- Home

- »

- Next Generation Technologies

- »

-

U.S. Biometrics Technology Market, Industry Report, 2030GVR Report cover

![U.S. Biometrics Technology Market Size, Share & Trends Report]()

U.S. Biometrics Technology Market Size, Share & Trends Analysis Report By Component, By Offering, By Authentication Type, By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-251-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Biometrics Technology Market Trends

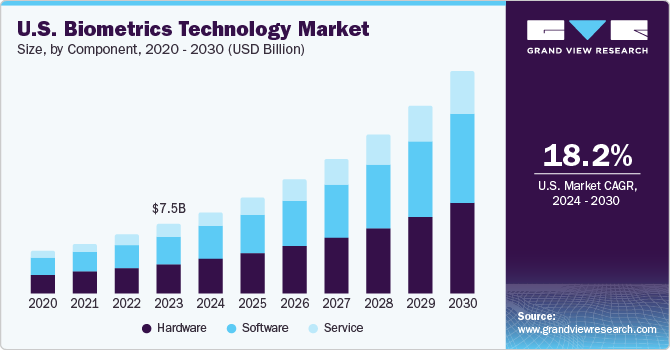

The U.S. biometrics technology market size was valued at USD 7.55 billion in 2023 and is projected to grow at a CAGR of 18.2% between 2024 and 2030. The growth outlook is largely attributed to the trend for biometric systems across the automotive and consumer electronics sectors. The growing penetration of surveillance, security, authentication, and identification solutions has augured well for the regional outlook. In essence, increased accessibility of facial recognition across end-use sectors, including consumer electronics, BFSI, government, defense, and security, has fueled the need for advanced biometric technologies.

The need for greater security has encouraged stakeholders to invest in state-of-the-art biometric technology. Prominently, commercial and public sectors have exhibited a profound demand for technology for employee attendance and identification. Lately, biometric authentication has gained ground to access email accounts, bank accounts, financial information and medical records.

Technological advancements in sensing technologies and the prevalence of smartphones and computers have spurred the footprint of biometric solutions. Of late, AI and ML-fueled biometric systems have redefined the business outlook as the demand for multi-factor authentication continues to gain ground across the U.S. market. The need to do away with data breaches and streamline safer, faster and easier access to goods and services will bode well for the regional outlook.

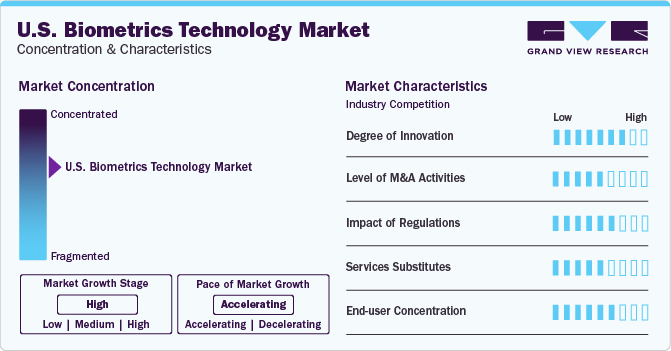

Market Concentration & Characteristics

Innovations, such as behavioral biometrics, have come to the fore in the banking sector with the footprint of gestures, voice recognition, keystroke dynamics, signature dynamics and the sound of steps. The next few years could witness the emergence and prominence of vein recognition, adaptive biometrics, DNA-based authentication, brainwave biometrics and integrated biometric systems.

Mergers & acquisitions activities could be noticeable as major companies gear up to propel their portfolios in the landscape. Investors and acquirers are keeping up with the trends and technological advancements to comply with regulations. To illustrate, in February 2024, First Advantage Corporation announced the acquisition of Sterling Check Corp. for USD 2.2 billion in cash and stock. The deal is likely to help the company unravel opportunities to propel growth through the infusion of funds into automated AI-powered technologies and digital identity.

The impact of regulations is likely to be pronounced as biometric privacy laws and regulations need businesses to inform consumers or employees and offer methods to consent to the collection of biometric identifiers and information. For instance, states such as Illinois have the Biometric Information Protection Act (BIPA) to impose obligations on organizations that collate and use biometric information.

Although the threat of substitutes may be subtle, the emergence of two-factor authentication using apps, such as Google authenticator, may remove the need for biometric data. However, a few biometric authentication is preferred to maintain compliance with vendors and policies. The need for a better and safer world will encourage end-users to inject funds into biometric technologies.

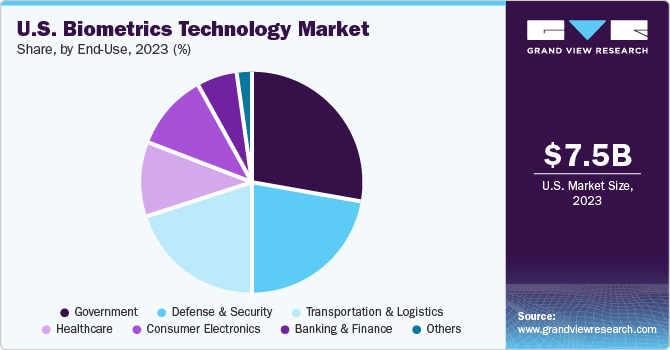

End-users, such as banking and finance, government, healthcare, consumer electronics, defense & security, and transport/logistics, are expected to seek advanced technology to streamline workflow. Soaring adoption of smartphones and the need for increased security will leverage the adoption of biometric technology. End-users are likely to focus on overcoming data security concerns and unfair practices.

Component Insights

The hardware segment spearheaded the U.S. biometrics technology market, accounting for 42.3% revenue share in 2023. The rising footprint of mobile biometric devices, the trend for biometric technology in consumer electronics, and the demand for hardware-based security capabilities have underscored the biometric component. Some dynamics, including high performance, precise identification accountability, high security, and reliability, will bode well for the segment's growth.

The software segment is expected to depict robust growth following the demand for AI and cloud services in biometric devices. Predominantly, biometric systems seek software to boost hardware and bolster the compatibility of biometric devices. The prevalence of real-time data streaming and the need to memorize and store geographic data will encourage industry leaders to infuse funds into the software component.

Offering Insights

The contact segment accounted for the largest revenue share in 2023, and it is poised to exhibit robust growth during the forecast period. The growth is partly due to the penetration of systems that recognize fingerprints, signatures, and palm prints. The trend for fingerprint recognition systems (in consumer electronics) and demand for contact-based biometric tools in sports institutions, fitness centers and wellness gyms will bode well for the industry growth.

The contactless segment is slated to depict strong growth on the back of heightened hygiene concerns and favorable government initiatives. In essence, the onslaught of the COVID-19 pandemic compelled end-users to invest in contactless technologies, prompting the demand for face recognition systems. Some upsides of contactless biometrics, including marking attendance remotely, preventing unauthorized login, and securing premise access, have made the offering highly sought-after among end-users.

Authentication Type Insights

The single factor segment spearheaded the regional market in 2023 and will continue to gain traction on the back of the trend for face and fingerprint recognition across travel, banking and government sectors. Some factors, including cost and user-friendly attributes, have made single factor authentication immensely popular in the U.S. Of late, finger vein scans, retina scans and voice recognition have provided an impetus to biometric verification system.

The two factor authentication segment will depict a notable growth in light of the need for high security while maintaining simple user interface. Notably, one-time passwords (OTPs) are popular as a second authentication factor. Several organizations regard two factor authentication as a strong method for verifying user identities. Industry leaders are likely to bank on the 2FA for increased scalability and high security.

Application Insights

The Non-AFIS segment will exhibit a considerable growth in the wake of surging penetration across PCs and cell phones. The growth outlook is partly due to applications and implementations of regulations. The non-automated fingerprint identification system (AFIS) technologies, such as finger scanning, are poised to be sought across the end-use applications. Besides, the demand for robust algorithms will reshape the industry dynamics.

The AFIS segment will showcase considerable growth on the heels of a heightened demand in civil and law enforcements applications. Governments are likely to use AFIS for identification in law enforcement, civil registers and elections. The use of advanced AFIS can help in the accurate and rapid identification of individuals (based on their unique fingerprint patterns). Fingerprint examiners are expected to use face recognition to iris scanning and fingerprint.

End-use Insights

The government segment will contribute notably toward the U.S. market share, largely due to the need to eradicate corruption, boost transparency and streamline workflow. The U.S. FBI asserts that no two individuals can have more than eight minutiae in common. Besides, the U.S. Customs and Border Protection (CBP) has considerably augmented non-intrusive inspection scanning capabilities and forward operating labs to recognize trends and identify suspected drugs. The CBP has spurred the use of facial biometric comparison technology to make existing travel needs more efficient.

The defense & security segment will witness notable growth to combat challenges stemming from identity theft and illegal migration. The 9/11 Commission Report authorized the U.S. government to use automated systems to record the departures and arrivals of visitors at land, sea and air ports of entry. Biometrics will be an invaluable enabler to bolster verification and identification, underscoring the safety and security of the nation.

Key U.S. Biometrics Technology Company Insights

Some of the leading players operating in the market include Aware Inc., Accu-Time Systems, Inc., EyeVerify and East Shore Technologies, Inc. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape.

-

In March 2022, Aware, Inc. joined forces with MIRACL to underscore its cloud-based biometric authentication technology to reduce the risk of data ransomware and data breaches.

-

In February 2023, Accu-Time Systems announced the rollout of a proprietary facial recognition system to provide a more hygienic alternative to keypads or fingerprint readers.

-

In January 2021, Ant Group contemplated selling EyeVerify, a U.S.-based biometric security company, against the backdrop of escalating tension between Washington and Beijing, Reuters quoted Financial Times.

Emerging companies, such as HID Global Corporation, Evolv Technology and NEC Corporation of America are likely to boost their portfolios.

-

In December 2022, HID announced the acquisition of Janam Technologies to bolster its penetration in smart credential issuance and reader solutions.

-

In November 2023, NEC Corporation of America inked a deal with Ideal Innovations Inc. to foster the use of face recognition technology.

Key U.S. Biometrics Technology Companies:

- Aware Inc.

- Accu-Time Systems, Inc.

- EyeVerify

- East Shore Technologies, Inc.

- HID Global Corporation

- Evolv Technology

- NEC Corporation of America

- Iris ID, Inc.

- BIO-key International, Inc.

- IDEMIA

Recent Developments

-

In January 2024, NEC Corporation of America asserted that it received level 2 certification from the Texas Risk and Authorization Management Program (TX-RAMP) for suit of biometric and face recognition solutions.

-

In March 2023, Iris ID reported that it showcased its “comprehensive range of iris recognition and dual biometric identity authentication solutions” in Las Vegas.

U.S. Biometrics Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.91 billion

Revenue Forecast in 2030

USD 24.34 billion

Growth rate

CAGR of 18.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, offering, authentication type, application, end-use

Key Companies Profiled

Aware Inc., Accu-Time Systems, Inc., EyeVerify, East Shore Technologies, Inc., HID Global Corporation, Evolv Technology, NEC Corporation of America, Iris ID, Inc., BIO-key International, Inc., IDEMIA

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biometrics Technology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. biometrics technology market based on component, offering, authentication type, application and end-use.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Contact

-

Contactless

-

Hybrid

-

-

Authentication Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Factor

-

Two Factor

-

Three Factor

-

Four Factor

-

Five Factor

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Face

-

Hand geometry

-

Voice

-

Signature

-

Iris

-

AFIS

-

Non-AFIS

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Government

-

Banking and Finance

-

Consumer Electronics

-

Healthcare

-

Transportation & Logistics

-

Defense & Security

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. biometrics technology market size was estimated at USD 7.55 billion in 2023 and is expected to reach USD 8.91 billion in 2024.

b. The global U.S. biometrics technology market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 24.34 billion by 2030.

b. The hardware segment dominated the U.S. biometrics technology market with a share of 42.3% in 2023. The rising footprint of mobile biometric devices, the trend for biometric technology in consumer electronics, and the demand for hardware-based security capabilities have underscored the biometric component.

b. Some key players operating in the U.S. biometrics technology market include Aware Inc., Accu-Time Systems, Inc., EyeVerify, East Shore Technologies, Inc., HID Global Corporation, Evolv Technology, NEC Corporation of America, Iris ID, Inc., BIO-key International, Inc., IDEMIA

b. Key factors that are driving the market growth include Increasing demand for security and identity verification and The rising demand for advancements in biometric technology.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."