- Home

- »

- Medical Devices

- »

-

Anastomosis Devices Market Size, Industry Report, 2030GVR Report cover

![Anastomosis Devices Market Size, Share & Trends Report]()

Anastomosis Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Cardiovascular Surgery, Gastro-intestinal Surgery), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-138-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anastomosis Devices Market Summary

The global anastomosis devices market was valued at USD 4.19 billion in 2024 and is projected to reach USD 5.80 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. An estimated 310 million major surgeries are performed annually, with the U.S. accounting for 40 to 50 million of these operations.

Key Market Trends & Insights

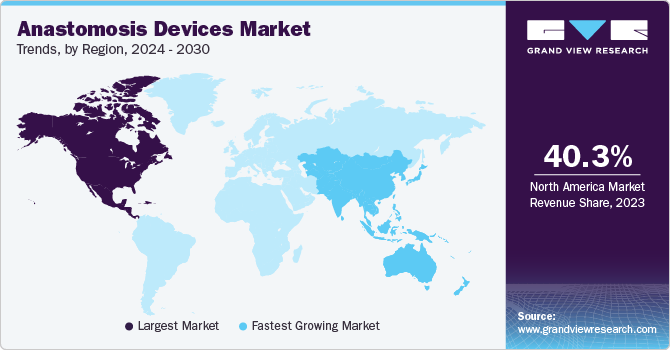

- The North America region held the largest market share, accounting for 40.2% of the total market revenue in 2024.

- The Asia Pacific region is identified as the fastest-growing market, with a CAGR of 6.9% over the forecast period.

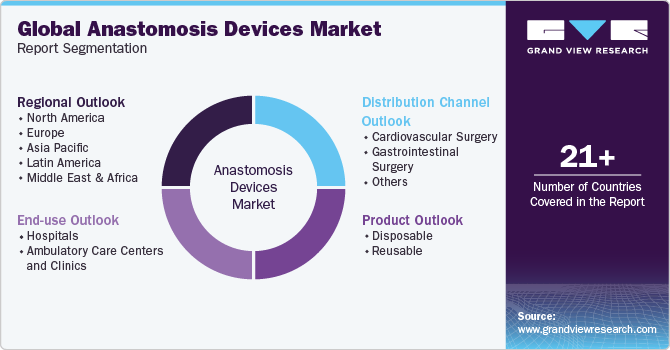

- By product, the disposable products segment contributed to the largest share of around 88.5% of the global market revenue in 2024.

- By application, cardiovascular surgery led the market and accounted for a share of 51.0% in 2024.

- By end use, hospitals held the largest revenue share of 57.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.19 Billion

- 2030 Projected Market Size: USD 5.80 Billion

- CAGR (2025-2030): 5.6%

- North America: Largest Market in 2024

This escalation is largely propelled by an aging population and increasing cases of lifestyle-related diseases, particularly cardiovascular conditions and cancer. As surgical intervention becomes a standard necessity in addressing these health challenges, the demand for effective anastomosis devices has escalated, indicating a market poised for substantial expansion.

Supporting this trend is the rising prevalence of chronic diseases, which is becoming a significant health burden worldwide. Cardiovascular diseases, responsible for approximately 17.9 million annual fatalities, remain a leading cause of mortality. Concurrently, the oncology sector is grappling with approximately 20 million new cancer diagnoses per year. The correlation between an uptick in chronic ailments and the concomitant need for surgical procedures utilizing anastomosis devices suggests a deep-rooted market demand that is unlikely to abate in the coming years.

Technological advancements are also playing a pivotal role in the evolution of the anastomosis devices market. Innovations around minimally invasive surgical techniques bolster patient outcomes and streamline operational efficiencies, resulting in shorter recovery times and reduced postoperative complications. These enhancements make the adoption of anastomosis devices increasingly favorable for both healthcare providers and patients, thereby driving market demand and fostering a more competitive landscape within the medical devices sector.

The growing focus on patient outcomes and healthcare expenditure strengthens the market dynamics. North America, representing a significant share of the anastomosis devices market, benefits from advanced healthcare infrastructure backed by substantial financial investments. Forecasts indicate a continued upward trajectory in healthcare spending, further amplifying the market’s potential. As healthcare systems worldwide prioritize improving quality of life and recovery rates, the adoption of innovative anastomosis devices is expected to gain momentum, ensuring sustained growth within this critical segment of the medical device industry.

Product Insights

Disposable products dominated the market and accounted for a share of 88.5% in 2024, owing to the availability of an array of disposable anastomotic products and greater market penetration. The majority of key players are involved in the production of disposable type of products. These products reduce the risk of cross-contamination, Surgical Site Infections (SSI), and other Healthcare-associated Infections (HAI). Another advantage of disposable anastomotic devices over reusable ones is that they reduce reprocessing costs and speed up the process. Some of the commercially available disposable anastomosis devices include Valtrac, DST series EEA staplers, Mitroflow Valsalva Conduit, Endo GIA Reload with Tri-Staple Technology and Endo Stitch by Covidien, Ltd. Medtronic’s Multifire Endo TA 30 Staplers and Reloads are the disposable reloadable laparoscopic stapler for resection, transection, and anastomosis with titanium staples which is designed to provide precise and accurate staple formation, ensuring secure closure of tissues during surgical procedures.

Reusable products are expected to grow at the fastest CAGR of 6.1% over the forecast period due to the environment-friendly and cost-effective benefits associated with reusable instruments. Reusable anastomosis devices are medical instruments that can be sterilized and used multiple times, which generates less waste. They are often used in surgical procedures that require a more robust and long-lasting connection between the two structures. The cost-benefit allied due to multiple uses of the same device is expected to fuel the market during the forecast period.

Application Insights

Cardiovascular surgery led the market and accounted for a share of 51.0% in 2024. Anastomosis devices are often used in cardiovascular surgeries to connect blood vessels during surgical procedures as they reduce the risk of complications during surgery. The growth of the cardiovascular surgery segment is attributable to the high prevalence of cardiovascular disease, the rising geriatric population, and the advancements in surgical techniques and technology. Cardiovascular diseases such as coronary artery disease, peripheral artery disease, and vascular diseases are the leading causes of death worldwide.

Gastro-intestinal surgery is expected to register the fastest CAGR of 5.8% over the forecast period. The prevalence of gastrointestinal disorders, such as inflammatory bowel disease, colorectal cancer, and diverticulitis, has contributed to the increasing demand for gastrointestinal surgery. An American Gastroenterological Association study found that 40% of individuals worldwide have Functional Gastrointestinal Disorders (FGIDs). Anastomosis devices are used in gastrointestinal surgery to make it safer, more effective, and less invasive. They allow surgeons to perform complex procedures with greater precision and accuracy, resulting in better patient outcomes.

End Use Insights

Hospitals held the largest revenue share of 57.5% in 2024 fueled by the availability of advanced medical equipment, skilled professionals who can easily perform surgeries and superior patient care. People prefer to undergo surgeries in hospitals as they perceive it to be a safer environment and have access to emergency medical care if needed. Moreover, medical insurance coverage and reimbursements play a significant role in hospital surgeries contributing to the largest revenue share in market. According to the data from the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), out of 7,191 hospitals in Brazil, 62% are privately owned. As of 2022, the country boasts 710 health insurance providers, 427,097 hospital beds, 546,000 physicians, 402,000 dentists, and 90,9000 drugstores.

Ambulatory care centers & clinics are projected to grow at the fastest CAGR of 5.7% over the forecast period. The increasing demand for minimally invasive surgeries, which require less hospital stay & faster recovery times, the rising prevalence of chronic diseases, and the adoption of advanced surgical methods are driving the market growth. Ambulatory care centers and clinics are well-equipped to handle surgical procedures and are therefore expected to see a surge in demand for their services.

Regional Insights

North America anastomosis devices market dominated the global market with a revenue share of 40.2% in 2024. Market growth in the region is attributable to the high healthcare spending, the presence of well-established hospitals, and the significant presence of key players in the U.S. According to the National Center for Biotechnology Information (NCBI), in 2020, around 40 to 50 million surgeries were conducted in the U.S. This surge in surgical procedures is expected to increase the demand for anastomosis devices, propelling regional growth. Moreover, according to the Monmouth Medical Center (MMC), over 600,000 surgical procedures are performed in the U.S. annually to treat several colon diseases.

U.S. Anastomosis Devices Market Trends

The anastomosis devices market in the U.S. dominated the North America anastomosis devices market with a revenue share of 81.3% in 2024. Rapid technological advancements and the presence of key manufacturers in the U.S. undertaking various initiatives, such as product approvals, product launches, mergers & acquisitions, to gain a competitive edge are expected to contribute to market growth. According to the United Network for Organ Sharing, in January 2023, around 42,887 organ transplants were performed in the U.S. in 2022, which demonstrates an increase of 3.7% over 2021.

Europe Anastomosis Devices Market Trends

Europe anastomosis devices market held substantial market share in 2024, driven by the rising prevalence of chronic diseases, advanced healthcare infrastructure, and the adoption of minimally invasive surgical techniques. The region benefits from cutting-edge medical technologies and a high volume of surgical procedures, particularly in cardiovascular and gastrointestinal surgeries, contributing to a substantial market demand.

The anastomosis devices market in Germany is expected to grow rapidly over the forecast period. In 2016, Germany conducted approximately 51,000 heart bypass surgeries, driving demand for anastomosis devices. The country’s robust healthcare system and investment in innovative medical technologies are projected to sustain market growth, solidifying its position as a key market player.

Asia Pacific Anastomosis Devices Market Trends

Asia Pacific anastomosis devices market is expected to register the fastest CAGR of 6.9% in the forecast period, fueled by increasing healthcare expenditures, improving medical infrastructure, and expanding awareness of advanced surgical techniques. Countries such as China and India are driving market growth, driven by an expanding patient population and rising demand for surgical interventions. The medical tourism industry is further boosting the adoption of anastomosis devices in the region.

The anastomosis devices market in Japan dominated the Asia Pacific anastomosis devices market in 2024. By 2024, it is anticipated that over 30% of Japan’s population will be aged 65 or older, necessitating increased surgical needs. Advancements in healthcare technology and favorable reimbursement policies are facilitating the adoption of anastomosis devices in Japanese hospitals, supporting market growth and expansion.

Key Anastomosis Devices Company Insights

Some key companies operating in the market include Medtronic; MIZUHO Corporation; Getinge; Peters Surgical; and Baxter; among others. Key players operating in the market are focusing on technological innovations and developing advanced technology-based devices to gain a significant revenue share. Companies are focusing on Gripping Surface Technology (GST), magnetic anastomosis technology, and 3D stapling technology for developing anastomosis devices that can reduce leaks at the staple line and provide less invasive solutions for surgeons & patients.

-

MIZUHO Corporation specializes in advanced surgical instruments and medical devices tailored for anastomosis procedures. Their portfolio includes specialized clamps and suturing devices that enhance surgical precision and improve patient outcomes during complex cardiovascular surgeries.

-

Peters Surgical emphasizes innovative surgical solutions, notably their Enclose® II Proximal Anastomosis Assist Device, designed for anastomosis during beating heart surgeries. Their products enhance efficiency and safety in surgical procedures, providing comprehensive solutions for diverse anastomotic techniques.

Key Anastomosis Devices Companies:

The following are the leading companies in the anastomosis devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- MIZUHO Corporation

- Getinge

- Peters Surgical

- Baxter

- Medical Device Business Services, Inc.

- CarpoNovum AB

- Vascular Graft Solutions Ltd.

- Medline Industries, LP.

- Seger Surgical Solutions Ltd.

Recent Developments

-

In May 2024, Ethicon announced the launch of the ECHELON LINEAR Cutter, the first surgical stapler combining 3D Stapling Technology and Gripping Surface Technology, significantly reducing staple line leaks and enhancing surgical outcomes.

-

In March 2024, Advanced Medical Solutions Group announced its proposed acquisition of Peters Surgical for approximately USD 141.4 million, enhancing its global position in tissue repair and skin closure technologies.

-

In March 2024, Getinge announced FDA 510(k) clearance for the Vasoview Hemopro 3, advancing endoscopic vessel harvesting technology with enhanced procedural efficiency and commitment to improving patient outcomes in cardiovascular surgery.

Anastomosis Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.42 billion

Revenue forecast in 2030

USD 5.80 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medtronic; MIZUHO Corporation; Getinge; Peters Surgical; Baxter; Medical Device Business Services, Inc.; CarpoNovum AB; Vascular Graft Solutions Ltd.; Medline Industries, LP.; Seger Surgical Solutions Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anastomosis Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anastomosis devices market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Surgery

-

Gastro-intestinal Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers & Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.