- Home

- »

- Reports

- »

-

Natural Gas Procurement & Sourcing Intelligence Report, 2030

![Natural Gas Procurement & Sourcing Intelligence Report, 2030]()

Natural Gas Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Apr, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10585

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Natural Gas - Procurement Trends

“The rising consumption in the emerging nations and the high demand from industrial and power generation sectors are driving the market growth.”

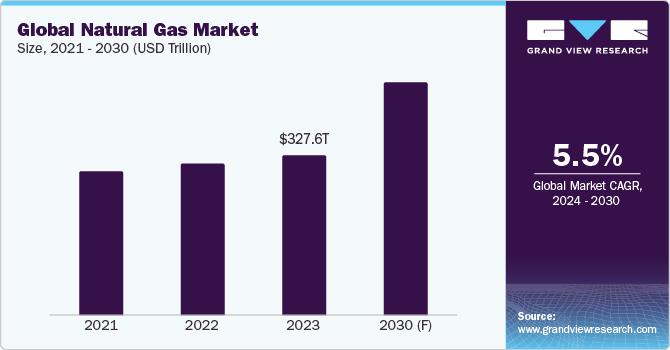

The sourcing and procurement of natural gas, LNG, or re-gasified LNG is a vital activity in large hydrocarbon-based sectors including refineries and gas processing facilities, and petrochemicals. The market is expected to grow at a CAGR of 5.5% from 2024 to 2030. One of the major components of the energy industry is natural gas. In 2023, gas demand increased by a nominal 0.5% worldwide. This was because the growth in North America, Africa, China, and the Middle East was somewhat balanced by the decline in other countries or regions. As per IEA 2024 estimates, the demand for gas is expected to increase by 2.5%. There is a heightened demand for heating in the U.S. due to expectations of cooler or milder temperatures in 2024. As a result, space heating demand, and in turn, natural gas, is going to rise quickly in the commercial and residential sectors. The steady growth in global energy demand, increasing consumption by emerging economies, and anticipation of colder weather conditions in the U.S. are driving the growth of this industry.

On the other hand, the demand for this category in India is expected to increase by 6% in 2024. This can be attributed to increasing consumption in industrial sectors, power generation, and fertilizer units. Further, the development of the country’s pipeline grid and city gas infrastructure is boosting the demand. Commodity supply in the nation rose by 5% in 2023. The major drivers of growth are refinery and industrial segments, petrochemicals, and power generation.

The global natural gas market size was estimated at USD 327.58 trillion in 2023. Geopolitical uncertainties and growing concerns about output and supply glut are two of the greatest risk factors for the global market in 2024. The unexpected storage withdrawal (almost 87 billion cubic feet of this energy commodity, as per EIA) by the U.S. utilities during the third week of December 2023, also influenced the short-term market conditions. Ample commodity supplies in the European region in February 2024 coupled with favorable weather conditions impacted its futures prices negatively.

Integrated oil and gas companies are actively seeking ways to improve operational efficiency with the help of the latest technologies such as AI/ML, IoT, and IIoT. A few examples include the implementation of sensors in wells and pressure control safety devices for real-time data collection, automation controls, and remote monitoring for maintenance checkups and upkeep. Then, with the increasing focus on renewable energy, renewable natural gas (RNG) is also gaining a lot of traction. According to Deloitte, in 2024, RNG can play a major role in the public gas utilities (PGU) sector as many waste facilities are strategically collaborating with PGUs to support energy security and carbon reduction efforts. RNGs are expected to be a critical component in meeting clean heat standards as they continue to emerge at the state level.

Supplier Intelligence

“What is the supplier landscape of the natural gas industry? How is the competitive rivalry between players?”

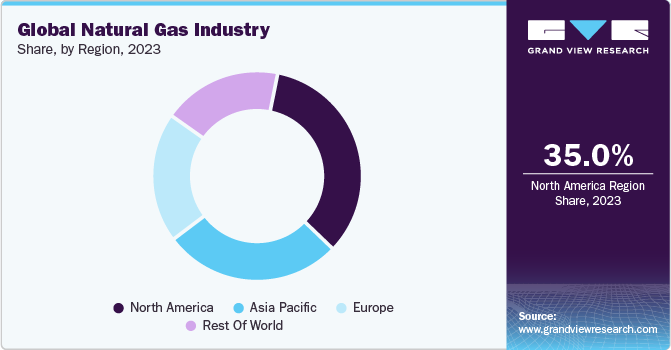

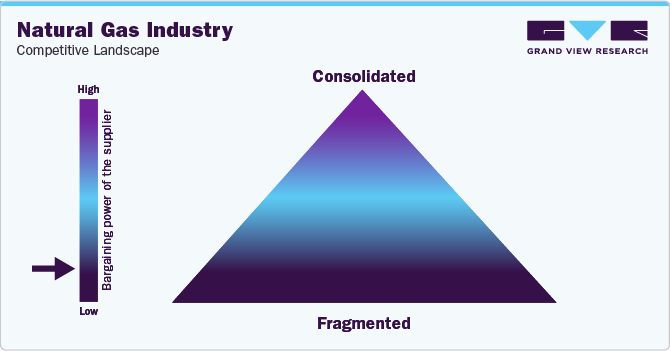

This industry is fragmented globally. This is because the companies have a high reliance on pipeline infrastructure, which prohibits cross-regional arbitrages. Most of the world's largest natural gas producers are global energy conglomerates with global oil and gas operations that encompass the upstream and downstream value chain. Since most energy companies are diversified across a wide variety of business sectors, the largest energy companies are also some of the largest oil companies. In this industry, procurement is mainly about risk allocation between suppliers and the end-users as no single strategy works favorably to protect the interests of the organization. This is mainly due to the complex nature of the sector. The top ten category producers worldwide are from the U.S., Russia, China, the UK, the Netherlands, and France. Two Chinese companies appear on the list of the top ten gas producers - China National Petroleum and Sinopec. At present, only 25% of the global gas markets are integrated.

As per IMF’s 2022 report, the total global energy investment decreased due to two main reasons. First, a significant number of companies or producers have recently reduced their oil and gas investments as a result of the clean energy transformation as they move away from fossil fuels steadily. At the same time, decreasing investments in the renewable energy sectors (mainly due to funding or cost problems in solar and wind sectors) in the U.S. markets contributed to the total decline in energy investment.

The top fifteen companies hold relatively substantial bargaining power compared to other fragmented players across the world. Competitiveness in the oil and energy industry, and particularly in the upstream sector, is extremely high. There are three major divisions-the upstream, midstream, and downstream sectors. In the upstream sector, the supplier landscape consists of the big integrated players (for instance, Exxon, Total, Chevron, etc.), private energy and oil companies that operate only in the upstream sector of this industry (which are involved in exploration and production-such as ConocoPhillips Company), and the last group includes a few handful of companies that control more than 80% of oil and gas reserves (for instance, Sinopec, Gazprom, Aramco, etc.). The requirement of huge initial capital, high internal competition within the industry, and national or international law restrictions are the major barriers to entry. The presence of alternatives like nuclear energy, hydrogen, and biofuels increases the threat of substitutes.

Key suppliers covered in the industry:

-

PJSC Gazprom

-

China National Petroleum Corporation (CNPC)

-

China Petroleum & Chemical Corporation, (or Sinopec)

-

ExxonMobil Corporation

-

BP p.l.c.

-

Chevron Corporation

-

Shell plc

-

TotalEnergies SE

-

Saudi Arabian Oil Group (or, Aramco)

-

Eni S.p.A.

-

PJSC Rosneft Oil Company

-

Petróleo Brasileiro S.A

-

Equinor ASA

-

ConocoPhillips Company

Pricing and Cost Intelligence

“What are some of the key components in production? Name a few factors that may influence the prices of natural gas.”

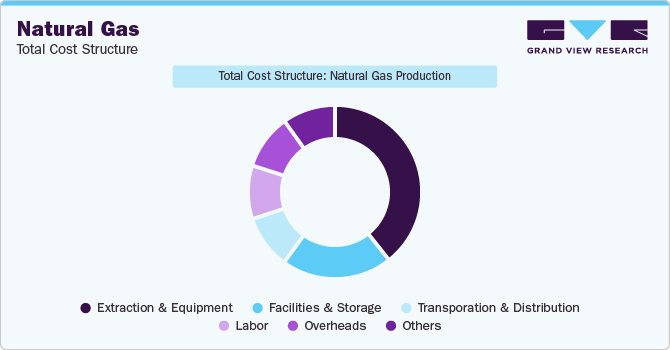

The major steps of this energy commodity production include extraction and planning, separation and removal, compression, storage, and transportation. The largest compound is predominantly methane, but natural gas also contains small amounts of nitrogen, helium, water vapor, CO2, butane, alkanes, propane, etc. The key cost components are extraction and equipment, facilities and storage, transportation and distribution, labor, and overheads. Other costs can include depreciation, insurance, and taxes. The majority of extractions occur in reserves located deep within the earth. They are often near solid or liquid hydrocarbon beds, such as coal or crude oil deposits. Hence, fluctuations in the prices of crude oil or coal can have a high impact on the total costs. Generally, prices are determined by two factors: commodity prices and basis prices. The commodity price is calculated using the NYMEX Henry Hub futures prices. The basis pricing includes storage, fuel, local production, and transportation costs. Fixed and floating pricing - are the most common pricing models in this industry. The retail prices for the commodity vary across states and cities. The variance can be because of the following six reasons-distance from the production site, availability and transmission pipeline capacity and storing hubs, volume and technical specifications of the commodity, cost share, state regulations, and competitiveness of suppliers around.

The chart below shows an overview of the total cost structure of the commodity’s production:

Apart from supply, demand, and weather factors influencing prices, competition with other fuels may also impact the final commodity prices to a large extent. For instance, large fuel-consuming companies in production facilities across sectors such as power plants, paper mills, and iron and steel can transition between coal, natural gas, and petroleum, depending on the relative cost of each fuel. Demand for natural gas may decline when the cost of competing fuels falls, thereby lowering prices.

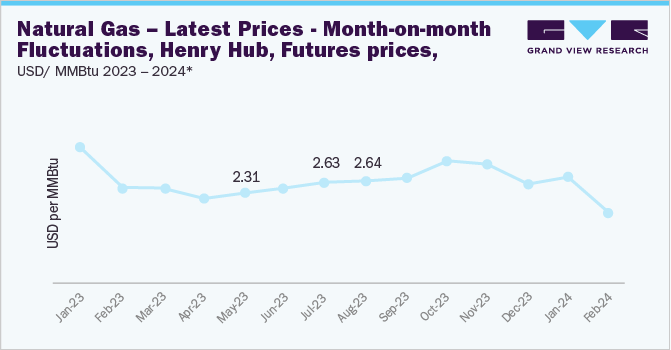

The chart below shows the month-on-month fluctuations in the commodity’s futures prices from 2023 to 2024*(Till February 2024).

As per EIA reports, at the end of February 2024, the U.S. natural gas futures market observed a bearish momentum due to a mix of weather conditions and energy production trends. In January and February 2024, the commodity futures price averaged around USD 2.71 and USD 1.79 per MMBtu, respectively. The U.S. commodity futures prices increased by 3% on February 29, 2024, after reaching a four-year low. This rebound can be attributed to a surge in European demand and higher temperatures in the southern U.S. parts, which increased cooling demand. Regardless, commodity prices have decreased by more than 30% since the start of 2023. In January 2024, the global monthly index of natural gas reached 153.39. The Dutch TTF benchmark for European gas prices decreased sharply in February 2024. Prices fell below EUR 25 per MWh, which is almost a 50% drop from February 2023. The low demand is a result of mild winter, particularly in Germany and France. One of the key factors for this sharp decline in European gas prices is the remarkable performance of renewable energy and nuclear power generation.

On the other hand, the demand for LNG globally is anticipated to increase, mainly driven by the European and Chinese markets. As per EIA, the short-term outlook for this commodity is still bearish with continued volatility amid high demand and ample supply exerting downward pressure on prices.

Sourcing Intelligence

“Who are the largest consumers and producers of this commodity? What are some of the sourcing strategies followed by companies?”

In terms of commodity production and consumption, the U.S. is the leading country followed by Russia and China. In December 2023, product consumption in the U.S. increased by 9.5% from December 2022. In 2023, production in North America reached 1.28 trillion cubic meters. In 2022, global natural gas production remained steady at 4.09 trillion cubic meters. However, the production in Russia decreased by 12% in 2022 due to a reduction in exports to Europe. Although the nation is the second largest commodity producer in the world, the EU plans to gradually phase out Russia-sourced natural gas by 2027. This is mainly due to the Russia-Ukraine war tensions in Europe. Russia’s natural gas export market is supported by China and India, in recent times. Some of the most preferred countries for sourcing and procurement are China, the U.S., Qatar, Iran, and Saudi Arabia.

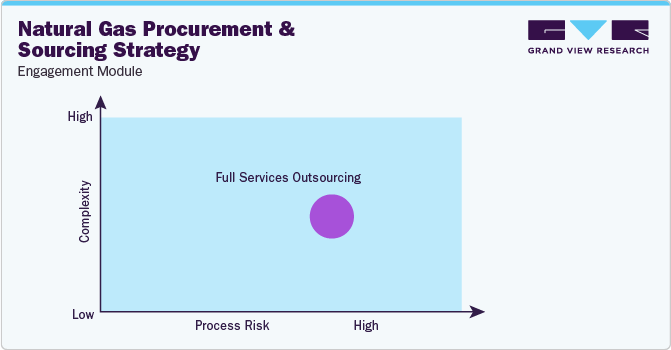

The major end-user industries include pharmaceuticals; petrochemicals; residential, industrial, and commercial sectors; and electricity generation entities. Companies across these sectors mainly outsource their commodity production requirements to their approved providers. One such instance is that many pharmaceutical firms have substantial challenges in implementing highly dependable energy solutions in their research and manufacturing facilities. Thus, in an effort to reduce costs and improve efficiencies, the most adopted engagement model is fully outsourced. Most of the companies, on average, have established long-term contracts with the vendors.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Under natural gas procurement intelligence, companies select vendors based on multiple specifications. Some of them include-cost per cubic meter or feet, pricing plans-fixed or variable, the size and diversification of its fuel base (for instance, hydrocarbon resource base), integration in operations, presence and operations in countries as per client’s target locations and other sustainable factors (for instance, technologies used, worker’s safety, reliability and lead/delivery times, quality, capacity, environmental competencies, etc.).

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). The extraction of this commodity is a significant expense for companies due to the use of high-pressure surface or processing equipment, making it of vital importance in this industry. Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Natural Gas Procurement Intelligence Report Scope

Report Attribute

Details

Natural Gas Market Growth Rate

CAGR of 5.5% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

12% - 18% (Annually)

Pricing Models

Contract-based, spot-price, and volume-based

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Production capacity, type of gas (dry or LNG), quality and grade of product, distribution and transportation options, technical specifications, and other operational and functional capabilities

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

PJSC Gazprom; China National Petroleum Corporation (CNPC); China Petroleum & Chemical Corporation; (or Sinopec), ExxonMobil Corporation; BP p.l.c.; Chevron Corporation; Shell plc; TotalEnergies SE; Saudi Arabian Oil Group (or, Aramco); Eni S.p.A.; PJSC Rosneft Oil Company; Petróleo Brasileiro S.A; Equinor ASA; ConocoPhillips Company

Regional Scope

Global

Revenue Forecast in 2030

USD 476.5 trillion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD trillion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. Factors such as the steady growth in global demand and increasing commercial and industrial power and electricity consumption are driving the industry growth.

b. According to LCC/BCC analysis, China, the U.S., Qatar, Iran, and Saudi Arabia are some of the ideal countries for sourcing natural gas.

b. The natural gas industry is fragmented. Some of the leading players include PJSC Gazprom, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation, (or Sinopec), ExxonMobil Corporation, BP p.l.c., Chevron Corporation, Shell plc, TotalEnergies SE, Saudi Arabian Oil Group (or, Aramco), Eni S.p.A., PJSC Rosneft Oil Company, Petróleo Brasileiro S.A, Equinor ASA, and ConocoPhillips Company.

b. The key cost components are extraction and equipment, facilities and storage, transportation and distribution, labor, and overheads. Other costs can include depreciation, insurance, tax, etc.

b. As part of their procurement strategy, companies select the vendors based on multiple specifications. Some of them include – cost per cubic meter or feet, pricing plans – fixed or variable, the size and diversification of its fuel base – (for instance, hydrocarbon resource base), integration in operations, presence and operations in countries as per client’s target locations and other sustainable factors (for instance, technologies used, worker’s safety, reliability and lead/delivery times, quality, capacity, environmental competencies, etc.).

b. The global natural gas market size was valued at USD 327.58 trillion in 2023 and is estimated to witness a CAGR of 5.5% from 2024 to 2030.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified