- Home

- »

- Sector Reports

- »

-

Healthcare 3D Printing Industry Overview Data Book, 2030

Database Overview

Grand View Research’s healthcare 3D printing industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 3 reports and one sector report overview:

Healthcare 3D Printing Industry Data Book Scope

Attributes

Details

Areas of Research

- Healthcare Additive Manufacturing Market

- 3D Bioprinting Market

- 3D Printed Drugs Market

Number of Reports/Presentations in the bundle

- 3 Individual Reports - PDFs

- 3 Individual Reports - Excel

- 1 Data book - Excel

Country Coverage

25+ Countries

Cumulative Coverage of Products

30+ Companies and respective product benchmarking

Highlights of Datasets

- End-use Revenue, by Countries

- Competitive Landscape

- Regulatory and Reimbursement Guidelines, by Countries

Total number of tables (Excel) in the bundle

162

Total number of figures in the bundle

184

Healthcare 3D Printing Industry Data Book Coverage Snapshot

Markets Covered

Healthcare 3D Printing Industry

USD 9.4 billion in 2022

17.0% CAGR (2023-2030)

Healthcare Additive Manufacturing Market Size

USD 7.4 billion in 2022

18.1% CAGR (2023-2030)

3D Bioprinting Market Size

USD 2.0 billion in 2022

12.48% CAGR (2023-2030)

3D Printed Drugs Market Size

USD 86.2 million in 2022

14.78% CAGR (2023-2030)

Healthcare 3D Printing Sector Outlook

The healthcare 3D printing industry was valued at USD 9.4 billion in 2022 and is estimated to witness a CAGR of 17.0% over the forecast period. Factors like the shortage of available organs for transplantation globally and the emergence of digital healthcare are expected to drive the market over the forecast period.

The healthcare 3D printing sector is expected to witness significant growth, owing to the intervention of government for improving healthcare infrastructure and increasing investments in the R&D sector. In addition, healthcare professionals increasingly explore 3D printing because it reduces the risks associated with anesthesia during long surgeries and improves healthcare.

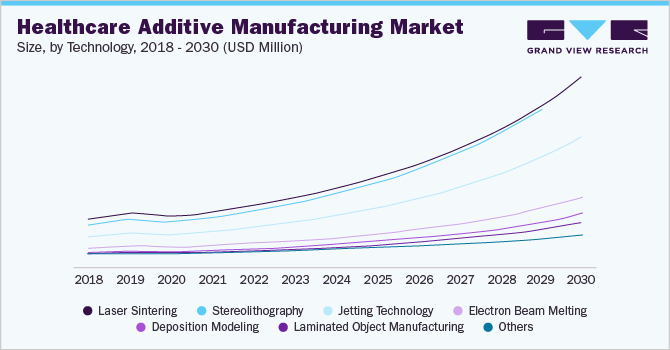

Healthcare Additive Manufacturing Market Analysis And Forecast

The global healthcare additive manufacturing market size was estimated at USD 7.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 18.1% from 2023 to 2030. The growing demand for customized medical and dental additives, including personalized implants, medical models, orthodontic appliances, splints, dental models, and others, is expected to drive the market's growth over the forecast period.

In healthcare, the requirement of every patient is unique, which has led to the high potential of additive manufacturing for customized and personalized medical applications. Moreover, the rising initiatives by the organization and the government to support small and medium-sized companies are expected to propel growth. For instance, in May 2022, U.S. President Joe Biden launched Additive Manufacturing Forward by joining five leading manufacturers in the U.S. to aid small-sized suppliers based in the U.S. to increase the utilization of additive manufacturing.

Healthcare Additive Manufacturing Market: Key Technology Segments

Laser Sintering

CAGR 16.7% (2023-2030)

Stereolithography

CAGR 18.4% (2023-2030)

Jetting Technology

CAGR 18.6% (2023-2030)

Electron Beam Melting

CAGR 18.9% (2023-2030)

Deposition Modeling

CAGR 20.4% (2023-2030)

Laminated Object Manufacturing

CAGR 20.1% (2023-2030)

Others

CAGR 14.7% (2023-2030)

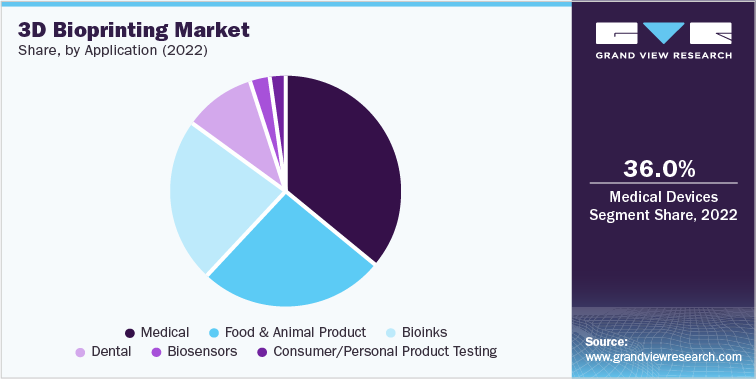

3D Bioprinting Market Analysis And Forecast

The global 3D bioprinting market size was valued at USD 2.0 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.48% from 2023 to 2030. The market is driven by the global organ donation shortage and utilization and demand for 3D Bioprinting to reduce animal testing of chemical, cosmetic, and pharmaceutical products. According to the organdonor.gov by the Health Resources and Services Administration, as of January 2023, around 104,234 individuals in the U.S. were waiting for organ transplantation list in the U.S. and around 88,901 individuals among them were waiting for kidney transplantation. Moreover, 3D Bioprinting is increasingly used as an alternative to animal experimentation in biomedical research. For instance, in February 2022, Bioprinting by light-sheet lithography: engineering of complex tissues with high resolution at a high-speed project (BRIGHTER Project) collaborated with the Institute of Bioengineering of Catalonia (IBEC) in the development of technology for the production of functional human tissues to replace animal testing.

3D Printed Drugs Market Analysis And Forecast

The global 3D printed drugs market size was valued at USD 86.2 million in 2022 and is expected to expand at a CAGR of 14.78% from 2023 to 2030. The rising demand for personalized medicine and the growing adoption of R&D activities for the adoption of 3D printing in drug manufacturing is expected to drive the market growth during the forecast period. 3D printed drugs can manufacture tailored dosages and significantly reduce the cost of the products; hence, many pharmaceutical corporations are adopting this technology to innovate the products. For instance, in February 2020, Merck collaborated with AMCM to develop and produce GMP tablet formulation by 3D printing technology for clinical trials and commercial manufacturing services.

3D Printed Drugs Market: Key Players

FabRx Ltd

Merck

Aprecia

Extend Biosciences

Bioduro

Affinity Therapeutics

Osmotica Pharmaceuticals

Aprecia Pharmaceuticals LLC

GlaxoSmithKline Plc

Competitive Insights

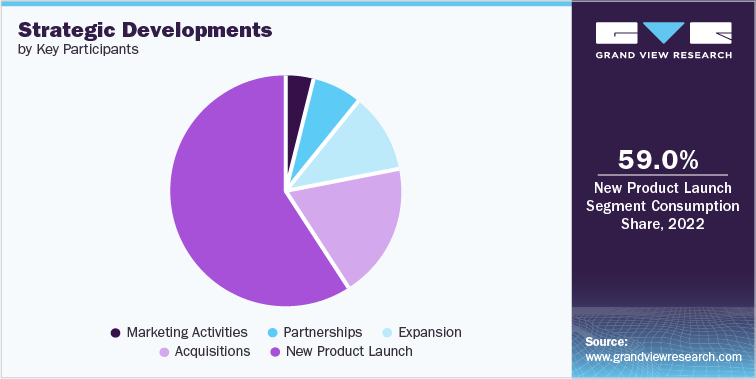

The market is moderately consolidated and competitive, with the key companies holding the majority of the shares. The companies have a vast range of products in several categories, which are designed keeping in mind the diverse demands of the patients, with variations in each category and demand for customized products. With the launch of new products and geographic expansion, these companies have established a significant presence in the market. These companies are constantly innovating to launch advanced and customized products through their state-of-the-art facilities. For instance, in January 2023, Axial3D opened a medical 3D printing facility in Northern Ireland to advance the application of 3D printing for medical device manufacturers, hospitals, and medical research organizations.

This section in the final deliverables also highlights various initiatives taken by the key companies in the recent past that strongly impacts this market space. The below figure represents the various strategic developments initiated by these market participants:

Key Drivers

-

Rising adoption of technologically advanced products in the healthcare industry

-

Rising demand for the customized and personalized products

-

Increasing R&D investment by the research institutions in 3D printing technology in the healthcare industry

-

Growing incidence of chronic diseases have increased demand for 3D printed technologies for the better and more effective treatment options

-

Rising adoption of in-house 3D printing facilities in the hospital settings

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified