- Home

- »

- Next Generation Technologies

- »

-

U.S. Data Collection And Labeling Market, Industry Report, 2030GVR Report cover

![U.S. Data Collection And Labeling Market Size, Share & Trends Report]()

U.S. Data Collection And Labeling Market Size, Share & Trends Analysis Report By Data Type (Audio, Image/ Video, Text), By Vertical (IT, Automotive, Government, Healthcare, BFSI), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-212-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

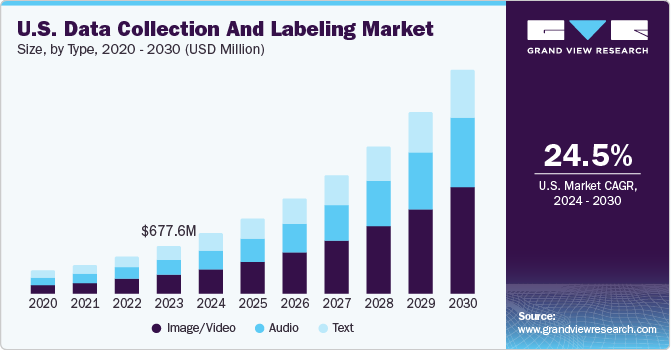

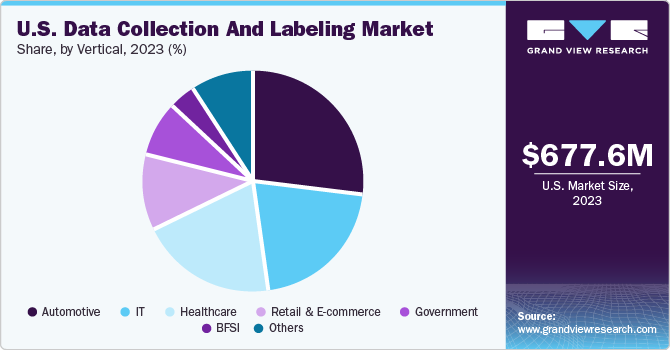

The U.S. data collection and labeling market size was valued at USD 677.6 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 24.5% from 2024 to 2030. The growth is largely attributed to the inundation of data and the surging complexity of machine learning algorithms. Businesses across automotive, healthcare, IT, BFSI and retail & e-commerce industries have sought data that offer actionable insights and help forecast future trends. Stakeholders are counting on AI & ML to unlock business potentials and automate their decision-making.

The expanding footprint of smartphones, penetration of internet surveys and demand for automobile GPS and Bluetooth have gained ground across the U.S. Of late, GPS manufacturers have banked on GPS tracks and travel time data to offer historical average travel time and real-time travel information. Moreover, industry participants seek the degree of automation, data security, user experience, and storage and interface to propel annotation.

In 2023, the U.S. accounted for over 23.4% of the data collection and labeling market. Technological advancements in semi-supervised learning, active learning, and the combination of human ingenuity with automated systems have reshaped the data collection and labeling market share in the U.S. To illustrate, automakers have infused funds into object detection systems to underscore autonomous driving, alluding to the need for data labeling in training models to respond to the surroundings aptly and accurately.

Market Concentration and Characteristics

The dynamics of data annotation and labeling suggest innovations could be replete in the North America region. State-of-the-art technological advancements in data labeling have boded well for autonomous vehicles, drone delivery systems, trucks, cars and buses. Predominantly, AI has received an impetus to assess information in real-time, while sensors and cameras have gained prominence in collision avoidance.

Amidst innovations, mergers & acquisitions have also become pronounced in the U.S. landscape as industry leaders seek to acquire novel technologies, diversify product lines, augment profitability, and bolster market share. M&A activities could be an invaluable strategic decision for companies’ growth and to gain a competitive edge in the industry. Synergies, including enhanced operational efficiency, increased revenue and reduced costs, could solidify the position of shareholders and other stakeholders.

Data deluge and pervasive privacy issues have compelled U.S. watchdogs to strengthen data labeling regulations. An aptly labeled data unveils a robust approach to validation and testing. To illustrate, the California Consumer Privacy Act (CCPA), signed into law in June 2018, offers a host of privacy rights to California consumers. The CCPA requires regulated businesses to offer disclosures to consumers (before collection) pertaining to the purpose and categories of collection.

The threat of substitutes tends to become high when companies outside the industry provide lower or attractive-cost products. One of Porter’s Five Forces can shape the competitive structure of the industry. Meanwhile, the threat of substitutes is subtle as AI and ML continue to gain ground. Predominantly, video annotation, image annotation and 3D point cloud annotation are expected to witness increased demand.

End-users, including automotive, BFSI, IT, government, retail & e-commerce and others, have spurred their positions in the U.S. market. For instance, the trend for machine learning in finance has brought a paradigm shift in investments, payments and banking. FinTech firms are counting on natural language processing (NLP) for automation capabilities and seamless processing of large volumes of unstructured data.

Data Type Insights

The image/video segment contributed 40.9% of the U.S. data collection and labeling market revenue share in 2023. The growth outlook is partly due to the demand for images and videos to identify people, objects, and logos. For instance, the trend for image annotation for model training has become pronounced to distinguish and recognize vehicles from traffic lights, pedestrians and objects on the road. Data scientists are expected to seek image labeling for enhanced computer vision and advanced functional AI models.

The audio segment is expected to witness notable growth on the back of surging demand for data labeling in transcription, speech recognition and sentiment analysis. The need for data labeling for audio annotation for surveillance, home security, interactive apps and content moderation will encourage stakeholders to bolster their portfolios. Lately, voice-controlled gadgets and virtual assistants have solidified their positions in the U.S. market, alluding to the demand forecast for annotations to provide more precise responses and seamless experience.

Vertical Insights

The automotive segment accounted for the largest revenue share in 2023 and it is poised to exhibit an upward growth trajectory against the backdrop of autonomous driving trend. The need to feed an ML algorithm with an influx of labeled training datasets, such as images and videos of other cyclists, cars, pedestrians, police traffic checks, traffic lights and potholes, has reshaped the industry dynamics. Notable demand for autonomous driving will continue to further the growth of data annotation in vehicle sensors and dashboard cameras.

The healthcare sector will depict considerable growth during the forecast period, partly due to the demand for accurate tagging and structuring of medical data. Predominantly, accurate data labeling can be pivotal in early disease detection, augmented clinical decision-making, personalized medicine, robotic surgery and drug discovery. For instance, doctors can use labeled data-powered AI tools to interpret medical images, such as MRIs and CT scans.

Key U.S. Data Collection And Labeling Company Insights

Some of the leading players operating in the market include Reality AI, Alegion, Oracle, IBM and Scale AI, Inc. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape.

-

In May 2022, Oracle joined forces with Informatica for data governance and enterprise cloud data integration for data warehouse and lakehouse solutions.

-

In October 2023, IBM rolled out IBM Storage Scale System 6000 to keep up with the demand for AI and data. The American behemoth claims the technology can store imagery, video, text and instrumentation data, among others.

-

In October 2023, Allegion plc announced an infusion of USD 20 million in an AI-powered computer vision intelligence (CVI) company, Ambient.ai. The collaboration is expected to bolster the adoption of AI in security.

Some emerging companies, such as Cogito Tech and Diveplane are likely to augment their strategies to gain a competitive edge.

-

In September 2022, Diveplane received a major boost from Sigma Defense LLC, L3Harris Technologies, Calibrate Ventures and Shield Capital as they raised USD 25 million in Series A funding to help the former invest in AI solutions.

-

In August 2023, Cogito Tech asserted the significance of accurate, high-quality, and pertinent data labeling for the development of Large Language Models (LLMs). The company exhorted about the importance of Human-in-the-loop feedback for the iterative evolution of machine learning models.

Key U.S. Data Collection And Labeling Companies:

- Reality AI

- IBM

- Oracle

- Alegion

- Labelbox, Inc

- Dobility, Inc.

- Scale AI, Inc.

- Cogito Tech

- Diveplane

- Appen Limited

Recent Developments

-

In July 2022, IBM announced the acquisition of Databand.ai to augment its software portfolio across AI, data and automation. For the record, Databand.ai was IBM's fifth acquisition in 2022, signifying the latter’s commitment to hybrid cloud and AI skills and capabilities.

-

In June 2022, Oracle completed the acquisition of Cerner as the Austin-based company gears up to ramp up its cloud business in the hospital and health system landscape.

U.S. Data Collection and Labeling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 855.0 million

Revenue Forecast in 2030

USD 3,178.7 million

Growth rate

CAGR of 24.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Data type; vertical

Key Companies Profiled

Reality AI; IBM; Oracle; Alegion; Labelbox, Inc; Dobility, Inc.; Scale AI, Inc.; Cogito Tech; Diveplane; Appen Limited

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Data Collection And Labeling Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. data collection and labeling market report based on data type and vertical.

-

Data Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Text

-

Image/ Video

-

Audio

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT

-

Automotive

-

Government

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. data collection and labeling market size was estimated at USD 677.6 million in 2023 and is expected to reach USD 855.0 million in 2024.

b. The U.S. data collection and labeling market is expected to grow at a compound annual growth rate of 24.5% from 2024 to 2030 to reach USD 3,178.7 million by 2030.

b. Image/Video dominated the U.S. data collection and labeling market with a share of 40.9% in 2023. The growth outlook is partly due to the demand for images and videos to identify people, objects, and logos. For instance, the trend for image annotation for model training has become pronounced to distinguish and recognize vehicles from traffic lights, pedestrians and objects on the road.

b. Some key players operating in the U.S. data collection and labeling market include Reality AI; IBM; Oracle; Alegion; Labelbox, Inc; Dobility, Inc.; Scale AI, Inc.; Cogito Tech; Diveplane; Appen Limited.

b. Some key players operating in the U.S. data collection and labeling market include expanding footprint of smartphones, penetration of internet surveys, and demand for automobile GPS.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."