmet needs of the patients. Also, rising government initiatives to encourage organ donation are projected to propel market growth. For instance, the Health Resources and Services Administration's Division of Transplantation sponsored four grant programs that focus on increasing the number of organs donors and transplant procedures.

As a result of established healthcare infrastructure in the U.S., France, U.K., and other European countries, demand for advanced transplant products for the management of organ failure & tissue replacement has increased. Moreover, the number of advanced transplant centers in these regions is increasing. For instance, according to the National Kidney Center, there are around 244 kidney transplant centers in the U.S.Rising number of organ donors and improving healthcare infrastructure in developing economies such as China, India, Argentina, and Brazil are expected to propel market growth. In addition, demand for these products in these countries is rising due to the growing burden of acute and chronic diseases, such as high blood pressure and diabetes..

Regional Insights

In 2022, North America dominated the transplantation market with a market share of 39.0% and is expected to maintain its dominance throughout the study period. Well-developed healthcare facilities and the local presence of many large biotechnology and medical devices companies, such as Arthrex, Inc.; Zimmer Biomet; Medtronic; Novartis AG; and Stryker are supporting the market growth.

The gap between demand and supply of organs, including kidneys, liver, and heart, for transplantation, has increased in the last decade. However, governments and NGOs of various countries are taking initiatives to encourage people to donate organs and save lives. New guidelines and rules for organ donation make the donation process more transparent and easier. In 2020, the Human Resource & Services Administration launched the Hospital Organ Donor Campaign in April 2020. This led to an increase in the number of organ donations from the previous year.

Asia Pacific market is projected to rise at the highest rate during the forecast period, owing to the growing research on stem cells to develop in-vitro tissue and organs as well as developing healthcare infrastructure in Asian countries such as India, Thailand, Philippines, Indonesia.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of many large, small, and medium-scale vendors. The leading players in the industry are Zimmer Biomet; Medtronic; Stryker Corporation. These players are involved in launching new products, mergers & acquisitions, and regional expansion to gain maximum revenue share in the industry. Mergers and acquisitions support vendors in expanding their existing product portfolio and geographical reach. For instance, In April 2023, a team of surgeons in Spain performed world’s first robotic lung transplant, a novel lung transplant method that uses robot labelled as Da Vinci.

Rising regulatory approvals for allografts, autologous grafts, and other materials along with the development of innovative products, such as 3D bioprinting, have led to high demand for transplant products. This 3D bioprinting can be used to regenerate tissues and organs. For instance, in September 2020 Israel-based CollPlant Biotechnologies and United therapeutics announced a collaboration to include 3D bioprinting in the development of human kidneys for transplant. Some of the prominent players in the global transplantation market include:

-

Abbvie, Inc

-

Arthrex, Inc.

-

Zimmer Biomet

-

Medtronic

-

Novartis AG

-

Strykers

-

21st Century Medicine

-

BiolifeSolutions, Inc

-

Teva Pharmaceuticals

-

Veloxis Pharmaceutical

Transplantation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.5 billion

Revenue forecast in 2030

USD 30.9 billion

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie, Inc.; Arthrex, Inc.; Zimmer Biomet; Medtronic; Novartis AG; Stryker; 21st Century Medicine; BioLifeSolutions, Inc; Teva Pharmaceuticals; Veloxis Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized options to meet your exact research needs. Explore purchase options

Global Transplantation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global transplantation market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Tissue Products

-

Immunosuppressive Drugs

-

Preservation Solution

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Organ Transplantation

-

Tissue Transplantation

-

-

End-Use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Hospitals

-

Transplant Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transplantation market size was estimated at USD 15.0 billion in 2022 and is expected to reach USD 30.9 billion in 2023.

b. The global transplantation market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 30.9 billion by 2030.

b. North America dominated the transplantation market with a share of 39.0% in 2022. This is attributable to well-developed healthcare facilities and the local presence of many large biotechnology and medical device companies.

b. Some key players operating in the transplantation market include AbbVie, Inc.; Arthrex, Inc.; Zimmer Biomet; Medtronic; Novartis AG; Stryker; 21st Century Medicine; BioLifeSolutions, Inc; Teva Pharmaceuticals; and Veloxis Pharmaceuticals.

b. Key factors that are driving the transplantation market growth include an increase in the incidence of acute diseases, the introduction of technologically advanced products, and an increasing number of tissue banks.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."