- Home

- »

- Sector Reports

- »

-

Laundry Care Industry Growth & Analysis Data Book, 2030

Database Overview

Grand View Research’s laundry care industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research.

Laundry Care Industry Data Book Scope

Attributes

Details

Areas of Research

- Laundry Sanitizer Market

- Laundry Detergent Market

- Fabric Softeners & Conditioners Market

Number of Reports/Presentations in the Bundle

1 Sector Outlook Report (PDF) + 4 Summary Presentations for Individual Areas of Research (PDF) + 1 Statistic eBook (Excel) + 4 Individual Databook (Excel)

Cumulative Coverage of Countries

15+ Countries

Cumulative Coverage of Products

15 + level 1 & 2 Products

Highlights of Datasets

- Product Data, by Country

- Import/Export Data, by Country

- Demand/Consumption Data , by Country

- Statistic e-Book

- Competitive Analysis

Laundry Care Industry Data Book Coverage Snapshot

Markets Covered

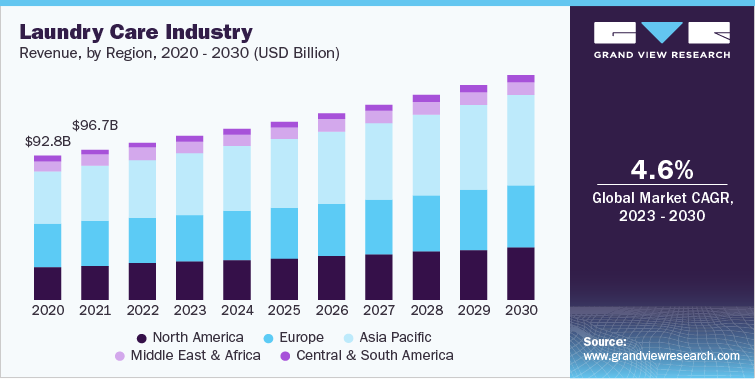

Laundry Care Industry

USD 100.76 billion in 2022

4.6% CAGR (2023-2030)

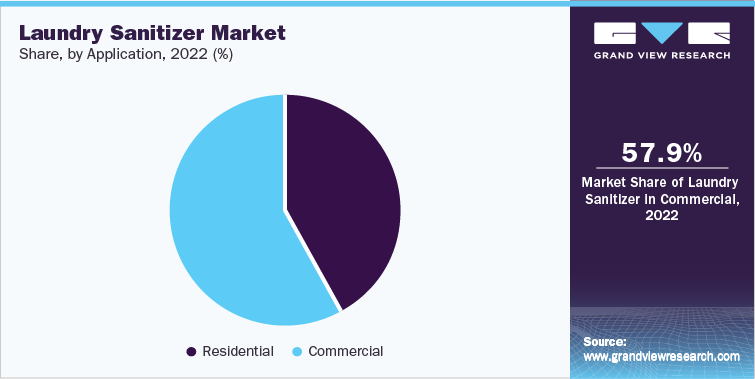

Laundry Sanitizer Market Size

USD 37.33 million in 2022

2.8% CAGR (2023-2030)

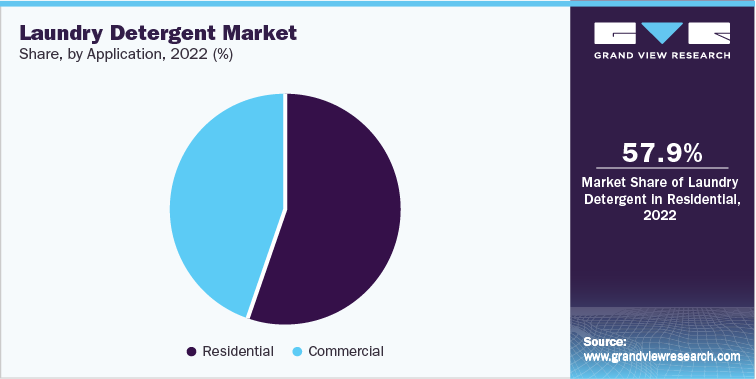

Laundry Detergent Market Size

USD 82.78 billion in 2022

4.7% CAGR (2023-2030)

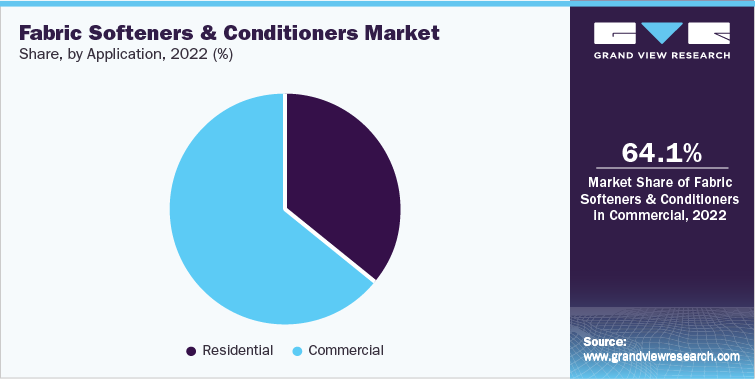

Fabric Softeners & Conditioners Market Size

USD 17.95 billion in 2022

4.0% CAGR (2023-2030)

Laundry Care Sector Outlook

The growing demand for laundry care products as a result of the rising population in developing countries is the main factor influencing the growth of the global market. Customers are further enticed to spend more on fabric care and cleaning supplies by the availability of a variety of wash & care solutions. Global demand for laundry care products is predominantly driven by consumers' growing awareness of hygiene and health. Additionally, increased consumer preference for eco-friendly products and scented laundry care products, together with rising daily use of laundry care products due to requirements, will contribute to market growth over the forecast period.

As individuals lead increasingly busy lifestyles, they prioritize clean and well-maintained garments, leading to a greater need for professional laundry services. As per statistics published by Harvard Business Review in 2022, 86.5 million U.S. citizens have utilized an on-demand laundry and dry-cleaning service at least once in their lives. In addition, 40% of these service users are between the ages of 18 and 34, indicating that the younger generation is driving the growth of the global industry.

Laundry Sanitizer Market Analysis And Forecast

The demand for fragrance-free laundry sanitizers is fueled by the rising number of laundry product allergies and the rising popularity of environmentally friendly cleaning solutions. Consumers' increasing understanding of the components in laundry products is anticipated to fuel the segment’s expansion during the forecast period. To appeal to the younger generation, major market players are producing eco-friendly laundry sanitizers. For instance, several market participants are selling laundry sanitizers that contain no bleach. Sanitizers in simple form are offered by companies like Lysol and Clorox.

Consumers actively looking for cleaning supplies and laundry sanitizers as a consequence of the pandemic is encouraging for businesses in the sector. One of the key elements assisting businesses in gaining market share is awareness of cleanliness and good handwashing hygiene. For instance, Dettol developed a program in 2020 to assist companies in developing hygienic awareness sanitizing products. This program was intended to make sanitary goods more accessible to companies.

Laundry Detergent Market Analysis And Forecast

Consumers are able to spend more on commodities like laundry detergents while economies develop and disposable incomes increase. They are seeking products that have greater cleaning capabilities, different fragrance alternatives, or eco-friendly characteristics. Consumers are paying more attention to their laundry habits as a result of rising hygiene and cleanliness awareness, especially in the wake of the COVID-19 outbreak. They place a higher value on goods with powerful stain removal, germ-killing capabilities, and odor control. Also, as more people enter the workforce, the need for convenient and effective laundry solutions rises.

In response to diverse consumer needs, laundry detergents are being formulated for specific purposes, such as baby laundry, sports gear, delicate fabrics, or brightening white clothes. These specialty detergents cater to niche markets and offer targeted solutions. For instance, The Laundress offers eco-friendly and plant-based laundry detergents. They offer a variety of products formulated for different purposes, including options for baby clothing, delicate fabrics, and specialty items like cashmere.

Fabric Softeners & Conditioners Market Analysis And Forecast

The demand for products like fabric conditioners and softeners, which assist maintain the softness of clothing, is predicted to increase as more consumers choose expensive apparel. Fabric softeners and conditioners are preferred by consumers for a variety of reasons as part of their laundry care regimen, including fabric protection, wrinkle reduction, smell enhancement, easy ironing, static cling reduction, and more.

The market for fabric softeners and conditioners is expected to gain momentum from millennials' growing preference for premium products. However, millennials also have a propensity to neglect laundry maintenance. As a result, to draw in younger customers, personal care companies are implementing social media promotions and marketing.

Detergents and other similar products are also more frequently purchased from consumers' local hypermarkets and supermarkets due to the availability of a wide range of products, significant discounts, efficient point-of-purchase displays, and other promotional offers. To promote client involvement, businesses like Unilever and Proctor & Gamble set up discounts and promotional campaigns in these shops.

Competitive Insights

The manufacturers aim to achieve optimum business growth and a strong market position through the implementation of various strategies such as acquisitions, new product launches, collaborations, and strengthening of distribution networks in the global as well as regional markets. The manufacturers in the market aim to intensify their market positions by widening their customer base. Thus, multinational players are aiming to achieve business growth in the regional market through mergers, acquisitions, and other strategic initiatives.

-

For instance, in July 2022, Dirt Is Good, a laundry brand of Unilever, introduced a newly developed capsule that offers superior cleaning performance and can help decarbonize the washing process. Instead of plastic packaging, the new capsules come in cardboard containers, which will stop more than 6,000 tonnes of plastic from entering the waste stream each year.

-

For instance, in May 2021, Comfort, a Unilever laundry brand, announced a new pack formulation and design. According to the brand's owner, Unilever, the new formulation uses Pro-Fibre Technology and is intended to shield clothing from color fading, bobbling, and shape loss.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified