- Home

- »

- Petrochemicals

- »

-

U.S. Onshore Drilling Fluids Market Size, Industry Report, 2018-2025GVR Report cover

![U.S. Onshore Drilling Fluids Market Size, Share & Trends Report]()

U.S. Onshore Drilling Fluids Market Size, Share & Trends Analysis Report By Product (WBF, OBF, SBF), By Additive, By Basin (Permian, Eagle Ford, Niobrara), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-945-6

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Industry Insights

The U.S. onshore drilling fluids market size was valued at USD 1,006.9 million in 2016. Growing demand for crude oil and gas in industrial sectors such as power and transport sectors is expected to drive the oil & gas production in the region. Growing concerns toward collapsing boreholes, spill containment, and handling solid wastes are expected to drive drilling mud demand over the forecast period.

Eagle Ford basin emerged as the leading regional market in the U.S. Surging energy demand coupled with favorable government initiatives to reduce dependency on oil imports is expected to drive onshore oil E&P activities. However stringent regulations regarding oil pollution are expected to steer demand for efficient oil production and transport equipment.

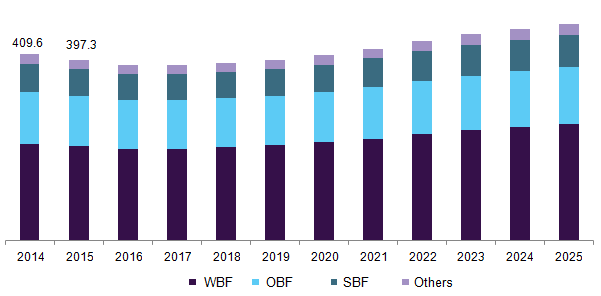

Eagle Ford onshore drilling fluids market revenue by product, 2014 - 2025 (Million)

Increasing petroleum E&P activities in the U.S. have been a major factor towards increased drilling mud requirement over the past few years. There has been increasing production in the associated oil & gas reserves of other oil fields of the U.S. Most of the reservoirs have several rock strata, which require different types of mud systems. Additionally, boring activities in shale or tight reserves require frequent change of additives, which is estimated to boost sales over the forecast period.

Growing concern toward environmental impact associated with the dumping of waste mud systems has urged regulatory bodies in various states of the U.S. to issue stringent guidelines regarding treatment and disposal of used additives. The U.S. EPA has laid protocols regarding the discharge of waste OBF and WBF in its basins. Canadian Association of Petroleum Producers and National Oceanic and Atmospheric Administration have issued stringent guidelines for disposal of waste mud systems in North America.

Oil & gas has dominated as a major source of primary energy over the past few years. Although coal is expected to lose its share by 2025, it is anticipated to account for over 75% of total energy supply along with oil & gas. This can be majorly attributed to the growing consumption in the form of feedstock in petrochemicals.

Boring fluid technology is constantly evolving owing to emerging need to operate under severe conditions such as high temperature & pressure environment in shale gas and tight gas reservoirs. Rising technical demands including increased lubricity requirements in air boring and increasing restrictions on oil-based systems (OBF), such as environmental remediation, are anticipated to raise R&D in this field.

A major challenge in the drilling mud industry is to meet the rising demand for solutions that can increase production rates in conditions such as high temperature and pressure in onshore horizontal and directional wells. The components of mud systems need to be selected so that discharge of cuttings and mud has the least environmental impact over the long term.

Product Insights

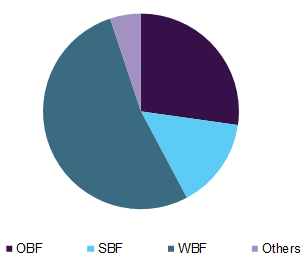

Water-based fluids (WBF) emerged as the leading product segment and accounted for over 50% of the total revenue in 2016. Its base consists of fresh water, brine, saturated, or formate brine. The selection of media depends on good conditions such as terrain, soil permeability, formation, proximity to the aquifer, and drive mechanisms. Growing concern toward the environmental impact of waste generated in oil & gas operations is anticipated to raise the demand for WBF over the forecast period. Rising product demand may be attributed to the low toxicity of these products.

U.S. onshore drilling fluids market revenue by product, 2016 (%)

Mud additives serve various functions including removing cuttings from wellbore, controlling formation pressures, lubricating and cooling the drill bit, sealing permeable formations while boring, and maintaining wellbore stability. Product compositions vary based on wellbore demands, rig capabilities, and environmental concerns.

Engineers design boring mud systems to control subsurface pressures, minimize formation damage, control borehole erosion, and optimize boring parameters including penetration rate and hole cleaning. As a large number of modern wellbores highly deviate, boring mud systems manage stability problems and hole cleaning specific to these wells.

Shale stabilizers and alkalinity & pH control agents are the major components in the WBM. Adverse environmental effects of OBF coupled with strict government regulations toward the wastage created in the process are anticipated to hinder the market growth. Development of advance boring fluid chemicals, particularly for wells where horizontal boring is required is anticipated to create immense opportunities for the onshore drilling fluids market.

OBF lies on a moderate penetration-low growth rate side. This particular segment is anticipated to witness stagnant growth on account of adverse environmental impact associated with waste discharge. Synthetic-based fluids (SBF) are anticipated to witness moderate growth over the forecast period on account of their ability to provide excellent borehole control, thermal stability, lubricity, and penetration rates, which are beneficial in reducing the overall cost.

Basin Insights

Permian basin is anticipated to emerge as the fastest-growing regional market in the U.S. with a CAGR of 3.4% from over the next eight years. WBF and OBF lubricate the tools and reduce corrosion in reactive formations. Growing concern towards oily drilled cuttings and sampling coupled with environmental impacts associated with waste discharge is expected to drive product demand over the forecast period.

The Eagle Ford Shale contains 5.2 billion barrels of proven oil reserves and 23.7 trillion cubic feet of natural gas reserves, according to the U.S. Energy Information Administration (EIA). The major players involved in the Eagle Ford include EOG Resources.

Many companies are planning to invest in Niobrara operations owing to the lower involvement of companies in the surface of the Niobrara and hydrocarbon-rich shales in the Rockies. For example, ConocoPhillips announced that the company is expected to target a rig to operate in the Niobrara in 2017.

Several companies are working to expose the resources trapped in Niobrara and five major companies stand out as those poised to dominate the Basin. Anadarko Petroleum, one of the five key competitors, has targeted the DJ Basin (Wattenberg Field) and accounted for the production of 356,000 BOE/d and 350,000 of net acres’ surface of Niobrara. The other leading Niobrara shale producers include Noble Energy, Devon Energy, EOG Resources, and Whiting Petroleum.

U.S. Onshore Drilling Fluids Market Share Insights

Drilling mud manufacturers have been adopting various strategies such as new product development, partnerships, agreements, collaborations, and joint ventures. These strategies have been adopted to increase market penetration and cater to changing technological requirements for different end-use sectors in the region. WBF has been extensively used in the oil & gas industry owing to low costs and less environmental impact.

The major players operating in the U.S. drilling mud industry comprise some of the integrated oilfield service provider companies such as Schlumberger, Halliburton, and Baker Hughes. Some of the other prominent players in the U.S. include Hamilton Technologies, Anchor Drilling Fluids, Francis Drilling Fluids, and National Oilwell Varco.

Report Scope

Attribute

Details

The base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

The U.S.

Basin scope

Permian, Eagle Ford, Niobrara, Bakken, Utica, Marcellus

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the U.S. onshore drilling fluids market based on product and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

OBF

-

WBF

-

SBF

-

Others

-

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

OBF Additives

-

Protective chemicals

-

Viscosifiers

-

Fluid Loss Control Additives

-

Dispersants

-

Wetting Agents

-

Weighting Agents

-

Lost circulation materials

-

Thinners

-

Others

-

-

SBF Additives

-

Rheology Modifiers

-

Viscosifiers

-

Fluid Loss Control Additives

-

Protective chemicals

-

Surfactants

-

Thinners

-

Wetting Agents

-

Others

-

-

WBF Additives

-

Weighting Agents

-

Protective chemicals

-

Alkalinity & pH Control Materials

-

Viscosifiers

-

Fluid Loss Control Additives

-

Shale Stabilizers

-

Thinners

-

Lost Circulation Materials

-

Surfactants

-

Defoamers

-

Others

-

-

-

Basin Outlook (Revenue, USD Million, 2014 - 2025)

-

Permian

-

Eagle Ford

-

Niobrara

-

Bakken

-

Utica

-

Marcellus

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."