- Home

- »

- Reports

- »

-

EV Charging Connector Sourcing Intelligence Report, 2030

![EV Charging Connector Sourcing Intelligence Report, 2030]()

Electric Vehicle Charging Connector Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10509

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Electric Vehicle Charging Connector - Procurement Trends

“Rising sales of EVs coupled with a rapid expansion of charging network infrastructure and government investments are driving growth”

Procurement of the electric vehicle charging connector has gained prominence to provide more user-friendly experience and foster decarbonizing in the transportation sector. The global market is expected to grow at a CAGR of 18.09% from 2024 to 2030. The need for quick charging connectors has increased significantly across the globe due to the rising popularity of EVs. In 2022, globally, the number of installed EV chargers (AC and DC) increased to 10 million. The charging infrastructure is expanding rapidly as sales and demand keep increasing for these vehicles. In 2023, 1.2 million EVs were sold in the U.S. EVs constitute almost 7.6% of the total vehicle market in the U.S. as of 2023. In Q4 2023, EV sales increased by 8.1%. Tesla continues to dominate the EV market with 55% of the total share in 2023. These are, in turn, boosting the demand for connectors.

The global electric vehicle charging connector market size was estimated at USD 70.03 million in 2023. One of the critical components of the EV charging infrastructure is its connector, sockets, and plugs used in charging stations. Different stations, depending on the charging level (Level 1, 2, or 3), require different types of connectors. The mainstream charging technology that is currently in use is wired plug-in charging or conductive charging system. Conductive charging can be either direct current (DC) or alternative current (AC). The charging connector can be divided into Type 1 (or J Plug or SAE J1772), Type 2, CCS Type 1, CCS Type 2, CHAdeMO, GB/T, and Tesla connectors. A prominent trend pertains to the standardization of Tesla's charging plug as the industry benchmark in the U.S. In 2023, OEMs such as Ford, General Motors, and Honda announced plans to adopt Tesla’s charging ports for their vehicles. As a result of this, Tesla has been rapidly building their supercharger network to increase its availability at stations for use. By adopting Tesla's charging plug, other automotive manufacturers can significantly increase the number of stations available, thereby bolstering procurement activities.

The expansion of charging networks is driven by the efforts of both governments and private enterprises worldwide. Notably, Asia Pacific accounted for 43% of the global market share in 2023. For instance, India is among the few countries in the world which supports the “EV30@30” program-an aim to have at least 30% of new vehicle sales to be electric by the end of 2030. A robust network of EV charging stations is a prerequisite for supporting this major transition in India. The government has enabled many policies to promote the charging network development. Similarly, the U.S.’s “NEVI Formula Program” and EU’s “Regulation for the Deployment of Alternative Fuels Infrastructure” provide favorable policies and additional investment for expanding charging station infrastructure.

The EV charging segment is constantly evolving with the adoption of new technologies. A few instances include the shift to bidirectional charging and Open Charge Point Protocol (OCPP) 2.0. OCPP 2.0.1 additionally has the ability to support plug-and-charge for electric vehicles that use the ISO 15118 protocol.

Supplier Intelligence

“What is the nature of the electric vehicle charging connector? What is the supplier landscape?”

While the industry is fragmented, the top eight to ten players such as Tesla, ABB, Bosch, Siemens, Schneider, Yazaki, and Sumitomo hold dominant procurement positions in the market with better negotiation power. The supplier landscape consists of fiber optic cable manufacturers and a few automotive companies. Due to the lack of standardization, this market is moving towards more and more fragmentation. There is a rise in many small and mid-sized companies trying to provide EV connectors.

Regionally in China, as per 2022 estimates, TGOOD dominated with 40% of the total BEV charging station sector/market share. In 2022, the top five companies in the charging operations sector were TGOOD (TELD), Star Charge, YKC, State Grid, and Xiaojuchongdian in China. Global and regional suppliers are increasingly expanding their partnerships to widen their global footprint. For instance, Star Charge has formed partnerships with more than 60 OEMs globally such as Porsche, Land Rover, Volkswagen and Mercedes Benz. in 2022. Similarly, in August 2023, Fisker, an EV startup company, entered a partnership agreement with Tesla. As per the deal, Fisker’s customers would be able to access Tesla’s supercharger network by 2025. Fisker’s vehicles would be made with a NACS port for charging starting in 2025.

On a global level, with about 31,000 EV charging outlets and about 3,400 supercharger stations, Tesla is among the leading companies to have one of the largest networks of fast-charging stations. Similarly, ABB is also another widely used brand in the charging segments. In 2021, ABB sold around 460,000 units of EV chargers spanning 88 markets globally. Out of this, 21,000 chargers were DC fast chargers and 440,000 were AC chargers. OEMs and manufacturers are steadily increasing production as demand increases for EV charging stations. The bargaining power of suppliers will remain moderate to low as long as standardization does not come into place. The bargaining power of buyers (end-user companies, OEMs, automotive manufacturers, and consumers) will continue to remain high as a result of fragmentation. However, the power can be limited or reduced depending on the consumers' dependency on a particular type of charging connector. Currently, there are three to four different types of connectors; hence, the threat of substitutes is moderate.

Key suppliers covered in the industry:

-

ABB Ltd.

-

Bosch Automotive Service Solutions LLC.

-

Tesla, Inc.

-

Siemens AG

-

YAZAKI Corporation

-

Sumitomo Electric Industries, Ltd

-

Huber + Suhner AG

-

ITT Cannon Inc.

-

Amphenol Corporation

-

Fujikura Global

-

Aptiv PLC

-

Hirose Electric Co., Ltd

Pricing and Cost Intelligence

“What is the total cost associated with electric vehicle charging connector production?”

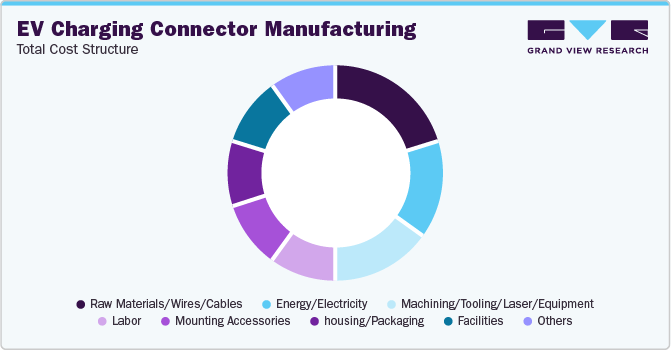

The production of an EV charging connector includes multiple steps such as straightening of wires before being bundled and laser engraved cutting, and stripping the cables and wires to meet standards. Accessories, waterproof rings, and housing are then installed, compressed, and fixed. Finally, tail rings, clips, and tail housings are added. There are two main cost heads-CAPEX (Capital Expenditures) and OPEX (Operating Expenses). Under CAPEX cost, the main components are raw materials/ wires/ cables, machining/tooling/ laser equipment, mounting accessories, housing and packaging, and facilities. It includes mainly the materials related to the body, latch, and contact parts of the connector. Operational expenses costs consist of energy, labor, SG&A expenses, tax, and overheads.

The cost to manufacture a wire or cable can in turn depend on several factors such as the type of metals used-steel or copper-type of wiring, size, and thickness. The major raw materials used are copper, aluminum, steel, thermoplastic polymers, or fiberglass. Hence, fluctuations in the prices of raw materials can significantly impact the total cost structure and procurement.

Copper is a major component used in EV motors, batteries, wiring, and charging stations. In 2023, copper prices in the London Metal increased by 1% - 2%. In September 2023, global copper prices reached USD 8,535 per MT on account of robust demand from China. In August 2023, copper production remained very strong in China, a 36% increase month-on-month from July 2023.

In 2023, on average, the installation cost for EV charging stations is around USD 1,000 - USD 3,000. Cost varies based on region and the type of station requirements. Commercial installation costs for level 2 chargers can start from USD 12,000. Operating an electric vehicle charging unit entails ongoing expenses, such as monthly fees charged by certain manufacturers for utilizing their cloud-based systems. Additionally, some manufacturers may impose charges for allowing others to use the charger in public locations.

Sourcing Intelligence

“What kind of sourcing strategies are considered in this industry?”

Given China's status as the leading global market for EVs, the rapid expansion of the nation's electric vehicle charging industry represents a promising avenue for foreign direct investment. In 2022 and 2023, China witnessed rapid expansion in the EV charger sector fueled by the high adoption of EVs in the nation. The total number of charging infrastructures in China reached 5.21 million units in 2022. By 2023, the number of units increased by 80% - 85%.

China was the largest exporter of electrical connectors globally in 2022 followed by the U.S. The U.S., Hong Kong, Japan, South Korea, Vietnam, Australia, and Germany are the nation's principal partners. According to the Santander Trade 2022 report, electrical and electronic components constitute about 27% of China’s exports. The majority of the world's electrical connector imports come from China, Japan, and Vietnam as per Volza's November 2023 estimates.

The most preferred countries for the procurement of EV charging connectors are China, Japan, South Korea, the U.S., and Germany. Most of the automotive manufacturers or OEMs or EV makers prefer opting for a hybrid outsourcing engagement model with the cable manufacturers. Tesla is the only OEM that has a complete in-house development team with end-to-end facilities. The famous “North American Charging Standard,” or NACS port, was developed as a result of Tesla’s in-house charging technology. Initially, it was exclusively for Tesla, which gave them a competitive edge. However, with the expansion of supercharger networks, NACS is starting to gain traction among other EV makers. Having said that, most of the EV makers have long-term contracts with their approved suppliers such as ABB, Siemens, or Sumitomo. This is because these suppliers specialize in the manufacture of custom EV charging connectors using a range of techniques including metal contact machining, over-molding, and injection molding.

“In a hybrid/bundled outsourcing model, some part of the overall operation is outsourced to third parties. Generally, critical operations are retained in-house”.

Under electric vehicle charging connector sourcing intelligence, the suppliers are evaluated on specified parameters (such as power type/ratings, speed, vehicle type/applications, etc.), adherence to standards, years of experience, and expertise in cable and connector manufacturing. For instance, North America and Japan use mainly Type 1 connectors for EV charging. It is commonly known as J plug connectors. Similarly, Type 2 connectors are predominant in the European Region and are commonly known as “Menneks”. For both type 1 and 2 connectors, it is critical to ensure that manufacturers adhere to IEC 62196 international standards. The standard has been updated to incorporate connectors for plugs, sockets, outlets, vehicle connectors, and vehicle inlets.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Electric Vehicle Charging Connector Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 18.09% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 18% (Annually)

Pricing Models

Cost-plus and time-based, energy-based, fixed rate, and hybrid pricing models

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

By socket type, charging power and time, electric consumption, operational and functional capabilities, quality measures, standards followed, certifications, regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

ABB Ltd., Bosch Automotive Service Solutions LLC., Tesla, Inc., Siemens AG, YAZAKI Corporation, Sumitomo Electric Industries, Ltd, Huber + Suhner AG, ITT Cannon Inc., Amphenol Corporation, Fujikura Global, Aptiv PLC, and Hirose Electric Co., Ltd.

Regional Scope

Global

Revenue Forecast in 2030

USD 224.3 million

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD million and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global electric vehicle charging connector category size was valued at USD 70.03 million in 2023 and is estimated to witness a CAGR of 18.09% from 2024 to 2030.

b. Rising sales and demand for EVs, government initiatives promoting the expansion of charging infrastructure and the shift to cleaner and sustainable transportation solutions are driving the category growth.

b. According to LCC/BCC analysis, China, Japan, South Korea, the U.S., and Germany are the ideal countries for procuring EV charging connectors.

b. The electric vehicle charging connector category is fragmented. Some of the leading players include ABB Ltd., Bosch Automotive Service Solutions LLC., Tesla, Inc., Siemens AG, YAZAKI Corporation, Sumitomo Electric Industries, Ltd, Huber + Suhner AG, ITT Cannon Inc., Amphenol Corporation, Fujikura Global, Aptiv PLC, and Hirose Electric Co., Ltd.

b. There are two main cost heads – capex and operational. Under capex cost, the main components are raw materials/ wires/ cables, machining/tooling/ laser equipment, mounting accessories, housing and packaging, and facilities. Operational costs consist of energy, labor, SG&A expenses, tax, overheads, etc.

b. Under sourcing, the category suppliers are evaluated on specified parameters (such as power type/ratings, speed, vehicle type/applications, etc.), adherence to standards, years of experience, and expertise in cable and connector manufacturing. For both type 1 and 2 connectors, it is critical to ensure that manufacturers adhere to IEC 62196 international standards.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified