- Home

- »

- Clinical Diagnostics

- »

-

Urinary Tract Infection Testing Market Size Report, 2030GVR Report cover

![Urinary Tract Infection Testing Market Size, Share & Trends Report]()

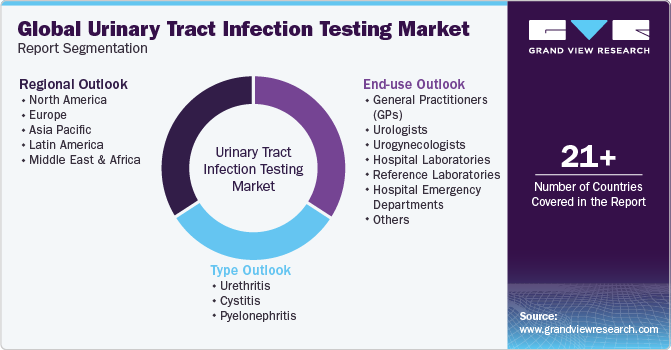

Urinary Tract Infection Testing Market Size, Share & Trends Analysis Report By Type (Urethritis, Cystitis, Pyelonephritis), By End Use (Reference Laboratories, General Practitioners, Urologists, Urgent Care), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-951-8

- Number of Report Pages: 113

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Urinary Tract Infection Testing Market Trends

The global urinary tract infection testing market size was valued at USD 579.2 million in 2022 and is anticipated to grow at a CAGR of 4.4% from 2023 to 2030 owing to factors such as the rising incidence rate of urinary tract infections., rapid technological advancements, increasing geriatric population, and R&D investments by key players to introduce self-testing products. Urinary tract infections are becoming a common health concern. According to research studies, urinary tract infection testing (UTI) occurs in one in five adult women at some point in their life. In the U.S., about 25%-40% of women aged 20-40 have suffered a UTI. Over 6 million UTI patients visit physicians annually in the U.S., of which around 20% of those visits are to the emergency department.

Women are more prone to UTIs than men. The incidence of disease in adult women tends to increase with age. The infection rate is comparatively high in postmenopausal women, owing to some factors, such as changes in vaginal flora, which provides a favorable environment for the growth of certain pathogens. According to Cell Reports Medicine in 2022, approximately 50% of urinary tract infections in postmenopausal women develop into recurrent UTIs, which can last for years and decrease the quality of life physically and mentally. Furthermore, in case of unsuccessful treatment, it can develop into life-threatening urosepsis.

The introduction of portable handheld equipment and the availability of at-home sample collection kits & self-testing kits for UTI testing are likely to boost adoption. For instance, in May 2020, Healthy.io Ltd. launched a home test kit in the UK. Moreover, point-of-care testing for UTIs will be a key growth area, which is expected to increase investments by market players. Moreover, researchers are developing technologically advanced products for disease diagnosis, which are expected to be commercialized in space in the coming years. In January 2020, engineers at the University of Bath developed a test for UTIs using a smartphone camera. They have claimed it can detect E. coli in a urine sample in less than 25 minutes.

The market experienced a setback during the COVID-19 pandemic. Amid the pandemic, hospitals and clinics reported a decrease in the number of urinary tract infection testing. However, globally the effect of the COVID-19 pandemic declined post the second quarter of 2021, which helped the market regain traction.

However, false results associated with UTI testing may hamper space growth. According to a research article published by CUTIC, rapid tests or dipstick tests can give false-positive results in one out of five patients. Such factors can hamper their reliability, slowing down space growth. In addition, an advanced automated system can also provide false results. Nevertheless, the rate of false results is relatively less in the case of an advanced system.

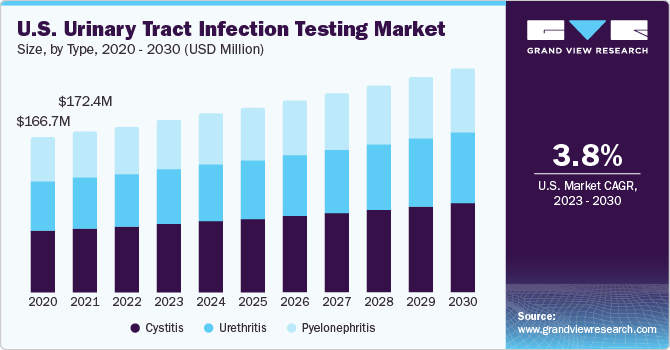

Type Insights

The cystitis segment accounted for the largest revenue share of 41.4% in 2022. This can be attributed to the high incidence & recurrence rate of cystitis, the increased number of product approvals, and the high number of diabetes patients more prone to cystitis. According to NCBI’s epidemiology report, acute cystitis globally occurs in about 10 out of 100 women annually. In addition, its recurrence rate is also high in women; half of the women affected by cystitis have it again within a year.

The pyelonephritis segment is expected to grow at the fastest CAGR of 4.8% during the forecast period. The growth of the segment is attributed to the growing prevalence of pyelonephritis. According to NCBI statistics, in the U.S., more than 250,000 cases of pyelonephritis are diagnosed every year. The study further suggested that globally, in women aged 18 to 49 years, there are around 28 pyelonephritis cases per 10,000 individuals.

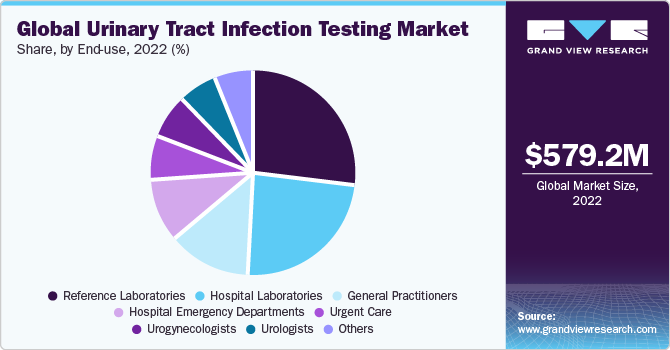

End Use Insights

The reference laboratories segment accounted for the largest revenue share of around 26.7% in 2022. The growth can be attributed to ongoing efforts to improve patient outcomes by providing diagnostic facilities. In addition, reference labs can handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices, which is anticipated to offer economies of scale to service providers.

The general practitioner segment held a significant market share in 2022. This can be attributed to the fact that it is the primary point of contact for most patients with urinary tract infection, and in most cases, uncomplicated UTIs is diagnosed and treated by a general practitioner. According to an American Urological Association article, in the U.S., UTIs contribute to more than 8 to 10 million doctor visits every year.

The urogynecologists segment is estimated to register the fastest CAGR of 5.2% over the forecast period. Urogynaecologists specialize in diagnosing and treating urinary tract disorders, including urinary tract infections (UTIs). Their expertise in urological conditions makes them highly sought after for accurate and comprehensive UTI testing. Additionally, the increased awareness of UTIs and their impact on women's health leads to more women seeking specialized care from urogynaecologists.

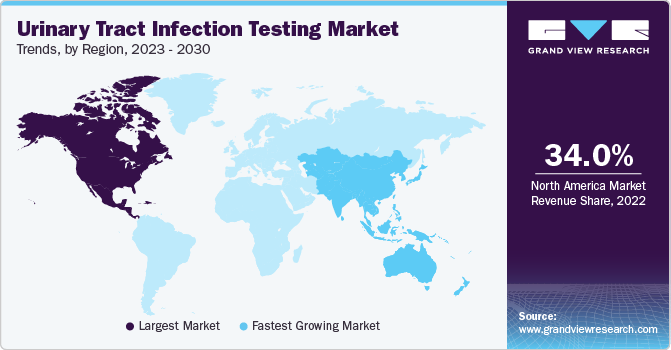

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.0% in 2022, owing to the high disease burden, availability of infrastructure, increased healthcare expenditure, rapid technological advancements, proactive government initiatives, rise in patient awareness, and presence of major players. According to Goodbill Inc., in 2022, the average emergency room (ER) visit cost for the treatment of UTI in the U.S. is approximately USD 2500 per visit.

Asia Pacific is expected to grow at the fastest CAGR of 5.2% during the forecast period. The high growth rate can be attributed to the rising disease incidence rate and the high geriatric population. Increasing demand for cost-effective diagnostics and a growing population are among the factors significantly contributing to market growth. Asia Pacific markets such as Australia and South Korea already have a healthcare reimbursement system that provides coverage for UTI diagnostic tests. As of 2020, people aged 65 years and above were estimated to be around 414 million in Asia Pacific.

Key Companies & Market Share Insights

Key players operating in the global urinary tract infection testing market are trying to gain market share through product launches, mergers & acquisitions, and other strategic initiatives. For instance, in December 2022, Thermo Fisher Scientific announced the launch of TrueMark Infectious Disease Research Panels. These panels are aimed to rapidly and accurately detect the microorganism causing gastrointestinal, respiratory, urinary, vaginal, and sexually transmitted diseases. Additionally, in September 2022, Sysmex Corporation launched UF-1500, a fully automated urine particle analyzer that will aid urine sediment testing. Furthermore, in May 2022, Vela Diagnostics announced the launch of the AMR PCR Test along with PathoKey MP UTI ID. It will aid in the detection of UTI Pathogens as well as Antimicrobial Resistance Genes.

Moreover, in December 2021, BD (Becton, Dickinson, and Company completed the acquisition of Scanwell Health Inc., a developer of smartphone aided at-home medical test kits. In July 2020, Uqora, Inc. (Pharmavite, LLC), a urinary health biotechnology company, launched a UTI diagnostic and management kit. It includes the rapid diagnostic device, Clarify, compatible with PoC and homecare settings. Similarly, in May 2020, Healthy.io Ltd. launched a urinary tract infection rapid home test kit in the UK.

Key Urinary Tract Infection Testing Companies:

- QIAGEN

- Accelerate Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Danaher

- Siemens Healthcare GmbH

- Randox Laboratories Ltd.

- Thermo Fisher Scientific, Inc.

- BIOMÉRIEUX

- T2 Biosystems, Inc.

Urinary Tract Infection Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 602.7 million

Revenue forecast in 2030

USD 812.0 million

Growth Rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

QIAGEN; Accelerate Diagnostics, Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Danaher; Siemens Healthcare GmbH; Randox Laboratories Ltd.; Thermo Fisher Scientific, Inc.; BIOMÉRIEUX; T2 Biosystems, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urinary Tract Infection Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global urinary tract infection testingmarket based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Urethritis

-

Cystitis

-

Pyelonephritis

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

General practitioners (GPs)

-

Urologists

-

Urogynecologists

-

Hospital Laboratories

-

Reference Laboratories

-

Hospital Emergency Departments

-

Urgent Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global urinary tract infection testing market size was valued at USD 579.2 million in 2022 and is anticipated to reach USD 602.7 million in 2023.

b. The global urinary tract infection testing market is expected to witness a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 812.0 million by 2030.

b. Based on type, the cystitis segment accounted for a share of 41.42% in 2022 due to the high incidence & recurrence rate of cystitis and the increasing number of diabetes patients who are more prone to cystitis.

b. Some of the key players in the UTI testing market are QIAGEN; Accelerate Diagnostics, Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation; Siemens Healthcare GmbH; Randox Laboratories Ltd.; Thermo Fisher Scientific, Inc.; bioMérieux SA; T2 Biosystems, Inc.

b. The major factors driving UTI testing market growth are the rising disease burden and the launch of at-home and self-testing kits for the early diagnosis of UTI.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."