- Home

- »

- Reports

- »

-

Lab Chemicals Procurement & Cost Intelligence Report, 2030

![Lab Chemicals Procurement & Cost Intelligence Report, 2030]()

Lab Chemicals Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jan, 2024

- Base Year for Estimate: 2022

- Report ID: GVR-P-10567

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Lab Chemicals Category Overview

“Increasing R&D activities in pharmaceuticals and academic institutions, along with rising focus on green chemistry are accelerating the lab chemicals category’s growth.”

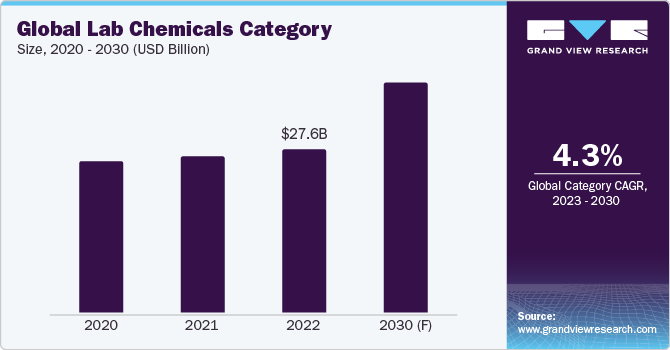

The lab chemicals category is expected to grow at a CAGR of 4.3% from 2023 to 2030. Factors such as the utilization of laboratory chemicals in academic institutions, pharmaceutical research and development (R&D), and healthcare organizations are driving the category’s growth. Additionally, growing awareness about healthcare and environmental concerns, and technological advancements in the industry are also expected to boost the category over the forecast period.

The category has witnessed advancements in compound manufacturing, such as additive technologies, automation, and digitalization. The rising implementation of the Internet of Things (IoT) to capture operational data and streamline the process can help in evaluating material quality. The acquired data through IoT can simulate and predict maintenance requirements to enhance asset life. For instance, through sensor measurements, operators can prevent production losses and unexpected shutdowns due to overheating.

The global lab chemicals category size was estimated at USD 27.6 billion in 2022. AI and machine learning (ML) algorithms can enhance laboratory experiments and clinical trials by generating new biochemical formulation and material combinations. AI can also automate chemical processes by collecting valuable data to advance operational efficiency. Leakages or contamination can be prevented at an early stage using AI solutions.

The rising focus on reducing the impact of hazardous compounds and materials on the environment has resulted in the emergence of green chemistry. This pushes manufacturers to move towards alternative energy resources, enhance waste management, and install recycling technologies to prioritize environmental regulations and sustainability. Rising demand for personalized medicines and advanced diagnostics is driving the growth of specialized compounds. Personalized medicines offer unique and tailored solutions to a specific disease. It can also predict the patient’s likelihood of developing certain illnesses and prevent them before the symptoms develop.

Cloud computing can help laboratories automatically store records associated with chemical discovery, and development through direct data capture (DDC). This system eliminates the task of transferring data between platforms manually and creating duplicate data. Cloud computing tools conduct complex calculations to determine material and compound compatibility. Additionally, cloud-based solutions offer scalability without the need for significant initial investments. Cloud data storage facilitates flexible, secure, and rapid information storage and exchange while decreasing operational expenses and minimizing supply chain risks.

Supplier Intelligence

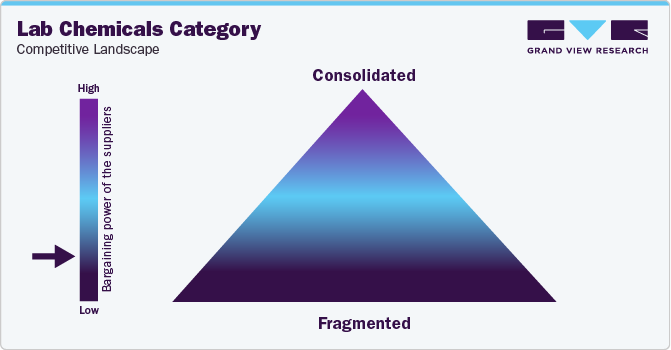

“What are the characteristics of the lab chemicals category?”The global lab chemicals category is fragmented with several key players competing among themselves by carrying out new experiments, quality control activities, studying compound reactions, developing new chemicals, and analyzing biological samples. Manufacturers and suppliers of the category must follow strict guidelines during production and transportation of the compounds to prevent environmental impact. Regulatory bodies such as EPA, OSHA, and FDA govern the usage and sale of chemicals, along with meeting safety standards.

Buyers in the category, such as research institutions, pharmaceutical companies, and educational organizations, often have several options for suppliers of basic chemicals which reduces their dependency on a single supplier. They can easily compare prices and switch suppliers if they find better deals or products. Buyers might also have the power to negotiate due to the availability of alternative products and competitive pricing. Target customers such as academic institutions, healthcare organizations, biotechnology firms, and R&D laboratories heavily rely on laboratories to carry out their experiments and quality control activities.

