- Home

- »

- Market Trend Reports

- »

-

Polyurethane (PU) Foam Quarterly Price Forecast, 2024

![Global Polyurethane (PU) Foam Quarterly Price Forecast, 2024 (Q1, Q2, Q3, Q4)Report]()

Global Polyurethane (PU) Foam Quarterly Price Forecast, 2024 (Q1, Q2, Q3, Q4)

- Published: Sep, 2023

- Report ID: GVR-MT-100146

- Format: PDF, Horizon Databook

- Number of Pages: 6

- Report Coverage: 2024 - 2030

Industry Overview

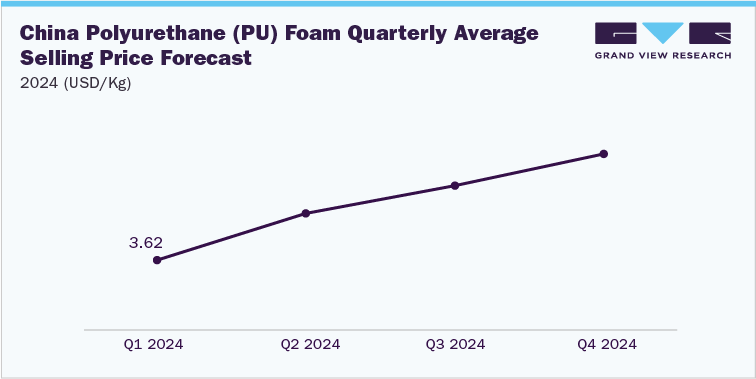

The global polyurethane (PU) foam market is majorly influenced by fluctuations in the prices of toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), which are derived from crude oil. According to the U.S. Energy Information Administration (USEIA), the prices of TDI and MDI are expected to increase as a result of planned production cuts by some of the major oil producers in 2024. This, in turn, is expected to lead to inflation in the prices of PU foam.

Additionally, the coating and construction industry in China are the major demand drivers for PU foam. However, the economic slowdown has impacted the country’s construction industry, hence the demand for PU foam has slightly declined.

Such economic restraints are anticipated to create a sluggish demand for PU foams across the country. However, the Chinese government continues to progress with the completion of the construction of the CSP project with thermal energy storage by 2024, which may generate demand for PU foams across the country, hence affecting price fluctuations.

Polyurethane (PU) foam is manufactured with an amalgamation of isocyanates, namely, Toluene diisocyanate (TDI) and Methylene diphenyl diisocyanate (MDI). The prices of TDI and MDI have a considerable impact on the prices of their end product, and polyurethane foam.

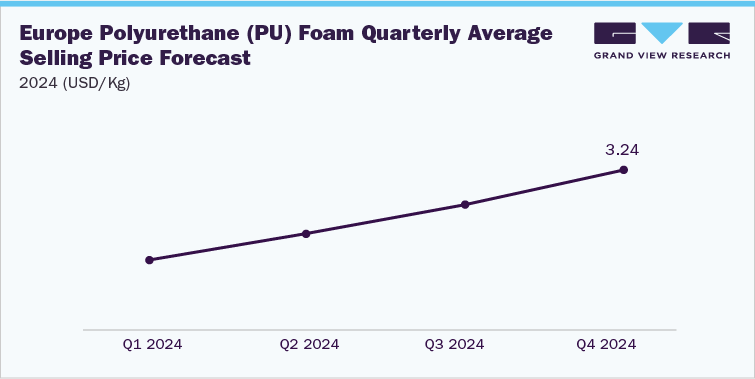

In February 2023, BASF SE, a global TDI manufacturer and supplier, announced the shutdown of its Ludwigshafen-based plant in Germany, due to the high costs of energy and raw materials required to produce TDI, owing to the ongoing Russia-Ukraine implications. The announcement has resulted in a reduced supply of TDI, a major raw material required to produce PU foam, hence pushing the prices upwards. The upward price trend is likely to continue in 2024.

Deliverable Overview

The deliverable consists of a quarterly price trend analysis of Polyurethane (PU) Foam for 2024 (Q1, Q2, Q3, Q4) at global and regional levels.

Scope Details

Attribute

Details

Total number of slides in the analysis

6

List of regions

North America; Europe; Asia Pacific (China & India); Central & South America; and Middle East & Africa

Deliverable format

PDF

Country scope

China and India

Commodity covered

Polyurethane (PU) Foam

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified