- Home

- »

- Medical Devices

- »

-

Microscope Market Size, Share And Growth Report, 2030GVR Report cover

![Microscope Market Size, Share & Trends Report]()

Microscope Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Optical, Electron, Scanning Probe), By Application (Nanotechnology, Life Science), By Region, and Segment Forecasts

- Report ID: 978-1-68038-033-0

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microscope Market Summary

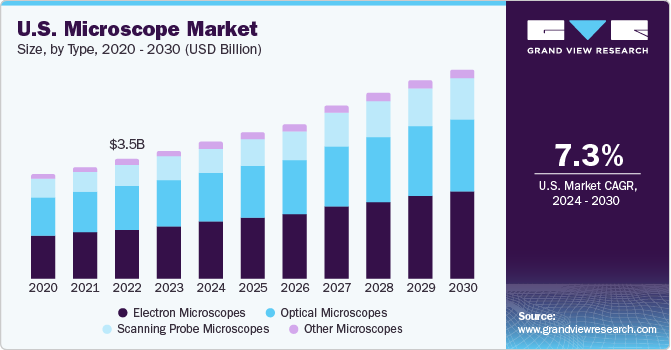

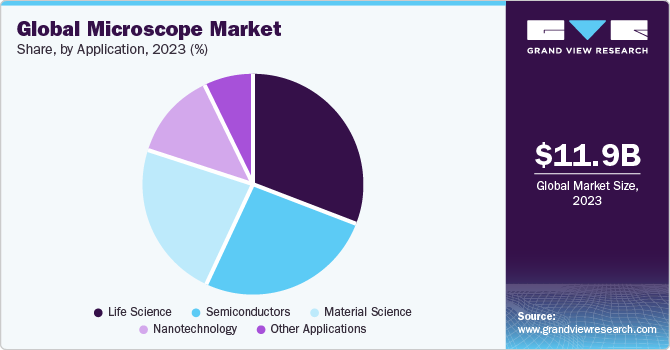

The global microscope market size was estimated at USD 11.94 billion in 2023 and is projected to reach USD 20.43 billion by 2030, growing at a CAGR of 8.0% from 2024 to 2030. Growing applications and high demand for technologically advanced magnification devices is driving the market. Furthermore, the market is experiencing growth due to increased demand from the healthcare sector and the rapidly expanding semiconductor industry.

Key Market Trends & Insights

- Asia Pacific dominated the overall microscope market in 2023 with a share of 37.1%.

- China accounted for the largest share of the microscope market in the Asia Pacific region in 2023.

- By type, The electron microscope segment held the largest share of over 41.84% in 2023.

- By Application, The life science segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.94 Billion

- 2030 Projected Market Size: USD 20.43 Billion

- CAGR (2024-2030): 8.0%

- Asia Pacific: Largest market in 2023

Additionally, the adoption of microscopy to facilitate research endeavors fuels the demand for microscopes. In order to improve market penetration, the microscope industry is currently undergoing advancements in technology, developing types that boast faster performance and incorporate user-friendly sample preparation techniques. Furthermore, the ongoing technical advancements, including integration with display modalities for high-definition imaging and 3-dimensional views, are poised to drive increased demand for microscopes throughout the forecast period.

The sector is expanding through the incorporation of cutting-edge technologies such as the Internet of Things (IoT) and extended ultraviolet lithography (EUVL) and deep learning. IoT creates a need for memory, connectivity, sensors, and microcontrollers, employing neural networks to improve the type of Integrated Circuits (ICs). Meanwhile, EUVL plays a pivotal role in the manufacturing of high-end computing chips. Electron microscopy, providing high-resolution imaging, enables a thorough assessment ranging from packaged devices to atomic-level gate structures. Systems based on electron beams are applied in scrutinizing the sources of device failures to optimize the manufacturing process.

The growing emphasis on research and development in areas like neuroscience, life sciences, nanotechnology, and semiconductor technology is anticipated to drive the adoption of microscopes. These instruments, known for their high image resolution, are essential for investigating cell signaling pathways and studying cancer cell proliferation. Furthermore, scanning probe microscopes offer versatility by not relying on the wavelength of the light source for magnification, making them suitable for diverse environments such as gas and liquid and allowing the examination of insulator and conductor specimens.

Market Concentration & Characteristics

The market demonstrates significant innovation, with advancements like super-resolution microscopy and AI integration. Ongoing developments focus on enhancing imaging capabilities and analytical functions, reflecting a dynamic and forward-thinking industry.

The market is characterized with low to moderate level of M&A activity. Several market players, such as Thermo Fisher Scientific, Inc., Zeiss Group, and Bruker Corporation, are involved in merger and acquisition activities. Companies are strategically engaging in M&A to strengthen their market position, foster innovation, and expand their product portfolios.

Stringent regulatory standards are pivotal in shaping the market, ensuring quality, safety, and adherence to industry norms, and influencing development and market accessibility.

Emerging technologies such as advanced imaging software and non-optical analytical tools pose potential substitutes in the microscope market, offering alternative research and analysis methods and impacting traditional microscope demand.

Market witnesses strategic regional expansion as companies target specific geographic areas, establishing partnerships and adapting technologies to address unique healthcare and research needs, thereby broadening their market presence and catering to diverse regional demands.

Type Insights

The electron microscope segment held the largest share of over 41.84% in 2023. Unlike optical microscopes, electron microscopes use an accelerated electron beam for illumination, capitalizing on the shorter wavelength of electrons compared to visible light, resulting in superior resolving power. Industries and well-established research laboratories constitute key end-users, though the relatively higher cost than optical microscopes present a consideration. Anticipated market penetration growth stems from collaborations between manufacturers and academic/research organizations.

On the basis of electron microscope, the scanning probes microscope segment is expected to show lucrative growth during the forecast period SEMs offer exceptionally high-resolution imaging, allowing researchers and scientists to observe specimens at nanoscale levels with unparalleled clarity. The ability to produce detailed three-dimensional images further enhances their utility in various scientific disciplines, ranging from materials science to biology.

Application Insights

The life science segment accounted for the largest revenue share in 2023. in life sciences studies, a variety of instruments are employed, encompassing compound microscopes like upright, inverted, and fluorescence microscopes, as well as laser microdissection and digital microscopes. The heightened adoption of high-magnification microscopes, including atomic force and electron microscopy, is notably on the rise, facilitating the observation of genetic structures in viruses and bacteria. Furthermore, the expanding applications in disease diagnosis contribute to the overall market growth.

The nanotechnology industry segment is estimated to register the fastest CAGR over the forecast period. Substantial investments are currently being made in the research and development of nanotechnology, expanding the potential applications of various types of microscopes. Microscopes in material sciences are pivotal for understanding properties, atomic and subatomic structures, and their associated functions. This encompasses a wide array of microscopes, ranging from compounds to highly efficient electron microscopes, selected based on the required degree of magnification. Within material sciences, these applications extend to areas such as chemistry, solid-state physics, and various industrial uses, including the inspection of surfaces in metallic, ceramic, and polymeric materials across diverse industries.

Regional Insights

Asia Pacific dominated the overall microscope market in 2023 with a share of 37.1%. The growth of the region is propelled by the presence of prominent manufacturers in countries like Japan, alongside a thriving community of local manufacturers in China and India. The continuous expansion of healthcare facilities, rising demand for diagnostic centers, and the increasing number of research and development projects are expected to sustain the market's dominance throughout the forecast period.

China accounted for the largest share of the microscope market in the Asia Pacific region in 2023. The country has grown substantially in research and development activities across diverse fields, including life sciences, materials science, and healthcare. The government's strategic investments in scientific infrastructure and a burgeoning number of research institutions and universities have fueled the demand for advanced microscopes in academic and industrial settings.

The Latin America region is expected to show a lucrative growth over the forecast period. The region is experiencing a surge in demand for advanced microscopy technologies, driven by expanding research and development activities across various scientific disciplines. Additionally, the growing prevalence of chronic diseases necessitates enhanced diagnostic capabilities, spurring the adoption of sophisticated microscopy solutions in healthcare settings, thereby contributing to the overall market growth.

Brazil accounted for the largest share of the microscope market in the Latin America region in 2023. Brazil's commitment to fostering innovation and research is reflected in increased funding for scientific projects and the establishment of state-of-the-art laboratories. Moreover, the country's expanding healthcare infrastructure and a growing emphasis on diagnostic capabilities drive the demand for advanced microscopy technologies.

Key Microscope Company Insights

Key players such as Thermo Fisher Scientific, Inc, Bruker Corporation and Zeiss Group have been focusing on product innovation, expanding their service offerings, and improving operational efficiency. Additionally, these industry leaders often engage in strategic collaborations, acquisitions, and partnerships to strengthen their market presence and maintain a competitive edge in the rapidly evolving field of microscopy.

Emerging players such as CAMECA and Joel ltd. are actively pursuing strategies to establish their presence by introducing innovative technologies, forming strategic partnerships, and focusing on niche applications. Furthermore, these players are leveraging technological advancements and strategic partnerships to compete effectively with established market leaders.

Key Microscope Companies:

The following are the leading companies in the microscope market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these microscope companies are analyzed to map the supply network.

- Zeiss Group

- Bruker Corporation

- CAMECA

- Thermo Fisher Scientific, Inc.

- Nikon Corporation

- Olympus Corporation

- NT-MDT SI

- Hitachi High-Tech Corporation

- JEOL Ltd.

- Oxford Instruments (Asylum Corporation)

Recent Developments

-

In November 2023, Ashoka University partnered with Carl Zeiss India (Bangalore) Pvt. Ltd. to establish a core imaging facility. Under this partnership Carl Zeiss India will provide Ashoka University with microscopy technology.

-

In July 2023, at the Microscopy and Microanalysis (M&M) 2023 Conference, ZEISS Microscopy presents an array of interactive display features, highlighting new Type launches and introducing emerging researchers.

-

In April 2023, Nikon unveiled the ECLIPSE Ui, Japan's inaugural digital imaging microscope designed for medical applications, with the goal of enhancing the efficiency of pathological observation and facilitating data sharing.

Microscope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.88 billion

Revenue forecast in 2030

USD 20.43 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base Year

2023

Historical Data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Zeiss Group; Bruker Corporation; CAMECA; Thermo Fisher Scientific, Inc.; Nikon Corporation; Olympus Corporation; NT-MDT SI; Hitachi High-Tech Corporation; JEOL Ltd.; Oxford Instruments (Asylum Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

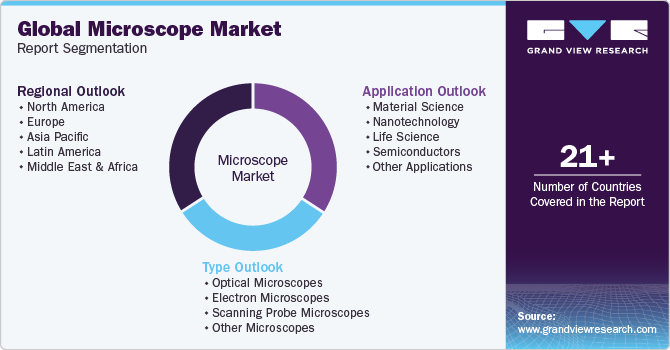

Global Microscope Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microscope market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical

-

Upright

-

Inverted

-

Stereomicroscopes

-

Phase Contrast

-

Fluorescence

-

Confocal Scanning

-

Near Field Scanning

-

Other Optical Microscopes

-

-

Electron

-

Scanning Electron

-

Transmission

-

-

Scanning Probe

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Science

-

Nanotechnology

-

Life Science

-

Semiconductors

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. Increasing demand for nanotechnology-based research and consequent rise in funding, rapidly growing semiconductor industry, rising R&D expenditure catering to emerging application areas, and growing demand in application areas such as miniature transistor chips and quantum, are the major factors driving the growth of the microscope market.

b. The global microscope market size was estimated at USD 11.94 billion in 2023 and is expected to reach USD 12.88 billion in 2024.

b. The global microscope market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 20.43 billion by 2030.

b. Asia Pacific dominated the market and captured the largest revenue share of 37.1% in 2023. This is attributable to the presence of a majority of manufacturers in the region

b. Key companies in the microscope market include Zeiss Group, Bruker Corporation, CAMECA, Thermo Fisher Scientific, Inc., Nikon Corporation, Olympus Corporation, NT-MDT SI, Hitachi High-Tech Corporation, JEOL Ltd., and Oxford Instruments (Asylum Corporation).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.