- Home

- »

- Next Generation Technologies

- »

-

Anime Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Anime Market Size, Share & Trends Report]()

Anime Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment), By Genre (Action & Adventure, Sci-Fi & Fantasy), And Segment Forecasts

- Report ID: GVR-3-68038-841-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anime Market Summary

The global anime market size was estimated at USD 37,698.9 million in 2025 and is projected to reach USD 77,268.4 million by 2033, growing at a CAGR of 9.2% from 2026 to 2033. The market is primarily driven by the rise of social media platforms, which have fostered community building among fans, allowing for greater interaction and engagement.

Key Market Trends & Insights

- Japan accounted for the largest market share of over 43% in 2025.

- The U.S. anime market dominated the market with a share of over 61% in 2025.

- Based on type, the merchandising segment accounted for the largest revenue share of over 31% in 2025.

- Based on genre, the sci-fi & fantasy segment is expected to grow at the highest CAGR of 9.9% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 37,698.9 Million

- 2033 Projected Market Size: USD 77,268.4 Million

- CAGR (2026-2033): 9.2%

- Japan: Largest market in 2025

This increased connectivity is increasingly promoting anime culture globally. Additionally, the strong connection between popular anime series and merchandise sales is significantly driving the expansion of the anime industry. From figures to clothing, the demand for anime-related products continues to grow, enhancing the overall market is expected to further fuel the market growth in the coming years.The growing dominance of streaming platforms have made anime more accessible worldwide, with episodes often being released simultaneously across multiple regions. This global reach has helped break down geographical barriers, allowing anime to expand beyond Japan and into mainstream entertainment markets, particularly in the West. With subscriptions growing and exclusive content being produced for these platforms, streaming has become a driving force behind anime’s increasing popularity and commercial success.

Additionally, the growing advancements in animation technology and techniques are transforming the anime industry, enhancing both production and viewer experiences. Improved software and tools facilitate higher production quality, resulting in visually captivating content that appeals to both dedicated fans and newcomers. The emergence of virtual reality (VR) and augmented reality (AR) technologies opens new avenues for immersive storytelling, enabling fans to interact with their favorite series and characters in innovative ways, thereby driving market growth.

Furthermore, the growing international collaborations are playing an increasingly significant role in shaping the anime industry. Partnerships between Japanese anime studios and Western production companies have led to hybrid projects that seamlessly blend diverse cultural elements and storytelling styles. These collaborations help enrich the quality of content and appeal to a wider global audience, highlighting the growing interconnectedness of the entertainment industry. This trend is anticipated to drive further growth and expansion within the anime market.

Moreover, the increasing popularity of video games inspired by anime is emerging as a significant trend within the anime industry, creating new revenue streams and expanding audience engagement. These games often feature beloved characters and storylines from popular anime series, allowing fans to immerse themselves in familiar worlds while interacting with their favorite characters in dynamic ways. This convergence of anime and gaming is enhancing the overall experience for fans and thereby attracting more groups of audience, including gamers who may not have previously engaged with anime. These factors are expected to drive market growth in the coming years.

Product Insights

The merchandising segment accounted for the largest market share of over 31% in 2025. This dominance is largely attributed to the increasing popularity of anime in various regions, especially in the U.S., where the demand for merchandise related to popular titles like "Demon Slayer" and "My Hero Academia" is surging. The rise of conventions and events dedicated to anime culture further fuels this demand, as fans seek to collect items that resonate with their favorite series and characters. These factors are expected to drive the segmental growth in the coming years.

The internet distribution segment is expected to witness the fastest CAGR of over 13% from 2026 to 2033. This rapid growth can be attributed to the increasing accessibility of anime through various streaming platforms, which allow viewers to easily access a diverse range of titles. As more consumers turn to online platforms for their entertainment needs, the demand for digital content continues to rise, driving significant growth in this segment. The convenience of online shopping for anime merchandise also complements this trend, making it easier for fans to engage with their favorite franchises across multiple mediums.

Genre Insights

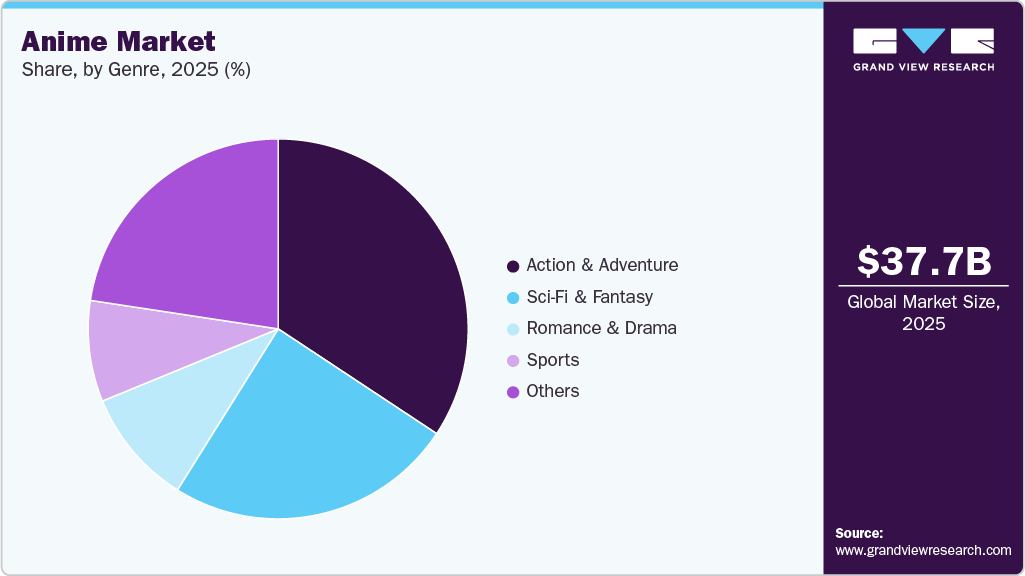

The action & adventure segment accounted for the largest market share in 2025, driven by its widespread appeal across diverse demographics. This genre captivates audiences with fast-paced storytelling and intricate character development, catering to those seeking escapism. The availability of these series on streaming platforms has significantly boosted viewer engagement, enabling fans to access an extensive library of titles. Additionally, the influx of new action and adventure anime in the U.S. is playing a crucial role in this segment's growth, attracting a varied audience eager for compelling narratives and high-quality animation.

The sci-fi & fantasy segment is expected to register the fastest CAGR from 2026 to 2033, fueled by advancements in animation technology that enable more immersive and creative storytelling. This genre resonates with audiences through its exploration of futuristic themes and fantastical worlds, appealing to a broad demographic seeking innovative narratives. The growing availability of diverse titles on streaming platforms has further boosted its popularity. Notable trends driving this growth include collaborations between anime studios and gaming companies, resulting in cross-media adaptations that broaden the audience reach and deepen viewer engagement.

Regional Insights

North America is expected to grow at the highest CAGR of over 15% from 2026 to 2033. The advancements in animation technology and techniques are revolutionizing the way anime is produced and experienced in the region. Improved software and tools allow for higher production quality and more visually stunning content, capturing the attention of both dedicated fans and new viewers, which is further driving the market.

U.S. Anime Market Trends

The U.S. anime market is expected to grow at a CAGR of over 15% from 2026 to 2033. The expansion of streaming platforms is a key driver fueling the growth of the U.S. anime market due to several interconnected factors that enhance accessibility, audience reach, and content variety.

Europe Anime Market Trends

Europe anime market is expected to grow at a CAGR of over 10% from 2026 to 2033. This growth is driven by the rising popularity of Japanese pop culture among younger demographics in the region and the increasing availability of anime content on digital streaming platforms, which enhances accessibility for viewers. The influence of social media and fan communities has amplified anime's visibility, while collaborations between anime production houses and European distributors broaden its audience reach. Additionally, the integration of anime into mainstream entertainment through merchandise, themed events, and educational sectors is contributing to its appeal, supported by a growing interest in anime-inspired storytelling and artistic styles.

The UK anime market is expected to grow at a significant rate in the coming years. This expansion is largely driven by the proliferation of streaming platforms that provide easy access to a wide array of anime titles, as well as an increasing number of licensed distributions. Partnerships between major streaming services, such as Netflix and Nippon Television, to acquire popular anime titles further enhance the market's appeal.

The Germany anime market landscape is bolstered by the increasing preference for online consumption of anime content, particularly within the action and adventure genres. The popularity of streaming services has facilitated easier access to anime, allowing viewers to engage more deeply with the content. Furthermore, young audiences are increasingly drawn to anime culture, supported by local conventions and events that celebrate this medium.

Japan Anime Market Trends

Japan accounted for the largest market share of over 43% in 2025, driven by surging global demand for streaming content, robust domestic merchandising and licensing revenues, and government-backed initiatives promoting anime as a key cultural export. Additionally, the proliferation of short-form content on TikTok and YouTube Shorts, along with cross-media adaptations into manga, games, and live-action films, is expanding franchise values and fan engagement in Japan, thereby driving the market growth.

Asia Pacific Anime Market Trends

Asia Pacific anime accounted for a significant share of over 24% in 2025, driven by several factors, including the increasing consumption of digital content and the popularity of streaming services. Countries of the region are leading this trend, with a strong fanbase that actively engages with both local and international anime productions. The rise of mobile gaming and interactive content related to anime is also a significant trend, enhancing viewer engagement and expanding market opportunities.

The China anime market is experiencing rapid expansion fueled by rising disposable incomes and an increasing appetite for diverse entertainment options. The integration of advanced technologies such as virtual reality (VR) and augmented reality (AR) into anime experiences enhances viewer engagement and broadens audience reach. Additionally, the government's support for cultural exports has led to greater international collaboration and distribution of Chinese anime content, contributing to its global appeal.

Key Anime Company Insights

Some of the key players operating in the market Crunchyroll (Sony Pictures Entertainment), Bioworld Merchandising, Inc.

-

Crunchyroll (Sony Pictures Entertainment Inc.) is a joint venture that operates independently, formed by U.S.-based Sony Pictures Entertainment, Inc. and Japan’s Aniplex, which is a subsidiary of Sony Music Entertainment (Japan) Inc. The company provides a streaming platform specializing in anime, manga, and Asian media, primarily targeting the U.S. market. The platform offers a vast library of titles, including simulcasts of popular series, allowing fans to watch episodes shortly after their release in Japan.

-

Bioworld Merchandising, Inc. is a company specializing in licensed apparel and accessories, offering a wide range of products tied to popular culture, including anime. The company plays a crucial role by producing and distributing merchandise that enhances fan engagement and reflects the increasing mainstream acceptance of anime, thereby supporting the thriving fan culture and driving demand for anime-related products.

Atomic Flare, and Eleven Arts are some of the emerging participants in the Anime market.

-

Atomic Flare is a company dedicated to providing hard-to-find video games, anime, and pop culture merchandise at affordable prices. The company features a diverse range of officially licensed products from popular franchises such as Final Fantasy, Pokemon, and My Hero Academia, among others. The company emphasizes local shipping and personalized customer service, ensuring a memorable shopping experience.

-

Eleven Arts is a dedicated film distribution company specializing in bringing anime and live-action films to North American audiences. Originally focused on theatrical releases, Eleven Arts has expanded its operations to encompass all aspects of film distribution, including translation, localization, home video, and merchandise. By collaborating closely with studios and producers in Japan, Eleven Arts aims to enhance the overall experience for anime fans in North America, striving to deliver compelling stories and high-quality content.

Key Anime Companies:

The following are the leading companies in the anime market. These companies collectively hold the largest market share and dictate industry trends.

- Pierrot Co., Ltd.

- Production I.G, Inc.

- Studio Ghibli, Inc.

- Bioworld Merchandising, Inc.

- Sunrise, Inc. (Bandai Namco Filmworks)

- Toei Animation Co., Ltd.

- Bones Inc.

- Kyoto Animation Co., Ltd.

- MADHOUSE, Inc.

- Crunchyroll (Sony Pictures Entertainment Inc.)

- Progressive Animation Works Co., Ltd. (PA Works)

- Good Smile Company, Inc.

- Discotek Media

- Sentai Holdings, LLC (AMC Networks)

- VIZ Media, LLC

- Ufotable Co., Ltd.

- Eleven Arts

- Atomic Flare

Recent Developments

-

In February 2025, Bandai Namco Filmworks, Inc. announced a significant investment of USD 3.9 billion over the next three years to expand its anime, video game, and capital investments, signaling heightened competition for profitable intellectual properties among Japanese entertainment companies.

-

In January 2025, Crunchyroll announced at Sony Group Corporation's CES press conference that it will launch a new digital manga application called Crunchyroll Manga later this year. This app will serve as a premium add-on for Crunchyroll subscribers and will be available as a standalone application on iOS and Android, with plans for web browser support in the future.

-

In August 2024, Discotek Media revealed 25 new upcoming releases during its panel at Otakon, an annual three-day anime convention and a live stream event, highlighting a diverse lineup of anime and tokusatsu titles, further broadening the variety available to U.S. consumers. This includes well-known franchises such as Lupin III and Digimon, alongside niche offerings like Kiss×sis and various tokusatsu films.

Anime Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 41,657.3 million

Revenue forecast in 2033

USD 77,268.4 million

Growth rate

CAGR of 9.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, genre, and region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Pierrot Co., Ltd.; Production I.G, Inc.; Studio Ghibli, Inc.; Sunrise, Inc. (Bandai Namco Filmworks); Toei Animation Co., Ltd.; Bones Inc.; Kyoto Animation Co., Ltd.; MADHOUSE, Inc.; Crunchyroll (Sony Pictures Entertainment Inc.); Progressive Animation Works Co., Ltd. (PA Works); Good Smile Company, Inc.; Discotek Media; Sentai Holdings, LLC (AMC Networks); VIZ Media, LLC; Ufotable Co., Ltd.; Atomic Flare

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anime Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the anime market report based on type and genre:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

T.V.

-

Movie

-

Video

-

Internet Distribution

-

Merchandising

-

Music

-

Pachinko

-

Live Entertainment

-

-

Genre Outlook (Revenue, USD Million, 2021 - 2033)

-

Action & Adventure

-

Sci-Fi & Fantasy

-

Romance & Drama

-

Sports

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Hungary

-

Austria

-

Russia

-

Netherlands

-

Finland

-

Sweden

-

Czech Republic

-

-

Asia Pacific

-

ANZ

-

China

-

Philippines

-

South Korea

-

Indonesia

-

Vietnam

-

Thailand

-

Malaysia

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global anime market size was valued at USD 37,698.9 million in 2025 and is expected to reach USD 41,657.3 million in 2026.

b. The global anime market is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2033 to reach USD 77,268.4 million by 2033.

b. Japan dominated the anime market with a share of over 39% in 2025. This is attributable to increased sales of anime content across the globe.

b. Some key players operating in the anime market include Pierrot Co., Ltd.; Production I.G, Inc.; Studio Ghibli, Inc.; Sunrise, Inc. (Bandai Namco Filmworks); Toei Animation Co., Ltd.; Bones Inc.; Kyoto Animation Co., Ltd.; MADHOUSE, Inc.; Crunchyroll (Sony Pictures Entertainment Inc.); Progressive Animation Works Co., Ltd. (PA Works); Good Smile Company, Inc.; Discotek Media; Sentai Holdings, LLC (AMC Networks); VIZ Media, LLC; Ufotable Co., Ltd.; Atomic Flare

b. The rising popularity and sales of Japanese anime content in other parts of the world apart from Japan are expected to drive the growth of the anime market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.