- Home

- »

- Advanced Interior Materials

- »

-

Global Aluminum Casting Market Share, Size Forecast ReportGVR Report cover

![Aluminum Casting Market Size, Share & Trends Report]()

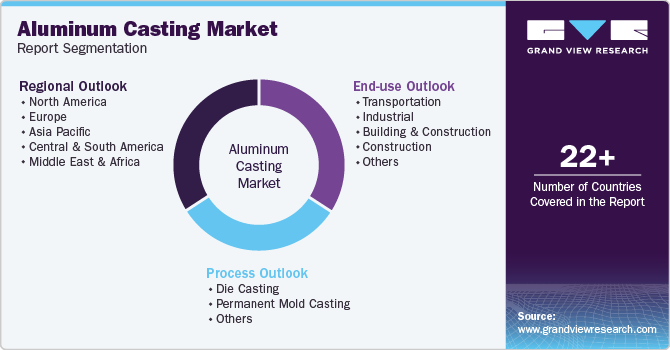

Aluminum Casting Market Size, Share & Trends Analysis Report By Process (Die Casting, Permanent Mold Casting), By End-use (Transportation, Industrial, Building & Construction), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-008-8

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

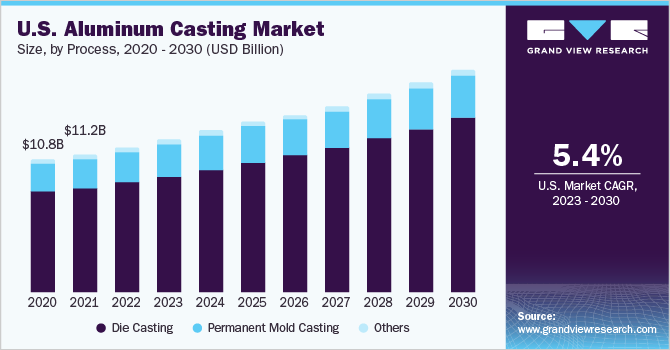

The global aluminum casting market size was valued at USD 90.97 billion in 2022 and is estimated to exhibit a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. The increasing use of aluminum in automobiles owing to its high strength and lightweight is likely to drive the market over the coming years. Nearly 30-40% of aluminum is being used per lightweight vehicle every year and is likely to reach 70% over the coming years owing to stringent regulations on reducing fuel emissions across the globe. According to the Federal Reserve Bank of St. Louis, the global sales of lightweight vehicles reached 17.385 million units in May 2019. Thus, increasing demand for lightweight vehicles on account of soaring environmental pollution, rising disposable incomes, and changing lifestyles of consumers is anticipated to boost the demand for aluminum casting.

Increasing demand for general utility and sports utility vehicles is anticipated to drive product demand in the U.S. For instance, according to the automotive consultancy firm, LMC Automotive, the U.S. is likely to have more than 90 mainstream SUV models by 2023. Moreover, automobile manufacturers in the country are under increasing pressure to meet the regulatory requirements pertaining to the environmental impact of vehicles. As per Corporate Average Fuel Economy (CAFE), passenger cars are required to reach a fuel economy target of 54.5 miles per gallon by 2026 owing to the increasing emission of greenhouse gases, which, in turn, is anticipated to augment market growth.

The application scope of aluminum casting is widening to agricultural equipment, construction equipment, mining equipment, and other heavy-duty machinery. The growth in these types of machinery is largely attributed to developing economies such as India and Brazil, where there is a high need for modernizing equipment to attain greater levels of productivity and efficiency. India is among the largest manufacturers of farm equipment like tractors, tillers, and harvesters. Tractor sales in the country are expected to grow by nearly 8.0% from 2018 to 2022, thereby driving the market.

On the flip side, factors such as high prices of aluminum casting machinery, along with high investments in technological advancements in aluminum casting, are likely to hamper the market growth. Moreover, strict rules and guidelines laid down by the U.S. Environmental Protection Agency (EPA) and the European Environment Agency regarding harmful emissions into the environment during the casting process are likely to hinder market growth in the coming years.

Process Insights

The die casting segment accounted for the largest volume share of around 53.0% in 2022 owing to the rising demand for aluminum casting products in the automotive sector. Die casting is used to manufacture various auto parts such as engines, cylinders, gears, and flywheels, which are used in high-end vehicles to mass-produce vehicles. This is owing to factors such as the low cost of die casting and strict CO2 emission laws being laid down around the world.

Aluminum die casting is further segmented into pressure die casting and others. The distinct characteristics offered by pressure die casting such as smooth surface finish, easy filling of cavity, strong mechanical properties, and tighter dimension tolerance are expected to assist segment growth, especially in the automotive sector. The others category includes vacuum and squeeze die casting.

Permanent mold casting is a process to manufacture a large number of cast products using a single mold structure that is made from high-temperature withstanding materials, such as cast iron and die steel. The finished product from permanent mold casting has a superior finish with high dimensional tolerance, which makes it suitable for the manufacturing of motorsport and recreational vehicle components.

Rising demand for motorcycles, especially in the U.S., is likely to drive the demand for permanent mold casting over the coming years. As per data published by the U.S. International Trade Commission (USITC) in 2018, the new registration of 600cc or fewer motorcycles increased from 58.3 thousand units in 2013 to 63.4 thousand units in 2017. Thus, steady demand from the motorcycle segment is likely to offer ample opportunities for manufacturers of aluminum permanent mold casting in the near future.

End-use Insights

The transportation segment accounted for the largest revenue share of over 58.0% in 2022. The growth is attributed to the increasing demand for lightweight vehicles and aircraft globally. Sports vehicle is among the most lucrative segments in the lightweight vehicle sector. The popularity of sporting events, rallies, and races in North America and Europe continue to drive the demand for sports vehicles, thereby boosting the demand for aluminum casting.

The growth in the transportation segment is also supported by increasing demand for aircraft as aluminum cast products are used in manufacturing jet or aircraft engines. A study published by Airbus in 2018 stated that the demand for new aircraft is estimated to reach nearly 39,000 over the next 10 years. Rising demand for new aircraft is likely to propel the need for new jet engines, thereby positively influencing the market growth.

In the industrial segment, construction equipment is likely to observe strong growth in the years to come owing to rigorous infrastructure development across the globe. Asia Pacific has observed a surge of Chinese construction equipment manufacturers such as XCMG and Sany in this segment over the past decade, which is likely to result in steady demand for aluminum casting products.

The building and construction segment is anticipated to exhibit a CAGR of 3.4% in terms of volume from 2023 to 2030 owing to the increasing use of aluminum casting products in houses. Aluminum casting can be employed in various applications such as roofing, door handles, windows, and curtain walling. The rising replacement of iron and steel due to changing consumer preferences and the benefits of aluminum, such as lightweight and aesthetic appeal, are anticipated to drive the market over the coming years.

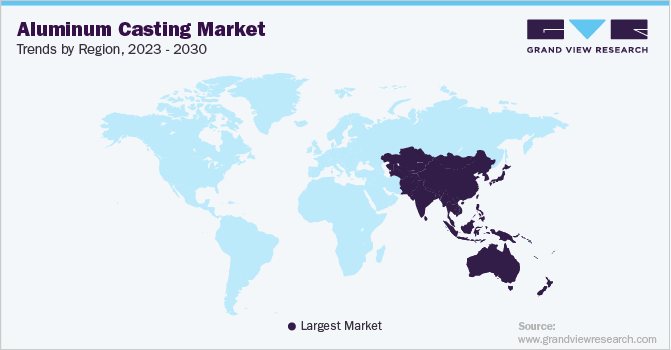

Regional Insights

Asia Pacific held the largest volume-based share of over 44.0% in 2022 owing to the rapidly expanding manufacturing sector in China and India. Automakers are shifting or expanding their production facilities in these countries owing to the low labor cost and government policy support, such as 100% FDI allowed under automatic route for auto components. As of December 2018, Continental, a Germany-based automaker, invested USD 25.65 million in setting up a premium surface materials facility in Pune, India with a production capacity of 5 million square meters.

In North America, demand for lightweight vehicles is anticipated to grow at a healthy rate over the coming years on account of the North American Free Trade Agreement (NAFTA). It was announced with an intention to achieve the objective of 54.5 mpg fuel efficiency in two phases by 2025. This is forcing automotive players to achieve a 25% reduction in the weight of the car body, which, in turn, is likely to boost the demand for aluminum casting over the coming years.

Europe emerged as the second-largest regional market in 2021 owing to its established automotive sector, supported by stringent regulations on reducing CO2 emissions. Euro 6c with real driving emissions (RDE) and Euro 6b emission standards along with World Harmonized Light Vehicle Testing Procedure (WLTP) is likely to boost the demand for lightweight materials such as aluminum in the region, which, in turn, is anticipated to augment market growth over the coming years.

Key Companies & Market Share Insights

The market is competitive and is likely to expand on account of the growing penetration of aluminum castings in EVs. For instance, in September 2020, Tesla announced the installation of aluminum casting machines for the production of chassis at a German plant, for increasing its EV production. This enables the company to leverage the market growth. Some prominent players in the global aluminum casting market include:

-

Walbro

-

Alcoa Corporation

-

Consolidated Metco, Inc.

-

BUVO Castings

-

RDW Wolf, GmbH

-

Georg Fischer Ltd.

-

Dynacast

-

GIBBS

-

Ryobi Limited

-

Martinrea Honsel Germany GmbH

-

Bodine Aluminum

-

Alcast Technologies

-

Endurance Technologies Limited

-

Aluminum Corporation of China Limited

Aluminum Casting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 95.59 billion

Revenue forecast in 2030

USD 135.20 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; France; Russia; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

Walbro; Alcoa Corporation; Consolidated Metco; Inc.; BUVO Castings; RDW Wolf; GmbH; Georg Fischer Ltd.; Dynacast; GIBBS; Ryobi Limited; Martinrea Honsel Germany GmbH; Bodine Aluminum; Alcast Technologies; Endurance Technologies Limited; Aluminum Corporation of China Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Casting Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum casting market report based on process, end-use, and region:

-

Process Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Die casting

-

Pressure die casting

-

Others

-

-

Permanent mold casting

-

Others

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Transportation

-

Industrial

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aluminum casting market size was estimated at USD 90.97 billion in 2022 and is expected to reach USD 95.59 billion in 2023.

b. The global aluminum casting market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 135.20 billion by 2030.

b. The die casting segment dominated the aluminum casting market with a share of 76.4% in 2022. This is attributable to the rising demand for aluminum casting products in the automotive sector. Die casting is used to manufacture various auto parts such as engines, cylinders, gears, and flywheels, which are used in high-end vehicles to mass-produce vehicles

b. Some of the key players operating in the aluminum casting market include Walbro, Alcoa Corporation, Consolidated Metco, Inc., BUVO Castings, RDW Wolf, GmbH, Georg Fischer Ltd., Dynacast, GIBBS, Ryobi Limited, Martinrea Honsel Germany Gmbh, Bodine Aluminum, Alcast Technologies, Endurance Technologies Limited and Aluminum Corporation of China Limited among other players.

b. Increasing usage of aluminum casting products in the automotive industry, rise in the building & construction sector along with growing investment in the EV industry are the major factor attributed to the growth of the aluminum casting market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."