- Home

- »

- Healthcare IT

- »

-

U.S. Advance Care Planning Solutions Market Size Report 2030GVR Report cover

![U.S. Advance Care Planning Solutions Market Size, Share & Trends Report]()

U.S. Advance Care Planning Solutions Market Size, Share & Trends Analysis By Component (Services, Software), By Types Of ACP Documents (Living Will, Medical Power Of Attorney, POLST), By End-Use Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-013-3

- Number of Pages: 70

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

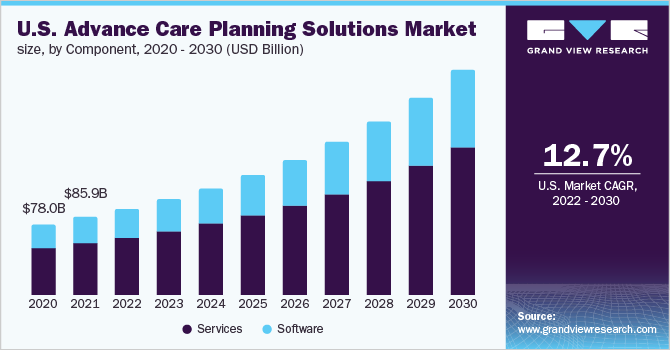

The U.S. advance care planning solutions market size was valued at USD 85.9 billion in 2021 and is anticipated to expand at a CAGR of 12.7% from 2022 to 2030. The significant market growth can be attributed to the growing elderly population and the advanced care planning process which helps individuals plan their current as well as future decisions related to their medical treatment and place of care.

Advance care planning empowers individuals to make their own plans for their future healthcare. Advance care planning solutions provide healthcare professionals with directions in terms of treatment when a patient is not in a position to make their own healthcare choices. This reduces the chance that the individual receives care or treatment that they don’t want at the end of life. Advance care planning offers healthcare professionals to have structured and meaningful conversations with their patients about their wishes and preferences regarding treatment preferences and decreases moral distress among care providers.

Key factors that are driving the market growth include an increasing focus on patient-centric care, a rising need for solutions to reduce healthcare costs, and strong government support. Furthermore, the rising adoption of services and technological software in the healthcare sector is favoring the healthcare industry's growth. In January 2022, Iris Healthcare was acquired by Aledade a primary care enablement company. The acquisition between the companies strengthened the position of Iris Healthcare and scaled value-based primary care benefiting both physicians and patients.

Component Insights

The services segment dominated the market with a market share of 68.0% in 2021. The driving force for the expansion of the services segment is owing to the growing number of individuals planning their current as well as future medical treatment to have a planned end-of-life as per their wish. Thus, as a part of the service program, consultants help individuals fill their advance directives as per their choice. The organization ensures that individuals get the care they want when they are unable to make their own choices. Furthermore, organizations are adopting strategies such as collaboration and partnership to empower advance care planning services. For instance, in July 2021, Iris Healthcare, partnered with Scripps Health, an integrated delivery system, to provide advance care planning (ACP) services to the organization’s Medicare Advantage (MA) members.

The growth of the services segment is followed by the software segment. The software segment is expected to grow at a CAGR of 13.5% over the forecast period owing to the potential to provide digital tools to support the making, uploading, and able to share the advance care planning documents, portable medical records, and videos of patients.

Types of ACP Documents Insights

The medical power of attorney segment dominated the market with a market share of 33.3% in 2021. The driving force for the expansion of the medical power of attorney segment also known as the durable power of attorney as this legal document authorizes individuals to make healthcare decisions avoiding the necessity of getting the court involved in the process. Moreover, this legal manuscript describes in detail under which circumstances the healthcare provider should attempt to prolong the lifespan of the individual. A medical power of attorney can be ended at any time as per the individual’s wish.

The growth of the medical power of attorney segment is followed by the living will segment. The living will segment is expected to grow at a CAGR of 13.2% over the forecast period. it is mostly used only at the end of life if the individual is critically ill, that is, at the stage of permanently unconscious or where they can’t be treated.

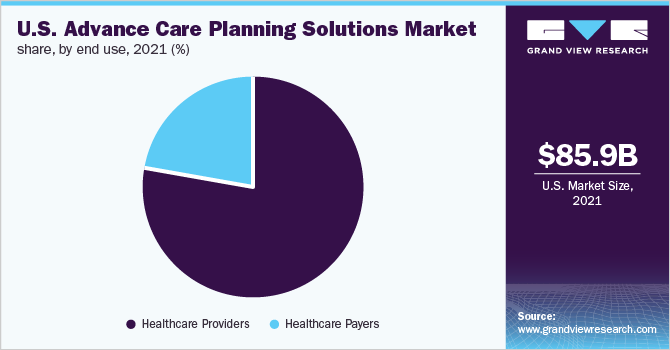

End-use Insights

The healthcare providers segment dominated the market with a market share of 78.3% in 2021. The driving force for the expansion of the healthcare payers segment is the growing patient demand for patient-centered care, higher healthcare quality, an expanding patient base, and an increase in the need for quick services. ADVault provides advance care planning (ACP) tools to various healthcare providers such as chronic care management companies, home health & hospice agencies, accountable care organizations, skilled nursing & hospice facilities, hospitals, medical practices, hospice & palliative care providers, and healthcare systems.

The growth of the healthcare providers segment is followed by the healthcare payers segment. The healthcare providers segment is expected to grow at a CAGR of 14.2% over the forecast period owing to the potential to fix service rates, collect payments, process claims, and pay provider claims. Healthcare payers include healthcare plan providers, Medicaid, and Medicare.

Key Companies & Market Share Insights

Some of the strategies being undertaken by the players are portfolio diversification, geographical expansions, product enhancements, and mergers and acquisitions. In June 2021, Vynca announced its partnership with Indianapolis-based Community Health Network (Community) providing access to healthcare services, and enabling patients as well as care team members of the Community to digitally generate and share advance care planning (ACP) documents.

In November 2021, ADVault announced its partnership with Kno2 with an aim to enhance the capacity of post-acute care providers and hospitals to access advance care planning (ACP) documents as well as portable medical orderings. Some of the prominent players in the U.S. advance care planning solutions market include:

-

ADVault, Inc.

-

Vynca, Inc.

-

WiserCare

-

Sharp HealthCare

-

ACP Decisions (A DBA of Nous Foundation, Inc.)

-

Iris (Aledade)

-

Bronson Healthcare

U.S. Advance Care Planning Solutions Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 95.0 billion

Revenue forecast in 2030

USD 246.9 billion

Growth rate

CAGR of 12.7% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historic data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Component, types of ACP documents, end-use

Country Scope

U.S.

Key companies profiled

ADVault, Inc.; Vynca, Inc.; WiserCare; Sharp HealthCare; ACP Decisions (A DBA of Nous Foundation, Inc.); Iris (Aledade); Bronson Healthcare

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Advance Care Planning Solutions Market Segmentation

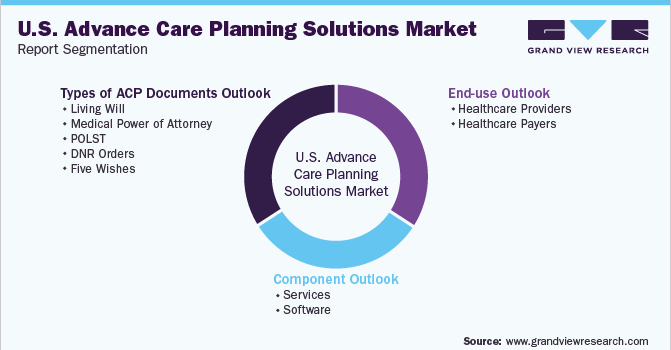

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. advance care planning solutions market based on component, types of ACP documents, and end-use:

-

Component Outlook (USD Billion, 2017 - 2030)

-

Services

-

Software

-

-

Types of ACP Documents Outlook (USD Billion, 2017 - 2030)

-

Living Will

-

Medical Power of Attorney

-

POLST

-

DNR Orders

-

Five Wishes

-

-

End-Use Outlook (USD Billion, 2017 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Frequently Asked Questions About This Report

b. The U.S. advance care planning solutions market size was estimated at USD 85.9 billion in 2021 and is expected to reach USD 95.0 billion in 2022.

b. The U.S. advance care planning solutions market is expected to grow at a compound annual growth rate of 12.7% from 2022 to 2030 to reach USD 246.9 billion by 2030.

b. The services segment dominated the U.S. advance care planning solutions market with a share of 68.0% in terms of revenue in 2021 owing to a growing number of individuals planning their current as well as future medical treatment to have a planned end-of-life as per their wish. Thus as a part of the service program, consultants help individuals fill their advance directives as per their choice.

b. Some of the key players operating in the U.S. advance care planning solutions market are ADVault, Inc., Vynca, Inc., WiserCare, Sharp HealthCare, ACP Decisions (A DBA of Nous Foundation, Inc.), Iris (Aledade), and Bronson Healthcare

b. Key factors that are driving the U.S. advance care planning solutions market growth include increasing focus on patient-centric care, rising need for solutions to reduce healthcare costs, and strong government support.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."