- Home

- »

- Digital Media

- »

-

Anime Movies And TV Shows Market Size Report, 2030GVR Report cover

![Anime Movies And TV Shows Market Size, Share & Trends Report]()

Anime Movies And TV Shows Market Size, Share & Trends Analysis Report By Type (TV Shows, Movies), By Genre (Action & Adventure, Romance & Drama), By Platform, By Audience, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-101-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global anime movies and TV shows market size was estimated at USD 11.17 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. This growth can be credited to the increasing consumer preference for anime content across the globe. Anime, referred to as animation in Japan, has an increasing fanbase with different stories across a wide range of genres. Some of the most popular genres include romance, comedy, action & adventure, sci-fi & fantasy, and horror. The availability of anime content for all age groups is creating lucrative growth opportunities for the market.The market growth is being further driven by the increasing popularity of anime, with a significant rise in the consumption of online content. The availability of various anime-specific websites and mobile apps is providing positive growth prospects for the market.

The audience can access these platforms across different parts of the world. For instance, in January 2023, a renowned anime streaming platform Crunchyroll announced its launch in India. It is available to the Indian audience at affordable subscription plans and comprises a vast library of anime shows.Apart from the anime-only platforms, such as Crunchyroll, Funimation, and Viewster, the audience is increasingly accessing the content through streaming services, including Netflix, Amazon Prime, Hulu, Hidive, etc. These companies are focusing on providing exclusive anime content to fans and are making hefty investments in anime production to gain a competitive edge in the market.

In August 2022, the leading Japanese entertainment company Nippon TV inked an agreement with Netflix to stream its 13 licensed anime titles on the streaming platform. The first titles will be streamed across 104 nations, including Finland, Spain, Turkey, UAE, Saudi Arabia, and South Africa. Several anime conventions are being organized globally every year, which is enhancing the outlook of the market further. These conventions provide a space for the fans to come together, find new content, and connect with the larger anime community. Some of the biggest anime conventions in the U.S. include Anime Expo, Anime Matsuri, Sakuracon, Anime NYC, and Metrocon.

Type Insights

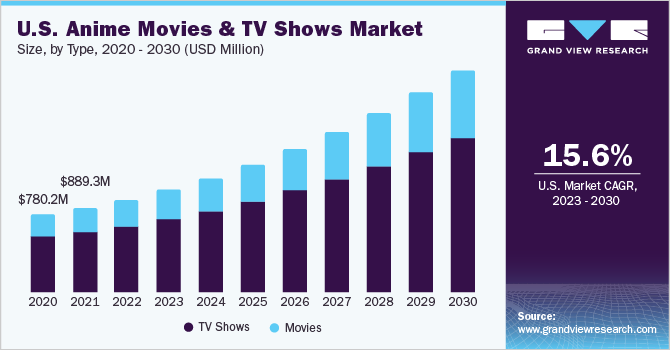

The TV shows segment captured a revenue share of around 71.0% in 2022 and is estimated to record significant growth over the coming years. Anime TV shows have longer runtimes, spanning multiple episodes or seasons. This allows for more in-depth storytelling, character development, and world-building compared to movies, which are usually limited to a particular duration. Moreover, TV shows can develop narratives at a more gradual pace, giving viewers time to connect with the story and its characters, allowing deeper immersion into the fictional world. The movies segment is estimated to record a CAGR of over 12.0% from 2023 to 2030.

This is due to the increasing popularity of this entertainment source. Anime movies offer more original and distinguished content than mainstream cinema. They explore a wide range of themes, genres, and art styles, pushing creative boundaries and fresh narratives that can attract viewers. These movies are known for their exceptional animation, attention to detail, and artistic forms. They usually feature captivating sequences, vibrant colors, and imaginative worlds, accompanied by unique storylines. Moreover, anime movies are now being released in different languages on popular streaming channels, which is driving their popularity at a global level.

Genre Insights

The action & adventure segment captured a revenue share of around 34.0% in 2022 and is estimated to record significant growth over the coming years. The narrative of action & adventure titles is mainly focused on a main character that fights humans, aliens, robots, animals, etc. They usually consist of characters that explore vast possibilities in the world and beyond. Although the genre is mainly aimed at young males, it has steadily gained massive traction among female audiences.

The wide availability in various other languages is increasing its global reach, thereby supporting segmentgrowth. The romance & drama segment is estimated to record a CAGR of over 13.0% from 2023 to 2030. The growth can be credited to the increasing fanbase for the anime titles in this segment. The stories are a mix of comedy, drama, and plots, which adds to their intriguing content. Some of the popular anime titles in this segment include My Love Story!!, Snow White With The Red Hair, Romantic Killer, Tomo-chan Is A Girl!, etc.

Audience Insights

The adults segment captured a revenue share of around 64.0% in 2022 owing to the wide availability of genres, such as comedy, romance, thrillers, fantasy, etc., that interest this audience segment. This diversity provides a broader appeal to adult viewers through high-quality animation, engaging storylines, and unique cultural perspectives. Moreover, their availability on OTT websites and various other platforms is making anime more accessible to adults, which is favoring the segmentgrowth further. The children & kids segment is estimated to record a CAGR of nearly 14.0% from 2023 to 2030.

This can be credited to the increasing interest of kids in anime as they present characters and storylines involving fantastical worlds with advanced technology and fantastical creatures. They have the potential to grab children's attention with well-developed characters and engaging plot twists. Some of the renowned anime titles that are popular among this age group are Naruto, My Hero Academia, Haikyu!!, Doraemon, and Pokemon Master Journeys. Moreover, certain anime shows also provide educational content that introduces kids to new ideas and concepts in history, geography, and science.

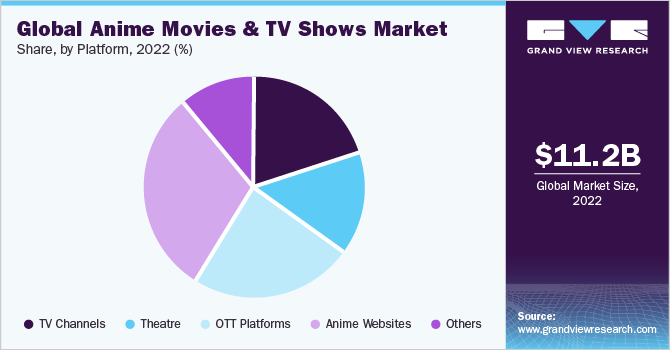

Platform Insights

The anime websites segment captured a revenue share of around 30.0% in 2022 and is estimated to record significant growth over the coming years. This can be attributed to the wide availability of various anime titles. These platforms comprise large anime libraries and can be accessed across different parts of the globe. They offer not only movies and shows but also games and manga content, and anime merchandise. Some of the popular anime websites include Anime Planet, Crunchyroll, Funimation, etc. Crunchyroll is known to have more than 30,000 anime episodes and a manga and anime store.

The OTT platforms segment is estimated to record a CAGR of over 12.0% from 2023 to 2030. This can be credited to the wide availability of various anime titles with different genres on the OTT platforms. Moreover, the availability of anime content in various languages on these streaming sites is also favoring segment growth. Having realized the demand for anime, OTT services are focusing on publishing more value-driven content under this category. The rising number of subscriptions for streaming platforms is urging companies to distribute anime content to meet the rising consumer demand.

Regional Insights

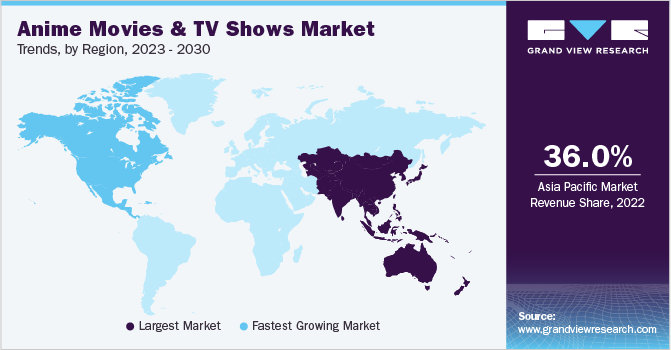

Asia Pacific captured a revenue share of nearly 36.0% of the overall revenue in 2022. This can be attributed to the growing popularity of anime content among young individuals in India and China. The growing preference to develop in-house anime content in various parts of the region is favoring the expansion of the regional market. Moreover, the region has a strong presence of various anime studios, which is creating lucrative opportunities for the regional anime movies & TV shows market.

North America is expected to record a CAGR of over 17.0% from 2023 to 2030. The growing interest of the regional audience in anime content, coupled with increasing internet penetration and digital distribution, is favoring the market growth. Moreover, easy accessibility of anime content on various platforms, from big television networks to independent channels and streaming sites, is also driving the growth of the regional market.

Key Companies & Market Share Insights

The key players operating in the market are actively involved in strategic initiatives, such as mergers & acquisitions, collaborations, and partnerships, to strengthen their presence in the industry. They are focusing on releasing various new tiles on the streaming platforms to engage a wider base of audience. In April 2023, a new anime series Oshi no Ko became the largest anime premiere on HIDIVE, breaking the records of all the previous anime titles on the streaming platform. The series has been produced by the studio Doga Kobo and will be exclusively available on HIDIVE in North America. Some of the prominent players in the global anime movies & TV shows market are:

-

Anime Studios

-

Pierrot Co., Ltd.

-

Production I.G, Inc.

-

Studio Ghibli, Inc.

-

Sunrise, Inc. (Bandai Namco Filmworks)

-

Toei Animation Co., Ltd.

-

Bones Inc.

-

Kyoto Animation Co., Ltd.

-

MADHOUSE, Inc.

-

Crunchyroll (Sony Pictures Entertainment Inc.)

-

Progressive Animation Works Co., Ltd. (PA Works)

-

Good Smile Company, Inc.

-

Discotek Media

-

Sentai Holdings, LLC (AMC Networks)

-

VIZ Media, LLC

-

Ufotable Co., Ltd.

-

Atomic Flare

-

-

Anime Streaming Platforms

-

Crunchyroll

-

Hulu, LLC

-

Netflix

-

HIDIVE, LLC

-

Tubi, Inc.

-

Anime Network

-

RetroCrush (Cinedigm)

-

HBO Max (WarnerMedia Direct, LLC)

-

Anime Movies And TV Shows Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.37 billion

Revenue forecast in 2030

USD 26.89 billion

Growth rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, genre, audience, platform, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; India; Japan; South Korea; Australia & New Zealand (ANZ); Brazil; Mexico; Saudi Arabia

Key companies profiled

Pierrot Co., Ltd.; Production I.G, Inc.; Studio Ghibli, Inc.; Sunrise, Inc. (Bandai Namco Filmworks); Toei Animation Co., Ltd.; Bones Inc.; Kyoto Animation Co., Ltd.; MADHOUSE, Inc.; Crunchyroll (Sony Pictures Entertainment Inc.); Progressive Animation Works Co., Ltd. (PA Works); Good Smile Company, Inc.; Discotek Media; Sentai Holdings, LLC (AMC Networks); VIZ Media, LLC; Ufotable Co., Ltd.; Atomic Flare; Hulu, LLC; Amazon Prime; Netflix; HIDIVE, LLC; Tubi, Inc.; Anime Network; RetroCrush (Cinedigm); HBO Max (WarnerMedia Direct, LLC)

Pricing and purchase options

Free re Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anime Movies And TV Shows Market Report Segmentation

This report forecasts revenue growth at the global and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anime movies and TV shows market report based on type, genre, audience, platform, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

TV Shows

-

Action & Adventure

-

Movies

-

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Sci-Fi & Fantasy

-

Sports

-

Romance & Drama

-

Others

-

-

Audience Outlook (Revenue, USD Million, 2018 - 2030)

-

Children & Kids

-

Teenagers

-

Adults

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

TV Channels

-

Theatre

-

OTT Platforms

-

Anime Websites

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia and New Zealand (ANZ)

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global anime movies and TV shows market size was estimated at USD 11.17 billion in 2022 and is expected to reach USD 12.37 billion in 2023.

b. The global anime movies and TV shows market is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030 to reach USD 26.89 billion by 2030.

b. Asia Pacific captured the revenue share of nearly 56% in 2022 owing to growing interest of the regional audience in anime content, coupled with increasing internet penetration and digital distribution.

b. The key players in this anime movies and TV shows market include Pierrot Co., Ltd., Production I.G, Inc., Studio Ghibli, Inc., Sunrise, Inc., Toei Animation Co., Ltd., Bones Inc., Kyoto Animation Co., Ltd., MADHOUSE, Inc., Crunchyroll, PA Works, Good Smile Company, Inc., Discotek Media, Sentai Holdings, LLC, VIZ Media, LLC, Ufotable Co., Ltd., Atomic Flare, Hulu, LLC, Amazon Prime, Netflix, HIDIVE, LLC, Tubi, Inc., Anime Network, RetroCrush, and HBO Max, among others.

b. Key factors boosting the growth of the anime movies and TV shows market include a growing focus on animated video entertainment and availability of anime content for all age groups along with growing penetration of internet and broadband services worldwide among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."