Key suppliers covered in the category:

-

Thermo Fisher Scientific

-

Avantor

-

Merck Group

-

Thomas Scientific

-

Agilent Technologies

-

Perkin Elmer

-

TCI America

-

BD Biosciences

-

AquaPhoenix Scientific

-

GE Healthcare

- Bio-Rad Laboratories

Pricing and Cost Intelligence

“What are some of the major cost components in lab chemicals? How are these components impacting the category?”

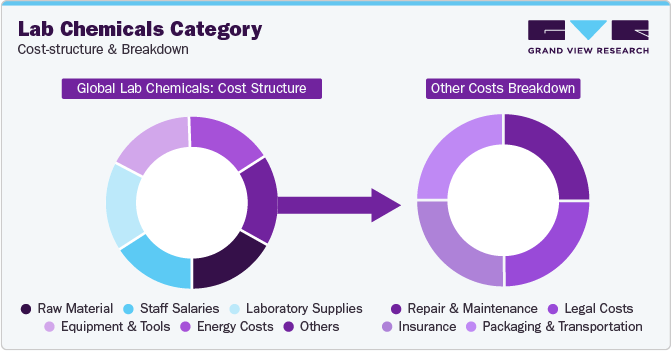

Raw materials, staff salaries, laboratory supplies, equipment and tools, and energy costs are some of the cost components in this category. Other cost considerations include repairs and maintenance, legal costs, insurance, and packaging and transportation. Raw materials, staff salaries, laboratory supplies, and equipment and tools account for a major part of the cost components. Equipment and tools play a crucial role in carrying out research in the laboratories to develop chemicals.

Unlike purchasing equipment, which is a one-time expense, staff salaries are paid regularly, making them a crucial part of the operating expenses. The salaries vary depending on the staff’s skills and experience. For instance, as compared to an entry-level assistant, a qualified and experienced cytotechnologist specializing in cellular anomalies can demand a higher salary. On the other hand, lab equipment regularly requires maintenance throughout its operational span. Maintenance costs can vary depending on the condition of the equipment, the duration of the equipment utilized, and other factors.

The chart below indicates the average salary of technicians in chemical laboratories across various countries:

Average Salary of Chemical Laboratory Technician by Country (USD) (2023)

Country

Salary (USD per annum)

U.S.

51,400

UK

30,076

Japan

25,609

India

3,001

China

-

Russia

-

Salaries of technicians in a chemical laboratory depend on their experiences, qualifications, and lab locations. For instance, in the U.S., the average salary of a lab technician is around USD 51,400 per year. The salary of a lab technician in the U.S. typically ranges from USD 37,000 to USD 70,000 per year. For an entry-level technician, the salary is around USD 37,000 per year. The demand for technician jobs in the U.S. is expected to rise due to the growth of chemical industry resulting in research and development activities of chemicals for drug manufacturing/development.

Similarly, in Japan, the yearly average salary of a technician is USD 25,609. Additionally, they also earn an average bonus of USD 387 each year. In the UK, the technician at a lab earns on average USD 30,076 per year. For entry-level positions, the salary starts at around USD 27,000 each year in the UK. While an experienced worker makes up to USD 37,168 yearly. The salary for such a position is expected to increase due to the rising number of research institutions, and the number of jobs for chemical development-related activities in Japan and the UK.

The report provides a detailed analysis of the cost structure of lab chemicals and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What are some of the best sourcing practices considered for lab chemicals?”

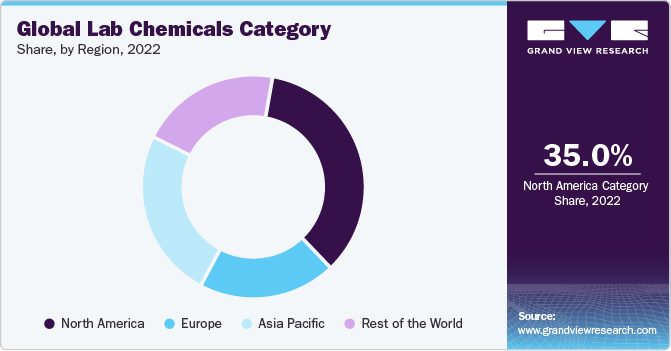

North America dominated the lab chemicals category with a major revenue share in 2022. This is attributed to the U.S., which is the second-largest chemical-producing country in the world. According to a March 2022 report by Cybersecurity & Infrastructure Security Agency (CISA), around 13% of the world’s chemicals come from the U.S. The industry contributes to approximately 25% of the U.S. GDP. The U.S. chemical industry comprises four components, namely, agricultural chemicals, consumer compounds, specialty, and basic chemicals. There are around 11,128 chemical manufacturing facilities across the U.S. as of 2023.

In terms of sourcing lab chemicals, China, India, and Germany are the preferred countries due to cheap labor and low-cost lab equipment. India’s chemical industry is the outperformer in terms of production growth due to rising utilization of compounds in agricultural, and pharmaceutical industries. India plays a key role in both chemical consumption and manufacturing due to rising research in pharmaceutical industries in new drug development. According to the IBEF August 2023 report, India holds 14th position in exports and 8th position in import of chemicals at the global level. Additionally, the Indian industry contributes to 7% of the country’s GDP. The growing chemical industry in the country is expected to boost the demand for the category in India.

China is also one of the major chemical-producing countries that witnessed a growth in production by 6.6% in 2022. China’s industry is expected to grow at 4% - 5% annually due to rising production of chemicals and the pharmaceutical industry. China’s spending on chemical R&D is among the top in the world. Rising drug development, compound testing, and research are expected to further drive the category’s growth.

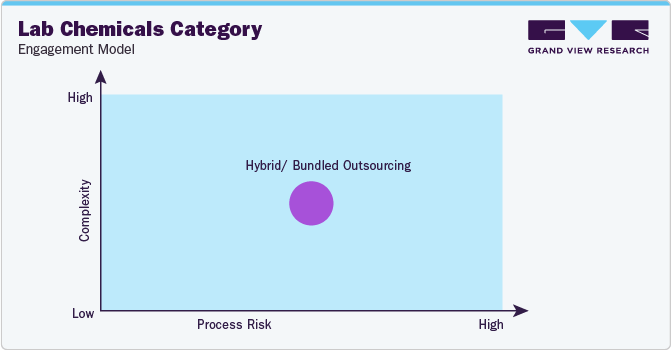

“In the hybrid outsourcing model, suppliers outsource some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client.”

In terms of lab chemicals sourcing intelligence, pharmaceutical companies outsource their analytical testing activities to laboratory chemical companies. These activities include chemical development & testing, quality control, and other activities. Outsourcing can give them a higher quality of test data as testing companies use precise testing equipment. Lab chemical companies such as Thermo Fisher Scientific, Agilent Technologies, Thomas Scientific, and Perkin Elmer have complete testing, research, and development teams. They carry out various activities such as sample collection, acid extraction for testing, molecular diagnostics, molecular detection, and storage through the in-house team.

The most prevalent type of operating model is an approved provider model since businesses in this category are required to follow specific chemical standards because of the interactions of substances during the research process. In this model, category providers must comply with rules and regulations as specified by various government bodies such as EPA, OSHA, and FDA. For instance, the Occupational Safety and Health Administration (OSHA) health standard 1910.1450(a)(2) is required that specifies the limit of employee exposure to hazardous chemicals.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Lab Chemicals Procurement Intelligence Report Scope

Report Attribute

Details

Lab Chemicals Category Growth Rate

CAGR of 4.3% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

5% - 6% (Annually)

Pricing Models

Volume-based pricing, cost plus pricing, value-based pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Product range, purity, and grade, end-to-end services, global reach, regulatory compliance, operational capabilities, quality measures, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Thermo Fisher Scientific, Avantor, Merck Group, Thomas Scientific, Agilent Technologies, Perkin Elmer, TCI America, BD Biosciences, AquaPhoenix Scientific, GE Healthcare, Bio-Rad Laboratories

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 38.7 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global lab chemicals category size was valued at approximately USD 27.6 billion in 2022 and is estimated to witness a CAGR of 4.3% from 2023 to 2030.

b. The rising research and development activities in the pharmaceutical industry and academic institutions, growing focus on sustainable chemical production, and increasing automation in the chemical research process are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis India, China, and Germany are the ideal countries for sourcing lab chemicals.

b. This category is fragmented with the presence of numerous players differentiating themselves by carrying out new research activities, and new chemical development to sustain in the market. Some of the key players are Thermo Fisher Scientific, Avantor, Merck Group, Thomas Scientific, Agilent Technologies, Perkin Elmer, TCI America, BD Biosciences, AquaPhoenix Scientific, GE Healthcare, and Bio-Rad Laboratories.

b. Raw materials, staff salaries, laboratory supplies, equipment and tools, and energy costs are some of the cost components in the category. Other costs include repairs and maintenance, legal costs, insurance, and packaging and transportation.

b. Conducting a thorough needs assessment, evaluating suppliers based on product range and end-use they cater to, checking product grade, purity, production capacity, discounts on bulk quantity purchases, and negotiations of contracts. Other considerations include whether they can offer end-to-end services such as complete chemical development, packaging, and transporting, time taken to research, the firm’s reputation, and experience in the field. Clients also seek whether firms adhere to thorough standards and guidelines of EPA, FDA, OSHA, and other governing bodies.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified