- Home

- »

- Reports

- »

-

Manned Guarding Services Supplier Intelligence Report, 2030

![Manned Guarding Services Supplier Intelligence Report, 2030]()

Manned Guarding Services Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Feb, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10577

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Category Overview

“Rising security concerns in private and public sectors is fueling the category’s growth.”

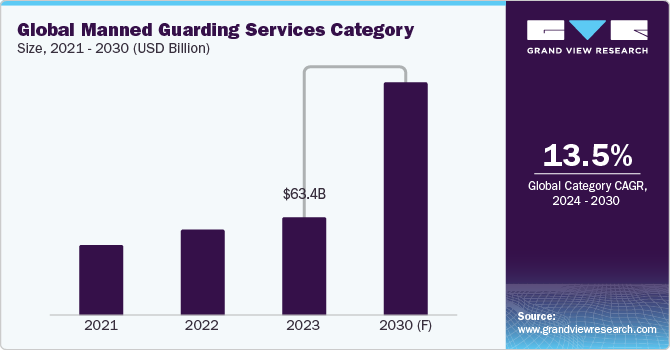

The global manned guarding services category is anticipated to grow at a CAGR of 13.5% from 2024 to 2030. Key factors that are driving the growth of the category include rising concerns about security in private and public sectors, an increase in crime rate in major cities, growing demand for round-the-clock deployment of security personnel and surveillance in commercial & residential complexes, and an upsurge in threat perception for high-profile people. In addition, the rising need for border patrol agents and airport security due to increased globalization and demand for international travel are also fueling the category’s growth. However,the cost of employing and maintaining guards can be rather high, particularly for multinational corporations due to the requirement of adherence to regulations, the high cost of providing training, and other related expenses. This may hinder the category’s growth.

Over the course of the projection timeframe, the service sector will hold the largest share of the category. Services give its clients access to security guards and equipment for a set amount of time.The majority of commercial facilities and residential apartments discover that outsourcing security services is more affordable than maintaining an internal team of security personnel. This spares businesses from getting concerned about the hiring process, providing amenities, and other related concerns that come with employing a full security force, which can be costly.By utilizing the services offered in the category, clients can avoid investing time and resources in training security personnel and can stay current on innovations in the security sector. The service provider can guarantee that cutting-edge security features are supplied in line with client specifications.The equipment segment is anticipated to witness the fastest growth rate as a result of ongoing technological advancements.

The global manned guarding services category was valued at USD 63.4 billion in 2023. Physical security is now more important than ever due to the threat of terrorism and other criminal activity. To safeguard individuals and their belongings, governments and other institutions are spending more money on manned security services. In addition, there is a greater need for services offered in the category as a result of the growing use of technology in security.These days, security personnel are required to monitor and react to alarm systems, security cameras, and access control systems. The enforcement of rules and regulations, such as the General Data Protection Regulation (GDPR) of the European Union, is an important factor propelling the global category.Businesses need to make sure they abide by these laws, which frequently necessitates hiring physical security services. In general, the demand for physical security is expected to fuel the category’s growth.

Technological solutions that are supplementing the growth of the global category, include artificial intelligence (AI), biometrics, drone, mobile-supported security, and analytics. Surveillance systems driven by artificial intelligence have the ability to identify people with high warrants or criminal records, monitor huge gatherings, and recognize anomalous behavior. These technologies can add an extra degree of security by collaborating with manned security services. Although manned security services are majorly provided by humans but in the future, service delivery will be altered by the use of robotics and artificial intelligence. In addition, biometric solutions such as iris scanning, fingerprint scanning, facial recognition are all being utilized to improve security in variety of contexts. The technology can be used to confirm people's identities in high-security zones, manage building access, and monitor worker attendance.

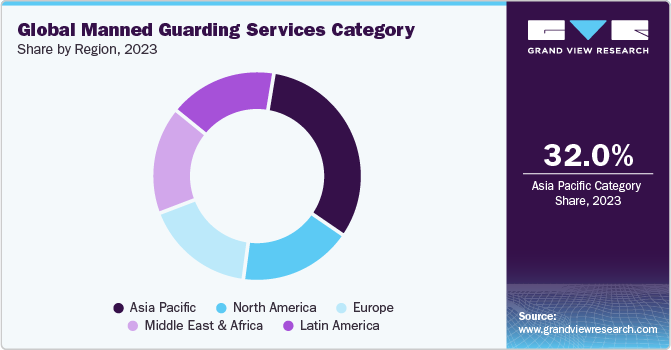

Asia Pacific dominates the global category, accounting for a substantial market share. The growth of the region can be attributed to rising standards of living, urbanization, and population. In addition, the region's expanding tourism industry, coupled with political and economic stability, is also propelling the category's expansion. the businesses in this region are spending more money on security services to safeguard their employees and property and ensure local laws are followed. North America, on the other hand, is anticipated to witness the fastest growth rate owing to factors such as a growth in the number of enterprises requiring protection, a rise in the demand for security services, and a growing understanding of the necessity for security in the region. The rising adoption of technology in security services, such as CCTV and access control systems, is another factor driving the industry’s growth.

Supplier Intelligence

“What best describes the nature of the manned guarding services category? Who are some of the main participants?”

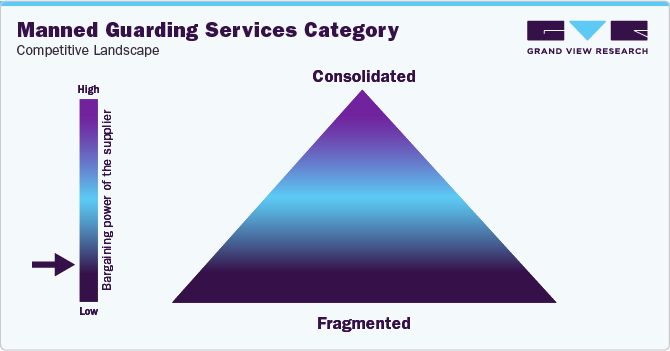

The global manned guarding services category exhibits a fragmented landscape, with the presence of a large number of global and regional market players having intense competition.The key players are making significant investments in research & development (R&D) to broaden their product offerings, further contributing to the category’s growth.In addition, the players are engaging in a range of strategic endeavors aimed at broadening their global reach. Notable developments in the category include the introduction of new products, agreements under contracts, mergers and acquisitions, increased investments, and cooperation with other entities. For instance, in mid-2022,Transguard Group LLC (UAE-based service provider), announced the strengthening of its collaboration with a UAE-based airline by adding ‘check-in’ agents.

The bargaining power of suppliers in the category is anticipated to stay moderate due to the existence of large service providers with strong networks along with several other local and regional players.Buyers will probably always have a strong negotiating position because there are so many large and small players in the industry which will enable them to move to different players based on the pricing and service quality. In addition, the category is anticipated to remain relatively safe from new entrants because of the high initial investment requirements, lengthy contracts, and strict licensing procedures. Furthermore, the existence of major competitors with a well-established clientele and robust distribution system will deter new entrants.

Key suppliers covered in the category:

-

Allied Universal Security Services LLC

-

Axis International Security Services Limited

-

Corps Security (UK) Ltd.

-

G4S Limited

-

Guardian Protection Services Limited

-

Gurkha Security Services Ltd.

-

ICTS Europe S.A.

-

Mitie Group plc

-

Prosegur Compañía De Seguridad, S.A.

-

Securitas AB

-

Security and Intelligence Services Ltd.

-

Transguard Group LLC

Pricing and Cost Intelligence

“What is the cost structure for manned guarding services? What variables affect the prices?”

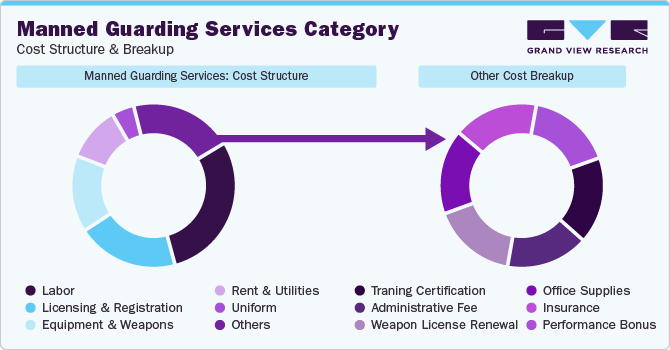

The cost structure of the global manned guarding services category is constituted by labor, licensing & registration, equipment & weapons, rent & utilities, uniforms, and others.Other costs can be further divided into training certification, administrative fees, weapon license renewal, office supplies, insurance, and performance bonuses. Labor holds the largest chunk of the overall cost components as the category is labor-intensive and the services offered in the category rest on the security personnel who deliver their services as per the requirements of the client.Hiring and retaining security personnel has become unaffordable in many markets. Consequently, a great deal of security firms have started searching for methods to save personnel expenses without compromising on output and quality.

Key factors that influence the charges for the services offered in the category include armed/unarmed personnel, number of security personnels required, location, time of the day, experience, and level of training.The service provider will charge higher fees for armed security personnel as they undergo additional training because they need to be capable of handling firearms, hence, turning them costlier in comparison to unarmed personnel. In addition, a higher number of security personnel deployed will lead to higher charges. It is recommended to have a thorough discussion with the service provider to understand the requirement based on the number of entry points, access to visitors, cameras deployed, etc. Furthermore, the cost of hiring security personnel is significantly influenced by their degree of training.

The prominent pricing model followed in the industry is per-hour / hourly pricing wherein the price charged is based on the number of hours a service is required to be delivered.Depending on the requirement, employing a security guard might cost anywhere between USD 21.5 per hour to USD 99.5 per hour on average. For instance,the prices will be lower if a guard is required to keep an eye out for potential shoplifters at a retail location. On the other hand, if an executive needs full-time, personal protection, the price each day may reach over USD 1,490.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do manned guarding services engage? What is the type of engagement model?”

In terms of global manned guarding services category sourcing intelligence, buyers in the industry follow a full-services outsourcing model to engage with their service providers. It can be difficult to put together an internal security team. It could be a case wherein salaries offered to those security guards by businesses can be incompetent, or they may not be able to provide the necessary services. People differ in their level of security expertise, which can make it challenging to put up a well-rounded team. Completely outsourcing the security requirements to a third-party service provider enables a business with a skilled team of security personnels.The competent employees of third-party security firms can design the ideal strategy for a business enterprise. They have the ability to tailor a plan of action for any size of property or business, regardless of the degree of threat. The requirements for security are extensive and difficult to manage internally and outsourcing leads to a high caliber of expertise.

In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.

In terms of operating model, buyers in the category typically select an approved service provider, who meets a predefined set of qualifications, quality standards, prior-proven performances, or other selection criteria. An approved service provider is the one who has already delivered its services to the buyer in the past and has met the expectations. Selecting an approved provider not only saves time from conducting thorough research and comparing different service providers on different parameters but also enables the buyers to get a better deal since in terms of pricing as a service provider would never want to lose an old client because it will affect its goodwill. In addition, the buyers also get the flexibility to get their service requirements customized as per their needs. Furthermore, since the services offered in the category are majorly executed by the deployment of physical security personnel, working with the personnel who have already delivered their service in the past leads to better client satisfaction.

India is one of the preferred low-cost/best-cost countries for sourcing manned guarding services. Businesses prefer India for a variety of reasons, such as lower costs, easier access to a workforce with education and experience, benefits from a different time zone, scalability, and an extensive array of services. The manned security sector in the nation is known for providing high-quality services at affordable prices.The country is known to offer the cheapest labor for any industry and security services is one such. Many global businesses have established their facilities in India because of the benefits such as adequate and economic labor support, favorable government initiatives, etc. The market in India is currently fragmented, but with the passage of the Private Security Agencies Regulation Act (PSARA) in several states and the rise of organized play in user industry segments, it is anticipated to become more structured.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Manned Guarding Services Category Procurement Intelligence Report Scope

Report Attribute

Details

Manned Guarding Services Category Growth Rate

CAGR of 13.5% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Per-hour Pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Geographical service provision, years in service, employee strength, industries served, revenue generated, certifications, daily escort, VIP escort, static guarding, mobile patrolling, alarm response, technology support, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Allied Universal Security Services LLC, Axis International Security Services Limited, Corps Security (UK) Ltd., G4S Limited, Guardian Protection Services Limited, Gurkha Security Services Ltd., ICTS Europe S.A., Mitie Group plc, Prosegur Compañía De Seguridad, S.A., Securitas AB, Security and Intelligence Services Ltd., and Transguard Group LLC

Regional Scope

Global

Revenue Forecast in 2030

USD 153.9 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global manned guarding services category size was valued at approximately USD 63.4 billion in 2023 and is estimated to witness a CAGR of 13.5% from 2024 to 2030.

b. Rising concerns pertaining to security in private and public sectors, increase in rate of crime in major cities, growing demand for round-the-clock deployment of security personnel and surveillance in commercial & residential complexes, and an upsurge in threat perception for high-profile people are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and China are the ideal destinations for sourcing manned guarding services.

b. This category exhibits a fragmented landscape with intense competition. Some of the key players are Allied Universal Security Services LLC, Axis International Security Services Limited, Corps Security (UK) Ltd., G4S Limited, Guardian Protection Services Limited, Gurkha Security Services Ltd., ICTS Europe S.A., Mitie Group plc, Prosegur Compañía De Seguridad, S.A., Securitas AB, Security and Intelligence Services Ltd., and Transguard Group LLC.

b. Labor, licensing & registration, equipment & weapons, rent & utilities, uniform, and others are the major cost components of this category. Other costs can be further bifurcated into training certification, administrative fee, weapon license renewal, office supplies, insurance, and performance bonus.

b. Reviewing the type of services that are on offer by the service provider, assessing the technological capabilities of a service provider, comparing the prices charged by different service provider, and examining the regulatory certifications of a service provider are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified