Contract Manufacturing Services: Evolving Trend to Shape Biopharmaceutical Arena

In the current scenario, contract manufacturing services for small as well as large-molecule drug products are popular and are an ever-increasing trend within the pharmaceutical sector. Insufficient internal resources to cope with increasing therapeutic demand is driving this vertical. Latin America is offering great opportunities owing to the region's competitive costs, superior patient recruitment rates, and lower costs per patient turning this region into an attractive destination for pharmaceutical development.

Global drug shortfall coupled with increasing disease prevalence is driving the growth

Budget constraints are certainly the main driver influencing the progress in this market. Other factors include insufficient internal resources, limited capacity, and lack of expertise. CMOs/CROs are expected to experience strong growth ahead in Latin American countries owing to constantly improving economic conditions and the presence of biopharmaceutical manufacturing facilities herein.

Latin America region also counts the presence of major international pharmaceutical companies in countries like Brazil, Argentina, Colombia, Mexico, Chile, and Peru which in turn augments the growth in this market.

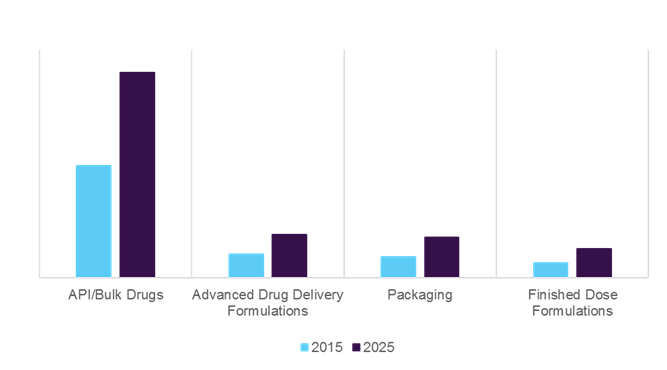

Latin America Contract Manufacturing Service Market, 2015 & 2025, (USD Million)

Companies with a global footprint, and diversified product offerings are expected to dominate the market

Publicly traded CROs are expected to outperform aided by a backdrop of healthy R&D budgets, cuts to internal capacity, and steadily increasing outsourcing penetration rates. Albany Molecular Research Institute made substantial progress in 2015 owing to its broad service portfolio as well as investments in mergers and acquisitions.

Catalent Inc. is estimated to account for a considerable market share due to the growing demand from biopharma companies for complex dosage formulations. Amongst the CROs, Quintiles is anticipated to witness significant growth as a consequence of the continuous increase in preclinical demand coupled with the company’s share in late-stage development steps.

Addressable pharmaceutical contract manufacturing market

The increasing priority of the biopharma companies towards clinical trials in order to increase the probability of products filling in for patent expirations in the next several years is anticipated to propel market growth. This data point bodes well for the sustainability of continued outperformance for both early and late-stage CROs in the coming years.

Competitive outlook

CMOs/CROs are involved in transforming themselves from low-margin to high-margin formulation manufacturers to stay competitive in the market. Growth in outsourced biopharma manufacturing and expansion of services for early-stage drug production are the major factors contributing to this transformation.

CROs are involved in acquisitions in order to gain a market presence. For instance, Quintiles acquired Encore Health in May 2014 in order to strengthen and expand its service capabilities. In March 2014, Charles River Laboratories acquired Argenta/BioFocus. This acquisition is expected to position Charles River Laboratories as a complete service provider for in early stage drug development

In-depth report on Latin America pharmaceutical contract manufacturing services market by Grand View Research:

In-depth report on Latin America pharmaceutical contract manufacturing services market by Grand View Research:

To schedule a free market intelligence database demo, please complete the form below:

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

Your transaction & personal information is safe and secure.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.