- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Die Casting Market Size, Industry Report, 2030GVR Report cover

![Aluminum Die Casting Market Size, Share & Trends Report]()

Aluminum Die Casting Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Transportation, Industrial, Telecommunication, Energy, Consumer Durables), By Production Process (Pressure Die Casting, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-324-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Die Casting Market Summary

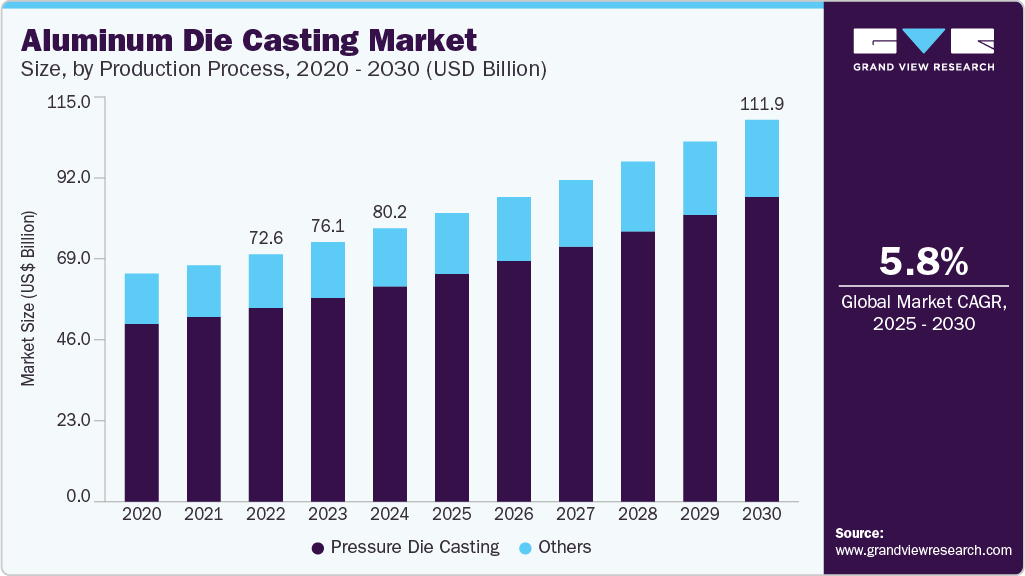

The global aluminum die casting market size was estimated at USD 80.16 billion in 2024 and is projected to reach USD 111.99 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. Increasing usage of aluminum in various applications, such as transportation and telecommunication, is expected to boost market growth during the forecast period.

Key Market Trends & Insights

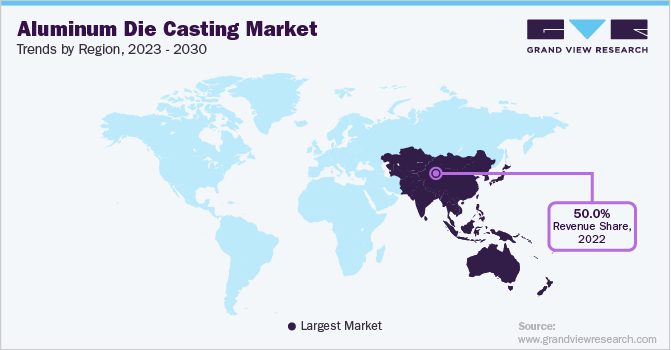

- Asia Pacific held over 51% revenue share of the global aluminum die casting market in 2024.

- China aluminum die casting industry accounted for a key share in the regional market in 2024.

- By production process, pressure die casting segment held the largest revenue share of more than 78.0% in 2024.

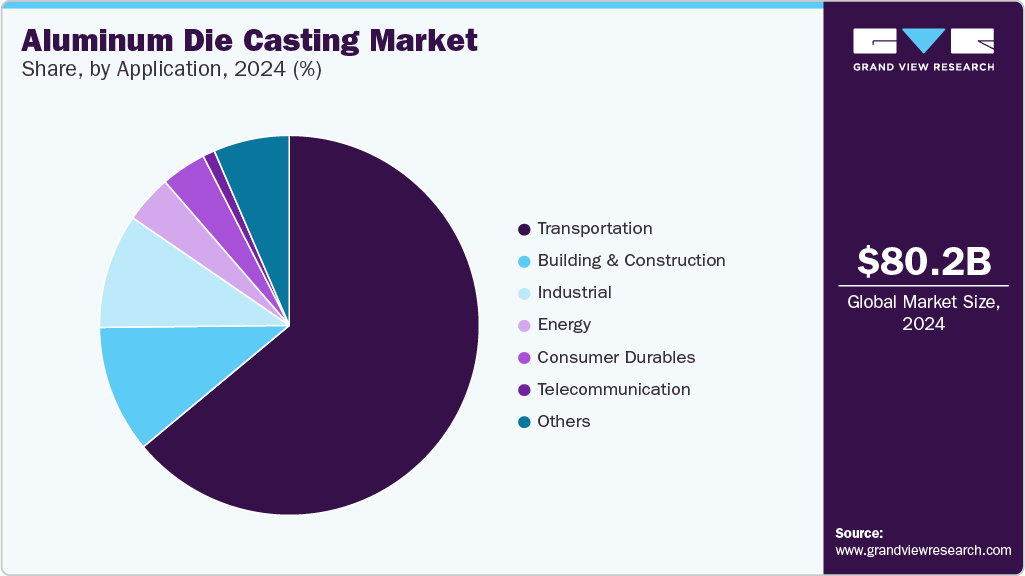

- By application, in 2024, the transportation segment held the largest revenue share, surpassing 63%, driven by the growing demand for lightweight vehicles.

Market Size & Forecast

- 2024 Market Size: USD 80.16 Billion

- 2030 Projected Market Size: USD 111.99 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

A rising preference for high-strength and lightweight castings is a prominent driving factor. Manufacturers must comply with the regulations to enhance fuel efficiency and reduce harmful emissions in the transportation industry. This is possible through the incorporation of lightweight materials in the production of vehicles.

The U.S. is a prominent producer and consumer of aluminum die casting. The upward growth trajectory of the U.S. market was severely impacted in 2020 as product demand drastically reduced due to the emergence of the COVID-19 pandemic, which led to a decline in production and consumption activities. However, acquisition activities increased significantly during this period, and global players targeted regional players.

For instance, in 2024, Frigate Manufacturing, a leader in aluminum die casting, introduced advanced digital technologies to enhance production efficiency and product quality. The company implemented digital twins and Industry 4.0 technologies, creating virtual replicas of the casting process to simulate, predict, and optimize die casting cycles in real time. This integration resulted in a 20% improvement in overall production efficiency by reducing defects and downtime. In addition, Frigate adopted closed-loop recycling systems, reducing raw material consumption by 30-40% and minimizing procurement costs. The company also utilized high-strength aluminum alloys, such as Aluminum Zinc and Aluminum Silicon, which offer 30% greater strength and superior fatigue resistance, providing a competitive advantage in high-performance sectors like aerospace and automotive.

In 2024, the U.S. construction industry experienced significant growth, with total construction spending reaching a record high of USD 2.17 trillion in October, marking a 0.4% increase from the previous month and a 7.2% rise year-over-year. This upward trend continued into 2025, with January 2025 construction spending estimated at a seasonally adjusted annual rate of USD 2.19 trillion, 3.3% higher than January 2024.

The growth was primarily driven by a surge in non-residential construction, particularly in data centers and manufacturing facilities, which accounted for 94% of the increase in non-residential spending from December 2023 to December 2024. Aluminum die castings are increasingly utilized in the construction industry for applications such as windows, curtain walling, shop partitions, cladding, and prefabricated buildings. Their lightweight, durable, and corrosion-resistant properties make them ideal for these applications, contributing to the industry's expansion. The continued growth in construction spending, particularly in non-residential sectors, underscores the increasing demand for advanced materials like aluminum die castings in the building and construction industry.

Drivers, Opportunities & Restraints

Automakers are under regulatory pressure to improve vehicle efficiency and reduce environmental impact due to greenhouse gas emissions. Aluminum is a sustainable material due to its contribution to reducing carbon dioxide (CO2). It prevents around 70 million tons of unwanted CO2 from mixing into the air. In vehicles, 100 kg of aluminum can help save 46 liters of fuel annually.

Fuel efficiency regulations became stricter due to the Volkswagen emission fraud in September 2015. Europe has taken the lead with the new Euro 6c emissions standards. Most industry leaders rely on weight reduction as the most basic way to increase fuel efficiency, and aluminum is an essential part of this process. In such a scenario, the demand for aluminum in the automotive sector will undoubtedly grow at an extraordinary rate in the coming years.

Technological developments in the automotive field are propelling the demand for automotive products. China is the world's largest automobile market in terms of supply and demand. South Korea, Japan, and India are among the top 10 largest automobile markets, which have created a significant demand for aluminum in the Asia Pacific region. Growing demand for cars in the U.S. is also expected to drive the aluminum die-casting market over the forecast period.

Aluminum die casting is used in the automobile industry for various applications such as engine blocks, pistons, suspension arms, frames, heat shields, trim, and heat exchangers. The wide range of aluminum applications adds to a significant reduction in the vehicle's weight. Hence, the share of automotive applications in the aluminum casting market will likely witness substantial growth over the forecast period.

Rising disposable incomes and increasing environmental awareness have significantly driven the demand for aluminum die casting in the construction sector, particularly in developing economies. This casting method is increasingly used to produce various products, including windows, cladding, curtain walls, fittings, and more, with its popularity growing in recent years. The robust expansion of the construction industry, spurred by urbanization and infrastructure development, has been a key factor behind the rapid growth of the aluminum die-casting industry in 2024-25.

While the COVID-19 pandemic initially severely impacted the construction sector, the industry has experienced a strong recovery since mid-2020, with construction activities ramping up across different regions. As of 2024, construction spending has notably risen, particularly in the Asia-Pacific region, where developing economies such as China, India, Malaysia, and Indonesia continue to drive growth. These countries' ongoing urbanization and infrastructure needs are expected to maintain strong demand for aluminum die-casting products in the construction industry. In addition, the sector's increasing focus on sustainability and energy-efficient materials further supports the adoption of aluminum die-casting in various construction applications.

The aluminum die-casting industry is a key segment of the heavy industries sector, which is known for producing a range of small to large, often heavy products, as well as extensive machine tools and other heavy equipment components. Given its scale and the complexity of operations, this sector is highly capital-intensive, requiring significant space and specialized infrastructure. Furthermore, transporting aluminum die-casting products demands skilled labor, increasing overall costs.

As technology advances, the need for continuous innovation and the production of high-quality products necessitates substantial investment in research and development (R&D). This, coupled with the requirement for skilled professionals to operate advanced machinery, presents a challenge, particularly in developing and underdeveloped economies with a shortage of such expertise.

In addition to high production costs, stringent regulations pose another challenge to the aluminum die-casting industry, especially in developed regions like North America and Europe. Rules enforced by bodies such as the U.S. Environmental Protection Agency (EPA) and the European Environment Agency (EEA) regarding environmental emissions are becoming more stringent, which could potentially limit the growth of the global aluminum die-casting industry in the coming years. Aluminum production is energy-intensive and contributes to significant carbon emissions, including CO2 and other greenhouse gases. The casting process also produces harmful byproducts, such as hexafluoroethane (C2F6), tetrafluoromethane (CF4), and fluoride compounds, all detrimental to the environment. These factors increasingly draw attention from regulators and environmental advocates, creating a challenging landscape for the industry's growth in 2024-25.

Production Process Insights

Pressure die casting held the largest revenue share of more than 78.0% in 2024.The pressure die casting segment is expected to be driven by its exceptional characteristics, including efficient cavity filling, smooth surface finish, tight dimensional tolerance, and superior mechanical properties. These advantages have made pressure die casting increasingly popular, particularly in the automotive sector, where its demand is expected to continue growing in the coming years.

Pressure die casting is further divided into high-pressure and low-pressure categories, with high-pressure die casting (HPDC) leading the market in 2024. Low-pressure die casting's relatively limited share is attributed to its longer casting cycle, which reduces its overall production efficiency. HPDC, on the other hand, is favored for its ability to deliver higher production rates, making it a preferred choice across various industries.

Other die-casting methods, such as vacuum die casting and squeeze die casting, are gaining traction due to their suitability for specialized applications, such as turbine blade and solar sensor casting. These methods produce finished products with refined grain structures, offering enhanced tensile strength and improved stress rupture resistance, making them ideal for demanding, high-performance applications.

Application Insights

In 2024, the transportation segment held the largest revenue share, surpassing 63%, driven by the growing demand for lightweight vehicles. This shift toward lighter vehicles is a key factor propelling the adoption of aluminum products, with die-cast parts expected to grow significantly throughout the forecast period.

The industrial segment, encompassing agricultural, construction, and mining equipment, also plays a pivotal role in the aluminum die-casting industry. Aluminum cast products are widely used in machinery components across these industries. As infrastructural development continues to rise in Asian countries, the demand for construction equipment is expected to increase, further supporting market growth.

In the building and construction sector, the demand for aluminum die-cast products is predominantly driven by their use in residential applications, including door handles, roofing, curtain walling, and windows. The ongoing trend of replacing traditional materials like iron and steel with aluminum, driven by evolving consumer preferences, positively influences market growth, particularly in the construction and housing sectors. This shift aligns with sustainability goals and highlights aluminum's growing versatility in modern building projects.

Regional Insights

North America aluminum die casting industry is expected to experience steady growth throughout the forecast period of 2024-25, driven by a combination of recovery efforts post-pandemic and the increasing focus on sustainability. The region's companies strongly emphasize returning to pre-COVID production levels while integrating more sustainable solutions into their operations, which is anticipated to boost demand for aluminum die-cast products. For instance, in early 2024, Rio Tinto expanded its commitment to sustainability by launching an advanced series of aluminum alloys designed to support greater recycling efficiency for die casters. This initiative aims to reduce the carbon footprint of aluminum production while enhancing the overall quality and recyclability of aluminum products. Additionally, many other companies in North America are actively working on developing eco-friendly aluminum solutions and investing in clean technologies, which is expected to fuel market growth over the forecast period. As industries continue to prioritize energy-efficient and environmentally responsible solutions, the demand for high-quality, sustainable aluminum die-cast products is likely to see a significant increase in North America.

U.S. Aluminum Die Casting Market Trends

The U.S. aluminum die casting industry is experiencing robust growth, driven by increasing demand for lightweight, durable components in the automotive and industrial sectors. The automotive industry's shift towards electric vehicles and fuel-efficient designs has amplified the need for aluminum die-cast parts, such as engine blocks and structural components. Advancements in high-pressure die casting technologies have enhanced production efficiency and precision, further propelling market expansion. In addition, government initiatives aimed at revitalizing domestic aluminum production and reducing carbon emissions are expected to bolster the industry's growth trajectory in the coming years.

Asia Pacific Aluminum Die Casting Market Trends

Asia Pacific held over 51% revenue share of the global aluminum die casting market in 2024. Asia Pacific aluminum die casting industry is characterized by low-cost skilled labor, making it the most lucrative region for manufacturers to set up production facilities. Moreover, a shift in the global production landscape toward South Asian countries is expected to positively influence the market growth over the forecast period positively.

China aluminum die casting industry accounted for a key share in the regional market in 2024, considering the widespread presence of the end-use industries in the country. It is one of the largest manufacturing hubs in the world. Moreover, China spends a significant amount on military and defense. Although the COVID-19 pandemic also impacted China’s manufacturing operations, the country reported a fast recovery compared to other parts of the world.

Europe Aluminum Die Casting Market Trends

The Europe aluminum die casting industry is experiencing robust growth due to the rising demand from the automotive, aerospace, and electronics industries. Aluminum die casting offers lightweight, corrosion-resistant, and high-strength components, which are crucial for automotive applications, particularly in electric vehicles (EVs) and lightweight structural components. The growing focus on reducing vehicle weight to improve fuel efficiency and meet stringent emission standards has propelled the adoption of aluminum die casting. Germany, France, and Italy are leading markets due to their well-established automotive manufacturing infrastructure. Additionally, the aerospace industry’s preference for aluminum die-cast parts, driven by durability and precision, supports market expansion.

Latin America Aluminum Die Casting Market Trends

Latin American aluminum die casting industry manufacturers are increasingly adopting advanced die casting technologies to enhance production efficiency and meet environmental standards. The region's emphasis on sustainability is evident in Brazil's remarkable aluminum recycling rate of 98.4%, positioning it as a global leader in aluminum recycling. This focus on recycling not only reduces production costs but also aligns with global environmental goals.

Middle East Aluminum Die Casting Market Trends

The aluminum die casting industry in the Middle East is driven by technological advancements and sustainability initiatives. Manufacturers are increasingly adopting advanced die casting technologies to enhance production efficiency and meet environmental standards. The region's emphasis on sustainability is evident in efforts to improve recycling rates and reduce carbon emissions. In addition, countries like the United Arab Emirates are investing in modernizing their die-casting processes to cater to the growing demand for lightweight and durable components in various sectors.

Key Aluminum Die Casting Company Insights

The aluminum die-casting industry remains highly competitive owing to the presence of numerous players worldwide. The COVID-19 pandemic significantly disrupted market dynamics, causing a temporary halt in production activities as companies faced lockdowns and supply chain challenges, adversely impacting sales. However, with restrictions easing, most companies have resumed operations, implementing stringent safety protocols to safeguard their workforce and ensure continuity in production.

In 2024-25, the industry is witnessing renewed growth, with key players ramping up production to meet increasing demand, especially in sectors like automotive. Notably, in September 2020, Tesla made headlines by announcing plans to replace hundreds of robots at its car factory in Germany with large machines designed to produce simpler chassis parts. This strategic move aimed to increase electric vehicle production capacity (EVs). Tesla’s decision to expand its operations further, with plans to produce compact cars tailored for the European market, is expected to drive additional investments in its manufacturing facilities and, in turn, spur demand for aluminum die-casting products. The continued expansion of EV production and the increasing demand for lightweight components across various industries are poised to create new growth opportunities in the aluminum die-casting sector.

Key Aluminum Die Casting Companies:

The following are the leading companies in the aluminum die casting market. These companies collectively hold the largest market share and dictate industry trends.

- Alcast Technologies

- BUVO Castings

- Chongqing CHAL Precision Aluminium Co., Ltd.

- Consolidated Metco, Inc.

- Endurance Technologies Limited

- FAIST Group

- GF Casting Solutions

- GIBBS

- Martinrea Honsel Germany GmbH

- Madison-Kipp Corporation

- Ryobi Limited

Aluminum Die Casting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.62 billion

Revenue forecast in 2030

USD 111.99 billion

Growth Rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Production process, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; U.K.; Turkey; China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

Alcast Technologies; BUVO Castings; Chongqing CHAL Precision Aluminium Co., Ltd.; Consolidated Metco, Inc.; Endurance Technologies Limited; FAIST Group; GF Casting Solutions; GIBBS; Martinrea Honsel Germany GmbH; Madison-Kipp Corporation; Ryobi Limited

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

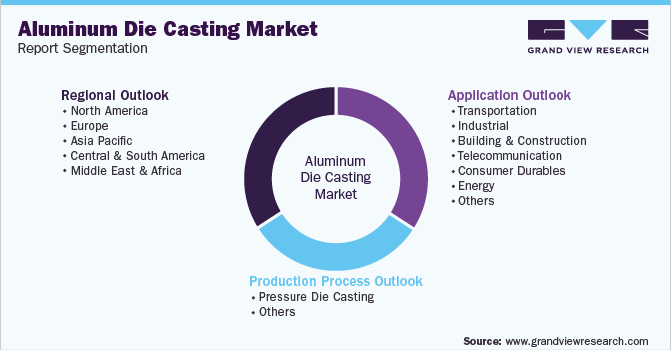

Global Aluminum Die Casting Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum die casting market report based on production process, application, and region:

-

Production Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pressure Die Casting

-

High Pressure Die Casting

-

Low Pressure Die Casting

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

General Road Transportation

-

Sports Road Transportation

-

Heavy Vehicles

-

Aerospace & Aviation

-

-

Industrial

-

Agricultural Equipment

-

Construction Equipment

-

Others

-

-

Building & Construction

-

Telecommunication

-

Consumer Durables

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

UK

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aluminum die casting market size was estimated at USD 80.17 billion in 2024 and is expected to reach USD 84.62 million in 2025.

b. The global aluminum die casting market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 111.99 billion by 2030.

b. In 2024, the transportation segment held the largest revenue share, surpassing 63%, driven by the growing demand for lightweight vehicles.

b. Some of the key vendors of the global aluminum die casting market are Alcast Technologies; BUVO Castings; Chongqing CHAL Precision Aluminium Co., Ltd.; Consolidated Metco, Inc.; Endurance Technologies Limited; FAIST Group; GF Casting Solutions; GIBBS; Martinrea Honsel Germany GmbH; Madison-Kipp Corporation; Ryobi Limited.

b. The key factor that is driving the growth of the global aluminum die casting market is the growing demand from industries like automotive, construction, and aerospace. Aluminum die casting is used in the automobile industry for various applications such as engine blocks, pistons, suspension arms, frames, heat shields, trim, and heat exchangers. The wide range of aluminum applications adds to a significant reduction in the vehicle's weight. Hence, the share of automotive applications in the aluminum casting market will likely witness strong growth in the future as well.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.