- Home

- »

- Reports

- »

-

Electric Vehicle (EV) Battery Supplier Intelligence Report, 2030

![Electric Vehicle (EV) Battery Supplier Intelligence Report, 2030]()

Electric Vehicle Battery Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10508

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Electric Vehicle Battery-Procurement Trends

“Increasing sales of EV passenger cars coupled with strong consumer adoption rates and a growing requirement to reduce carbon footprint are driving the industry’s growth.”

Electric vehicle battery procurement has unlocked opportunities on the back of sustainability trends and demand for supply chain resilience in upstream, midstream, downstream and battery recycling. The global market is poised to grow at a CAGR of 21.1% between 2024 and 2030. The demand for EV batteries has been increasing steadily since 2022 in North America and Europe. Global demand is driven by the need to reduce the impact of climate change through the electrification of transportation and the broader transition to cleaner energy sources. The global demand for EV batteries increased by 65% in 2022, as per IEA 2023 report estimates. By 2030, 40% of the demand for lithium-ion batteries is projected to come from China. The major demand will be for these two major types: Lithium Iron Phosphate (LFP) and Lithium Nickel Manganese Cobalt Oxide (NMC).

The global electric vehicle battery market size was estimated at USD 52.07 billion in 2023. Major OEMs, almost 13 out of 15 companies, announced between 2022 and 2023 that they would ban ICE vehicles sooner to achieve new emission reduction targets. EU’s regulatory “Fit for 55” program, in addition to net-zero emission targets/guidelines, further boosts the demand for robust procurement.

McKinsey's 2023 report estimates that by 2030, the demand for Li-on batteries will grow by 27% per year to reach 4,700 GWh. EU and the U.S. regions are expected to witness the highest growth owing to a general trend of localization of the supply chain. Many European and U.S. companies are exploring new models for the recycling segment. At the same time, many companies in the same region have announced new refining, mining, and cell production projects coupled with factory expansions to meet battery demand.

According to industry experts, in 2023, within the next seven years, many companies are planning to reduce the carbon footprint of battery manufacturing by almost 90%. However, this significantly requires massive changes in the supply chain. The usage of low-carbon power and circular materials are the most efficient decarbonization levers. Recent developments in battery technology include improved cell energy density, novel active material chemistries like solid-state batteries and lithium-sulfur batteries, and systems for producing cells and packaging, such as cell-to-pack design and electrode dry coating.

One of the most significant advances in EV battery technology has been the improvement of battery chemistry. Researchers and engineers are doing constant fine-tuning of lithium-ion batteries’ chemistry to improve efficiency, energy density, and longevity. Silicon anode batteries are also gaining popularity as they can store more energy than graphite anodes. Startup companies such as Sila Nanotechnologies are constantly working to commercialize this silicon anode as it can significantly increase the range of EVs. Battery recycling is also gaining traction and companies such as Tesla and Redwood Materials are exploring new and efficient ways of battery recycling.

Supplier Intelligence

“What is the nature of the electric vehicle battery industry? Who are some of the leading players?”

The industry is moderately consolidated. In essence, the EV market is rapidly expanding, alluding to a growing synergy between OEMs and battery manufacturers to intensify R&D activities in battery technology, develop advanced energy storage systems and foster procurement. Collaborative initiatives in battery development have been prioritized to address the challenges of performance, cost, and safety. Most of the battery manufacturers are looking to scale up their manufacturing facilities; their focus being on gigafactories. Increasingly, vertical integrations are being opted by OEMs and battery suppliers to achieve a competitive edge.

There will be a further push from governments to increase the production of lithium-ion batteries in gigafactories in order to reduce the dependence of their critical industries on foreign energy sources and to ensure domestic energy security. For instance, in October 2022, under the Biden-Harris Administration’s “Bipartisan Infrastructure Law,” it was declared that 20 companies would receive total funding of USD 2.8 billion to develop and expand commercial facilities for large-scale EV battery manufacturing. The facilities, in 12 states of the U.S., would extract and process lithium, graphite, and other battery-related materials and produce new battery components from recycled materials.

The Inflation Reduction Act of 2022 is a major boon to the battery recycling industry. The "Advanced Manufacturing Production Credit" provision in the Act, offers tax credits for ten years to local manufacturers of battery cells and modules. Similarly, in India, as per the Economic Times report in October 2023, the Indian government planned to lower prices and promote the use of EVs by implementing a production-linked incentive (PLI) program for batteries.

Key suppliers covered in the industry:

-

Contemporary Amperex Technology Co., Ltd. (CATL)

-

LG Energy Solution

-

BYD Company Ltd.

-

Panasonic Corporation

-

Samsung SDI Co., Ltd.

-

SK Innovation Co., Ltd.

-

Toshiba Corporation

-

EnerSys, Inc.

-

Mitsubishi Corporation

-

Hitachi, Ltd.

-

Tesla, Inc.

-

Gotion High Tech Co Ltd (Guoxuan High-Tech)

Amidst the prevailing trends, leading EV manufacturers are shifting to local sourcing for faster, simpler and cheaper supply chains. While EV is a new portfolio for OEMs and suppliers, key players, such as LG Energy Solution, CATL, BYD, and Panasonic, contributed 60-70% of the EV battery market share in 2022.

Pricing and Cost Intelligence

“What is the total cost associated with electric vehicle battery production?”

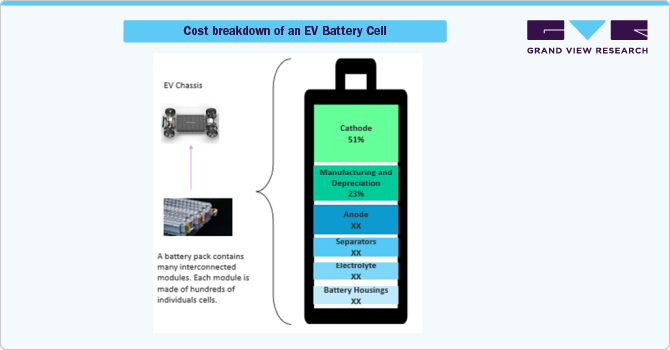

The total cost structure of EV battery production includes components such as raw materials, energy, labor, packaging, depreciation, facilities and utilities, insurance, and marketing. Raw materials form the largest cost component and can account for more than 50% - 60% of the total cost. A number of variables, including the cost of raw materials, production costs, packaging complexity, and supply chain stability, can further affect the total cost of the EV battery pack and influence procurement.

The chemical composition and the metals used are its key components. This is because, for an EV battery cell, the main elements are - cathode, anode, separators, electrolyte, and battery housings. Hence, the contribution of raw materials to overall cost is high but the percentage keeps varying based on the composition and metals used.

If we take a single EV battery cell, the cathode accounts for almost 51% of the total cost followed by manufacturing and depreciation costs at 23%. The mineral compositions used in the cathode are lithium, nickel, cobalt, and manganese. The composition of the cathode is pivotal for the capacity, lifespan, cost, power, and performance of the battery. Similarly, in anode, the standard material used is graphite in most of the lithium-ion batteries.

The chart below illustrates the cost breakdown of an EV battery cell:

Battery cells containing lithium nickel cobalt aluminum oxide (NCA) cost on average USD 120.3 per kilowatt-hour (kWh), while battery cells containing lithium nickel cobalt manganese oxide (NCM) cost on average USD 112.7 per kilowatt-hour (kWh). Compared to NCM and NCA, LFP batteries are less expensive (USD 70 - USD 80 per kWh) to manufacture since they do not include nickel, cobalt, or magnesium. NCA cathodes are more expensive and are predominantly used in high-performance EV models.

Sourcing Intelligence

“What kind of sourcing strategies are considered in EV battery procurement?”

According to the 2023 IEA report, China is the world leader in the manufacturing of EV batteries. China dominates every part of the EV battery supply chain. Around 95% of the LFP batteries, which are used in electric light-duty vehicles, are manufactured in China. In 2023, IEA estimates that almost two-thirds of the world’s EV battery production is in China and the U.S. accounted for a nominal 10% of the total share. In addition, China is the world leader in the processing of rare earth and graphite, two materials required for EV batteries.

Under electric vehicle battery sourcing intelligence, China, Japan, and South Korea are the most preferred countries. In Q3 2023, the top five countries producing the most EV batteries were China, the U.S., Germany, the U.K., and France. China’s production was 16% more in Q3 2023 compared to Q2 2023. It was 30% more compared to Q3 2022. The U.S. produced 9% more in Q3 2023. Compared to Q3 2022, the U.S.’s production was 49% more in 2023 for the same quarter.

“In the approved provider model, the companies choose a specific vendor that meets a predefined set of qualifications, quality standards, prior-proven performances, or other selection criteria.”

The steps required in making and using an EV battery are classified into four general categories - upstream, midstream, downstream, and end-of-life. Raw materials are extracted from mines. Midstream stage consists of refiners and processors who purify the raw materials. Then it is made into cathode and anode. In the downstream stage, battery manufacturers generally assemble the cells into modules and then pack and sell them to automotive manufacturers. Hence, the battery manufacturing process is difficult and expensive.

Tesla is the only company that manufactures batteries in-house without collaborating with external suppliers. However, recently, as a result of the battery manufacturing process, Tesla has been unable to churn out new cars as quickly as people wish to purchase them. The situation is changing now as Tesla, starting in February 2025, will be partnering with an Australian company to provide materials required for lithium-ion batteries. Battery manufacturers and automotive companies are increasingly opting for a hybrid outsourcing model to meet the increasing consumer demand.

Most of the end-user companies adopt an approved provider-operating model. While procuring batteries and selecting EV battery vendors, suppliers are mainly evaluated on battery power, voltage, capacity, and desired performance characteristics. It is also important to ensure the battery chemistry for rugged EV applications or long-distance applications. Furthermore, it is also imperative to check that the manufacturer conforms to the industry's standards and possesses pertinent certifications, including ISO 9001, 14001, UN38.3, and MSDS.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Electric Vehicle Battery Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 21.1% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

15% - 20% (Annually)

Pricing Models

Volume-based, contract-based

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Production capacity, type of battery, battery capacity, propulsion, operational capabilities, quality measures, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution, BYD Company Ltd., Panasonic Corporation, Samsung SDI Co., Ltd., SK Innovation Co., Ltd., Toshiba Corporation, EnerSys, Inc., Mitsubishi Corporation, Hitachi, Ltd., Tesla, Inc., and Gotion High Tech Co Ltd (Guoxuan High-Tech).

Regional Scope

Global

Revenue Forecast in 2030

USD 198.9 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD million and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global electric vehicle battery category size was valued at USD 52.07 billion in 2023 and is estimated to witness a CAGR of 21.1% between 2024 and 2030.

b. Increasing popularity and sales of electric vehicles coupled with a rise in vehicle registration, expansion of charging infrastructure and gigafactories, and a growing requirement for high-performance systems are driving the category growth.

b. According to LCC/BCC analysis, China, South Korea, and Japan are the ideal countries for procuring EV batteries.

b. The electric vehicle battery category is moderately consolidated. Some of the leading players include Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution, BYD Company Ltd., Panasonic Corporation, Samsung SDI Co., Ltd., SK Innovation Co., Ltd., Toshiba Corporation, EnerSys, Inc., Mitsubishi Corporation, Hitachi, Ltd., Tesla, Inc., and Gotion High Tech Co Ltd (Guoxuan High-Tech).

b. The key components for battery manufacturing include raw materials, energy, labor, packaging, depreciation, facilities and utilities, insurance and marketing. For a single EV battery cell, the cost breakdown includes cathode, anode, electrolytes, separators, battery housing, manufacturing, and depreciation.

b. While selecting EV battery vendors, suppliers are mainly evaluated on battery power, voltage, capacity, and desired performance characteristics. It is also important to ensure the battery chemistry for rugged EV applications or long-distance applications. Further, it is also imperative to check that the manufacturer conforms to the industry's standards and possesses pertinent certifications, including ISO 9001, 14001, UN38.3, and MSDS.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified