- Home

- »

- Advanced Interior Materials

- »

-

Aggregates Market Growth, Industry Report, 2020-2027GVR Report cover

![Aggregates Market Size, Share & Trends Report]()

Aggregates Market (2020 - 2027) Size, Share & Trends Analysis Report By Type (Gravel, Crushed Stone, Sand), By Application (Concrete, Road Base & Coverings), By Region (APAC, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-458-1

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aggregates Market Summary

The global aggregates market size was estimated at USD 463.37 billion in 2019 and is projected to reach USD 602.9 billion by 2027, growing at a CAGR of 3.3% from 2020 to 2027. The rapid growth of the construction industry, particularly in emerging economies is expected to drive the aggregates market over the coming years.

Key Market Trends & Insights

- Asia Pacific led the market and accounted for a revenue share of over 66% in 2019.

- Mexico is expected to register the highest CAGR from 2020 to 2027.

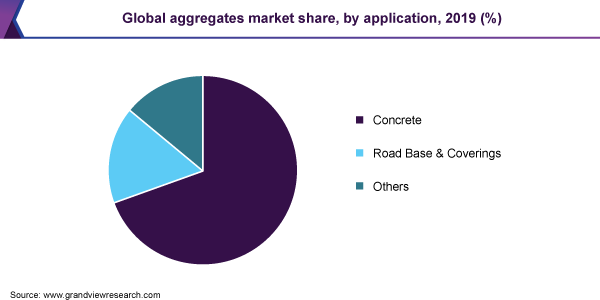

- In terms of application, concrete segment was the leading application in 2019 and accounted for a revenue share of 68.3%.

- In terms of type, crushed stone segment led the market and accounted for a revenue share of 58.1% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 463.37 Billion

- 2027 Projected Market Size: USD 602.9 Billion

- CAGR (2020-2027): 3.3%

- Asia Pacific: Largest market in 2019

The commercial & residential construction sector and transport infrastructure are the key end-use industries of the product. It is mainly used in cement and concrete manufacturing, railway ballast, and road base & coverings. However, the COVID-19 pandemic has directly limited or halted construction activities due to the imposed lockdowns in major cities across the world. This is expected to hamper the market growth in 2020, with a sharp recovery expected in 2021.

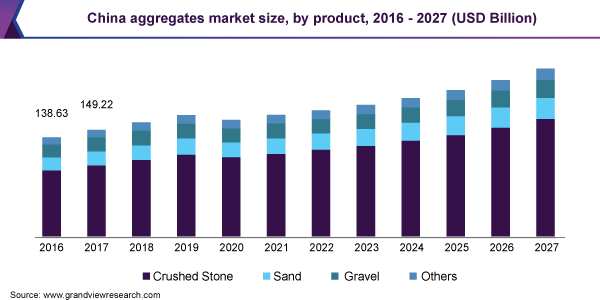

As per the initial figures obtained in Q1 of FY 2020, China’s construction activities contracted by nearly 3.1%. Restrictions in the movement of goods coupled with slow growth in the building & construction sector are likely to lower the product demand over the FY 2020. On the other hand, the consumption patterns for the product in China are projected to rebound from the second half of 2020.

The growth is projected to be driven by the macroeconomic environment as construction activities in the country have witnessed momentum since May displaying positive growth. As per the publication released by the International Monetary Fund (IMF) in April 2020, the country’s GDP is anticipated to recover by the Q2 of FY 2020 as imposed lockdowns are being lifted along with the implementation of new supporting policies. This is likely to benefit the market in China over the short term.

Type Insights

Crushed stone led the market and accounted for a revenue share of 58.1% in 2019. The segment will expand further at the fastest CAGR from 2020 to 2027 due to easy availability. For instance, in the U.S. every state produces crushed stone except for Delaware. The product is largely used as a construction material for the manufacturing of cement and in roadway construction. Sand is widely used in the manufacturing of concrete along with coarse aggregates, and cement.

The growing housing sector across all emerging economies, such as India, Indonesia, and China, due to rapid urbanization is expected to be a key driver for the segment’s growth. Gravel is widely used in the manufacturing of concrete blocks, pipes, bricks, and roadway construction materials. The demand for the product is largely catered by the growth in the high-rise buildings, which utilize concrete in an enormous amount. The high-rise buildings have observed significant growth over the past decade.

Application Insights

Concrete was the leading application segment in 2019 and accounted for a revenue share of 68.3%. The segment is estimated to retain its dominant position throughout the forecast years due to the rapidly growing housing sector and rising number of new infrastructure projects, including roadway and railway across various regions. Post the COVID-19 pandemic, the U.S., China, and India are likely to contribute to the majority of new infrastructural projects, thereby supporting the segment growth.

The road base & coverings segment acquired the second-highest revenue share in 2019. It is estimated that 1 kilometer of roadway construction requires nearly 25,000 tons of crushed stones. The roadway construction sector is expected to grow steadily in emerging economies owing to heavy investments in the sector, specifically from India. In 2019, the government of India proposed several projects for roadway infrastructure development in the country.

Regional Insights

Asia Pacific led the market and accounted for a revenue share of over 66% in 2019 and will expand further at the fastest CAGR from 2020 to 2027. This growth is due to the well-established construction sector in the region. As per the stats released by the IMF, the Asia Pacific economy is likely to be the least affected region due to the COVID-19 pandemic. Rapid industrialization and urbanization, the resurgence in foreign investment funding, and increasing disposable income levels are likely to boost construction spending in the region, thereby driving the demand for aggregates over the coming years.

Europe is one of the most affected regions due to the pandemic. The regional market is expected to witness a sharp decline in 2020 and witness a sluggish growth thereafter until 2027. Moreover, construction activities in Europe have witnessed slower growth since the past few years due to the overall economic slowdown and political uncertainties, such as Brexit.

The pandemic had compelled North America to completely suspend all manufacturing and other activities, construction being one of them. However, in the second half of 2020, the activities are slowly beginning to resume their operations. For instance, in July 2020, plans were unveiled for the development of a new 322-unit housing project in New York, U.S. The project is part of the state’s USD 1.4 billion initiative and is being built as a joint venture between Monadnock Development and CB Emmanuel Realty.

Central & South America is projected to register a steady growth rate over the forecast period owing to heavy investments for the development of roadway infrastructure. For instance, the government of Argentina is planning major road development across the country by 2022. The government has identified 16 key road projects with a total length of nearly 7,000 kilometers.

Key Companies & Market Share Insights

The global market is highly competitive and most of the companies have vast distribution channels spread across regions and are fully integrated across the value chain. Companies compete based on various factors, such as aggressive pricing strategy, to gain a higher market share. They also focus on new product and technology developments and on refining the existing products to sustain the competition. Some of the prominent players in the aggregates market include:

-

LafargeHolcim

-

Martin Marietta

-

LSR Group

-

HeidelbergCement AG

-

CEMEX S.A.B. de C.V

-

Vulcan Materials Company

-

CRH plc

-

Adelaide Brighton Ltd

-

Eurocement Group

-

Rogers Group Inc.

Aggregates Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 429.0 billion

Revenue forecast in 2027

USD 602.9 billion

Growth rate

CAGR of 3.3% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in billion tons, revenue in USD billion, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; China; India; Brazil

Key companies profiled

LafargeHolcim; HeidelbergCement Ag; CEMEX S.A.B. de C.V.; Eurocement Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global aggregates market report on the basis of type, application, and region:

-

Type Outlook (Volume, Billion Tons; Revenue, USD Billion, 2016 - 2027)

-

Crushed Stone

-

Sand

-

Gravel

-

Others

-

-

Application Outlook (Volume, Billion Tons; Revenue, USD Billion, 2016 - 2027)

-

Concrete

-

Road Base & Coverings

-

Others

-

-

Regional Outlook (Volume, Billion Tons; Revenue, USD Billion, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The aggregates market size was estimated at USD 463.37 billion in 2019 and is expected to reach USD 429.06 billion in 2020.

b. The aggregates market is expected to grow at a compound annual growth rate of 3.3% from 2020 to 2027 to reach USD 602.98 billion by 2027.

b. Crushed stone dominated the aggregates market and accounted for a share of 58.1% in 2019, owing to its easy availability and low price.

b. Some of the key players operating in the aggregates market include LafargeHolcim, HeidelbergCement Ag, CEMEX S.A.B. de C.V, and Eurocement Group.

b. The key factors that are driving the aggregates market include the expanding construction industry in emerging economies of Asia Pacific and the restoration of infrastructure in Europe & North America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.