- Home

- »

- Medical Devices

- »

-

Trauma & Extremities Devices Market Size, Industry Report, 2019-2026GVR Report cover

![Trauma And Extremities Devices Market Size, Share & Trends Report]()

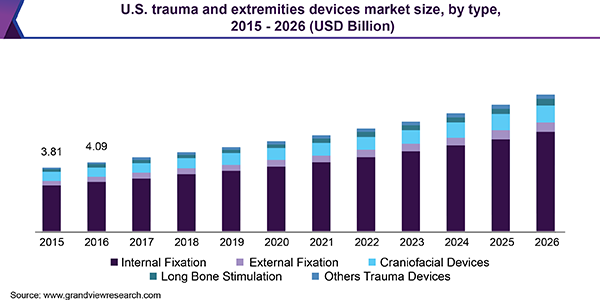

Trauma And Extremities Devices Market Size, Share & Trends Analysis Report By Type (Internal Fixation, External Fixation, Craniofacial Devices, Long Bone Stimulation), By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-1-68038-136-8

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Industry Insights

The global trauma and extremities devices market was valued at USD 10.04 billion in 2018 and is projected to expand at a CAGR of 7.7% over the forecast period. Rising urbanization in developing countries leading to innumerable road accidents coupled with improving healthcare facilities are anticipated to drive the growth.

The percentage of road accidents in low-income countries is as high as 24% as opposed to the 9% observed in high-income countries. This serves as an attractive opportunity for smaller companies to expand their business into these regions. Local implants are preferred in low-income countries due to their low prices thus adding to the advantages of these devices for the sector players.

Market players are contributing to the growth through research and seeking approval for their innovative products. The National University of Science and Technology MISIS has developed a therapeutic product for medulla trauma which damages the spinal cord. The R&D activities aimed at improving quality of the existing products and making them biocompatible, surgeon friendly, and affordable.

The prevalence of diabetes reached 422 million in 2014 and is forecasted to witness rapid growth, especially in middle-income countries. Other complications, such as diabetic foot, also affect a large cohort of diabetes patients. Almost 7% of diabetics are afflicted with diabetic foot annually, causing 20% of them to be hospitalized. This accounts for USD 13 billion excluding the costs associated with diabetes. Diabetic foot is managed by external fixators thus increasing its popularity. External fixators enable skeletal alignment by providing mechanical stability to structurally deficient bones. Rising prevalence of diabetic foot is expected to lead to an upsurge in demand for external fixators.

Type Insights

On the basis of the types of fixation, the trauma and extremities devices market is segmented into internal and external. Internal fixation held the largest market share in 2018 owing to the lesser price of the devices and the advantages associated with the such as fewer scars, broad indications, and absence of casts and fracture blisters. The material used for internal fixators is durable, non-corrosive, and stable. These are also compatible with CT scans and MRI scans.

Use of bone grafts is also increasing with the sector players introducing new products to cater to the growing demand. In June 2016, Medtronic obtained a second confirmation from the U.S. Food and Drug Administration (FDA) for the INFUSE bone graft that was originally approved in 2013. It had reached net sales of USD 1 billion in late 2015 and was approved for two more indications by the FDA.

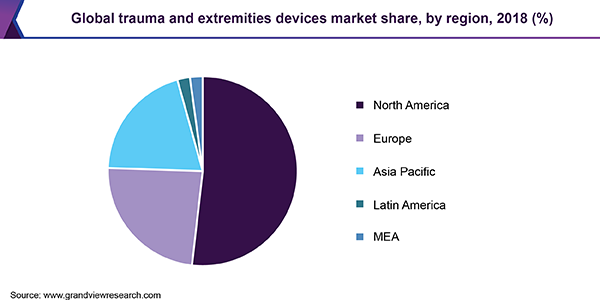

Regional Insights

In 2018, North America accounted for the maximum market share in terms of revenue. The presence of industry giants, such as DePuy Synthes; Stryker Corporation; Zimmer Biomet Holdings, Inc.; and Wright Medical Group, Inc. boosts the regional growth. In 2018, Smith and Nephew recorded 3% growth in the net sales in U.S. Moreover, Wright Medical Technology, Inc. estimated a market worth USD 300 million for their bone graft, AUGMENT, indicated for foot and ankle fusion.

Asia Pacific is expected to emerge as the fastest growing region over the forecast period. Rising number of road accidents is the key driving factor driving the regional growth. Improving healthcare reforms and economic conditions are facilitating high demand. Also, it is compelling the manufacturers to provide biocompatible implants anatomically closer to their native structure, entailing minimally invasive and cost-efficient procedures.

In 2015, the Asia Pacific Medical Technology Association was formed by industry giants such as, Baxter; Medtronic; B. Braun Melsungen AG; Stryker; Zimmer Biomet; Johnson & Johnson Services, Inc.; Becton, Dickinson and Company; GE Healthcare; Cardinal Health; Koninklijke Philips N.V.; Siemens; Boston Scientific Corporation; and Abbott. The sole purpose of this association was to establish a focused platform for medical devices in Asia. It is headquartered in Singapore and the focus lies in developing cost-effective products in compliance with government and ethical regulatory frameworks.

Trauma and Extremities Devices Market Share Insights

Some of the major players operating in the market include DePuy Synthes, Stryker, Zimmer Biomet, and Medtronic among others. These companies provide a wide range of products with customized fixations and durable materials. The vertical has witnessed dynamic merger and acquisition activities in recent years. This contributes to the large share captured by the few industry giants. In May 2016, DePuy Synthes acquired BioMedical Enterprises, Inc. on undisclosed terms. The company is expected to provide a more comprehensive product portfolio for hands, wrist, feet, and ankle.

In April 2016, Stryker Corporation completed the acquisition of Stanmore Implants Worldwide Limited. The transaction was worth USD 39.61 million and was projected to expand the orthopedic oncology solution capabilities of the company.

New product development is one of the key factors augmenting the market. Industry players invest in R&D and launch new and improved products using better material and providing ease of use. For instance, in May 2016, Acumed launched two new products, small fragment base set and ankle plating system 3. The company anticipates a strong revenue growth, thus strengthening its position as a leader. Also, in July 2016, the company’s wrist fixation implants, Acu-Loc and Acu-Loc 2, reached a sale count of 0.5 million worldwide. This product was introduced in 2014 and achieved the set target in two years.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2026

Market representation

Revenue in USD Million & CAGR from 2019 to 2026

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, China, India, Brazil, Mexico, South Africa, UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the global trauma and extremities devices market based on type and region:

-

Type (Revenue, USD Million, 2015 - 2026)

-

Internal Fixation Devices

-

Plates and screws

-

Rods and Pins

-

Bone Grafts

-

-

External Fixation Devices

-

Craniofacial Devices

-

Internal Craniofacial Devices

-

External Craniofacial Devices

-

-

Long Bone Stimulation

-

Other Trauma Devices

-

-

Region Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."